Semiconductors are the building blocks of our digital world, but in their production there are emissions that need to be treated, and environmental considerations that must be taken into account

Japanese engineering firm Tsukishima Kankyo Engineering is one of the companies reducing and recycling through treatment of the ammonia wastewater discharged during the semiconductor manufacturing process.

Over the last 10 to 20 years, Japanese firms have faced very stiff price competition against their Asian neighbors, and it is specifically true in the field of heavy industry, where Korea became the leader in shipbuilding ahead of Japan. Nevertheless, when it comes to certain advanced engineering processes, like industrial boilers and furnaces, we still see Nippon firms dominate niche segments. How is a company like yours able to remain competitive despite this stiff price race against Asian countries?

Given that there are red and blue oceans, our basic principle is not to enter the red ocean. We have already decided that we will not pursue the red ocean like a general waste disposal business. Our approach is to focus on market continuity and sustainability to see whether we can continuously receive inquiries in the market, as well as the uniqueness or distinctiveness of the business domain. We are trying to establish our dominance in these regions.

We are specializing in not the "artery industry" but the "venous industry". The venous industry is a business that we can extract to be reused. Like veins in the body, we conduct treatment on the waste from the product manufacturing process. The arterial industry that produces products tends to attract attention, but it is important that the arterial industry and the venous industry are always paired. Tsukishima Kikai Co., Ltd. (www.tsk-g.co.jp) handles equipment for chemical plant and batteries and specializes in processes for the arterial industry and then Tsukishima Kankyo Engineering., Ltd. specializes in processes for the venous industry. We both can provide a consistent proposal together.

Due to environmental concerns, we are seeing international governments roll out environmental policies that are putting stringent measures on manufacturers, specifically in the semiconductor industry which has very toxic gasses within its production cycle. What opportunities does this increase in environmental concern for your business? What changes have you felt over the last 10 years as international governments roll out these stringent regulations?

In view of achieving carbon neutrality by 2050, we are engaged in the development of technologies. In order for the development of technology to succeed, economic growth is also required. Since cost competitiveness is a must in selling technologies, we are looking at how we can maintain our cost competitiveness for our business. Our technical team is trying to be creative and come up with some ideas and initiatives. It is now in progress, so we would like to conduct the market in these technologies. The technologies must be evaluated by achieving the cost competitiveness at the same time. Depending on the necessity, we would like to form an alliance with some other companies to achieve that kind of technology.

We just emerged from the two to three years of the COVID-19 pandemic. As a result, we saw many governments create very loose monetary policies that benefited the manufacturing sector. Today, however, there are rising interest rates and liquidity is being taken out of global markets in the US. Moreover, we are experiencing a certain manufacturing downturn. For example, Samsung posted a 2.4 billion loss in its semiconductor division just last month. However, most major manufacturers expect a rebound in the second half of the year because of China's consumer-led recovery and decrease in inventories. Despite all this, the Nikkei hit a 33-year high last week. When Mr. Warren Buffett visited, he said that he believes in the Japanese story. It is an interesting time because the Japanese yen and the US dollar are at a relatively weak level, which makes Japanese exports more competitive. What is your outlook for the next six to 12 months in the manufacturing field? What makes Japan so attractive to investors right now? How do you explain the incredible rebound in interest?

We see notable growth in the manufacturing sector, especially in the semiconductor industry. We can enjoy the increase brought in this area because we have a business related to that sector, particularly in Japan. Rather than general-purpose semiconductor devices, Japanese companies have the upper grade in equipment and materials. In that area, the semiconductor industry can continue to be a growth market. After the 80s and 90s, many companies tried to relocate their factories to overseas countries, especially southeast Asia countries. As a result, the performance of domestic factories has been sluggish. Recently, due to the weaker yen, many companies hesitate to continue relocating their factories to Southeast Asian countries.

We are seeing the sluggishness of surrounding countries around Japan in terms of plant engineering businesses. My estimation is that the yen will vary between the range of 130 to 140 yen per dollar, but I do not think that there would be a surge up to 150 yen per dollar. I believe the yen will become stronger in the midterm. Instead of exporting or relocating plants overseas, maybe entering the plant business in those local countries aside from Japan would be the direction we will be heading to and some of the situations we will have to think about.

Japan is in a very interesting situation in the semiconductor industry and is a leader in equipment with companies like Tokyo Electron and Dainippon Screen and Materials. There are also new foundries and fabs such as TSMC with Sony in Kumamoto and Samsung planning to open a fab. It is part of a more global outlook which shows that all the major fabs and foundries are investing in mega factories in Japan, Arizona, and Germany. However, there are huge environmental concerns when it comes to this increase in semiconductor plants because of the highly corrosive gasses utilized in semiconductor production. Your company offers a series of technologies to make the semiconductor process more sustainable, like your kiln gasification and solvent recovery. Could you tell us a bit more about your business in the semiconductor field? How do you assist your clients in making more sustainable fab operations?

We are proposing a treatment technology for ammonia wastewater discharged from the semiconductor process. Specifically, it will be a technology that reuses and detoxifies ammonia wastewater. Facilities using those technologies are an important part of the semiconductor process. Without our process, you cannot build the whole plant for semiconductor processes. In that regard, our business in this domain would also be a niche top market.

TSKE is in the business of waste or wastewater treatment from semiconductor plants in territories like Eastern Asia, including Japan.

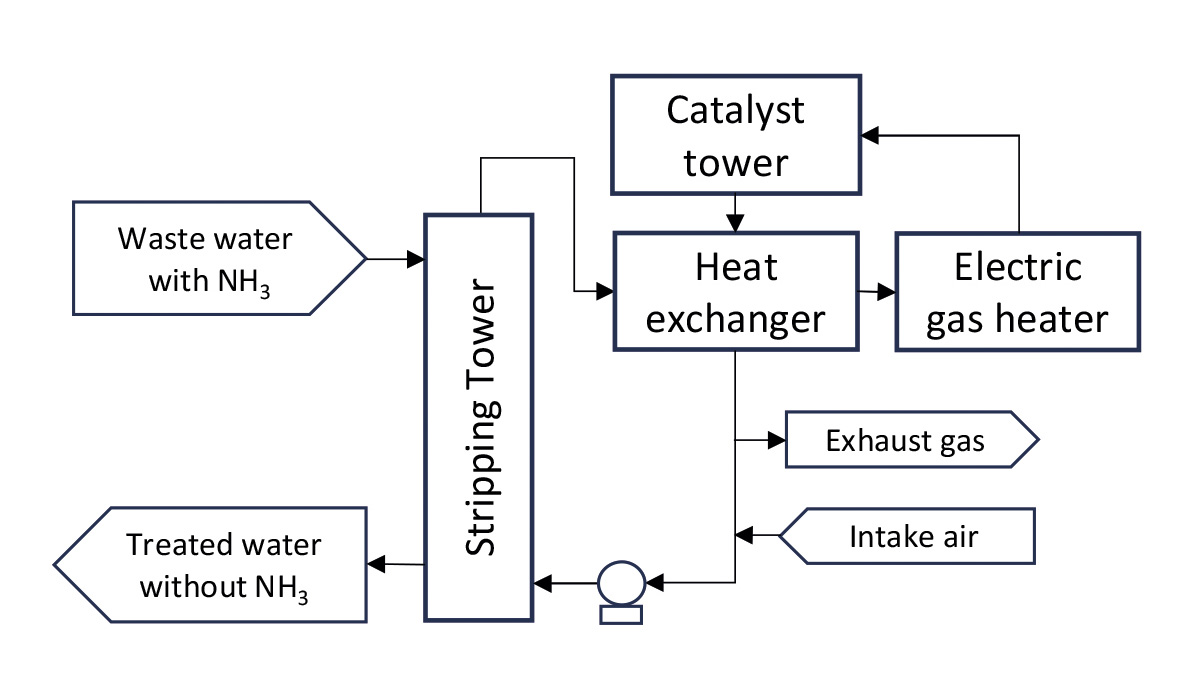

We will explain in detail about the ammonia treatment facility. Wastewater from semiconductor factories includes wastewater containing ammonia used for cleaning Silicon Wafers. It is a process that consumes a lot of water, and it is very important to remove ammonia for us to reuse the water in the process. We are proposing a simple, yet highly efficient ammonia removal technique. This technology is called stripping, where we use air or steam to separate ammonia from the water content. The removed ammonia can be simply recovered as ammonia water according to the customer's needs, or if ammonia water is not required, it can be decomposed into nitrogen and water to render it harmless.

First, the ammonia wastewater is fed to the Stripping Tower. At that time, Caustic Soda is used to make the wastewater strongly alkaline so that ammonia can be easily stripped.

Next, when recovering ammonia, the steam containing ammonia emitted from the top of the stripping tower is condensed into ammonia water or absorbed into sulfuric acid to be recovered as Ammonia Sulfate. If ammonia recovery is not required, strip the ammonia in the wastewater with air and decompose it into Nitrogen and water using an Oxidation Catalyst. With this method, heat is generated when ammonia is decomposed in the catalyst, and that heat can be used as a heat source for stripping. It is excellent in terms of running costs because it requires less heat energy supply from the outside for stripping. We also have a random tower packing called Spirax as one of our products, which we use in a tower that treats ammonia wastewater.

Throughout your company's history, you have created a series of partnerships like your collaboration with a renown Japanese catalyst manufacturer, where you use its high-performance catalyst in a variety of your systems. Looking at the future, are you currently looking for partners? If so, what does a partner of choice look like? What kind of technologies are you looking to create a collaboration with?

We are looking for a partner that has a heat recovery system. The heat recovery system has not been used in many applications, so if we can establish the technology, we can expect the market to expand. Rather than trying to develop technologies from scratch, a better approach is visiting and selecting potential partner companies that have such technologies. We can merge the technologies we have with theirs. We are also paying attention to the heat recovery from boilers and how we can include the efficiency of the technology that we are currently researching. For now, we would like to find potential alliances or partners in Japan or outside Japan.

We are currently working on the development of ammonia combustion technology. There may be some things we can further improve. We are communicating and exchanging information with our clients, and they have been asking about the progress of the technology. If our needs meet theirs, then we can consider the possibility of joint research and development. We do not have any specific examples at this point, but we are now exchanging information with our clients in that regard. Concerning overseas partners, we need to achieve price competitiveness. It is important for us to explore and discover construction vendors as well as vendors that can handle procurement. It will be much more inexpensive if we can procure in each country. We try to select a particular vendor who knows the region for each project.

Looking at the future, what region or type of markets will you be looking to prioritize?

Our focus is on East Asia, Southeast Asia and the Middle East. Since we have a Tsukishima Group subsidiary there, we would like to pursue the possibility of rolling out and scaling our business in Southeast Asian countries and so on.

You have long-standing expertise working with petrochemical-related companies, but you also work with semiconductor firms, metal & paper processing, recycling plants, pharmaceutical & medical sector. What allows you to work with such a variety of clients? Looking at the next five years, is there a particular sector or type of clients that you believe to have a higher growth potential for your company?

We talked earlier about the arterial and venous industries. The arterial industry has a wide variety of markets and customers, and the technologies we propose are different. On the other hand, the proposing technologies for the vein industry are generally the same across markets and customers. Specifically for waste disposal, the technology is for three forms of waste treatment: solid, liquid, and gaseous. As long as we have the technology, we will be able to serve, contribute and make a proposal to our customers for their environmental process. We enjoy continuously receiving inquiries in the vein business from various industries.

In the recent past, the semiconductor field has been growing in the market and our company has been booming. Looking ahead, we believe that as long as we are developing in the venous industry, we can continue to offer our technology to customers with active investments. It is difficult to determine which sectors and markets will grow in the next five years. However, since the arterial and venous industries are one and the same, we believe we can take advantage of our strengths in various industries. In this aspect, we can enjoy the orders from customers. Even though improvements and technological developments are necessary to meet customer needs. By doing so, we can catch up with the progress in the growing market in varied industries.

To further continue our business, it is important to build long-term relationships with our customers by proactively providing maintenance and improvement proposals after equipment is operated. Continuing to look to the future, promising areas are the growth of the semiconductor sector and the recycling business for rare metals and other resources, as well as the use of carbon-free materials (like ammonia and other fuels).

Imagine we come back on the very last day of your presidency when you are about to pass the company to the next generation, and we interview you again. What dreams and goals would you like to have achieved for the company by then that you would like to tell us in that new interview?

Tsukishima Holdings has a corporate philosophy of contributing to the world through environmental technology and creating the future. That is something we consider and put into practice every day. We look at how we can contribute to the environment. Kankyo in Japanese means environment and is a part of our name. Many people think about decarbonization when they hear about the environment. However, it is not just limited to decarbonization as there are other many problems as well. As an environmental solution provider, We would like to commit to solving environmental problems, which is the dream or target that we would like to pursue.

0 COMMENTS