HYTC, a Korean precision equipment manufacturer, secures deals with major automakers and battery manufacturers by delivering top-tier precision components.

Looking at your international network, you’ve been able to support major Korean MNCs such as LG Energy Solution, SK On, and joint ventures between LG and Hyundai. Your collaborations with these companies have helped you expand internationally, open factories, and secure business overseas. What challenges and opportunities have you encountered while pursuing this ambitious endeavor?

First of all, we are expanding because we see significant opportunities abroad. The “big three” in Korea—LG, Samsung, and SK—have established their operations internationally, with R&D primarily happening in Korea. If we don’t follow this trend, we risk incurring substantial losses in terms of delivery costs, missed opportunities, and time delays. To grow alongside these major players, we are committed to continuous expansion.

This expansion comes with both risks and opportunities, and there are several challenges we need to overcome. One of the biggest challenges for us, and for SMEs in general, is the need to attract more human resources. Secondly, communication is much easier within Korea, where we share a common language and culture. However, operating abroad introduces challenges in terms of communication and coordination between headquarters and our overseas branches. To address this, we are in the process of establishing a global operation system.

Another critical factor is maintaining quality and cost-effectiveness. In Korea, we have established a reputation for high-quality products at competitive prices. However, when we operate internationally, we need to ensure that the same level of quality and pricing is upheld across different markets, which can be difficult due to the varying conditions in each country. We are closely monitoring this and working to adapt our processes to meet local demands. To remain competitive, we are focused on fostering new talent and training local employees to improve our position in each market.

Interestingly, you have not confined yourself to domestic customers but have expanded opportunities with international partners. Where do you see potential for growth beyond the bounderies of South Korea? Are you also considering expanding into other industries?

At the moment, we are focusing exclusively on the battery industry. Even if we were to double or triple our battery production capacity, we would still struggle to meet the growing demand in this massive industry. Our current business target is the “532 Strategy”, which divides our revenue targets as follows: 50% from the big three Korean MNCs, 30% from industries like motorcycles and energy storage systems (ESS), and 20% from new overseas clients, including global automakers like Tesla, which has its own battery production facility, and Volkswagen, which has a dedicated battery subsidiary, PowerCo.

That being said, with our expertise in other fields, we remain open to opportunities for diversification in the future as we continue to grow.

Could you explain on the specific processes of battery manufacturing that HYTC is involved in?

While the overall process consists of many steps, the key stages include coating process, stacking, assembly, and packing. I will elaborate on these in detail.

First, regarding the coating stage, HYTC provides assembly equipment for cutting and winding cells. This includes components such as knife units, knife spacers, and PX shafts. We handle the entire process, from design and assembly to production and rigorous testing, ensuring high-quality supply for our clients.

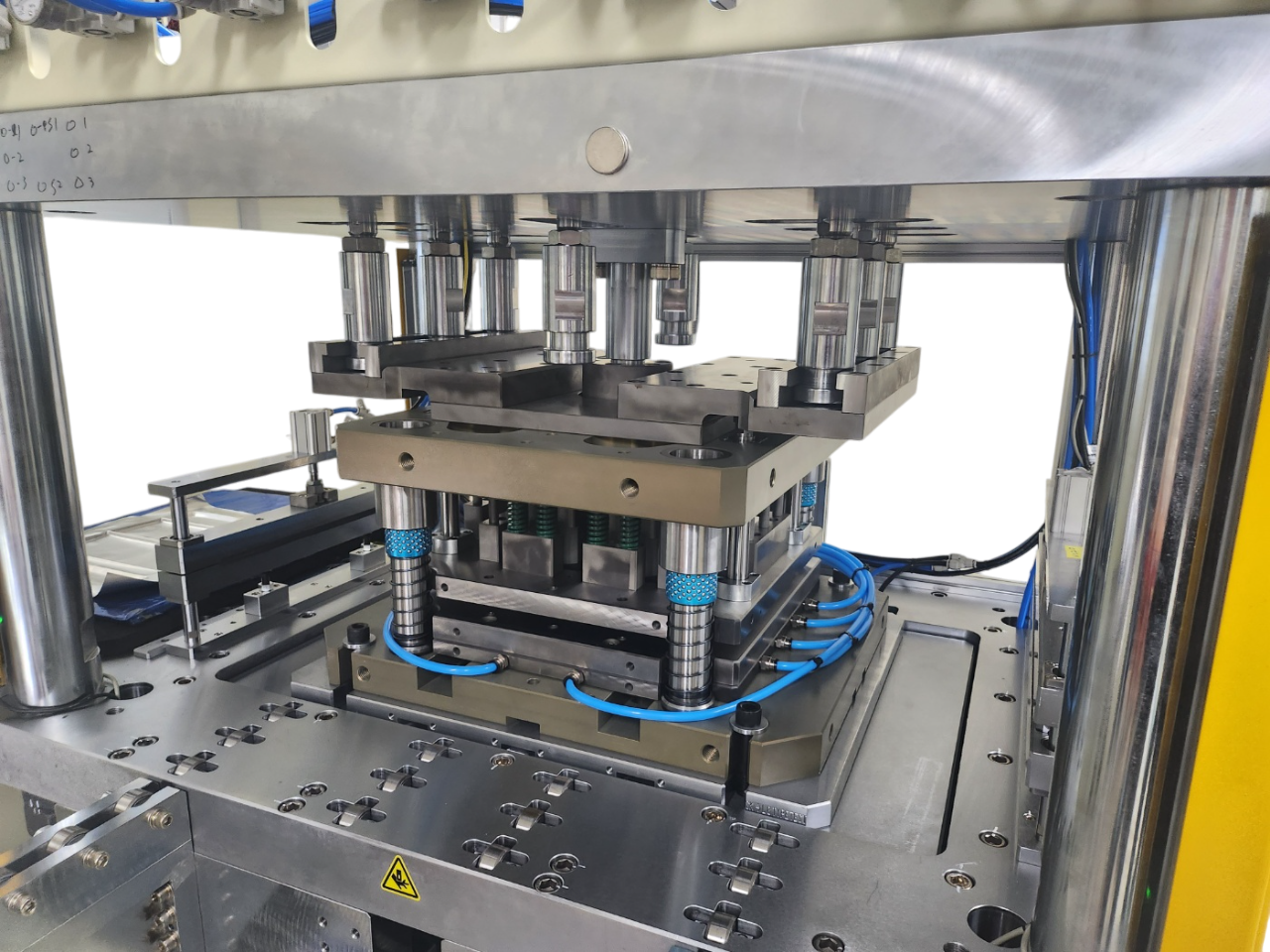

For the stacking and assembly processes, we manufacture precision parts used to cut and form battery cells. These include the mandrel, mandrel holder or gripper, notching molds, and electrode cutters.

When manufacturing batteries, there are two primary methods: the winding method and the stacking method. At HYTC, we produce specialized equipment for both methods. For winding, we manufacture components such as mandrels and mandrel holders. For stacking, we provide equipment like notching molds and mandrel grippers. This versatility allows us to meet the diverse needs of our clients, regardless of whether they require winding or stacking solutions.

Batteries also come in three distinct shapes: cylindrical, prismatic, and pouch. Cylindrical batteries typically use the winding method, while prismatic and pouch batteries utilize the stacking method. HYTC is equipped to manufacture equipment for all three battery types. Each of the "big three" multinational companies in Korea has different preferences for battery shapes and production methods. Therefore, our ability to support all three types and methods ensures we can meet the varying demands of these industry leaders.

Research from SNE and Goldman Sachs estimates that average battery pack prices will fall below 100 USD/kWh by 2025 and continue declining to around 60 USD/kWh by 2030. One common approach to achieving these objectives is the standardization of processes and battery types, leveraging scale and optimization. However, we still observe a wide variety of processes, form factors, and chemistries being used today. Do you anticipate the industry moving toward standardization?

From my personal experience with secondary batteries, I began with laptop batteries, then moved on to mobile batteries, and now, of course, to electric vehicle (EV) batteries. This background gives me some insight into future trends. In analyzing the secondary battery market, the key drivers have been cost, capacity, and safety. Currently, the market is a seller's market, but I believe that in the future, automakers will become the dominant players.

Let me provide an example involving the overseas automotive companies we’ve been discussing. These discussions highlight the importance of standardization. If standardization becomes a reality, a single battery designed for luxury vehicles could be used across all luxury car models. Similarly, a battery designed for economy vehicles could be used across all low-cost cars. Right now, however, batteries are often specific to particular models. So, in the future, I see standardization as a key trend in the industry.

When this standardization occurs at the top tier of the supply chain, how do you think it will affect suppliers, such as equipment makers and part manufacturers like yourselves?

Let me use cutter as an example concerning current standardization efforts. HYTC is already producing over 80 different types of cutters. Therefore, we are currently working on an internal project to reduce the number of cutter types we use. These cutters differ slightly in systems or specific characteristics like length, but these minor differences are often not visible to equipment manufacturers or end customers. However, because we are a company that meticulously processes and controls the details of parts, we must be well-versed in manufacturing specifics, statistics, and precise measurements, which puts us at the forefront of the standardization process.

In fact, we are one of the companies most eager for standardization. If you look back at the mobile phone industry, for example, each phone used to have a unique connector. Today, we can connect any phone with any charger. However, we believe there is a distinction between how final customers perceive standardization and how we, as manufacturers, approach it. For us, the standardization process is more meticulous, requiring a deeper understanding of the finer details. Nonetheless, we would fully welcome the standardization of batteries.

Earlier this year, HYTC received order from LG Energy Solution for secondary battery notching molds and cutter system for the USD 1 billion plant in United States, a joint venture between Hyundai and LG Energy Solution. This milestone highlights the critical role of the notching process in battery production yield, quality, and cell performance. Additionally, HYTC is also undergoing an evaluation with Samsung SDI and SK for notching molds. What were the key factors that led to your selection as a primary supplier?

Several factors contributed to our selection as a primary supplier. First and foremost, it’s our readiness in advance. We are able to swiftly respond to our clients' needs, and this is crucial in such a competitive market. While there are many companies that have been supplying LG Energy Solution for over 10 years, this is our first time entering the business. We recognized that traditional suppliers lacked the capacity to provide the level of service and maintenance that clients required. To address this, we established and operated a local subsidiary in advance that can quickly responded to client demands. This agility has been a key reason why our clients gave us the opportunity to expand into the notching mold business.

To maintain quality, notching molds undergo a process called regrinding after being used a certain number of times. The mold replacement cycle for regrinding is a critical factor because it directly impacts the efficiency of our customer’s production processes. This leads to an increase in defective products and ultimately results in higher costs due to more frequent mold replacements. it creates inefficiencies, resulting in defective products and ultimately higher costs due to more frequent mold replacements. By extending the mold’s lifecycle by 20 to 30%, we’ve been able to help our clients reduce costs and increase production efficiency, which has directly contributed to our selection as a supplier.

I understand that your company offers one-stop services for development, production, and local support. Do you believe this comprehensive approach will enable you to replicate your success in Korea and attract international clients overseas?

I'd like to share an example with our European clients. HYTC had video calls with these companies, and they asked us to create certain parts for them to test our capabilities. It took us just 30 seconds per part to understand their design and confirm the details. They were very impressed by this speed, as when they contacted Chinese suppliers, they had to wait longer time for a response. In contrast, it only took us 30 minutes to confirm the part drawings. This quick turnaround demonstrates our ability to efficiently analyze and respond to part designs, regardless of their complexity. This capability is a key competitive advantage for us and positions us well for attracting international clients.

You recently became President of the company. Could you describe where the company stands today and what your vision is for the future?

Did you notice the HYTC Way displayed on the wall when you first entered the company? This represents our vision. Our main goal is to become the global leader in ultra-precision equipment parts. To achieve this, we strive towards the goals of the "3S" approach—Small, Speedy, and Strong. Although we are a small company, we are incredibly agile and resilient.

To reach our goal of becoming the global number one, we are concentrating on notching molds. This will become a key revenue source for our business. Since this area has the potential to increase our annual sales by up to 30%, we have made it a primary focus area. We are also committed to becoming the best solution provider in the market.

Currently, our business model is B2B and OEM. While meeting Quality, Cost, and Delivery (Q.C.D) based on customer orders is fundamental, we aim to provide an enhanced level of quality and value. Leveraging state-of-the-art facilities and skilled technical expertise, we ensure impeccable quality and actively participate in resolving the pain points that arise in our customers' processes, thereby building their trust. When we receive our clients' issues, we form a task force to analyze and effectively address these problems with innovative solutions. This ability to provide tailored solutions is one of our major strengths.

Another example is the case of our client’s China plant, where their cutters had been faulty for several years. They asked us to resolve the issue, and through our technical analysis, we identified a key flaw in the design that other OEM makers hadn't discovered. By pointing this out to them, HYTC was able to resolve the issue in a very short time, something that had plagued them for years.

Another initiative you are working on is the development of tool horns for 46 size cylindrical batteries. Currently, the two types are the 4680 and 46120. I understand you already have the 4680 tool horn ready, and you are now developing the 46120. Is this development being done in collaboration with your customers, or is it aimed at expanding your footprint?

When it comes to battery manufacturing, the tool horn is the only component that has not yet been localized in Korea. We’ve actually been selected for a national project, which is supported and funded by the government, to localize the horn production.

As you may know, the 4680 battery has a diameter of 46 millimeters and a length of 80 millimeters. To increase capacity, the current horn diameter is 3.5 millimeters, but we are working to reduce it to 3.0 millimeters. Our ultimate goal is to reduce the horn diameter to 2.5 millimeters. Additionally, to enhance capacity, we are developing to extend the length from 95 millimeters to 120 millimeters. This will not only significantly reduce costs but also double the capacity.

In conclusion, I believe the 4680 market will experience substantial growth by 2030, driven mainly by LG and Tesla.

50% of your revenue comes from the big three Korean MNCs. I also see that you’ve made significant investments in R&D and facilities to help expand your customer base. Looking ahead, what challenges do you anticipate in your efforts to grow your customer base and increase market share?

Our primary focus is addressing the weaknesses commonly found in Korean SMEs. I often benchmark against Japanese SMEs, and interestingly, their strengths are the areas where we face challenges. Specifically, attracting new talent and establishing effective management structures are two major obstacles. These are not issues that can be easily solved with financial investment. While we can invest in other areas and see results, overcoming these two challenges requires a more nuanced approach.

We are actively investing in human resources to provide our team members with more opportunities to grow, gain experience, and push themselves to develop further. We are implementing a step-by-step strategy to address these weaknesses and strengthen our company’s foundation.

Could you elaborate more on the specific strategies you are implementing to nurture future talent?

Our first strategy is to actively recruit new personnel. To do so, we have established strong partnerships with a university in Gyeonggi-do, which trains students for the industry, resulting in about 20 students joining our company each year.

Additionally, we have a comprehensive training program where we send our employees abroad to gain exposure to global practices. This includes a language training program to help them improve their English skills and develop their communication abilities.

The rest of our strategy focuses on hands-on learning. When new employees join our company, we ensure they have the opportunity to experience a variety of roles and tasks. This approach allows them to learn from their mistakes and challenges, fostering both personal and professional growth.

What would you like our readers to take away from this interview in just a few sentences?

I’ve been working in the manufacturing industry for approximately 40 years, and I truly understand the importance of this sector, especially given its significant contribution to the growth of the Korean economy. Recently, however, the perception of manufacturing has shifted, and many people now view it differently. I want to emphasize that, despite these changes, the manufacturing industry continues to be driven by immense effort and passion. Therefore, I hope that young talents will take greater interest in and engage with the manufacturing sector. This is the core message I would like to highlight.

For more details, explore their website at: http://www.hyseoul.com/ or on their latest article on Newsweek.com/HYTC

0 COMMENTS