Colombia’s economy is on a roll. For over a decade, the country has averaged more than 4% annual growth and it is now consistently registering higher rates of expansion than Mexico and Brazil – even in 2008 and 2009, when just about every other country in Latin America was suffering serious downturns.

It is a country now rightly bursting with confidence and with determined and interlinked strategies to create the structural conditions to bring even faster growth, while simultaneously implementing wide-ranging programs of regional and social development. The financial sector is a lynchpin in the country’s ambitions.

Juan Pablo Córdoba, President of the Colombian Securities Exchange (BVC), recognizes that the challenge for the Colombian economy is to now “sustain growth of 5-6% over a decade, since this is what is going to make a difference in terms of poverty reduction, expansion of the middle class and wealth improvement”.

|

| Juan Pablo Córdoba, President of the Colombian Securities Exchange (BVC) |

He adds that capital investment, presently at about 29% of GDP, is what will drive growth over the next two years.

María Mercedes Cuéllar, President of Asobancaria seconds this, seeing infrastructure development as a key element in future growth, as well as a sector attractive to foreign investors.

The financial sector is in good health and has been well regulated. David Bojanini, President of the Sura Group, highlights that “the economy has been managed in a very orthodox way with close control of financial companies, ensuring prudent behavior” and so were better placed than their counterparts elsewhere during the worldwide crisis of 2008-2009.

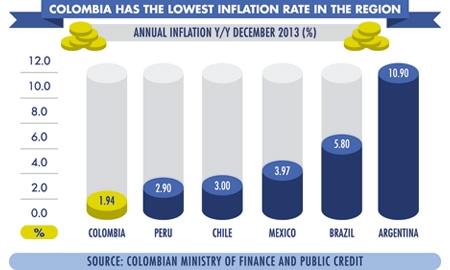

Luis Fernando Mejía, Director of Macroeconomic Policy at the Ministry of Finance, concurs, saying: “When the crisis came we were not in such a vulnerable position. Colombia grew at a rate of 1.9%, being probably the only economy in Latin America that had a noted growth in a context of regional recession.” He also points out the country’s controlled inflation of 1.9% and fiscal deficit of just 2.3%.

The Colombian financial sector is, rather exceptionally, largely Colombian-owned and is now confidently expanding into Andean, Central American and Caribbean countries.

| During the worst of the global economic recession, colombia’s GDP growth never dropped below 1.7%, well above its regional neighbors, including Peru, Mexico, Brazil and Chile |

With the coming into effect of several free trade agreements, notably that with the United States in 2012, and the founding of the Pacific Alliance with Mexico, Chile and Peru, the Colombian economy is opening up fast while opportunities for Colombian companies now abound outside the country. Luis Carlos Sarmiento Gutiérrez, President of the

Aval Group, one of those building a strong regional presence, highlights the advantages of Colombian banks as having “good portfolio quality, balance sheet strength, sufficiency of available funds, efficiency and profitability.”

Ms. Cuéllar says “there has been a financial revolution in Colombia in terms of financial inclusion”, referring particularly to the spread of personal banking into even the poorest sections of the population. She also highlights the growth of micro-credits to individuals, which now number 1.7 million and are usually for consumer purchases, as well as helping micro-entrepreneurs get started.

Mr. Bojanini sees similar potential in expanding insurance coverage to a much wider public, mentioning the Sura Group’s success in selling insurance products through retail outlets, by means of which they have “been able to reach people who, before, had no access to insurance.”

The financial sector is also responding to the growing need of the burgeoning middle class for financial products and services, with Mr. Córdoba of the BVC underscoring that pension funds in the country now have “between US$80-$100 billion of assets under management...something very positive for the development of the country’s capital markets.”

The Securities Exchange President also mentions the first Colombian Exchange Traded Fund (ETF), launched two years ago, with a fixed-income ETF now also planned. There will also be an ETF covering the main quoted companies in Colombia, Chile and Peru, the three countries that comprise the Integrated Latin America Market, or MILA.

| The president of the colombian securities exchange highlights the need for US$40-60 billion to carry out infrastructure projects over the next few years |

Mr. Córboda goes on to say that he sees the strong local stock exchange as “the ideal framework for channeling U.S. capital for major projects”, stating that infrastructure developments, the likely next major growth engine of the Colombian economy, may require the mobilization of between US$40-US$60 billion. He says the Colombian Securities Exchange has “a very direct role to play, especially in the canalization of resources to investment sectors.”

Mr. Bojanini adds that the infrastructure requirements cover everything from roads to ports, airports and railways – all that is needed to lay the foundations for achieving the country’s aim of sustained long-term growth.

The financial sector of Colombia is fully conscious of the crucial role it has to play in the country’s economic transformation into a regional powerhouse and in offering the world a dynamic gateway to Latin American markets. It is accepting the challenge, innovating, investing and initiating ideas. As Mr. Sarmiento Gutiérrez of the Aval Group says, “Colombia is now the prettiest girl at the ball and everyone wants to dance with her.” The country’s financial sector will surely be her vigilant chaperone.

0 COMMENTS