Japanese firm PRONEXUS plays an essential role in society through its high level of expertise in information disclosure.

In 2024, the Nikkei 225 surpassed 40,000, marking a record-breaking year for Japan’s financial markets. Experts attribute this bullish run to favorable macroeconomic conditions, such as the cheap yen and low interest rates, as well as a decade of corporate governance reforms. These reforms, initiated under the Abe administration with the Corporate Governance Code and the Stewardship Code, were further strengthened by the Tokyo Stock Exchange’s push to enhance corporate valuations through better communication with investors. How have these corporate governance reforms impacted your business, and to what extent do you think improved disclosure of Investor Relations (IR) information has contributed to the strong performance of Japanese equities?

Corporate governance reform has significantly increased the demand for transparency and information disclosure. While major companies often have the resources to meet these requirements, many listed SMEs lack the in-house expertise to navigate these areas. This is where we, as specialists, play a critical role.

We provide comprehensive support to managers in these companies, guiding them through all the necessary steps for effective IR and ESG disclosures. Beyond basic compliance, we also offer specific guidelines and activities aimed at improving ESG scores, helping companies align with investor expectations and enhance their overall corporate valuation.

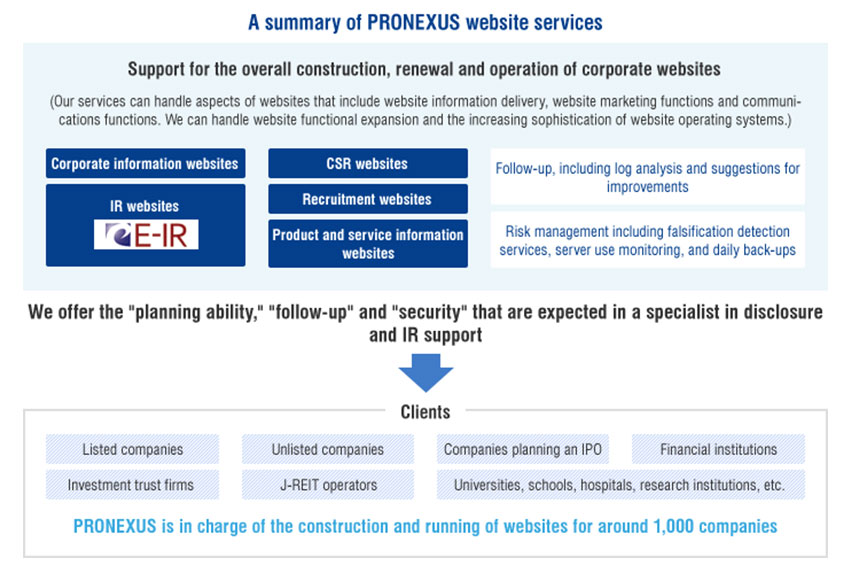

A summary of PRONEXUS website services

We also support companies in creating dedicated sustainability websites and sustainability reports. With the growing demand to integrate ESG aspects into IR communications and securities reporting, we provide comprehensive guidance and support to ensure companies meet these evolving requirements effectively.

The demand for these services has grown to the point where it currently exceeds our capacity. Recognizing this, we are actively strengthening our internal structure to better accommodate the increasing demand and continue delivering high-quality support to our clients.

Looking ahead, one of the key priorities for the JPX and TSE is fostering better relationships with shareholders, with a particular emphasis on English document disclosure, especially for Prime-Listed Companies. What opportunities does this heightened focus on improved information disclosure present for your company?

We have long provided English translation services for quarterly disclosures and financial reporting, but these were traditionally done on a voluntary basis by companies. With the recent corporate governance reforms, the law now mandates simultaneous English disclosure for financial reporting and news releases for Prime-Listed Companies.

While most Prime-Listed Companies are translating their quarterly disclosures, many are still lagging behind when it comes to translating news releases and full financial reports. This gap presents a clear opportunity for us to support companies in meeting these new requirements and ensuring they can effectively communicate with their global investors.

There are about 1,600 Prime-Listed Companies, and approximately half of them are our clients. With the new requirements coming into effect this April, we’ve already been receiving inquiries and orders.

To meet these needs, we have a subsidiary that specializes in financial translation, as financial documents require expert knowledge to ensure accuracy. This subsidiary has been operating for over ten years and utilizes a specialized financial dictionary to maintain precision. A key aspect of our work is ensuring continuity in translations by using consistent terminology, which is critical for accuracy and clarity.

Our subsidiary offers different levels of service to meet varying client needs. One service involves using machine translation supported by our specialized dictionary, followed by thorough review and editing by human translators. This ensures both quality and accuracy. For companies less concerned with precision, we also offer direct machine translation.

Additionally, there is growing discussion about requiring securities reports to be translated, which we anticipate will lead to sustained demand for our services in the future.

Japan is often seen as digitally uncompetitive, ranking among the lowest in the OECD for digital adoption and transformation. This has been a concern for successive governments. Despite this, your company has achieved strong results, often supported by the adoption of new digital tools like your IR tool for shareholder notices. Why do you think Japan struggles with digital competitiveness? To what extent do you believe AI can transform your operations, particularly in areas like translations and other related services?

We’ve made several active efforts to embrace digitalization across our services. One of our key initiatives is PRONEXUS WORKS, a system that leverages digital tools to create securities reports. The Japanese Financial Services Agency mandates the use of XBRL for securities reporting, and our system is fully compliant with this standard. Additionally, we offer a software service that makes convocation notices for shareholders’ meetings created with PRONEXUS WORKS accessible on smartphones. Given that smartphones are now ubiquitous in Japan, providing easily accessible mobile solutions has become essential.

Another area of innovation is investment trust prospectusess, which have traditionally been paper-based. With the Financial Services Agency leading the way toward digital formats, we are developing a system to make HTML-based prospectuses easily viewable on smartphones.

We also offer support systems for online general shareholders’ meetings and financial results briefing. We are diversifying our services to align with societal changes.

As for why Japan has lagged in digitalization, one significant reason is the demographic of its investors. Traditionally, most investors were from older generations who preferred paper-based documents. However, this landscape is changing rapidly due to the Nippon Individual Savings Account (NISA) initiatives, which have attracted 25 million accounts, with about one-third belonging to investors in their 30s and under. This younger demographic is more comfortable with digital tools and prefers them over paper.

The shift from a savings culture to an investment culture in Japan is underway, and younger investors are becoming a driving force. Their digital-first mindset will further accelerate the push toward digitalization in financial services and beyond.

Do you think those investors are more risk averse as well?

There are some challenges associated with digitalization. For instance, with paper-based documents, we require customers to sign after reviewing all the important information, providing a clear confirmation of their understanding. In a digital format, we must find the most effective ways to ensure that same level of comprehension.

Data falsification is another concern that we take seriously. To address this, we provide a software service that detects falsification, ensuring the authenticity of digital certificates when combined with our system. This gives both companies and investors peace of mind in a digital environment.

Rather than viewing the advancement of AI as a threat, we see it as a powerful tool to gain a forerunner’s advantage. With over a decade of specialized expertise in translation, we aim to combine our know-how with the latest AI technology to create innovative, high-quality AI translation services. By integrating our experience with cutting-edge tools, we’re looking to lead the way in this evolving field.

PRONEXUS provides a range of services to international companies operating in Japan, specializing in supporting foreign investment trusts and institutions issuing bonds in Japan. Your expertise includes preparing essential disclosure documents and sales materials, ensuring regulatory compliance, and facilitating effective market entry. What are your competitive advantages in assisting foreign investment trusts and institutions with sales in Japan, and why should companies choose PRONEXUS for their support?

We offer comprehensive services to foreign companies listed in Japan and financial institutions providing investment trusts as a product. Our expertise includes collaborating with law firms to translate documents that meet Japanese regulatory standards or reviewing existing translations to ensure compliance.

By aligning all documentation with Japanese guidelines, we enable foreign companies and institutions to effectively navigate the local market while ensuring their materials meet the required standards.

Are you looking to expand any of your services for international companies and are you looking to expand your international client network?

We are committed to supporting foreign companies entering the Japanese market, especially as the Tokyo Stock Exchange takes the lead in promoting foreign company listings. Our comprehensive services include documentation preparation and translation to ensure that foreign companies meet all relevant Japanese regulatory guidelines.

By providing end-to-end support, we aim to make the listing process seamless and efficient for foreign firms, enabling them to establish a strong presence in Japan’s financial market.

An IPO represents a significant milestone for a company but is often a complex and stressful process that can take months to complete. PRONEXUS offers comprehensive support for businesses preparing to go public, including assistance with stock listing applications and establishing management and accounting systems, ensuring all documentation requirements are met and facilitating a smooth IPO process. What makes PRONEXUS the ideal partner for companies preparing to go public, and how do you minimize the stress and challenges associated with the IPO process?

We typically begin working with potential IPO companies two to three years before their planned launch. The IPO process involves several procedures, including applications to the Tokyo Stock Exchange (TSE) and the Financial Services Agency (FSA). While securities firms provide guidance on the required documents and auditing companies review the final submissions, they don’t usually offer detailed assistance on how to prepare these materials.

This is where PRONEXUS plays a vital role. We fill the gap between these two entities, providing hands-on support to IPO companies in producing the necessary documents and ensuring they meet all requirements. With our extensive experience and know-how, we guide companies through the entire process, helping them understand what types of documentation are needed and what has worked for others in similar situations. We also perform final checks on the documents and offer seminars to teach companies how to prepare them effectively.

In most cases, companies planning an IPO consult with partners like us. Many of these businesses may not yet meet the TSE standards for going public. We assist with improving internal regulations, labor management, and other operational areas to bring them in line with the requirements. Additionally, we provide comprehensive support in structuring the company to ensure full compliance with TSE regulations.

Our approach is to work closely with the IPO company over a two-to-three-year period, creating a solid foundation for a successful public offering while minimizing stress and ensuring the process is as smooth as possible.

While you assist foreign companies operating in Japan, you also offer services to help Japanese companies expand internationally. These include market entry support, assistance with documentation to meet local regulatory requirements, and tailored IR support for global audiences. What are some of the key challenges Japanese companies face when expanding abroad, and how do you help them overcome these obstacles?

In Japan, approximately 200 companies adhere to the international IFRS standard, and we support 60% of them. Our services include providing guidelines, creating IFRS-compliant reporting and digital entry forms, and offering examples from other companies to streamline the process. Beyond IFRS-based reporting, we also assist Japanese companies with international expansion.

We have offices in Vietnam and Taiwan to directly support our clients in these regions. In other markets, we collaborate with local accounting firms to provide on-the-ground assistance. For Japanese companies expanding overseas, one common challenge is that a salesperson is typically dispatched to the local region for market research. However, these individuals often lack expertise in accounting, labor management, or regulatory compliance.

To address this, we provide fully equipped offices in Vietnam and Taiwan to help companies establish a local presence. We handle everything from securing government approvals for company registration to managing accounting, payroll, and even market research. This comprehensive support allows companies to focus on growth while minimizing operational complexities.

Many companies choose to work with us because they want to minimize risks and maximize their investment when expanding abroad. By partnering with us, they can operate locally with minimal initial investment. Another reason companies trust us is that their overseas expansion projects are often managed by accounting or general affairs divisions—teams we already have close, trusted relationships with through our domestic work. In this way, our overseas business is seamlessly aligned with our domestic services, ensuring continuity and reliability for our clients.

Business partnerships are clearly essential to your company, as demonstrated by your collaborations with accounting firms in various countries. Are you looking to expand your international partnership network, and if so, what kinds of partnerships are you seeking and in which countries?

We have established successful partnerships in Taiwan and Vietnam, and we aim to replicate these experiences in other countries. One of the biggest hurdles for Japanese companies expanding abroad is language, which presents a valuable business opportunity for us. Additionally, we are particularly interested in countries with high economic growth potential. Asia, being the most vibrant region currently, is our primary focus, with specific attention on Indonesia and Thailand.

In Indonesia, regulations have become more lenient. Previously, Japanese companies were required to form joint ventures with local firms, but now 100% investment by Japanese companies is permitted in the service and manufacturing sectors. This regulatory shift has made it significantly easier for Japanese companies to operate locally.

Indonesia also presents a unique opportunity with the government’s decision to move the capital from Jakarta to Nusantara due to overpopulation. Nusantara is a newly planned city, and while its development may take 20 years, this process will likely create a growing demand for Japanese technology and expertise. As Japanese companies enter this market, we see a significant opportunity to support them.

In Vietnam, where we already have an office, the market is evolving. There is a shift from manufacturing to service and retail sectors. While manufacturing growth is increasingly centered in India, Vietnam is experiencing more small-scale investments spread across multiple projects. We expect this trend to lead to a growing number of projects in Vietnam, providing new opportunities for our business.

As part of your mid-term strategy for your 100th anniversary in 2030, you plan to expand web services, English translation services, and BPO offerings to address the anticipated decline in printing sales. Additionally, you aim to strengthen your capabilities in meeting the growing demand for non-financial disclosures, including sustainability reporting. This strategy has already proven effective, with your company achieving a record high of JPY 31 billion in revenue last fiscal year. What do you see as the key drivers of growth as you approach this milestone anniversary? Which business areas do you plan to focus on most to continue achieving record-breaking sales?

Our recent growth can be attributed in part to the acquisition of Cine Focus Corp., an event video equipment and opperational support company, as well as the increasing demand for BPO, English translation, and web creation services. Non-printing business accounted for two-thirds of our sales in the last fiscal year, reflecting our successful diversification efforts. That said, the printing business still represents one-third of our revenue, so it remains an important component of our operations.

With the ongoing shift toward digitalization and the world becoming increasingly paperless, we anticipate reduced demand for paper-based documents. To address this, we are actively diversifying into digital fields to offset the shrinking demand for print.

One key area we are strengthening is employment services. We see a strong connection between enhancing a company’s attractiveness for hiring and its IR disclosures—both aim to communicate effectively, whether to potential employees or investors. Many Japanese B2B SMEs with advanced technologies and significant global market shares struggle to convey their value to potential employees. This creates a growing need for communication services, and we are already receiving substantial orders from clients in this area.

Another growing focus is retail support services. We provide solutions to help our clients’ retail partners effectively communicate the benefits of their products, addressing a significant gap in the market.

Looking toward our centennial anniversary, we are positioning ourselves as a communications-based service company. While disclosure remains our core pillar, we are augmenting it with employment and sales support services. Each company has separate budgets for disclosure, employment, and sales, and our strategy is to leverage our accumulated expertise to tap into all these areas effectively.

To transition to what you call a more communication-based company, will you be pursuing an M&A strategy to further enhance your capabilities?

Yes. That is a strategy we plan to use. For example, we may look at acquiring employment or marketing companies,

I believe you are a third-generation president of PRONEXUS, and as we have mentioned, the company’s centenary is approaching in 2030. What are your personal goals for your presidency? What would you most like to achieve during your time as president?

In 2030, I will commemorate my 60th anniversary alongside the company’s centennial year. My grandfather founded the company in 1930, initially as a printing business serving the securities industry. In 1976, my father took over and expanded the business into digital and disclosure services. When I succeeded him in 2010, I have built the company's disclosure business as a foundation, expanded its surrounding areas, diversified our business lines, and evolved the organization into one based on communications.

If I am fortunate enough to continue my presidency until the centennial year, my hope is that we will continue to grow, achieving JPY 40 billion in revenues, while making a strong contribution to society. Our legacy has always been about adapting to change and providing value, and I believe this mission will remain central as we move forward into the future.

For more information, please visit their website at: https://www.pronexus.co.jp/english/

0 COMMENTS