Mabuchi Motor, the world's largest manufacturer by volume of small electric motors producing more than 1 billion motors annually, looks to China to lead its “Five Region Management Structure” approach to the global market.

Could you give us an introduction to Mabuchi Motor? What is Mabuchi Motor’s core business and what makes you stand out from your competitors?

Since our founding, we have been providing small, lightweight, and highly efficient motors for various applications as a manufacturer specializing in small DC motors. We produce about more than 1 billion units per year, especially for the automotive industry and have an 85% market share in motors for automotive mirrors and a 70% share for door lock motors. Often, I like to think from the customer's perspective, why did they choose us? Our strengths are very simple and revolve around our high quality. We can provide that high-quality at a reasonable cost and with a very stable supply chain. Our production capacity exceeds around 1 billion units per year, as I mentioned, but the complaints we receive from customers are extremely lower than PPM(Parts Per Million) level. We have achieved such quality that we are considering moving to quality control at the PPB (Parts Per Billion) level within the company. (PPM refers to the number out of one million that you have detected as defective products.)

I actually took the position of president starting in the end of March this year. Currently, I’m doing customer courtesy visits, and almost everyone has had a high evaluation of the quality of our products. It is the monozukuri spirit of Mabuchi that enables us to provide such high-quality at such reasonable costs. In general, people think that the higher the quality of a product, the higher the cost. We don’t think so, in fact, we think it is the opposite. We believe that by realizing the ultimate level of quality, costs can go down. The first key to this is a standardization strategy. If we take all the requirements from our customers side-by-side, we can identify shared and common requirements across all customers versus requirements linked to a specific customer. That is the basic principle of our standardization, identifying common requirements across all customers and then applying that to our own standardized spec. By doing so, we can produce at a high volume and thus bring our costs down.

As for the customer's requirements, we will often explain to those customers that their specific customizations will inherently bring the cost up, and ask if they are willing to accept these higher costs. If the answer is yes, we will of course go ahead and customize the product for that customer. High volume obviously results in lower costs for the procurement of parts.

With motor products, the number of orders by customers can fluctuate, but by making everything fit to a standard we can manage those fluctuations. This means that we can manage inventory in a more effective way. Risk is avoided, as the inventory of components is standardized, meaning that if one component is not being used at the current time, it won’t go to waste and will be applied for other purposes. Standardization can make use common infrastructure facilities for each production stage, and by standardizing our production management, we can make the same product to the same standard in any of our factories around the world.

In recent times we have seen the global supply chains have been completely disrupted due to COVID-19. There is a shortage of semiconductors which is creating huge backlogs in many fields. On top of that, we have shipping problems, with container price surges and China’s zero COVID lockdown. How are you able to maintain your stable supply chain during such a tumultuous time?

In 2021, we experienced a lockdown in Vietnam, but we were able to shift that operation to other factories. From the customer’s perspective, nothing changed, as we were able to provide the final product to them without disruptions. As I mentioned, because everything is standardized, we can avoid any risk, and then we have the option of buying raw materials in advance. We understand it is not ideal from the perspective of management efficiency, but in order to maintain a stable supply chain, that is one of the options we can take.

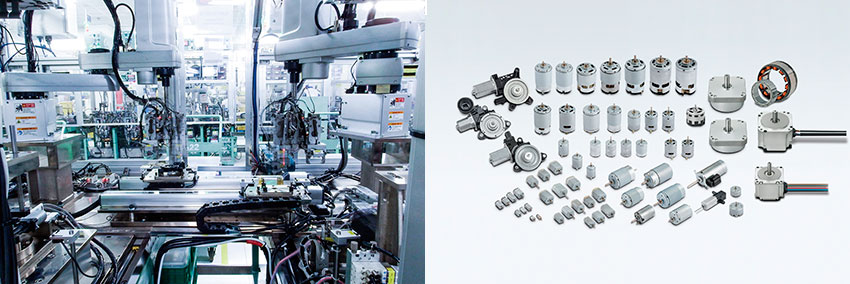

Production line of Mabuchi Motor (left) / Product lineup of Mabuchi Motor

Could you tell us about the competitive edge of Mabuchi Motor and how your corporate structure and philosophy allow you to excel globally?

Another uniqueness of our company is the technology that we use for production. That includes the facilities in the factories and molds. All of these molds, facilities, and parts are manufactured internally. As we are involved in the entire production line from beginning to finished products, we can achieve high quality whilst keeping costs relatively low.

The company culture is also a unique aspect of our business. We specialize in the motor business and have a corporate culture of continual improvement. Some of our products have been around for over 30 years now, yet we still strive for year-to-year improvements. Therefore, because of this accumulation of improvement, competitors find it very difficult to reach our level.

In terms of initiatives, I think a global management structure is one of the key characteristics of our company. We are small size-wise, but we always have considered our company a global company. By 1964 we already had a manufacturing subsidiary in Hong Kong, in 1965 we established ourselves in the US, and in 1966 came Germany. In 1987, we became the first Japanese company to establish a wholly owned subsidiary in mainland China. We have 20,000 employees worldwide, but only 800 belong to the headquarters in Japan. We actually have 21 subsidiaries outside of Japan, and out of those 13 companies, local people is holding the head position. We always try to adjust the operation and goal based on the economic development of a region of the country we are working in.

Take China as an example; initially, the labor cost in China was very low. Our solution involved hiring as many people as we could in order to produce a low-cost motor. Now the situation in China has changed, and we value China as the market itself, in addition to the manufacturing potential. We are trying to sell products targeted at the Chinese market, and the factories there need accelerated automation. We are trying to reduce the amount of labor required. In fact, we have established an R&D foundation in China so that we can develop products for the Chinese markets.

We now have the concept of a Five-Region Management Structure: Japan, China, America, Europe and ASEAN. It covers pretty much the entire world. Initially, our headquarters were in Japan, and the sales offices and factories were located in each country, but with this five-region concept, each region operates independently. Five each region has its own sales offices and factories, and there are R&D facilities; in Japan, Europe and China. Obviously, even though each region is independent, we still want to cooperate with each other and create synergies among the five regions.

Previously when we opened the factory in China and Vietnam, we dispatched Japanese staff there. At the newly opened factories in Poland and Mexico, we dispatched Chinese and Vietnamese staff. Cooperation between bases is possible because each base is independent but has standardized production processes. Moreover, each of them also possesses advanced technological capabilities. I don’t think we can do what we are trying to do without each employee following our management principle, which is “Contributing to international society and continuously increasing our contribution”. This management principle does not only apply to management but is also disseminated to each individual employee; all employees must understand our corporate values. This management principle was established in 1971. I know that “purpose-driven management” is a buzzword these days, but we have it in our management principle all the way back in 1971.

Our continual improvement ethos really stems from our desire to be needed by society. We only exist because society needs or wants us. We are trying to communicate the importance of this to all of our employees. Our aim has always been to make meaningful contributions to society. Our company was established to manufacture small DC motors for toys and models. Later, we entered and grew in the audio and video market with motors for CD and DVD players, and have since expanded the market for such applications to include home appliances and tools. With the advent of the iPhone and iPod, there was no longer a need for motors for listening to music, so we decided to shift our focus to the automotive industry. Currently, motors for automotive products account for more than 70% of our sales. Moving towards the future, we are focusing on the three M application areas, mobility, medical and machinery. In the past, we focused on products that provided enjoyment, but these days we focus more on solving social issues with our products.

Your company is clearly very good at striking a unique balance between quality and cost through integration and standardization. We understand that the automotive sector is still your major market, and this sector is going through a huge transformation right now with the shift to EVs. How is this shift impacting your business and how are you tailoring or changing your offering to better cater to the new needs of car makers?

First of all, we believe there are three major transitions in the automotive industry. The first is the shift to EVs, the second is autonomous driving, and the third is advanced safety equipment. In terms of EVs, in order to increase the battery efficiency and manage its temperature, we have this new technology called thermal management. We are trying to advance into that area. We don’t actually install a motor into the battery itself, we are talking more about installing a motor into thermal management systems to control the temperature. When you look at the car as a whole, there is a need to cool down the battery, but we can also utilize that heat that is generated by the battery. Heat can be used to warm up the car. To do so would require some kind of water flow. That’s where we come in. A valve is needed to switch the flow of coolant, and the motor plays that role.

We are not going to produce any large scale motor that will replace traditional internal combustion engines (ICE), however, when talking about mirrors, door locks, and power window lifters I think our motors will remain in the EVs society. With increasing expectancy for EVs to run more efficiently and be able to drive further distances, everything needs to become more compact and lightweight. I think this is where our existing technology can come into place in other requests as well and help to contribute.

One thing we have found is that in EVs without an engine, the sounds of motors may bother passengers. There have been some requests coming in to make these motors quieter. In fact, the quietness of our power window motors has been highly evaluated, and our motors are increasingly being adopted by Chinese EV manufacturers. In this way, I believe that all of our technologies can be improved and have added value.

Talking now about autonomous driving and advanced safety equipment. This all requires sensors to be installed. If any dirt, snow or soil gets on those sensors, they will not be able to operate correctly and we need additional components to clean up the sensors. Obviously, there are various ways of cleaning sensors, such as using airflow or a brush. Whatever the case may be, chances are that it will require a motor. That is another application that we can contribute to, and a potential revenue stream in the future.

By moving forward to autonomous driving, the way people spend their time inside a vehicle is obviously going to change. People used to focus on driving, but now they won’t have to handle the wheel, and more luxury components might be required. There are so many different ways that the cabin in particular will change. Perhaps the driver's seat will change to convert into a bed, maybe a more luxurious space will exist inside the cabin. In such a world, our technology could be better utilized.

Seeing things from a car manufacturer's perspective, they want to differentiate their products by applying technology geared toward autonomous driving, and to secure its safety. We are already seeing car manufacturers allocate their development resources more towards autonomous driving and advanced safety. For instance, right now we provide motors to them so they can manufacture actuators, but with their development resources shifting to different areas, they may just ask for us to provide the actuator as a unit product rather than just the motor. We want to shift our company so that we have the capability to provide actuators or other components, meeting the needs of our customers.

Can you elaborate a little on your strategy to approach these new sectors and markets?

As I mentioned earlier, we are focusing on 3M application fields for future growth: Mobility, Medical, and Machinery.

In regard to medical, last year we actually made a company in Switzerland our subsidiary. Using their technology, we want to advance in the medical field. The company produces high-speed rotation motors that are very silent. Applying that technology to get into the medical sector is one thing, but we can also use their technology to assist our existing motors. Our motors can keep advancing and improving. We can apply this to not only the medical field but sectors outside of the medical industry too.

The second area we are approaching is machinery, and our motors such as the new IA/IB series, are being used in the joints of robots.

Collaborative robots working in a factory

Brush motors were something that we have always been strong at, but we were lagging behind with brushless motors. However, the principles of how our motors work is the same whether that is brush or brushless. We excel at designing efficient magnetic circuits, and our technology allows us to make our products smaller and still reach the same level of power. Also, with our accumulated technology we can continue to provide high-quality at a cheaper cost. When we are talking about robots, as you know, some are very high-tech, very expensive, and very specialized. However, some are more compact and home oriented. We want to focus on the latter portion. Smaller and compact, but with high volume and high potential to expand our business in that area.

The third area I mentioned we are interested in was the mobility. Mobility doesn’t just cover automobiles but also includes lightweight vehicles and AGVs. We are not only providing the units, but also the brakes and wheels that are utilized in these types of vehicles. With our brushless motors, we are looking into packaging up those motors as a product. We are providing the "IS series" as brushless motors for autonomous mobile robots and personal mobility. We are in an age of automation, and Mabuchi Motor hopes to continue to evolve in this field.

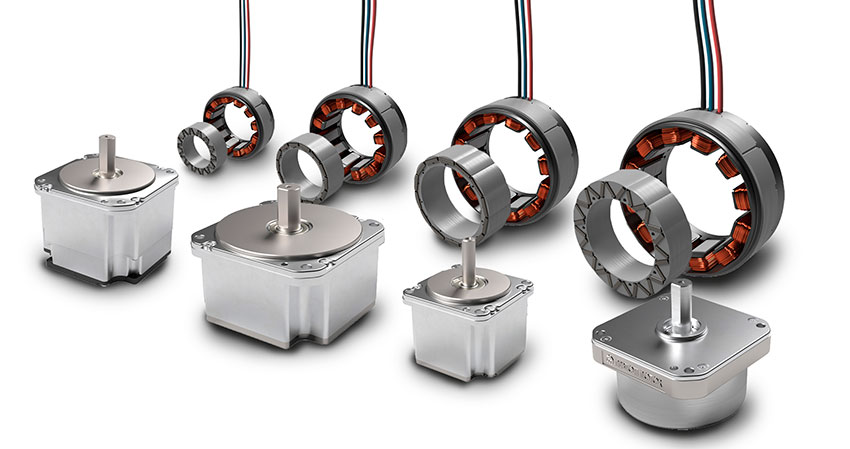

Brushless motors for light electric vehicles and collaborative robots

Historically your company has been one that has specialized in small-sized motors. During our research, we found that recently you have been expanding into larger, medium-sized motors, especially in automotive applications for things like power seats and electric parking brakes. Could you tell us your motivation for applying your expertise to these new, larger products and what challenges you are facing in this new endeavor?

The medium-sized motors are larger than the small-sized motors we have previously made. Compared to other companies, however, they are still small. It is a totally different philosophy in design because we have expertise in making things smaller. By advancing our technology in this area, I believe we can add value and differentiate ourselves from our competitors.

What do you consider to be the current focus of developing your international business?

China is currently taking the lead in our Five-Region Management Structure. We want other regions to follow China, and that is one thing we think we need to focus on. Obviously, all regions are changing and are never static. So rather than setting static goals we want to monitor a region and create dynamic goals according to each region's needs. China has developed quite far and has reached quite high targets. If you think about the area with the most potential for major changes, for us it feels like it might be ASEAN. We would like to put more focus on that region, and to that end, we set up a sales office in Thailand in 2018.

As you look towards the future, is there a goal that you wish to achieve during your time as president?

Besides the obvious financial goals, which of course have been made public, I want to create something new motor with new idea. My background is in engineering and this company’s strong point is in technology. My dream is to create a new motor product that makes a significant contribution to society.

0 COMMENTS