The elevator business may have experienced its ups and downs, but MEBS has remained a stalwart in the market and can trace its roots back to 1931.

Could you give us a brief overview of your company history and how your company has evolved since its inception?

We are part of the Mitsubishi Electric group. Our main business is to develop, manufacture and install elevators and escalators, as well as to conduct maintenance services. Our building systems business started in 1931 and our maintenance business in 1954. In the 1980s in Japan, we started seeing some high-rise buildings, for example, Sunshine City in Ikebukuro. Also, in the 1990s Landmark Tower in Yokohama was built. Mitsubishi Electric Corporation created premium high-quality, high-speed elevators for these buildings.

Inazawa Building Systems Works: Mother factory of elevators and escalators

To exemplify the precision of our elevators, we made a demonstration: a coin placed on its edge on an elevator floor never tipped over as the elevator moves up and down. We have nurtured a globally renowned reputation with this professional mentality. We believe that such precision is possible because of our high technology in terms of the manufacturing of components for elevators. Today, you can see the epitome of our technology in the Shanghai Tower (Shanghai Zhongxin Dasha) where we installed an elevator capable of traveling at speeds of up to 1,230 meters per minute in 2016.

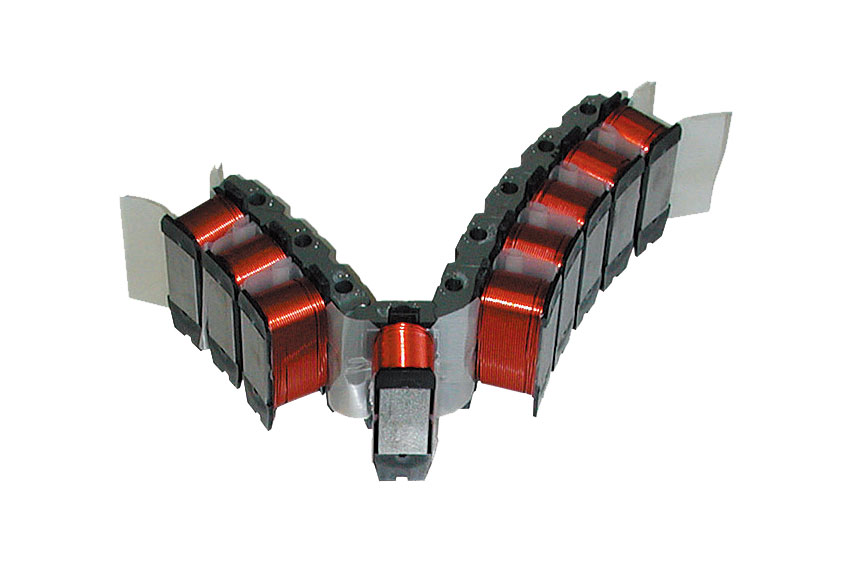

Some of our latest elevators are supported by high-efficiency motor technology called Poki-Poki-Motor, which is used in many Mitsubishi Electric Group products, and inverter technology that utilizes power semiconductor. Construction technology cultivated over many years at many sites is crucial as well. These are our main advantages.

I believe that up until certain period, capacity, productivity, quality and high performance were one of the cornerstones of Japanese manufacturing. However, the competitive environment in the elevator business has been changing rapidly worldwide. To this day in the premium elevator category, our products are highly praised around the world, but in the mass market category, we are faced with stiff price competition. Currently, we are also trying to expand the volume zone elevators in collaboration with local companies in the global markets.

The mechanism of an elevator is very simple. There's a cage and a rope with a motor, and the elevator goes up and down. The most important aspect is to have the elevator moving in a safe manner for a very long time.

In the past people would see the value in the product itself. However, that's not the case anymore. The customers see value in services, which in this case are maintenance services.

Mitsubishi’s proprietary “Poki-Poki Motor” technology: High-performance motor with highly efficient windings

How are you expanding your product portfolio beyond the premium elevator market to capture other related demand?

What we're doing is trying to expand our portfolio to cater to mass markets on a global scale. We produce standardized elevator with suppressing the cost. That's how we want to expand our portfolio.

What we want to do now is to focus on our stock. Altogether globally, we provide maintenance services to more than 900,000 elevators and escalators. In Japan we are taking care of some 240,000 units and will continue to provide maintenance services, operational services and renewals. That is going to be where we see our business value. Of course, we will keep developing products, but we will be focusing on services more than that.

In the past, if you developed something that was very good and of high quality, then you would be a strong company. However many Japanese manufacturers have forgotten how to provide value to customers, and I think that is an issue.

I really believe that when we have so many competitors that are providing products at a cheaper cost, it's important that we focus on providing goods and services at the same time. Of course, customers expect us to deliver good quality, high performance products. What's more important for the customers is that elevators will be used for 20 or 30 years, and they have to operate in a very safe manner and be maintained well and remain stable. That is a really important service that needs to be provided to our customers. That's where the customers see value from us.

I call this a stock business model, where we have so many customers that have been using our products, eventually they will need to have new elevators installed, or they need to have their elevators maintained or maybe renewed. We therefore need to look at our products as part of the building facility. It's important that we provide not just the elevators and escalators, but also the services for good operation.

AXIEZ-LINKs:Standard elevators for the Japanese market

We know from speaking to international commercial property owners and building management companies that there's a lot of uncertainty when it comes to service-related contracts for elevator systems, including what level of service would they be entitled to if it breaks down and what components are included in the breakdown service. How are you dispelling that uncertainty in the business model that you have adopted?

We have global presence in 96 countries and we are maintaining more than 900,000 elevators and escalators in total.

There are some grades in terms of the level of the services that we offer. No matter what level of service you choose you will get a very high-quality set of maintenance services that will go on for 20-30 years, the length of the lifetime of the elevator.

In the maintenance industry there are several segments. One of them is the maintenance services done by us and other manufacturers. There are also some services provided by independent service companies. To be honest, some of them provide low-cost maintenance at a lower level of quality.

I think that the level of service is one of the key features that we differentiate ourselves from our competitors. Now, I want you to just imagine how difficult or dangerous it can be to maintain elevators. It's dangerous and requires lots of effort. We therefore provide our field engineers with comprehensive training services so that customers can feel safe getting on the elevator.

In Japan we have a huge training center in Tokyo and there are some in other cities so that our field engineers can develop their skills. The importance of training doesn’t change abroad. We have huge ones in Thailand and in Shanghai, China. Wherever we operate there will always be training opportunities through the centers and other facilities.

Inspection scene in elevator shaft

Right now, we are in the middle of transitioning from being a so called ‘manufacturer’ to a new ‘stock business’ model company where we provide high quality elevators. That is why in April 2022 we merged the Building Systems Division of Mitsubishi Electric with Mitsubishi Electric Building Techno-Service Co., Ltd., and formed Mitsubishi Electric Building Solutions Corporation (MEBS).

I would like to talk to you briefly about what we aspire to do in the future. If you look at buildings, Mitsubishi Electric is actually providing various different types of facilities including ACs, lighting equipment, and power transformers. What we're aspiring to do is the asset management of the building itself as our company name “Mitsubishi Electric Building Solutions” shows.

We know a lot about elevator technology and offer maintenance service so there are particular services that we will be able to provide. For example, we know how elevators will be consuming energy and what kind of abnormal behaviors they may show. We know all that because we have knowledge both as a manufacturer and as a field engineer.

We acknowledge that our customers are either building owners or building management companies, or just ordinary people who use buildings. These customers are focused on energy suppression and safety operations. As for the maintenance companies, they want to save energy and money, and they are keen on having safe operations even when natural disasters strike, and that's what we're going to provide.

With the information technology revolution, we're seeing some new developments in terms of cloud, AI and data science. By combining our component know-how with information technology and our knowledge in the field, we have established a new system where we combine robotics with building security entrance systems. We can also do some energy management because various facilities or systems such as the BuilUnity are connected on the cloud. Furthermore, the AC control systems can be connected to the cloud so we can see how much energy consumption is going on.

There are many earthquakes in Japan. What we have is a system that enables us to see what kind of operational conditions the elevators are in about five minutes after the earthquake. Our information center allows us to remotely see what is happening at each elevator and know which of the elevators have been restored or not. If someone is trapped within the elevator, we would know where it was, and we would know which field engineers was working on which units.

Information center that monitors your building facilities 24 hours a day, 365 days a year

The previous generation elevators needed to have field engineers physically go to the actual location and it took a long time to restore after finishing the inspection of various equipment. However, now we can do it remotely, and for that we have established “ELE FIRST-smart”, which combines AI and ICT. In order to understand whether a unit will breakdown and require preventative maintenance or not, there is an algorithm that works it out. We got this algorithm because as a manufacturer we develop these components, and we have engineers in the field. So developing components as a manufacturer is really critical in providing our services.

Buildings and construction generate nearly 40% of global carbon emissions. As urbanization skyrockets, the sector needs to find ways to rapidly decarbonize through net-zero buildings. How do you envision the building services sector for which you cater to becoming more sustainable? What steps is the Mitsubishi Electric Group taking?

Going forward, there will be more concerns about carbon neutrality. It's not enough only for the demand side to be thinking about energy savings. Within a building, there will be various forms of energy coming in, including renewable energy, and we need to be thinking about the energy mix. If we can combine the supply side and the demand side of what will be the best energy mix, and how to use which type of energy at which locations, I think we can establish a new system.

Within Mitsubishi Electric, there is a division which caters to energy systems and the supply of energy. We have started collaborating with that division and we want to enhance the value of buildings by offering building management that caters to energy systems.

Mitsubishi Electric announced that it has developed "Multi-Regional Digital Power Supply Optimization Technology," which allows companies' facilities located in two or more regions to share power from renewable energy sources. They will be controlling the regional power supply by combining solar, wind, and other renewable energy sources. We will be collaborating with them so that we can have that mechanism include the building facility management system.

Some of the points that I've mentioned are still some way off in the future. I have talked to you about how we really cherish our past advantages as a manufacturer, and how we have built our core values which we're going to integrate with various other solutions and establish these newly integrated solutions. I think that's the way for many Japanese companies to create new innovations.

How will you complete this fully integrated solution for building management you envision? Will you be requiring partnerships in order to do so?

Unless you can really leverage the knowledge as a manufacture, Japan's manufacturing industry will not be successful in the future. One of our visions will be making more global alliances to provide more value in terms of building management by exploring new integration. One example of this is the collaboration with the security company in terms of the security of the building.

We are embarking on a new initiative, which is having more alliances with independent maintenance operators that work with multi brans. Building facilities are provided by a variety of manufacturers, and the property owner would much rather have one service provider so that they can provide a one-stop operation.

In 2021 we acquired a company called Hanshin Yusoki Co., Ltd., which was a maintenance company in Japan. In March 2022 Mitsubishi Electric acquired Motum AB, a Swedish maintenance and renewal company. These independent companies have their own know-how, and we would like to incorporate them into our group.

This question relates to robotics, and something that I thought was very exciting was the partnership with OKI for a robotics-based system related to elevator management and usage. Could you speak to us a little bit more about that project with OKI, and how robotics will be used in building management in the future?

We have several alliances with robotics manufacturers. Oki Electric Industry Co., Ltd. (OKI) is one of them. Currently within our company we are doing various POC (Proof of Concept)-related businesses, so we think it's important that we have robotics because Japan's population is declining and it's going to be a really huge issue in terms of labor shortages. Also, I think robots will be needed security wise.

Cooperation between OKI robots and Mitsubishi elevators

In the case of your company, what steps are you taking to ensure your labor force, and are you actively recruiting and training staff from overseas locations?

We recruit people from abroad all the time, but partly due to covid-19 we are not getting as many as we want. We have recently been resuming our training sessions, so we are happy about that. In terms of the labor environment, I think Japanese companies need to establish a globally standardized labor management system, including a global grading system and how to write a job description. We want to make an environment where people from abroad feel more at ease to participate in Japanese companies.

As you mentioned already earlier, you've already installed more than 900,000 elevators worldwide and you operate in more than 96 countries. As you now embark on this new stock business model, and since your foundation of the new company on April 1st 2022, what key countries or regions will you be focusing on for growth?

We aren't focused on just one single country because each region and country has their own challenges. In terms of the elevator business, it is China. China is somewhat skewed to the installation business, and in terms of safety the maintenance business is not so rampant yet. On top of installing new products we would be going into the maintenance business by leveraging our knowledge.

The second market would be the United States and Europe but there are only a very few Japanese elevators installed in these regions so our main theme for Europe and the US would be to try and expand our building management business, including selling AC’s. For the regions of Southeast Asia, East Asia, South America and the Middle East, we are among the top three companies in terms of market share so we will focus on both installing new components and the maintenance services.

As for Japan, we will be focusing more on the renewal. That's our regional and international strategy.

You mentioned before that you were put in charge of the building systems business two years ago, and of course with the merger you're now the CEO of this new firm that was created in 2022. Is there a personal goal or objective that you would like to achieve during your time as president?

I have been in the HVAC business and the home appliance business, for 40 years. We should change our mindset that products have value. We really have to think about our business customers. When we say customers or clients, who are they? I think we need to expand our concept of customers to include all the stakeholders who use the building.

We shouldn't be focusing just on the elevators or the AC's. We need to think about building management. I think one of the main mistakes that Japanese manufacturers made was that they were fixated on the products and they forgot about the concept of who the customers are, and what the benefits are for the customers and how they are going to be generating value for the customers.

I think we are in this position, as a new entity with a new mission within Mitsubishi Electric. I think we are in a very good position to come up with new business ideas and new innovations. Japanese companies need to be more profitable, and I think we can do that.

0 COMMENTS