With its unique production methods, KJ Chemicals looks to consolidate market position while developing new products that will enable it to achieve its carbon neutrality goals.

Japan’s chemical industry has suffered when it comes to the production of basic chemicals due to regional competitors who have been able to lower their costs, however, Japanese chemical manufacturers still remain leaders in highly functional and specialized chemicals. In addition, several specialized trading firms in Japan can develop niche chemicals and material technologies. In your opinion, what are the strengths and weaknesses of the Japanese chemical industry today?

The strengths of the Japanese chemical industry first and foremost lie in the quality of the products. Recently Japanese companies are becoming more aware of cost effectiveness with the increased globalization of the market. Our company is included in this, and while we used to have a bigger share of the market, part of our business has been taken over by Chinese companies in particular who provide products at a lower cost, but that are lower value. We changed our mindset to increase our productivity and our cost-effectiveness supported by the fundamental quality that is augmented by low cost.

Made-in-Japan itself has been known to mean quality, but we do understand that being conscious of price competitiveness is becoming more critical with the increased globalization of the world. We are making daily efforts to increase productivity while providing less costly products.

Increased productivity is interesting considering Japan’s current demographic situation. It is the oldest society in the world with a shrinking population due to low birth rates. In the next 15 years, it is estimated that one in three people will be over the age of 65 which creates issues such as a labor crisis as well as a shrinking domestic market. What have been some of the challenges you’ve seen as a result of this demographic shift and how are you reacting to these challenges?

To mitigate the impact of Japan’s demographic decline we have three approaches. The first is to increase production productivity through the introduction of automation and labor-saving equipment in order to require fewer people on site. We also want to take advantage of scale merit, meaning that we only require four people on site to produce a few hundred or a few thousand tons, so we are trying to consolidate our production to a bigger bulk, which would increase productivity within our existing facility. As for the development of new products, we are not confining ourselves just to in-house development, and to that end, we are open to collaborating and partnering outside of our company. At the same time, we are looking into hiring elderly people who possess experience and know-how to work in our R&D department. In fact, in the near future, we may possibly expand our R&D capabilities to foreign countries.

The biggest immediate issue we are experiencing is the shortage of labor, especially for the maintenance of our infrastructure and our plants for production. Our facilities have pipes, motors, and pumps, and these all require maintenance daily, but with the aging population, we are experiencing a shortage of technicians. Last year we established our subsidiary, KJ Chemitech, and they specialize in the training of maintenance for our facilities. We are inviting experienced technicians to teach and pass on their knowledge to the next generation, mitigating the issues.

You mentioned R&D as one way of mitigating demographic issues, and you also mentioned that you are open to working with partner companies as well. In terms of strengthening your R&D, are you looking to partner with overseas companies? Are you also looking to establish an overseas R&D base?

We are currently thinking about both approaches you mentioned, and of course, partnering with overseas companies is important. At the same time, having our own base for sales and development is necessary, and interestingly with our staff here in Japan, one-third are non-Japanese. We have high expectations for them to act as a trigger moving our company forward. Countries of interest would include China, Taiwan, Mongolia and Vietnam. We also have an Italian employee from a partner company.

Out of the countries you listed, which do you believe has the most potential in terms of establishing an R&D base?

Thinking about a production base, China and India would be an important area, but additionally, if we were to consider the latest technology it would be the US. Having said that, Japan is an advanced nation and there is an environment for new chemical development. For that reason, we will continue to center our business around Japan.

Using the world’s first production methods of acrylamide derivatives as your core technology you have been able to conduct R&D on acrylamide derivatives for paints and inks all the way up to various electronics materials as well. Can you tell us the development history of this unique production method and how it has helped you improve your product lineup over time?

Our acrylamide derivative products start with DMAA (dimethyl acrylamide). Initially, this product was developed in collaboration with a textile manufacturer to develop polyester fiber.

It was developed as an additive to improve sustainability. Unfortunately, it was not used for the modification of polyester fibers, but it was found that this product has features that can contribute to many industries, such as various compatibility and heat resistance, as well as adhesion. Therefore, we have been working on the development of a process to efficiently manufacture such compounds, and have now put three types of manufacturing methods into practical use. Several manufacturing methods are extremely efficient in the production of various acrylamide derivatives, and are selected and combined according to the characteristics of the product to be developed for optimal manufacturing.

Many of the products manufactured have the characteristic of sticking well and mixing well, and taking advantage of this feature, their use is expanding to include petroleum drilling chemicals and papermaking chemicals, various adhesives, medical materials such as inks, paints, contact lenses, and more recently, advanced semiconductor and electronic materials.

Are there any new applications you would like to introduce your products to?

The 3D printing and inkjet fields are expected to grow further in the future. In addition to this, we will actively propose materials for new fields that require our technology and products.

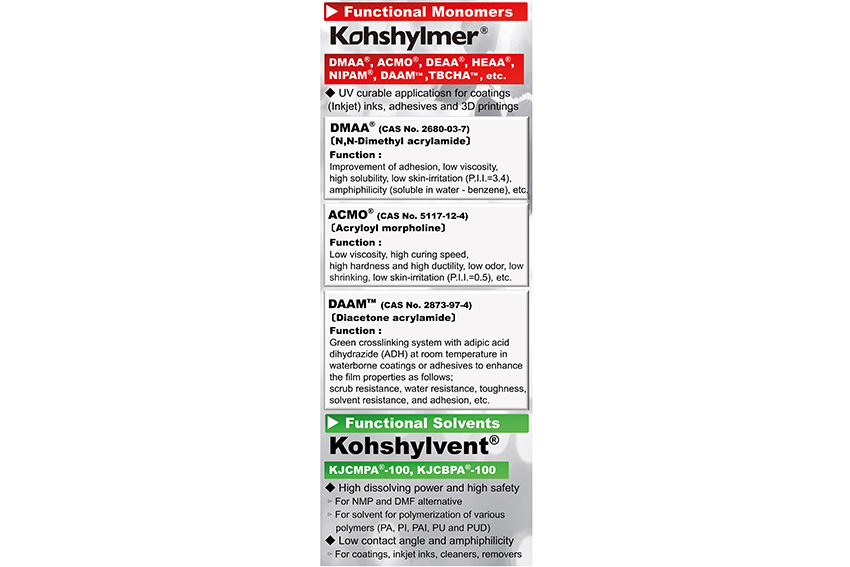

Kohshylmer is your functional monomer brand and it includes a variety of different categories of products. It is used in a variety of applications including contact lenses, cosmetics, electronic materials, and many more. How is the Kohshylmer brand superior to more conventional functional monomers?

There are three unique aspects to our Kohshylmer brand products. Firstly, take cosmetics applications like body soaps. Since these products stay on a shelf for a while it is necessary to maintain quality while it is on a shelf. Our chemical retains the product without changing the characteristics for a considerable amount of time. The second characteristic is that it mixes and adheres well. Take for example a hand cream, it will merge well with the skin. Thirdly, Kohshylmer has high heat resistance.

You recently exhibited your products at the New Functional Materials Exhibition held at Tokyo Big Sight. Was this event a success for your firm and are you looking to participate in any international exhibitions?

At the New Function Materials Exhibition, more people visited our booth than ever before.

At this exhibition, in addition to the products currently on sale, we introduced new products manufactured from biomass-derived raw materials. We have already received a large number of requests for samples for this new product. It was a success.

Pre-COVID we were participating in international exhibitions overseas. In China, we usually attend twice a year and in Europe, there is a coating exhibition that we have attended in the past. In the US we will be attending another exhibition on coatings and that will be held from the end of April 2024.

Your firm is heavily involved in the chemical sector, which is also the largest industrial consumer of oils and gas, producing more than 10% of fossil fuel emissions. If we look at Europe, 3,000 chemical companies will have to comply with new legal norms that aim to reduce diffuse emissions and carcinogenic or toxic substances. If we look domestically here in Japan, the Japanese government has already said that the country needs to achieve carbon neutrality by 2050. What strategies are you employing to reduce your environmental footprint and reach carbon-neutral targets?

We are in line with Japanese governmental policies for carbon neutrality targets. Our company’s mid-term strategy is to reduce CO2 emissions by half by 2030 with a target of complete carbon neutrality by 2050.

We achieve this by using renewable energy. Currently, 90% of the electricity for our factories comes from renewable sources. However, heavy oil is used as the fuel for the heating medium used to heat the plant.In the future, we plan to gradually switch to LNG and electricity.

Then we could expedite our ability to reach carbon neutrality goals. This is a step that we are actively working on now and green methanol is an option but right now the price is too expensive. We need to look at the trends, and what we are seeing right now will be a shift to LNG first then to methane gas. We have also been looking into the usage of hydrogen but it isn’t realistic quite yet.

Company compliance and sustainability are now criteria for a company’s global operations, and companies need to be mindful of human rights. We have applied for an evaluation from Eco-Vadis, the world's largest sustainability rating organization, and have received a gold rating for the past two years as proof of our excellent sustainability efforts. All of our products are developed, manufactured, and sold in an environment that receives a gold rating.

Imagine that we interview you again on the last day of your presidency. What goals or dreams would you like to achieve by the time you are ready to hand the baton to the next generation of KJ Chemical executives?

I would like to focus on the day-to-day operations of the company. My motto is to create a better company today than it was yesterday and to create an even better company for tomorrow. Our corporate philosophy is to contribute to the realization of a sustainable society by providing superior functional chemicals. Continuing these missions is what I want to do as the leader of the company.

0 COMMENTS