In a candid interview, the president of E. Katayama, a leader in the trade of specialized steel and construction materials, discusses how they’re tackling labor scarcity, meeting strict anti-seismic standards, and envisioning a future beyond borders.

It is a pivotal time for Japanese manufacturing. The past three years have seen large supply chain disruptions due to COVID as well as the US-China decoupling situation, and as a result, corporate groups are looking to diversify their suppliers for reliability reasons. Known for their reliability as well as their advanced technology, Japanese firms are in an interesting position. Combined with a weak JPY, many observers argue this is a unique opportunity. Do you agree with this sentiment, and what are the advantages of Japanese firms in this current macro environment?

In my personal perspective, I hold the belief that there might have been a decline in self-confidence among Japanese individuals. However, I am of the opinion that it is now opportune for the Japanese populace to reclaim this sense of confidence. Within the construction industry, we uphold remarkably stringent criteria concerning anti-seismic structures. It is my understanding that Japan is globally recognized as a leader in this domain. This accomplishment has considerably elevated the benchmark domestically. Consequently, manufacturers and entities involved in the construction sector within Japan should bolster their confidence in having achieved and exceeded these exacting standards. The capacity of these entities to erect exceptionally resilient edifices is a source of great pride and accomplishment.

Japan is located at the intersection of three tectonic plates, so is subject to frequent seismic activity. Of course, Japanese companies have developed unique technologies to ensure safety during such emergencies. Japan is not unique in this regard, especially when we look at the Pacific Ring of Fire, with countries like Indonesia having the same problems. Do you think that Japan has an opportunity to export technologies to Southeast Asia considering the economic growth in the region during recent years?

Indeed, Japan faces regular earthquakes and other natural disasters that have tragically claimed many lives. What is troubling is that we tend to grasp vital insights only after such heartrending events. My visits to several Asian countries have revealed buildings with apparent vulnerabilities. Nonetheless, I am uncertain if these nations will fully appreciate the force of nature until they directly encounter it. Effectively stressing the importance of these robust structures is, undoubtedly, quite a challenge.

The last construction boom in Japan was more than 50 years ago, prior to the 1964 Olympic Games. There is now less need for newer projects because of the demographic shift, and conversely, there is a higher need for maintenance and upkeep. If we look further into this demographic situation in Japan, the construction sector is one where one-in-four workers are above the age of 65, creating a labor crisis in addition to this lessened demand for newer construction projects. What are some of the challenges of this demographic shift and how has your firm reacted to them?

The direct repercussion of the declining population is the growing challenge of recruiting new talent. As you mentioned, Japanese buildings and infrastructure, having been constructed about 50 years ago, have reached an aging phase. Consequently, we are witnessing a surge in reconstruction projects. Take the Shibuya station redevelopment, for instance; it is not just about renovation but entails a comprehensive rebuild. Similarly, the Yamanote line saw the establishment of the Takanawa Gateway station, prompting a concurrent renewal of the neighboring area. This trend is leading to the reconstruction of each station along the Yamanote line as these structures age. In my view, this shift is favorably shaping the construction industry's landscape.

Addressing the implications of this declining population is poised to be a paramount concern for the next 5-10 years. The central challenge will be tackling labor scarcity within the construction sector. The task of securing Japanese workers competent to operate on construction sites is becoming increasingly daunting. To counter this, we are actively seeking to recruit Vietnamese trainees to supplement this shortage. The prospect of integrating robots into the construction industry is also being explored. However, while robots may find application in specific processes, their current capabilities fall short of autonomously managing the entire construction workflow on-site. The critical task at hand involves finding ways to secure essential workers for on-site operations. In my perspective, this challenge looms large on the horizon, and relying solely on Japanese labor to meet it is likely to be a formidable hurdle. This is driving the necessity of embracing more foreign workers on construction sites.

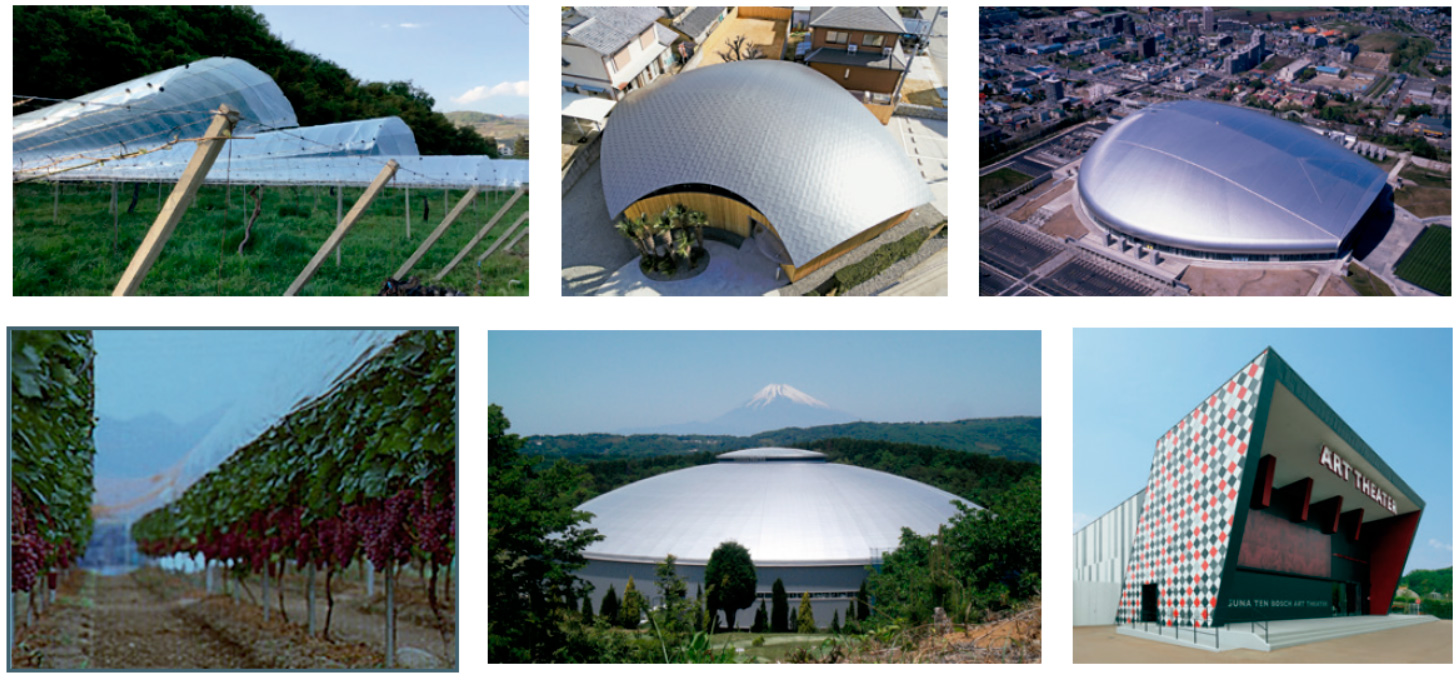

If we look at your company specifically, we know that you can be divided into two main business divisions: those being your construction division and your agriculture, forestry, and fishery division. Which one of these two are you currently focusing on and which do you believe has the most potential for future growth?

As an organization, our primary focus revolves around the trade of construction materials. Notably, our engagement with JFE Steel Group constitutes more than 60% of our overall business activity. Additionally, as you mentioned, we are also involved in sectors such as agriculture, forestry, and fishery. However, it is worth noting that these sectors contribute only a minor percentage to our total business operations.

You are a very old company, more than 100 years old in fact. You have a unique business model, and in many cases, traders are just connecting suppliers to end users or connecting manufacturers to site locations, but your firm has processing capabilities and it enables you to do much more than take the material and supply it. Could you give us an insight into your unique business model that has allowed you to be in business for so long?

Our constant consideration revolves around our customers, striving for maximum collaboration. While we primarily trade specialized steel, our portfolio encompasses a diverse array of products. In addition to our focus on steel materials, we also engage with non-ferrous materials. This versatility has undoubtedly contributed to our longevity in the industry.

In contrast, prominent corporations are intensifying their compliance measures and initiatives. However, I must admit that I am not fond of the ISO concept. Over the past three decades, we have deliberately chosen not to adhere to ISO standards. Given our company's capacity, obtaining ISO certification might seem prudent. Yet, it is important to acknowledge that such certification would likely impose rigid constraints, potentially compromising our agility in the business realm. I view this flexibility as yet another forte of our company.

Furthermore, many of these larger entities uphold remarkably high internal standards. Ironically, these exacting standards can occasionally impede their responsiveness to customer needs. In our case, being an SME affords us a distinctive advantage – an enhanced degree of flexibility. This, in turn, empowers us to cater to customer demands with remarkable adaptability, paving the way for collaborative problem-solving. Notably, a substantial portion of our workforce willingly ventures into the field, demonstrating a sophisticated proactive approach. This approach resonates effectively with both our customer base and the industry as a whole.

Can you go into more detail about how partnerships with other firms have played in your business and are you looking to partner with any firms from overseas countries?

Undoubtedly, there are numerous endeavors beyond our solitary capacity. As a trading entity, a mere focus on procurement and sales would yield relatively shallow customer relationships. Instead, our consistent approach has been to collaboratively devise solutions with our customers. This impetus drives us to maintain a closely-knit rapport with both suppliers and end-users. This strategy has facilitated the cultivation of stronger bonds, allowing us to not only forge connections but also to generate shared value. In this vein, our strategy extends to collaborating with customers to generate opportunities. Through this concerted effort, we not only foster job creation but also lay the foundation for mutual profitability.

Your firm has a global network when it comes to procurement and earlier you mentioned how the Japanese demographic shift is presenting difficulties to your company. We are seeing these days that Japanese firms are counteracting this shrinking demographic by expanding overseas. Is this an area of interest for your firm? If so, which countries or regions do you believe have the most potential for growth?

We have actually maintained a partnership with a Taiwanese counterpart for over two decades now. This collaboration has facilitated the transfer of processes from both Taiwan and China. While our rapport with Taiwan and China remains robust, over the past five years, our attention has shifted towards hiring Vietnamese trainees, thanks to certain affiliations we have. In terms of workforce, we intend to sustain our focus on Vietnam for several more years. This initiative extends beyond the realms of construction or manufacturing; we have also enlisted several CAD operators. Our aspiration is to assemble a cadre of three CAD operators. Given the scarcity of IT engineers in Japan, we are actively seeking to foster deeper connections with Vietnam.

Imagine that we come back to interview you again on the last day of your presidency: Do you have a personal goal or achievement that you would like to have accomplished by then?

The mantle of the presidency was passed down to me from my father, who in turn inherited it from my grandfather. My endeavor is to effectively convey these generational patterns to the upcoming cohort in a positive manner.

Regarding compliance, I previously mentioned my aversion to imposing excessive rules and restrictions on my staff. Instead, my inclination is to empower them with greater autonomy while nurturing a heightened awareness of their responsibilities and commitments. It has come to our attention that there are certain repercussions stemming from our decision not to pursue ISO certification. Hence, this is an issue that necessitates our attention as we move forward. Our aspiration is to evolve into a company that adeptly aligns with contemporary trends through transformative measures and adaptive changes.

Interview conducted by Karune Walker & Paul Mannion

0 COMMENTS