While many of the world’s banking sectors are struggling to recover from the global economic crisis, Colombian banks are thriving in both the local market and more recently, the international market, even making a recent bid to join the Organization for Economic Cooperation and Development (OECD).

The South American country learned a valuable lesson about its financial sector during the 1998 national economic crisis, which the rest of the world is discovering now: there needs to be more regulation and transparency.

“As a result of the crisis better legislation and regulations were created,” explains Luis Carlos Sarmiento Gutierrez, the president of Grupo Aval, the largest Colombian bank controlling around 30% of the country’s financial assets. “As far as banks were concerned, they stopped being so naïve. New rules for loans appeared.”

Mr. Sarmiento (who is the son of Colombia’s wealthiest man and 135th in the world, Luis Carlos Sarmiento Angulo) went on to say that Colombians have learned that they need to maintain control of the system and become international while still being managed by Colombians.

Unlike Mexico and Peru, who have not maintained local control, the three largest banking groups in Colombia,

Grupo Aval, Bancolombia and Davivienda, who control more than 60% of all banking operations, are all in the hands of Colombians.

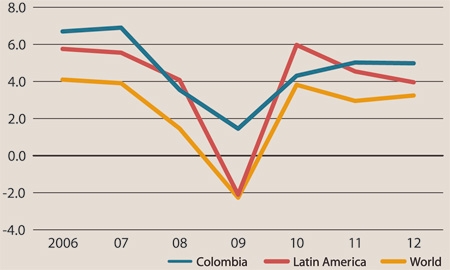

As a result of the solidity in Colombia today, the financial system’s assets totaled $666.58 billion, meaning a quarterly growth of 4.19% and an annual growth of 19.04%. The Colombian banks’ success and stability on a local level positions them to move into the international sphere.

Moves for economic expansion are seen both on a private and public level, as a result of the growing economy. The Colombian government put in a bid in January to join the OECD, which Colombian President Santos refers to as “a club with good practices.” The OECD, an international organization that works to promote responsible economic policies, is comprised of 34 countries, primarily economically advanced nations.

President Santos assures that OECD membership will be a very important qualitative jump in the country’s ongoing development and a way to move into the international scene. “We do not want to compare ourselves only to Latin America, we want to compare ourselves with the world. We have the potential and we have the means to emerge not only in Latin America, where we are already emerging, but also in the world.”

OECD member countries are seen as solid economies and more attractive to investors. According to Michael Shifter, president of the Inter-American Dialogue, the OECD is a privileged club. “Membership is a measure of a certain level of economic development and a commitment to sound policies and good-governance practices,” he says, pointing to Colombia’s qualifications for membership including a banking sector with strong fundamentals and macroeconomic stability.

Colombia’s bid has also received a vote of confidence from the U.S.

“I am very impressed that the Santos administration has adopted this as a goal,” says U.S. Secretary of State Hillary Clinton, who visited the OECD headquarters in Paris in June and highlighted her support for Colombia’s admission to the international entity. “The U.S. wants to support this impressive investment in the Colombian people and to look for how we can reach out to all Colombians.”

The economic development in the country in part is related to the strict banking regulations already in place, but also the control of the growing influence of the three main Colombian banks.

Grupo Aval, consisting of Bogota, Occident, Popular and AV Villas banks, has assets valued around $32 billion. Its recent purchase of BAC- Credomatic, a company in the British Virgin Islands, for $1.9 billion will give the company more prevalence throughout South and Central America and is expected to make a profit of $200 million this year. The group looks to expand through further bank acquisitions and is in the process of starting to sell its shares in the NYSE.

Bancolombia, the second largest banking group, is experiencing enormous success on a global scale with its policy since 2006 of universal banking, expanding their investment porfolio. When Bancolombia started selling their bonds, they received 235 investors from Europe, North America and Latin America totaling $2.7 billion and making them one of the most important Colombian players in the global market.

Of these three most important economic players, Davivienda, a member of Gru-po Bolivar, is the leader in credit card operations having 1.6 million of the 8 million in Colombia. Just like Grupo Aval, Davivienda has opened a branch in Miami, focusing on international trade. Among its growing global success, the company is also famed for its unbeatable working conditions: Davivienda president, Efrain Forero, was awarded the prize of best employer in 2010.

Although growth is important for the banks on an international scale they also are committed to giving back to Colombia. An example is Grupo Aval’s foundation Colfuturo, which helps send 1,000 students overseas every year with scholarships for Masters and PhD programs.

0 COMMENTS