As kilns and furnaces become increasingly crucial for the development of new materials, ONEJOON brings an innovative and competitive mindset to the industry.

With global supply chain realignment happening, especially driven by the Inflation Reduction Act in the US and the CHIPS Act in both the US and Europe, many multinational corporations are restructuring their supply chains around allied countries, including Korea. This seems like a prime opportunity for Korean suppliers to capitalize on this shift, grow, and increase their market share. Do you agree that now is an ideal moment for Korean suppliers to expand internationally? What challenges and opportunities do they face when entering foreign markets?

Absolutely. This is a pivotal moment for Korean suppliers, who are increasingly shifting their focus from domestic operations to global markets. However, while this presents a significant opportunity, it also poses considerable challenges.

To understand the full scope, we need to recognize the cultural differences between Korean suppliers—whether they supply key equipment or parts—and large conglomerates. In Korea, the relationship between big conglomerates and their smaller suppliers is vital. Typically, large companies set the strategic direction and make substantial investments based on their business plans, while suppliers provide critical support by delivering raw materials, major components, and essential production equipment. These conglomerates usually work with multiple suppliers, and transactions tend to follow standard parameters—such as product specifications, delivery times, quality, and quantity.

However, in the Korean industry, there's an intangible aspect to these business relationships, which includes trust, patience, and mutual support. Korean conglomerates and their suppliers share extensive experiences and information toward a common goal. This close-knit collaboration has been a driving force behind the rapid growth of Korea's industrial sector.

Now, as the domestic market reaches saturation, global opportunities are arising, particularly with regulatory shifts like the IRA creating more openings for Korean companies. Chinese companies, for example, face significant challenges when trying to enter the US market, which presents an advantage for Korean businesses. ONEJOON, for instance, established a US branch four years ago to expand our global presence, and other Korean companies are following suit.

However, building strong relationships with international customers is not easy due to cultural differences. The dynamics between large corporations and suppliers abroad are often quite different from those in Korea. Successfully navigating these cultural gaps is crucial for Korean suppliers to seize the opportunities abroad. Otherwise, they risk missing out on new business. International customers tend to focus more on results than on the long-standing relationships that have shaped Korea's business culture, which could pose a challenge for small and medium-sized enterprises.

Korean suppliers have developed strong competencies and a proven track record of working with large conglomerates. But when it comes to challenges, SMEs will need to overcome not only cultural differences but also variations in work ethics, compliance standards, and regulatory environments across countries. In many Asian markets, business relationships are heavily relationship-based, whereas in Western markets, particularly in North America, the business culture is quite different. Korean companies will need to learn and adapt to these new environments to succeed internationally.

You mentioned earlier that you opened an office in the US four years ago. I’d like to dive deeper into your analysis of the relationship between Korean companies and foreign partners. What impact have you observed in your US operations? What benefits have you seen in terms of localizing solutions and building relationships?

So far, our presence in North America has primarily focused on providing services. However, now is the time to shift towards actual sales activities—meeting customers in person and discussing feasible commercial projects. We’re still in a learning phase, working to overcome cultural differences and better understand how to engage with customers to scale up from laboratory projects to full commercial endeavors. This requires a different approach.

When discussing the US market, one of your industries is the battery sector, which has recently been affected by the limited growth of electric vehicles. Additionally, we’re seeing a trend of onshoring production in the US and Europe across various sectors. What industries do you foresee as opportunities for your company overseas? Is it limited to the battery industry?

I don’t believe the opportunities are limited to the battery industry. We see potential in other sectors as well, such as semiconductors and renewable energy, including fuel cells. While battery technologies and commercial expertise are widely available outside the United States, the US government is focused on bringing production within its borders. To do this, they need reliable partners or collaborators from outside the US, and I believe Korean suppliers are an excellent option, especially for companies seeking alternatives to Chinese suppliers. This opens up significant opportunities for ONEJOON and other Korean SMEs in the long run.

Onejoon’s core technology lies in thermal solutions, and thermal processes are not only applicable to battery materials but also to a wide range of other materials, such as ceramics. Additionally, many related industries, like those requiring heat treatment, present opportunities for us as well.

In the heat treatment and metal processing industry, there’s significant concern about environmental impact, especially due to the consumption of gas, oil, and electricity. While it's not solely the responsibility of equipment manufacturers, from the perspective of a furnace company, how should industry players act to minimize these effects? What solutions would be best to make the industry greener?

To create or produce value-added materials—not only for battery materials but also for fuel cells and carbon fibers—heat treatment is essential because it fundamentally changes the physical or chemical properties of materials. Without heat treatment, it’s impossible to develop new materials. While there are other processes, such as chemical reactions, they belong to a different domain. Most metallic or ceramic materials require heat treatment, and that’s where our expertise comes in.

Many see us as just a kiln manufacturer, but that’s only part of the picture. The kiln itself is a physical tool, but our real strength lies in providing tailored solutions. We know various alternative methods to produce value-added materials, each with different trade-offs. Some solutions are more energy-efficient but come with higher costs and complexity, while others may be more cost-competitive but generate more emissions and overlook environmental concerns. Balancing these factors is crucial.

Today, especially in the battery industry, we’ve seen rapid growth focused purely on meeting consumer demand without much regard for environmental or carbon footprint considerations. Manufacturers often use the cheapest equipment and kilns to mass-produce, but I don't think this trend will last. Environmental awareness is rising, and I believe this is an opportune moment for the industry to shift from purely quantitative growth to optimized and sustainable production.

The question now is: How can we produce the same or even improved materials more efficiently, while reducing environmental impact? At ONEJOON, we are prepared to help our customers meet new requirements—not just in terms of cost but also by optimizing for environmental efficiency. Our role will become increasingly important in this transition.

This shift is especially relevant for new markets like the United States and North America. For example, in the past, Europe rushed to import battery technology from China without fully considering environmental factors, assuming the Chinese processes were state-of-the-art. But these production methods didn’t align with local policies or environmental standards, leading to mismatches that have created challenges for European players. If the US can avoid these mistakes and learn from Europe’s experience, I believe the battery industry will evolve and make significant strides.

The US is well-positioned to lead this change—it has the foundational technology, a large market, and strong government support. The future will depend on how effectively the US can collaborate with companies like ours in Korea, and how well it integrates these lessons into a more sustainable, efficient industry.

At ONEJOON, we are acutely aware of the high energy consumption in furnaces and kilns, whether it’s electricity or gas. That’s why our technology team has been focusing on reducing energy consumption and developing more sustainable solutions. We’ve made progress, but implementing these solutions depends largely on our clients' willingness to invest in long-term sustainability. It requires time, experimentation, and validation of the new technology. Close collaboration with clients who share a forward-thinking mindset will be key to making these improvements a reality.

Pilot Sintering furnace

You mentioned how Europe spent significant time trying to attract Chinese battery manufacturers, largely because lithium iron phosphate (LFP) batteries were the most cost-competitive option. Secondary batteries remain expensive, which is a major hurdle to the large-scale rollout of electric vehicles. How do you help your clients address the pricing challenge?

Let me give you an example. Fifteen years ago, when we supplied kilns, their capacity was only about 10% of what we can achieve today. Yet, the energy consumption isn’t ten times higher; it is far less. This technological improvement has significantly contributed to lowering material costs by reducing utility consumption while increasing throughput.

Take the Roller Hearth Kiln (RHK) as another example. It's widely considered the state-of-the-art technology for producing cathode materials, whether for LFP or other types. As one of the world’s largest suppliers of RHKs, we understand both its strengths and its limitations. Despite having an advanced solution, our customers often prefer proven technologies over newer alternatives. They simply want to scale production quickly and at a lower cost. This is because the market is moving so fast, leaving little time to explore new options.

However, I believe that as the market matures—especially in the US, where clients like EV manufacturers are key players—there will be more room to think strategically about cost reductions. Saving 10% on equipment by opting for a cheaper kiln won’t necessarily result in a significant cost advantage, especially when competing against Chinese suppliers using similar methods. The success of the US market, and other new markets, will depend on how well companies understand these fundamentals and how effectively they collaborate.

This is one reason why I believe closer cooperation with Korean suppliers is crucial. Korean companies have a proven track record of success, not just in finding the right solutions but in knowing how to create and implement those solutions effectively. This know-how can be shared and applied in new markets.

For the US, this is especially important. The country has the technology, research institutions, universities, conglomerates, and a massive domestic market supported by the government. The US also has more resources and capital than Korea. This presents a great opportunity for Korean suppliers to reposition themselves, shifting from being domestic players to becoming global suppliers.

In the furnace industry, many companies have long histories, either in China, Japan, or Western countries. In contrast, your company, ONEJOON, is quite unique. Founded in 2008 and fully independent, you’ve grown at an impressive pace, especially in the past five years, in an industry dominated by legacy companies. To what do you attribute this success?

Our success ties directly to our focus on price competitiveness, but that’s only part of the story. Over the past five years, we’ve worked diligently to tailor our kiln products to meet the specific demands of our customers, particularly in terms of price. We understood early on that in order to compete, we needed to prioritize cost-effectiveness.

There are two main ways we achieved price competitiveness. First, we reduced production costs. By streamlining our own production processes, we’ve been able to cut expenses related to raw materials and labor, allowing us to offer kilns at 10-15% lower prices than competitors without sacrificing quality.

The second approach was to increase kiln capacity. Over the past five years, we’ve managed to double the capacity of our kilns without significantly increasing the price. At the same time, we reduced utility consumption, meaning our customers could enjoy double the throughput at a lower operational cost. This combination of higher capacity and reduced costs has made us a favored choice in the market, and we’ve consistently had a full pipeline of orders for the last five years.

This focus on understanding and meeting customer needs quickly and effectively is a core philosophy at ONEJOON. Many successful Korean suppliers share this approach—they recognize the critical demands of their customers and adapt their products to meet those needs as quickly as possible. That adaptability has been a key reason for our success.

You also mentioned the long-standing history of many Japanese players in this field, which makes our short history stand out. I believe another major factor behind ONEJOON’s success is our willingness to innovate. Despite facing technically challenging demands from customers, we were never afraid to try new things. In contrast, many companies with long histories tend to be more conservative and reluctant to take risks or explore unproven technologies. They prefer sticking with established methods and references.

Our approach has always been different. We thrive on finding solutions, even for tricky or complex customer requests, which has driven us to be innovative. This mindset of embracing challenges and innovation is at the core of our company’s DNA. It also sets us apart from our competitors. Perhaps because we’re a smaller company, we’re less constrained by conservatism, allowing us to stay flexible and responsive to new opportunities.

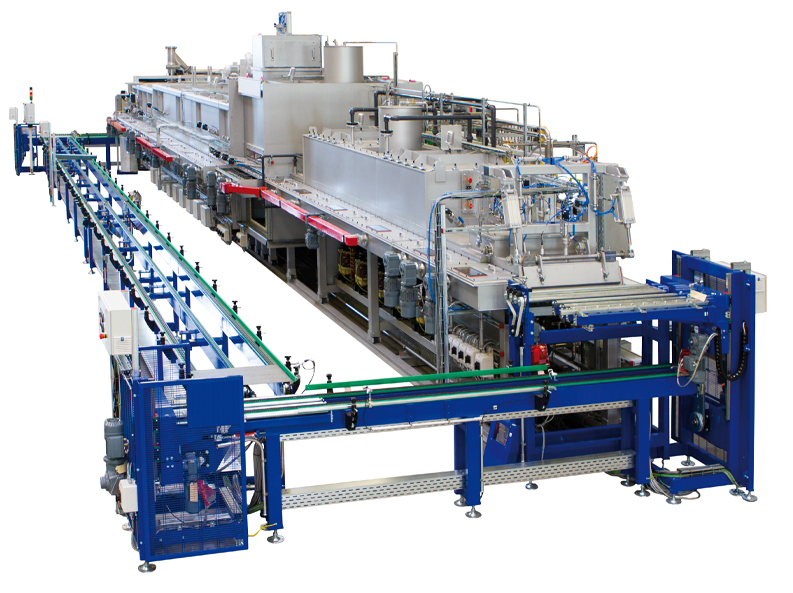

You're not just providing furnaces—you’re offering a full-service solution that includes automated systems attached to your furnaces. You can run simulations to ensure the furnace meets customer requirements, and you also handle EPC projects from start to finish. With all these turnkey solutions, what competitive advantages does this give you over the companies we discussed earlier? Could you share an example of a project you’re proud of that highlights this aspect?

This is one of the key differentiators that sets us apart from our competitors. We began as a furnace builder and a thermal solutions provider, but about 10 years ago, we expanded into powder handling systems. Initially, we didn’t offer this service, but as a comprehensive solution provider, we realized we had to fully understand our customers’ needs—including the properties of materials like precursors, lithium sources, and what happens during the reactions inside the kilns. We also had to handle how the materials are processed after heat treatment.

When our customers had difficulties managing powders, it became clear that our role wasn’t just to provide kilns—it was to offer a full process solution, from raw materials to finished products. This realization became a major driving force for us. Fortunately, about 10 years ago, there were very few specialized powder handling system providers, so it was relatively easy for us to enter the market. Leveraging our knowledge of materials, we were able to carve out a niche in this space, and today, powder handling technology is an essential part of our business.

In material processing, especially for cathode and anode production, there are two main aspects: powder handling and thermal solutions. What we discovered is that many companies focus solely on optimizing furnace performance, but that approach often leads to mismatches between kiln capacity and powder handling capacity. For true global optimization, customers need a seamless process from raw material handling through to the finished product, without any bottlenecks. That’s where our strength lies—we offer both powder handling and thermal solutions under one roof. As investments in this area grow, our integrated solution becomes even more effective and valuable to customers.

ONEJOON Test Center

Two years ago, I read an article discussing the calcination process for cathode production, particularly highlighting that the Roller Hearth Kiln (RHK) was the standard. There was speculation that the rotary kiln might be a better option. What’s the current status? What’s the most efficient technology being applied today, and how does your technology fit into this?

Currently, over 90% of cathode materials are produced using Roller Hearth Kilns, making it the dominant technology. We've supplied more than 200 RHKs to top-tier cathode active material (CAM) producers globally, and we have a strong track record in this area. While we also have the technology and experience to supply rotary kilns, the market has consistently demanded RHKs because they are the proven solution. Most customers aren’t exploring alternatives right now—they simply ask for RHKs, and that’s what we focus on optimizing.

That said, I believe RHKs may not be as efficient in the future as we face new demands from the next generation of materials. Rotary kilns, while not new, have their own merits and potential, and every major CAM producer has considered using them at some point. However, from a technical standpoint, rotary kilns aren't ideal for processing cathode or anode materials. They simply don’t meet the performance requirements for these applications.

Ultimately, kilns are just a means to an end in CAM production. Whether it’s RHKs, rotary kilns, or pusher slab kilns, they’re all tools that need to be chosen based on the specific needs of the customer. It’s like looking at cars on the street—whether it’s a truck, sedan, or SUV, they’re all vehicles, but they serve different purposes. Likewise, different kilns suit different applications, but for cathode and anode production, rotary kilns aren't the ideal solution today. What we need is a new type of kiln technology that can better meet the evolving requirements of the battery industry.

I believe solid-state batteries represent a highly promising and potentially transformative business—not only from the perspective of battery or EV manufacturers but also for suppliers like us. Currently, most electric vehicles are powered by lithium-ion batteries. However, if all-solid-state batteries become the norm, some existing players, such as cell manufacturers, will face significant challenges. They’ll have to shift their heavily invested production lines from lithium-ion to solid-state batteries, which can be a daunting task. But for solution providers like us, this shift represents a major opportunity, regardless of whether the technology is lithium-ion or solid-state.

We’ve been supporting the development of solid-state batteries from the beginning. Although this market is still relatively small, we’ve already established communication with these companies. Whenever a new material requires heat treatment, these developers need support from suppliers who can help scale production from the lab or pilot scale to mass production. Often, innovative materials are created in labs—whether at universities or companies—but many fail during the commercialization phase, not because the materials themselves are flawed, but because scaling up is extremely challenging.

That’s why our focus is on scaling up production from the lab stage to full commercial scale while maintaining economic feasibility. Solid-state battery developers recognize the value we bring, which is why they’ve approached us for collaboration. They frequently visit our test center in Germany, where we discuss their materials and even test samples they send us. We have a variety of kilns in our test center, including rotary kilns, pusher slab kilns, and vertical kilns. This allows us to cater to the specific thermal processes and requirements of different materials. After analyzing the materials, we provide detailed feedback and recommend the appropriate thermal processes. Once we align on a solution, the customer typically orders a pilot system.

Many companies only have lab-sized kilns capable of handling gram-level quantities, but they lack the capability to scale up to large-scale kilns that can handle production volumes in kilograms or tons. That’s where our test center comes in. Once customers gain confidence that they can scale up their production, we help them with budgeting for utilities and planning for commercial-scale investments. This is why solid-state battery developers need our expertise.

Working with these developers is fascinating for us because by supporting their commercialization efforts, we also contribute to overcoming the trial and error process that comes with producing solid-state batteries. In doing so, we play a role in their success.

As for solid-state batteries, they’re undoubtedly a cutting-edge technology, and right now, they are indeed expensive to produce. But it’s important to remember that lithium-ion batteries were also prohibitively expensive 10 years ago, with production efficiency at only 10-20% compared to today’s standards. Over time, economies of scale have significantly reduced the costs of cathode and anode materials. I believe solid-state batteries will follow a similar path, becoming more affordable with the support of solution providers like us who help developers achieve cost competitiveness.

In short, I’m optimistic about the future of solid-state batteries, and we have plenty of work ahead with our valued customers.

In 2020, ONEJOON acquired Eisenmann Thermal Solutions, which manufactures kilns and furnaces used in carbon fiber production. This acquisition allowed Onejoon to expand its portfolio from battery active material equipment to other applications. Today, Onejoon offers solutions for battery active materials, MLCC capacitor materials, carbon fibers, tire recycling, and biochar recycling companies. Looking toward the future, how do you see the balance between these different business areas?

As a company owner, my hope is that the carbon fiber, fuel cell, and recycling businesses will grow significantly, just like our battery business. Ideally, I'd like to see a balance between these areas. While batteries are, of course, one of the most critical areas for our company, I believe the carbon fiber industry holds immense potential for reducing the carbon footprint of human society. For instance, carbon fiber is widely used in wind turbines for electricity generation and in aerospace, where nearly 50% of the material is made from CFRP (carbon fiber-reinforced polymer). This lightweight material allows planes to fly longer distances. It’s a very promising industry, and I expect it to grow substantially.

I’d like to add that our core technology and foundational expertise are rooted in the same principles, whether it’s for carbon fiber, fuel cells, batteries, cathode, or anode materials. For example, when we acquired Eisenmann Thermal Solutions at the end of 2019, I was already familiar with the company. Every time I visited Eisenmann, I was impressed by their advanced technology, experienced engineers, extensive intellectual property, and their history of in-house knowledge and databases. But I always wondered why they weren’t more involved in the battery industry.

Then, I realized that their carbon fiber production lines required ultra-high-temperature furnaces, capable of reaching up to 2600°C for carbon fiber production. In fact, they had the capacity to reach 3000°C, which is hot enough to produce synthetic graphite—yet they hadn’t pursued this opportunity. I saw an excellent chance to expand their technology into the production of anode materials.

Over the past five years, we’ve leveraged Eisenmann’s technology to develop anode kilns capable of producing natural graphite, synthetic graphite, and even silicon anode materials. This has allowed us to finalize our portfolio for major battery materials. As you know, if a battery cell costs 100 euros, nearly 50 euros go toward the cathode and anode materials. That’s why mastering this technology is so crucial.

With this acquisition, we’ve now solidified our offerings for cathode, anode, and other battery-related materials, and much of this progress is thanks to the advanced technology we acquired from Eisenmann.

To return to your question, I’m not overly concerned about maintaining a strict balance between different business areas. Instead, I’m eagerly awaiting the discovery of new materials that will benefit humanity—because when that happens, we’ll be ready to play a vital role in scaling and supporting those innovations.

Modular kiln design for battery materials

We’ve discussed making furnaces more efficient, both from an economic and environmental perspective, but we haven’t talked much about the role of automation and digital technology in furnaces. From your perspective, today or perhaps in the future, how do you see these technologies contributing to enhancing furnace efficiency? And have you already implemented any of these technologies?

It’s very interesting that you mention digital technology, because for the next generation of kilns, our technical teams are actively working on how to incorporate these advancements. Currently, due to the quantitative growth of our customers, most are focused on proven technologies and finding cheaper production methods. However, to improve production efficiency, enhance the quality of materials during production, and reduce costs, we need a deeper understanding of what’s happening inside the kiln during the firing process.

We’re working to gather more data from the entire process and analyze it to determine the optimal solutions—whether that means adjusting temperatures, optimizing gas flow, or finding the ideal locations for gas circulation. We need to evaluate and analyze all of these factors. I believe this step is essential for us to elevate our technology to the next level. While we’re still exploring how to use this data—whether through AI, data mining, or another method—it’s definitely one of our primary areas of focus moving forward.

When you say this is one of your targets, are we looking at something far into the future, or do you expect to have solutions ready in the next few years?

It will take some time—probably more than two years—because reducing costs while achieving this level of innovation is a significant challenge. As I mentioned earlier, the willingness of end customers plays a crucial role in making these advancements happen. Most people assume that our customers are material producers, but they’re not the final users. They are connected to cell makers who in turn are linked to the ultimate end users—the electric vehicle manufacturers.

To fully understand these dynamics, EV manufacturers audit the material production lines, evaluating the cathode and anode materials and the conditions under which they’re produced. This is standard practice. Even if we offer a perfect solution, it’s difficult to directly communicate with the end users. As a result, I believe this market is still in its developmental stage, with many challenges remaining. Hopefully, in the next two or three years, we’ll see the market mature and these changes take shape. I’m optimistic that we’ll get there.

I have two questions regarding the U.S. market. First, it seems like you’re among the first to offer the concept of "lab to production." Is it because there wasn’t a market demand for such a service, and now you’re creating it? Second, across the supply chain, you need different types of engineers at various stages, which presents a major HR challenge. How are you overcoming the human resource issue and recruiting the right talent to integrate your lab-to-production model in the market?

The integration of powder handling and thermal solutions is indeed quite unique, even in Korea. It’s been a challenging process for us to gain our customers’ understanding of what we’re doing. We’ve had to explain the value and concept behind this integration, and while we have some successful case studies, we realized that applying this success to the U.S. market is a different challenge altogether. The business environment there is very different, so potential U.S. customers may not immediately understand the benefits of what we’re offering. Convincing them of our approach is one of the main challenges we face, and it’s something our U.S. colleagues are actively working on—figuring out how to communicate our unique offering effectively.

Regarding your second question, HR is indeed one of the biggest challenges we face, especially in terms of recruiting the right talent. For example, there aren’t many kiln engineers in Korea, so we’ve hired general mechanical engineers, who’ve had a tough time learning the ins and outs of kilns. Internally, we have two main teams: the powder handling group and the thermal solutions group. Our ultimate goal is to deliver a comprehensive solution that combines both to our customers. However, even within the company, aligning these two teams can be challenging—sometimes, they have conflicting objectives. But I believe that if we can overcome this, we’ll be truly unique in the market.

From an HR perspective, the challenge goes beyond Korea. Many of our talented colleagues are based in Germany and the U.S., but their roles and responsibilities differ. To put it simply, the more fundamental engineering work is done in Germany, while detailed, manufacturing-oriented work, including powder handling, is done in Korea. In the U.S., we focus more on sales, after-sales service, and project management. While this division works well, it’s not easy to find the right talent in the right place. For instance, finding a highly skilled fundamental engineer in the U.S. and relocating them to Germany is difficult, and vice versa with project managers in Korea moving to the U.S., due to regulations, personal preferences, and cultural factors.

As of now, we have more than 500 employees globally, which adds complexity to our HR management. It’s a common challenge for global businesses, not just ONEJOON. Many companies, especially suppliers in Korea, face similar difficulties in moving personnel between countries and managing a cohesive global team.

In 2023, ONEJOON’s revenue declined compared to 2022, reaching 137 billion KRW with an operating profit of 3.81 billion KRW. However, in the first half of 2024, the company showed positive signs, achieving 67% of the previous year's revenue and an operating profit of 17 billion KRW. What have been the key drivers for such a positive first half in 2024? Looking ahead 3 to 5 years, where do you see the company’s growth coming from?

ONEJOON operates as a project-based company, which creates a gap between revenue recognition and profit realization. This time lag can vary, making it challenging to pinpoint the exact reasons for performance fluctuations over specific periods. However, we do foresee a consistent upward trajectory in our revenue, which will naturally lead to positive profit growth.

Importantly, we are not simply commodity sellers, and our sales do not follow a monthly uniform distribution. For instance, revenue is recognized only when products are delivered to our customers, a process that typically takes at least eight months. Therefore, if we receive an order at a particular time, revenue recognition will vary significantly; some months will see high revenue while others will see much lower figures. Nonetheless, our overall growth trend remains steady.

Looking ahead over the next three to five years, we do not anticipate dramatic growth in the battery industry, as was seen in the past 5 to 10 years. However, this period will be crucial for the next decade, particularly with the emergence of new battery materials. We are receiving numerous inquiries from our customers regarding the development of innovative silicon anode materials. In this context, ONEJOON is poised to play a significant role in driving successful commercial-scale outcomes. Thus, we see potential growth not only in conventional batteries but also in next-generation battery technologies.

Regarding your international presence, with headquarters in Germany, the U.S., and China, which region do you believe offers the greatest opportunity for capitalizing on growth? Which region do you consider key?

I must be cautious in my response, as I don't want to disappoint my colleagues in other regions. However, there is a common consensus that the U.S. will play a more critical role in the future.

If we were to reconvene in two or three years for another interview, what accomplishments would you hope to reflect on—either personally or as the President of the company?

The next three to five years are crucial for the future of next-generation battery industries. When we meet again in two to three years, I hope to look back and see that we have successfully developed innovative solutions for battery materials, specifically for cathodes and anodes. I aspire for our contributions to enhance cost competitiveness while addressing environmental concerns, ultimately benefiting society and other industries.

To learn more about ONEJOON, read their article on newsweek.com/ONEJOON

0 COMMENTS