Harada Tea has been a leader in the production of Japanese tea for over a century, and is going global with innovative takes on the country’s cuisine.

By Cian O Neill and Daniel de Bomford

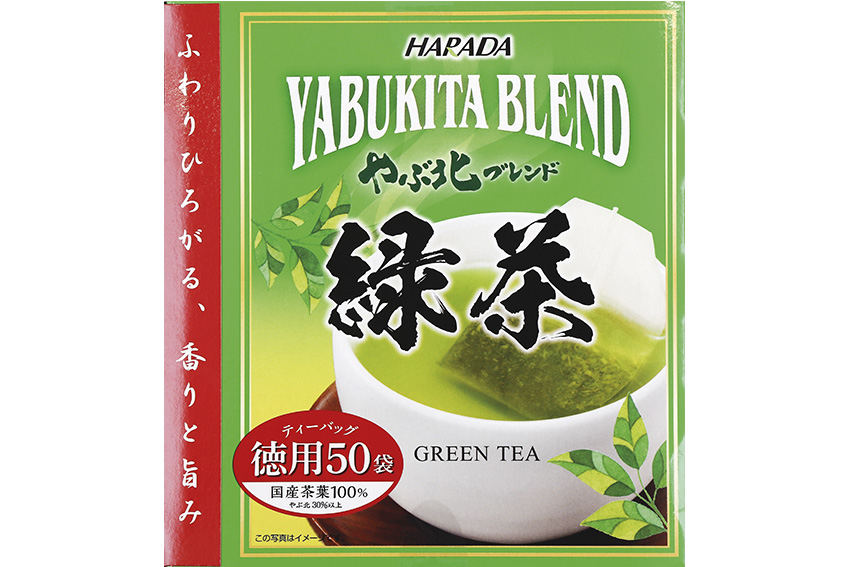

The vibrant green hue and earthy smooth taste of matcha has transcended Japanese borders to captivate global palates as a beloved and revered cultural export. With over a century of experience as a Japanese green tea producer, Harada Tea looks to the future of Japan-grown matcha, both to meet the domestic supply and export internationally. President Soichiro Harada says that while black tea has been considered the “standard” tea, green tea has begun to become popular. “Matcha powder is very easy to use without generating waste, and it is easily mixed with milk, confections or combination drinks,” Mr. Harada says. As green tea continues to be recognized for its health benefits and consumers become more health conscious, Mr. Harada sees that popularity increasing even further and Harada Tea is ready to capitalize on this growing demand.

Sourcing its tea from Japan, Harada Tea has been made more competitive with the weaker yen. Mr. Harada outlines the company’s policy: “Given the cost situation, we are not interested in going overseas for production since it is more cost-effective to rely on our tea cultivation in Japan.” Through its ability to source locally and its over 100 years of industry experience, Harada Tea maintains a strong relationship with growers in Japan and often advises them on best practices in a trend-driven market. “We get many consultation requests from small-scale tea leaf farmers. They want to know whether they should move toward the trend or keep their traditional way of producing,” Mr. Harada says. He explains that Harada Tea is cognizant of chasing trends as it often dilutes the uniqueness of local varieties.

While Harada Tea has its own branded products, the bulk of its business is as an original equipment manufacturer (OEM). Mr. Harada says that the company’s strength is its flexibility to support its clients and meet their unique specifications. “They may have specific requests about the taste, be it deeper, thinner or simpler,” he says. Mr. Harada explains that Harada Tea’s role in the market is to be a support for its customers: “We see ourselves as a behind-the-scenes company, not one that performs on stage. We provide the ingredients for the green tea that many people drink every day, but we are in the background, and we consider that an important role to play.” Furthermore, Harada Tea attained FSSC 22000 certification, an internationally recognized food safety certification—which Mr. Harada says is a rarity for tea manufacturers: “There are only a few companies that export tea which have this certification, so this gets us a lot of interest from overseas buyers.”

Harada Tea’s presence abroad presents a significant opportunity for expansion through e-commerce. Increasing its branded sales domestically would cause the company to compete directly with its OEM clients; however, the international market offers no such constraints. “We already have an OEM business overseas in a Singaporean supermarket. We provide OEM products, and we are providing ingredients for consumer drinks overseas as well,” Mr. Harada says.

In the United States, Harada Tea has partnered with Fujimart Corp., which operates the Maruichi supermarket chain. This partnership has created opportunities to develop products beyond tea—such as instant miso soup. “American people may not know, for example, how to make miso soup with dashi, so why not make it instant and just add hot water?” Mr. Harada says. Japanese products could have wide appeal in foreign markets and the company president notes that its new instant miso is vegan and halal. “In that vein, our idea is to provide traditional Japanese vegan or vegetarian food,” he adds. Harada Tea’s powdered miso is currently preparing for launch in the U.S., and what could follow are other products that capitalize on the popularity of Japanese cuisine. Mr. Harada outlines their future path: “There’s a traditional Japanese Buddhist vegetarian cuisine called shojin ryori, that we want to export.” He goes on to explain that products like soy sauce, which are not used as often, are another key target. “In order to ensure freshness, we want to make an instant soy sauce powder that can be prepared and used whenever needed,” he says.

A key reason to diversify the company’s offerings is the challenges that Japan’s aging population will bring to the country’s agricultural sector. Mr. Harada explains that the agriculture industry struggles with a particularly aged workforce and wages that lag behind other sectors. “One reason for that is that the mass media talks a lot about there being many people struggling with low wages and that an increase in the price of agricultural products that are staples is an economic burden,” he says. Mr. Harada believes that increased prices for staples would be unpopular in the Japanese market.

Domestic consumers are also becoming concerned about food packaging and its effect on the environment. Harada Tea has an environmentally friendly bag that uses less plastic and energy, but has found it challenging to get consumers to adopt it in the domestic market. “It’s a circular bag, but Japanese people prefer a more structured package, usually with a Ziploc-like closure, which places a bigger burden on the environment,” Mr. Harada says. He goes on to explain that packaging that meets global standards doesn’t sell well in Japan, so Harada Tea has created a custom solution to meet the unique sensibilities of the Japanese market: “We have to make our own customized machine to make packaging with more of a neat, clean design that is accepted by the Japanese market.” However, Mr. Harada says that consumers in Japan will often return cardboard packaging with minor scratches or dents and believes that the solution ultimately lies with reshaping Japanese expectations. “I think the key issue is not about potential environmentally friendly options but more about the Japanese mindset, which needs to be normalized to a global standard,” he says.

Food waste is another challenge that comes with the particularity of the Japanese mindset. Mr. Harada says that there are “unwritten rules” about shelf life: for example, he explains, a product with a one-year shelf life should not be sent from the factory with less than 70 percent of that period remaining. Likewise, if the product is already in the store, it shouldn’t be displayed on shelves without a discount. He points out that the government is currently having a discussion to change this unwritten rule; to increase the acceptable time window in which a product can leave the factory or remain on a shelf.

While the future is sure to be full of challenges, Harada Tea has seen dramatic shifts in the economic, political and social environment in its 107 years of business. Its strong connections to local suppliers and international partners ensures it will have the opportunity to continue to bring Japanese products into overseas markets. Mr. Harada explains the company’s future goals: “We want to be a window to introduce various new types of Japanese foods and condiments to the global market.”

To hear more from President Soichiro Harada of Harada Tea, check out this interview with him

0 COMMENTS