Toray Opelontex, a joint venture between Toray and The LYCRA Company, is revolutionizing the textile industry with its cutting-edge products and commitment to sustainability. From LYCRA® fiber to eco-friendly solutions, they are providing invisible yet invaluable contributions to the fabric of society.

Over the last 25-30 years, Japan has seen the rise of regional competitors from countries like China, Taiwan, and Korea, who have taken advantage of cheaper labor costs, thus pushing Japanese companies out of certain markets. This has led many Japanese companies to reinvent themselves, becoming leaders in different types of niche fields such as highly functional materials. Having said that, what do you believe are the strengths of Japanese firms?

The world, including Japan, is currently still recovering from COVID-19. Japanese major companies that are exporting goods will benefit from the current weak JPY. On the other side of the coin, Japanese who have relocated their production bases to foreign countries and also who need to import raw materials, the situation isn’t looking great.

Companies, on the other hand, that are shifting to highly functional materials are doing well now and then, and they clearly have the ability to actively develop new opportunities by analyzing the market closely, followed by swift actions and decision-making have been and will be generating good results.

It is our view that Japan is at a very exciting time for manufacturing. On one hand, we have had major supply chain disruptions in the last three years, caused by the COVID-19 pandemic as well as tension from the China-US decoupling situation. As a result, we are seeing many multinational groups try to diversify their supply chains with a focus on reliability. This is where Japan can enter; a country known for decades of high reliability, trustworthiness, and short lead times when it comes to production. Now, with a depreciated JPY, it is our view that there’s never been a more opportune moment for Japanese manufacturers to meet the pressing needs of this macroeconomic environment. With this in mind, what do you believe sets your firm apart from your competition?

At Toray Opelontex, our core product is called LYCRA® fiber, an elastic polyurethane fiber developed by The Lycra Company. LYCRA® fiber was initially used for the apparel industries and was welcomed with an astonishing voice that this is a ‘miracle’ fiber of its unbelievable physical characteristics during the creation period, and then expanded to many different fields. Our product does not constitute part of the garment by itself and is always used together with other materials, such as synthetic fibers, non-woven, or natural fibers. Our product is essential to add elasticity, and this is the key characteristic of LYCRA® fiber. We like to say that it is an ‘invisible’ product but creates ‘visible’ value, first to the fabric, and then to the people, and finally to society.

One of the biggest trends happening in Japan right now is, of course, the changing demographic situation. Japan is the oldest society in the world with a rapidly declining population. In fact, experts are predicting that the population will drop to under 100 million by 2050, with one in three people over the age of 65. This is causing a number of issues including a labor crisis and a shrinking domestic market. Having said this, what is your firm doing to ensure business continuity and to what extent do you believe you need to look overseas in order to ensure long-term success?

There are two measures against labor crisis issues in my opinion, and the first one involves an expansion of the current labor force to include the establishment of a re-employment system. The second approach is improving labor productivity by utilizing DX and automation, etc.

Considering the problem of the declining population in Japan, we should probably turn our eyes to the overseas market, but we have an important mission on the other hand. Our company is actually a joint venture between the Japanese company Toray and the US company The LYCRA Company. We exist to mainly take care of the domestic market. Despite the population currently on a downward decline, our company must continue to provide social value to our customers in Japan as our mission as long as people who need our products exist. I believe all the employees here at Toray Opelontex understand that this is our responsibility.

Fabric with excellent elasticity using LYCRA® fiber

Considering you’re a joint venture between Toray and The LYCRA Company, what synergistic effects have you been able to leverage thanks to the long history of your two parent companies?

Our company was established with human resources transferred from Toray and the technology from The LYCRA Company in its origin. Our company has developed into the company it is today with our R&D in our hands as well thanks to parent companies.

The augmentation of the LYCRA® brand has greatly contributed to the company’s growth. Our other parent company, Toray, is very famous as a giant chemical company in Japan, so I would say both brand recognition has greatly contributed to our success and will continue to contribute to our future growth.

Your Polyurethane LYCRA® fiber is a synthetic fiber that is thin and transparent, meaning it can be very stretchable, and any clothing made from LYCRA® fiber provides not only a world of freedom of movement but also comfort. What are the underlying chemical and molecular mechanisms that allow LYCRA® fiber to stretch significantly? How does LYCRA® fiber differ from other textile materials?

This characteristic lies in the molecular structure. There are hard and soft segments. If outer forces are applied to the fiber, the soft segment will stretch at a maximum of 5 to 7X. The hard segment plays a role as the center of the whole structure. When the soft segment stretches the hard segment works hard to pull back, allowing the fiber to return to its original length. It differs greatly from a number of other synthetic fibers in the market that don’t stretch as much as LYCRA® fiber does.

LYCRA® T400® fiber is a synthetic fiber that offers the right balance between style and comfort and is essentially a combination of polyethylene terephthalate (PET) and polytrimethylene terephthalate (PPT). How does the blend of PET and PPT achieve the right balance between stretch, comfort, and style?

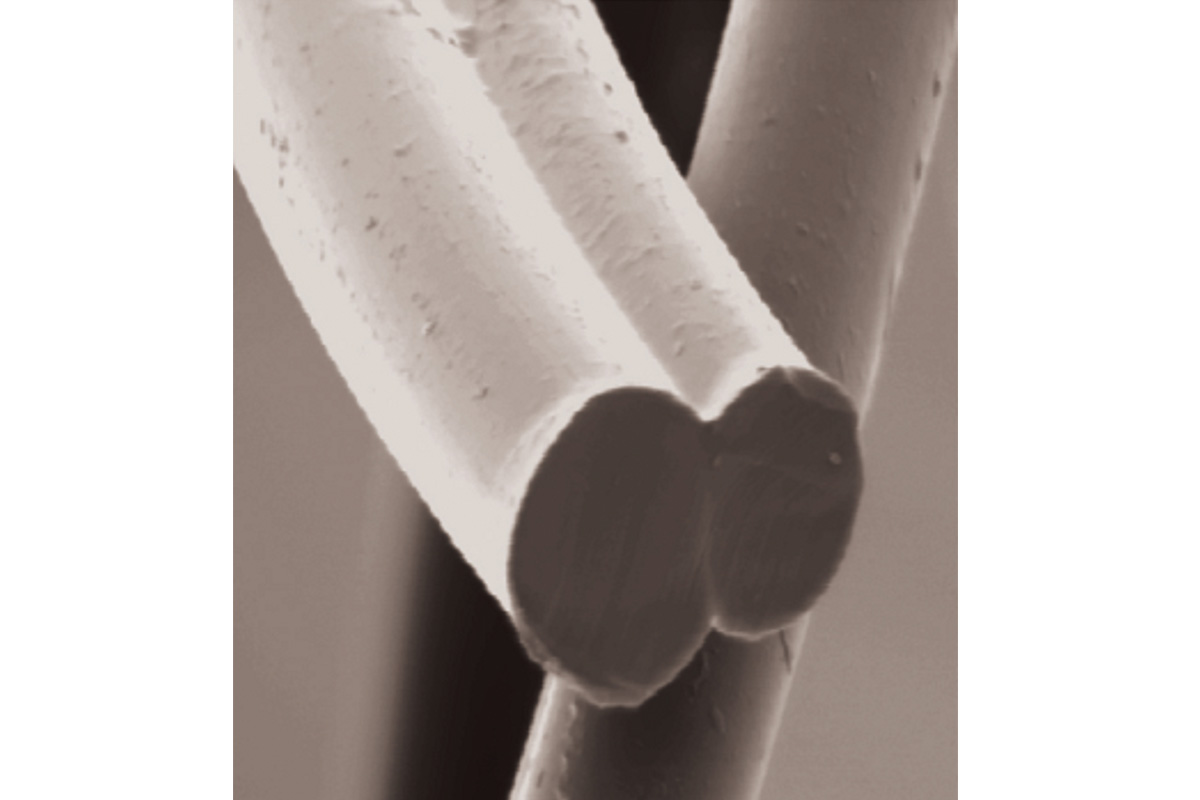

The mechanism to create elasticity for LYCRA® T400® fiber is completely different from that of the LYCRA® fiber. LYCRA T400 fiber is a special type of bicomponent fiber in which PET and PTT polymers are joined together within each filament. There is a difference in shrinkage generated by heat between PET and PTT and it generates a smooth, helical crimp. This crimp creates some stretch, but not as much as with LYCRA® fiber.

Cross section of LYCRA® T400® fiber

What are the differences in applications for LYCRA® fiber and LYCRA® T400® fiber?

The applications for those two are completely different. Applications for LYCRA® fiber capitalize on its elasticity and its pull-back performance, so it is used for swimwear, sportswear, underwear, diapers, etc. in which recovering force is required. LYCRA® T400® fiber, on the other hand, is used for the lining of suits and even jeans, etc. where so much elasticity might not be required.

Your company clearly is very dedicated to R&D, and Japanese companies are often leaders both domestically and globally when it comes to their R&D capabilities. Earlier you mentioned how the needs of your customers are always changing and that you have to constantly work to improve your products to meet their demands as well as provide value to them. Can you tell us more about your R&D capabilities and any unique technologies that you believe are unique to your firm? Are there any specific products that you are currently developing and would like to showcase for us today?

We have recently been increasing our investments in R&D. In addition to focusing on the developments of new fiber, we also reinforce how we can add value for our customers. Therefore, in the course of the development of new fiber, we need to simulate our downstream process to know how it creates new value in the fabric form.

Unfortunately, regarding new products, I cannot talk in detail today but I will say that we are trying to produce eco-friendly types of products. We are currently developing methods to recover and reuse the fabric of final fabrics that are collected from customers or shops. We have already established the fundamental technology and we are now constructing the test facilities with a targeted date of the end of this fiscal year.

The theme of eco-friendliness is one that is very important in the textile industry, and that is probably because it is one of the most polluted industries in the world. Critical reception to this is forcing many companies to develop new materials, and your company is no exception. In fact, your LYCRA® T400® EcoMade fiber is a material derived from plants and recycled materials from PET bottles. How is Toray Opelontex contributing to a more sustainable textile industry?

It is true that the textile industry’s value chain is very long and each step of the value chain has its own inventories and losses. However, each step provides inevitable value in the whole value chain. This means that in my opinion, it is hard to skip intermediate steps at once. So, the first step the textile industry needs to take is to produce an appropriate volume, based on a demand basis, which will allow us to reduce losses and excess inventory at each step.

In order to contribute to a more sustainable textile industry, as I mentioned earlier, we would like to put all our efforts into promoting the development of eco-friendly products and also establish a collection scheme for used final products and efficient use of them.

Eco-friendly materials are obviously very good for sustainability, but there is another challenge that many textile makers are facing when it comes to shifting towards sustainable materials. This challenge is how firms are able to provide the same type of comfort and softness despite the change in materials. How are you able to ensure that the textiles you produce retain the same type of comfortability, softness, and stretchability of the product itself?

One thing I’ve emphasized as the president of this firm is that we must not sacrifice our quality in order to be sustainable. In other words, we should not be self-satisfied with producing sustainable products and we cannot be pursuing a direction that our customers do not see value for.

Almost every interview we conduct inevitably comes to the theme of partnerships, and these partnerships are crucial in every single industry to develop innovative products and meet customer demands by adding value. This is especially true when combining domestic production with technology from overseas markets. What role do partnerships play in your business model, and are you looking for any new partnerships with overseas companies?

Our company is a joint venture, so we have two parent companies, which in turn our company itself is originated as a ‘partnership’. Sometimes we will look for suppliers or customers for partnerships then at the same time, both of our parent companies themselves are looking for partnerships. One option for us is to use the partnerships established by our parent companies.

Recently new partnership between The LYCRA Company and a company called Qore was press-released. That company is going to procure bio-material. This is a partnership we can benefit from.

LYCRA® fiber

You mentioned that the core focus of your company right now is the domestic market, but you also have the capacity to tackle new markets that your parent companies are unable to tackle. What is your current international strategy and what markets are you looking to cater your products to moving forward?

As I said earlier, our main market is Japan. This will not change in the future, and it will continue to be this way. Our R&D will be directed towards developing products that can contribute to the needs of Japanese customers, but at the same time, with close attention to global needs so that the developed products will be supplied overseas which our parent company cannot deal with their products.

Imagine that we come back in five years and have this interview all over again. What goals or dreams do you hope to achieve by the time we come back for that new interview?

Our products are ‘invisible’ in their physical entity as the final products but create ‘visible’ value in their role. With this mission in mind, I want to work together with our staff and the customers to fulfill this promise. Our company’s scale is not that big, but still, we will and will continue to provide value to customers that they appreciate. For that reason, the company slogan is “Small but diamond”.

0 COMMENTS