To many, the global supply chain has entered a new era. As companies and governments rethink the architecture of global trade, one country’s suppliers find themselves in an ideal situation: South Korea.

To many, the global supply chain has entered a new era. Not so long ago, manufacturing groups designed their production networks by prioritizing price efficiency, leading to supply chains that expanded across countries and continents. In recent years, however, a combination of supply-side disruptions, geopolitical tensions and advanced technological breakthroughs has forced companies and governments to rethink the architecture of global trade.

While America’s landmark policies, such as the Inflation Reduction Act (IRA) and the CHIPS Act, have grabbed headlines, most major economies passed similar policies, with common objectives like bringing strategic industries onshore and prioritizing suppliers from “friendly countries.”

The current period of transition will bring about both winners and losers. Amid this transitional period, one country’s suppliers find themselves in an ideal situation: South Korea.

Having established a robust track record over the past decade by supplying domestic multinationals, Korean firms are positioning themselves as alternatives of choice to replace traditional suppliers for the creation of supply chains compliant with each country’s policies.

Furthermore, Korean suppliers have historically competed on three core advantages: flexibility, fast delivery and the adoption of disruptive technologies. In an era where technological advancements converge with supply chain realignment, agility and speed have never been more in demand, leading the country’s suppliers to expand across industries.

South Korea's Leading Role in Batteries, Semiconductors, and Digital Tech

Secondary Batteries

The battery sector, essential to a growing number of applications from EVs (electric vehicles) to renewable energy, is first on the list. The aforementioned IRA, in particular, has spurred South Korean investments in the battery sector and presented companies with opportunities. Lim Jonghyun, president of A-PRO, a leader in battery activation equipment, argues: “North America is poised to heavily invest in EVs. Thanks to the IRA, we've managed to sidestep direct competition with Chinese counterparts."

"Thanks to the IRA, we've managed to sidestep direct competition with Chinese counterparts." Lim Jonghyun, president of A-PRO |

Korean groups like LG Energy Solution and Samsung SDI are pivotal in this evolving landscape as they look for domestic suppliers to enhance cost-efficiency and meet regulatory requirements. "We've been actively engaged in pilot services for Hyundai Motors and are collaborating on solid-state battery development," explains Mr. Lim. This collaboration underscores the synergy between major Korean conglomerates and suppliers, enabling the latter to build a track record with major groups before expanding globally.

James Choi, president of KEMCO, a subsidiary of Korea Zinc, sees opportunities in the production of nickel sulfate and precursor cathode active materials (pCAM), which are vital for battery manufacturing. Despite South Korea's strengths, it heavily relies on Chinese producers for these materials. Mr. Choi states: " Our main objective is to fill this gap. Once achieved by around 2028-29, our focus will shift to international expansion."

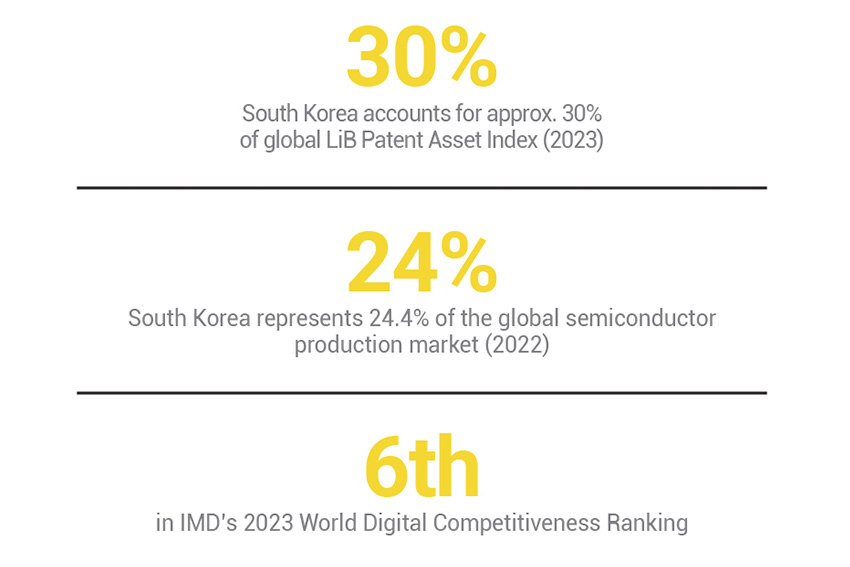

Investors were quick to take notice of this positive situation, sending Korean stocks soaring throughout 2023, with cathode producer Ecopro recording a +500 percent return, as reported by Bloomberg. Although 2024 saw a downturn due to slower EV sales, the long-term prospects for Korean battery companies remain promising. South Korea is poised to lead in R&D, with patent analysis from IAM media indicating that South Korean firms will soon outpace Chinese, Japanese and U.S. companies in both the quantity and quality of lithium-ion battery patents.

Semiconductors

The semiconductor industry is another area where Korean suppliers face major opportunities. The CHIPS Act aims to bolster domestic semiconductor production in the United States, creating new dynamics in the global supply chain.

A case in point is NextIn Inc. Having successfully localized various wafer inspection technologies, the company is now set to break the monopoly that KLA, a global leader in yield management systems, enjoys in the dark field inspection market, a technology utilized for the defect inspection of a large number of wafers. "Our growth strategy revolves around acquiring a substantial share of KLA's market,” explains Chris Park, CEO of NextIn Inc. “We are aiming for a share of 30 percent."

Here again, the collaboration with Korea’s leading semiconductor conglomerates has provided suppliers with a decisive advantage. Mr. Kang Doo-Hong, president of Asflow, which provides high-purity components such as valves, pipes and fittings to major foundries, emphasizes that working with those conglomerates has allowed the company to achieve reliable delivery and competitive pricing. "Chipmakers are fostering competition with overseas suppliers to drive down overall costs," says Mr. Kang. “This competition elevates the technological proficiency of domestic suppliers, enabling them to meet global standards and expand their market presence.”

To successfully expand, Mr. Kang notes the importance of local partnerships: "Securing reliable local partners is paramount. While localization aids in market penetration, listening to partners' needs and ensuring prudent investment in shared ventures are essential to sustain long-term partnerships."

Lee Dong-cheol, president of Hana Micron, Korea’s largest outsourced semiconductor assembly and test (OSAT) enterprise, also echoes this opinion: “As Samsung and SK Hynix expand into Western markets, they seek to bring their OSAT partners along.” In turn, this situation has provided the company with a local footprint to reach local partners. “Hana Micron is expanding its portfolio by engaging with U.S.-based fabless companies such as NXP or Microchip Technology.”

"As Samsung and SK Hynix expand into Western markets, they seek to bring their OSAT partners along." Lee Dong-cheol, president of Hana Micron |

Overall, this dynamic involves exporting Korean technologies and know-how internationally. “The engineers we deploy to the U.S. have a minimum of 10 years of experience working with our company [and Korean MNCs]. Their expertise makes them well-suited to implement systems successfully in a new location,” highlights Mr. Jeong Hwan Kim, CEO of Hyoungwon ENG, an engineering company specializing in the design and construction of ultra-high-purity systems for critical facilities and FABs. “In essence, we are confident that our approach will ensure the success of projects on different continents.”

Leveraging Digital Transformation

To further expand across industries, South Korean firms can count on a hidden ace: the country’s advanced IT environment. In IMD’s 2023 World Digital Competitiveness Ranking, South Korea ranked sixth globally, its best position to date.

Having access to this advanced digital ecosystem has enabled enterprises not just to compete, but to disrupt traditional sectors. Notable examples are found in the automotive field, where Mr. Bang Chang-seop, CEO of Dongseo Machine & Tools, a leader in aluminum die casting that counts Hyundai among its clients, has made the adoption of AI-based quality control a key factor in its development of giga casting technologies. “While our core expertise remains rooted in precision machining and casting processing, what sets us apart today is our commitment to infusing intelligence into these processes,” he explains. “Our focus has evolved to encompass the integration of smart technologies within our operations, thereby enhancing efficiency and productivity.”

In turn, the growing adoption of digital technologies across industries is creating opportunities for components and material suppliers. Such has been the experience of Novatech, which produces industrial magnets key to the creation of AI-enabling hardware. “As we transition to the era of autonomous vehicles equipped with advanced AI functions, the importance of controllers, sensors, motors and other mechanical and electric parts will increase,” explains Oh Choon Teak, Novatech’s CEO. “With the shift to motor-powered vehicles, the demand for magnets, which we produce, is steadily rising.”

While manufacturing firms are often criticized by industry experts for their limited utilization of digital tools, many Korean suppliers have made the adoption of smart technologies a cornerstone of their R&D strategies. A case in point is Korloy, one of Korea’s leading cutting tool specialists, which created a pilot line to freely experiment with novel processes. “Unlike the manufacturing section, where implementing new IoT equipment could disrupt production cycles, the pilot line operates independently, granting us the freedom to explore different digital solutions,” explains CEO Junghyun Yim. “This experimentation paves the way for insights that can potentially minimize future failures when integrating such technologies into the manufacturing domain.”

"Implementing new IoT equipment […] paves the way for insights that can potentially minimize future failures when integrating such technologies into the manufacturing domain." Junghyun Yim, President of Korloy |

Despite having limited resources relative to larger firms, advanced automation systems have allowed Korean SMEs to extend their product portfolios. DaeHan Precision Industry, an SME specialized in hydraulic hose fittings for the construction machinery sector, offers a striking case study. “Our competitiveness rests on three key factors,” explains President Kim Oh Gon. “First is productivity and automation. We're pioneers in adopting robots in our assembly lines and plan to introduce 39 robot lines by 2027. Second is material development.…Third is high-mix, low-volume production, allowing us to manufacture multiple products in low volumes from our smart factories.” Despite its small size, the company offers over 3,500 products, enabling it to tailor its offerings to each client's needs.

This is a situation also shared by Kim Shin Kyung, CEO of Shinhan Diamond, a company recognized for the development of diamond tools, such as CMP Pad for semiconductor production, or ARIX technologies for the construction industry. “We prioritize investments in areas that are digitalized and automated. This strategic approach ensures our alignment with the evolving technological landscape.”

South Korean suppliers’ eagerness to adopt digital tools has also created a fertile environment for startups and innovative ventures, which can swiftly find practical applications for frontier technologies. Choi Chi Won, president of P&C Solution, a leading developer of XR simulations for the defense, medical and education fields, sees potential in the manufacturing sector. “Developers in smart factories can input information on error resolution using AR or VR into the system. This allows individuals to undergo preemptive training through shadowing. Subsequently, when faced with a real issue on-site, workers can apply the learned solutions from AR or VR,” he explains.

As the industrial world embraces a new era of technological innovation and supply chain shifts, the demand for flexibility, speed and disruptive technologies has never been higher. Fortunately for Korean suppliers, these strengths have defined their success over the past decades, leading us to ask the question: Are Korean suppliers on the verge of transforming from small giants into global champions?

0 COMMENTS