Based in a small town in rural Nagano, Japan, Shine takes old auto parts and rebuilds them to be as good as new in what they call a "re-Manufacturing" process

The Western mindset of monozukuri conjures the mental image of the swordsmith banging away at a piece of steel until it's completely perfected, that idea of relentlessly pursuing perfection. Yet today we find companies here in Japan competing with regional competitors in South Korea, Taiwan, and China, and there is a need for QCD as well as short lead times. In the case of Shin-Etsu Denso, you’ve been in business for over 50 years now. Can you tell us some of the monozukuri elements of your business, and what you see as some of its advantages when compared to some of your regional competitor’s manufacturing?

As you mentioned, I think that monozukuri is that pursuit of perfection, not only just in making things, but I think it also applies to every element of everyday work. A lot of it comes down to this high sense of pride in what you do. There is also a pride element in the sense that what you are doing is making an impact or helping a customer do their business in a better way. For us, it is not just the actual manufacturing, but all of the tangibles, whether that be service or relationship management, and everything we do has this higher sense of pride.

That for me is what monozukuri is, and I think that has helped us become more focused on the domestic market, which in turn has brought us close to our customers, especially when it comes to them fully understanding what we do in terms of our business.

Remanufacturing is still new to Japanese consumers, and the past mindset was “new is better.” We are showing those customers that we can provide the same level of product and service with a part that is remanufactured. This is slowly turning the opinions of consumers when it comes to remanufacturing, in particular the quality and safety that goes behind it.

When we bring in a new customer we always like that customer to visit the factory first, because we want them to see everything that goes into what we are doing. It isn’t just a used part that has been cleaned, instead, each and every component is taken very seriously and reworked to what we consider is as good as new. I think for us this is where our sense of pride lies and where we set our priorities in terms of monozukuri. Being able to take something that is used, and remake it to a level where we feel it is brand new is something we pride ourselves on.

I would presume that a lot of Japanese consumers want brand-new things, they want OEM-based products. Today’s society however has a growing need for sustainability, and one of the greatest advantages of your product is this ability to reduce the burden on the environment. Remanufacturing products can save up to 80% of carbon emissions compared to OEM-based products. Can you give us a bit more of an insight into the climatic aspect of your parts, and how you are helping the environment in terms of saving resources and materials?

I think this is something that is not only new to Japan but globally; that increased awareness of where your parts or products are coming from or where they are produced. That is something that is being taken into account now, and factors like the quality or the price are not the only contributing factors to a sale anymore. “Is it sustainable? Am I doing damage to the environment? How can I do my part?” These are very valid questions that consumers are now asking themselves before purchasing, so I think this is something that will help us because we have been doing this before it became popular.

For us, it’s not the main reason we do it, but it definitely is a side benefit to our particular business model. That side benefit itself is something that can be discussed with the customers to give them more of a sense of relief. Big companies worldwide have a huge amount of pressure to be more environmentally friendly so they are looking for viable options. In the past where say a company like Nissan wouldn’t look at used or sustainable products, now they are looking into those options to be a part of their whole supply program. This enables them to show their care in CO2 reduction, but on another level, it enables them to connect with their consumers just beyond what the product is.

Obsolescence management, also sometimes referred to as Diminishing Manufacturing Sources and Material Shortages (DMSMS), is defined as the activities that are undertaken to mitigate the effects of obsolescence. Could you give us an insight into the use of digital tools for obsolescence management, and is this something that your company is looking to move towards in the future so that your clients can manage their inventory?

In some respects, it would be nice to know exactly where each and every one of our products is going when it is fitted and if there is an issue with it. That could be a kind of trigger for us to provide more services down the line. For us, I really think this might be something that is a little further in the future, and the other aspect to consider is that we are a remanufacturer and are not on the development side of a component or product. We are taking an existing product and remanufacturing that product, so adding functions to it would be something that we would need to do on our own, and something that would raise the complexity of our current business model. With our current way of operating, when we send off a product, we expect that the broken part that has been taken off the vehicle be sent back to us. So essentially our tracking needs to follow the product we ship out as well as the broken part being sent from the customer. Being able to track both allows us to maintain a constant update on our inventory or outgoing and incoming parts.

Alternator

That kind of data helps us in terms of ensuring that our supply chain or stock situation is in a good place. We can ensure that we have the proper amount of stock based on what’s going in and what needs to be bought in again. This digital tracking has helped us with shipments.

In terms of the product, that is something that is harder to realize for our production. It is a bit more sophisticated and perhaps it is something that we might consider again a few years down the line.

Can you tell us why you have chosen specifically to focus on electrical-based components?

Our company started out as a car service and battery replacement garage. From there we started noticing that there was a high percentage of failure in electric based components. Specifically alternators and starters which had both electrical components as well as mechanical components. Having both of those makes a product more susceptible to failure; we saw more failure in those products because it could fail on the electrical side, but also could fail on the mechanical side. Being able to remanufacture both requires a higher level of skill and couldn’t just be done anywhere so we started to remanufacture these parts in house and slowly became our main business focus. We are lucky to have found a component that could be technical enough, but in demand enough to allow us to be competitive.

Electrical components in vehicles evolved the most over the years, especially when we compare them to mechanical components. In the future, we are going to be moving towards EVs here in Japan, and if you look at Europe, 15% of all car sales are already EV-based cars. This is a big challenge to your business, can you give us an insight into how you plan to adapt and where you foresee your business model going with the transition to EVs?

This is the one that keeps me up at night. With complete EVs, there is no starter motor, no alternator, and the A/C compressor is different. When the shift to EVs happens it will be a big issue for us in terms of the product shift. This is something that we take very seriously, but in the domestic market, it is still a little young, and hard to predict the exact direction. For our business, we take components when they fail, and we come in and remanufacture, taking a product and putting it back in the market for customers to consume. We still need to collect data on what components are failing in electric vehicles, and at what point in the life cycle they are failing. There are many unknowns at this point, especially the big one, which is what electric vehicle will have the dominant market share in Japan. As of now, there is no clear winner, and there really aren’t that many models available. Right now if an electric vehicle is to fail, it has to be taken to a OEM dealership, and I think that model is in the long run not sustainable. Car repair shops that are are not linked to OEM dealerships will also need to learn how to handle electric vehicles and correctly do the replacement of components.

From what I know and understand, this is not cheaper either, and there are a lot of upfront costs for a garage to be able to do this kind of work. With a lot of these older garages, they have reached a crossroads on whether to continue their business or not. That kind of massive investment is pushing them toward giving up. One of our worries is who will actually be doing the service of these vehicles in the future and whether there will be room for this kind of aftermarket garage. Without that, our business becomes a little harder.

We do of course have OEM manufacturing customers, but at the same time, a majority of our business is through independent workshops and independent garages. Without them having the skill, know-how, and investment it would hinder us as well. It is something I worry about, but it is something that we have to deal with no matter what. For us the first step is identifying what components in electric vehicles are failing and if there is a chance to remanufacture those products. We are more than willing to invest, but before we do that we really need to have a better understanding of exactly where the market is going.

How do you envision that knowledge coming to you?

Working with OEM manufacturers and independent garages as well as seeing what our customers are having to deal with right now is enabling us to gather data to some degree. Our business relies on products breaking, so the data is going to come from the actual customers needing products, so it is through this connection with the customer that we learn exactly what they need help with.

OEM parts are traditionally favored by the Japanese and the Asian market who value new things. However, there is a need now to be more frugal with our resources with the population of the world exploding. How is the customer mindset changing? Are you now seeing the remanufacture of parts getting an increase in reputation and perceived value?

I think something that we need to do to grow the industry is increase the vehicle owner awareness of replacement parts, especially in terms of remanufacturing. Still today I see the end consumers or actual owners of the vehicle aren't the decision maker in this process of what goes into their vehicle. They go to a workshop and drop off their car, and then the workshop will go ahead and give them an exhaustive list of all the things that need to be replaced. The car owner just has to accept that, as they know very little about how their vehicle works.

I would like to help those car owners understand a little more about what options are available beyond brand new OEM parts, which is what the workshop will tell you to replace with. What we would like is, say for example your alternator fails, just ask or inquire if there are remanufacturing options or if there are different alternatives to the expensive brand named one that you are going to pressure me to buy. This shifts the pressure on the workshop to provide those kinds of options. This comes from basic know-how; the idea that the end user understands that there are alternatives. This is something that anyone in the remanufacturing industry needs to help with.

The biggest fear with workshops in the past when they used second-hand parts was that they weren’t to the quality standard of OEM parts. They replace the part and then a few months later the part fails and then that customer will come back. All of that man time and working hours are basically given away for free as well as potentially losing a repeat customer. This is why we focus heavily on providing the highest level quality remanufactured product. We want to eliminate the fear of potential product failure, and I think by using our products, slowly but surely the skepticism towards remanufactured parts will no longer be an issue. I think that will lead to more confidence in exploring more options beyond OEM, to the point where they can get products at a much cheaper cost than the genuine product but without the fear of losing the quality associated with a genuine part. We want potential customers to understand that this truly is a win-win situation for them, and at the same time, they keep their customers happy by providing better options. Those customers will, of course, be happy because their costs are kept low, and with happy customers, those workshops can expect to grow their business further. The quality really speaks for itself, and this is the kind of agenda we would really like to push moving forward. Ideally, we want a situation where a customer calls, we have the part in stock and we can tell those customers that the part will be at their workshop the following business day and that the car can be worked on and out the door as soon as possible.

Our products are not just a luxury that people put on their cars, they buy our products because something is broken, and it is essential to the operation of the vehicle. We are starting out with this negative mindset, it is not a happy time for that person. They are frustrated, stressed, and worried about the costs they are about to receive. For us, we want to make this as smooth and easy as possible, and that can come from the price, the delivery, and the service. This together changes the experience from a negative one to one that might not be as bad as they thought. Those end users then understand that they have a product that they can trust in the future.

How are your engineers able to learn about such niche products from thousands of different models of cars? How do you ensure that you back-engineer it properly and maintain the quality?

First, it is important to get the product in hand. If it is something new to us the first thing we do of course is to take it apart and analyze what components are being used. A lot of times there are shared components, so we can identify what is still being used by the original manufacturer. We also have testing parameters that we can do in-house, and then we will buy a genuine unit as well to understand what the expectations for the performance of a new unit are. We then adapt our testing primers to that exactly so that we ensure when we remanufacture the product it matches the same performance. Sometimes this process is referred to as reverse engineering, however, it is a little different for us because it has already been engineered. We are just helping to return the product back to a working state, and through our 50 years of experience, we have an idea of what components break down easier, or what are the wear and tear parts that are going to be there.

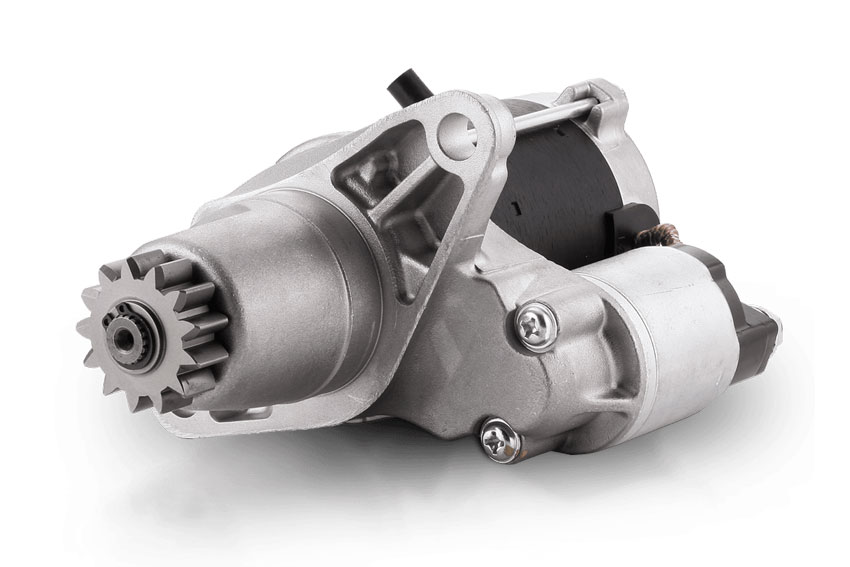

Starter

For the Japanese domestic market a lot of people like OEM components, so we try and do as much of the OEM components as we can, but at the same time, we are always looking for a different supply in order to be able to fill that gap not just on a price reduction level but also just on a supply level. A lot of OEMs are not always willing to sell certain parts to just anyone. For us as well we are sometimes looked at as a competitor, so we do have trouble sometimes sourcing these genuine components. What we have to do is find a different way, and that is why we are working with various suppliers domestically and abroad to get the same level of the component.

Another aspect that I consider quite interesting is the fact that as a remanufacturer, we see the failure rates in the market. Based on what demand we get from customers we have a deeper understanding of parts that have a tendency to fail. When a car comes back to us we can actually see where it’s failed, and what is broken, and we can collect that data to have a clearer picture of what exactly has occurred. We can then work on potentially fixing a lingering issue with a component; essentially tweaking and improving the original. Additionally, we can standardize, meaning that whenever a part comes through we know to use a new component in a particular spot where they tend to fail.

With those new components do you ever manufacture those replacement parts? Do you make it yourself or do you get an after-market part?

We would do that in-house in terms of that manufacturing. This is something that we work with our suppliers, and can only be achieved when there is trust between ourselves and our partners. We send them a component and let them know this is what we need, they then source parts that will then fit our criteria. Basically, it is a close collaboration between ourselves and our suppliers.

The population issue is a big concern here in Japan, and you’ve mentioned already how the domestic market is the core of your business. Japan now has a population that has dropped below 126 million. To add to the woes, this population is 30% over the age of 65. In years to come the consumer market is going to continue to shrink. Can you tell us how this population dynamic is affecting your business in terms of new clientele and are you looking to overseas markets to compensate for this shrinking demand?

The concept of shrinking demand is something that we always have to look at. With the population going in a downward trend we are also seeing the population of cars going down too. For us, it is a big issue, but at the same time, 120 million is still quite a lot. We also do business in Australia where the land size is almost the same as the US but with a population the size of Texas. I think the key is knowing your market and adjusting your parameters and expectations to match. Obviously, we want to grow year on year, and with the decreasing population that will become a harder thing to do. However, it isn’t all doom and gloom, and we can focus on what we can still do in the market, and find places where there is still demand. There is still a whole segment of the market that is untapped with our business model, which currently is focused on new products. If we can shift that perception, whether the population is going down or not won’t really matter if we can create buzz around remanufactured products over new ones. That is something we need to focus on more; basically, how can we attain more within the existing market of Japan?

The other aspect is that we do export as well as manufacturing in Indonesia where we have a sister company. That sister company is solely focusing on the export market, so products built there are exported outside of Japan. This is something that we have maintained since 1997.

One of the things for me that separates a remanufactured market from a new market is the average labor costs. Those labor costs will directly affect whether it’s going to be a remanufactured market or not. People don’t want to pay someone to fix things and they’ll just rather buy new products. If we look at countries like Thailand and Indonesia, they are slowly growing in terms of their labor costs and at some point, they are going to have to shift to a remanufacture market. That is where having local manufacturing in Indonesia already gives us some foresight into the future and perhaps we can start producing domestically for Indonesia soon, one of the world’s largest populations. As they continue to grow and progress from two wheels to four wheels there will be more drivers than in Japan and their labor costs will increase to a point in which remanufacturing is a viable option. We’re already set up to handle such demand, and this is something that we are looking forward to in the future. This will help us fill the gap left by the population decrease in Japan.

In the US and Europe green manufacturing has been a big business. In your company’s case are you able to get a foothold in Europe or America when it comes to remanufacturing? Is there a certain advantage that your company can bring as a Japanese firm when it comes to the remanufacturing of parts and the supply to the US and Europe?

We started out of course in Japan domestically as a service center. It was only in the 1980s and 1990s that a big boom in Japanese exports occurred. A lot of the Japanese car manufacturers were selling large numbers of units in the US, and the suppliers of parts hadn’t developed as much. We started out helping customers in the US by filling that demand for a company that could source replacement parts for Japanese vehicles. The good thing about that was that the Honda Civic was being built here and then exported to the US. We could find components in Japan to remanufacture and then sell to the US, and that worked well.

Nowadays there are very few similarities between the Japanese vehicles driven in the US and Japan. The market has shifted so that Toyota still makes cars for the US, but those cars are designed exclusively for the American market. The models are specific for the region, so if a customer wants an alternator for that model we can’t go out to Japan and find it. We would actually have to go to the US and find that part, send it back to Japan, remanufacture it, and then finally send it back to the US for installation. Once you reach that point the only ones that are doing good business are the freight companies. That is when we made our shift back to the domestic market.

With this remanufactured business model, it is imperative that you be close to the market, and for us, we need to be able to deliver our products to the customer's doorstep the next day. Vice versa, when a product is coming to us we need it quickly in order to begin work on it right away. Additionally, on top of all these parameters, the car parts need to align. Some of those areas of the US where we used to have 90% exports and now down to 10% exports. Now a majority of our business is domestic and that has happened within the last 20 years. The model itself dictates that short lead times are a must.

One silver lining comes with those emerging markets I mentioned earlier. A lot of those markets are taking second-hand Japanese vehicles, and basically, that is how their car population is growing. When they need a part for those cars, we have the parts in Japan that we can remanufacture and then ship. Possibly we could even send those parts to Indonesia for remanufacturing, meaning there are synergies present that make this a viable option. We have the know-how over many years to support that local market.

To summarize a long answer, with remanufacturing, it is key to be close to the market, and of course, that leads to success. One thing I will add however that with the US market, there is an emerging niche area we can capitalize on. There is a growing demand for older and popular Japanese sports cars from the 90s that can now be imported legally into the US. These cars were previously only offered exclusively in Japan, sometimes referred to as Japanese Domestic Market or JDM models but have gathered popularity and fame from the tuning culture and movies like Fast and the Furious series. There is a big market around that car culture, but if that imported car now breaks, you are going to be hard-pressed to find components because it was never sold in that country and there is no dealership with the part sourcing behind it. Basically, they need to look to Japan and this is where we want to be able to provide products sourced and remanufactured locally in Japan.

With the JDM market, is it safe to say that it's mainly focused on countries driving on the left-hand side as we do here in Japan?

Even in the US, there is a big following on the West Coast for Nissan Skylines or Silvias. For us to supply that market, I think it is exciting for us, and it is exciting for those end users. For someone that has poured their blood, sweat, and tears into restoring a JDM car that they love so much, our components are a lifesaver.

Alternators and starters of course are remanufactured products, but they can also be refurbished for medical use in CT scanners as well as other such medical devices. Can you tell us about this opportunity outside of the automotive industry? Where do you see the diversification of your business in the future?

The first step was what we consider off-highway, which is construction machinery, agriculture machinery, and even boats. Particularly around here, we have things like ski lifts and they use these kinds of components. These all use starters and alternators, and for us, these are the area with the most synergy easiest to crossover to. We have the know-how in remanufacturing starters and alternators so this is something we can continue to offer, just a different segment of the market.

Going to remanufacturing conferences there are companies out there that are doing anything related to computers, copy machines, and as you have mentioned; medical equipment. This is still brainstorming ideas but I think the medical equipment in Japan is quite at the forefront in terms of the actual equipment in use in hospitals right now, however, when equipment is replaced in Japanese hospitals where do the older machines go? I can see a potential in remanufacturing second hand Japanese medical devices for export to say Indonesia or Vietnam where there could still be a demand for such equipment. Right now however we haven’t dug into it just because we see that there is still great growth potential in automotive and Off-Highway. There is a lot on our plate in terms of where we can grow the business.

Between the existing internal combustion engine (ICE) type vehicles and electric hybrid vehicles, which one do you think will win out in the Japanese market?

My answer might change in a few years, but right now it is looking like fully electric vehicles will win. Japan was very fast in adopting the hybrid and that took over. If you take a look at the US and Europe however, they made the jump from ICEs to EVs without having the hybrid phase. I now see Japan playing catch up to the rest of the world. Recently Toyota made an announcement of their roadmap to develop over 20 different electric vehicles, so that announcement in itself is showing that the needle is moving toward EVs.

When it comes to how that electricity is generated and stored, that is something that we will see further down the line. Personally, despite owning an electric vehicle I still have a soft spot for ICEs. The analog feeling you get when you turn the key and hear the engine is something that is very hard to replace. Also, we were discussing earlier how part of car ownership is working on the vehicle and the idea of making it your own. With EVs unfortunately I think that is a lot harder and I see the electric vehicle as more of a vessel to get from point A to point B. If car restoration and tuning culture does resurge I think there will be a higher value placed on ICE cars.

Imagine that we come back on the very last day of your presidency and have this interview all over again. What are your goals and dreams for Shin-Etsu Denso that you hope to achieve during your time as president?

It really depends on when you come for that interview. If you come next year I will be quite sad. Hopefully, we are talking about many years from now. If you were able to come back in 30 years' time, then that itself shows that we have stood the test of time. We are 55 years old, which is a long time to be in any business, and if we can continue to grow then I think I will be very happy with that fact. For me, the biggest thing is to continue the business and be able to look back and know that people who worked for the company were happy and satisfied.

We actually have an employee here who has been with us for over twenty years who joined because his mother was working here, and just recently his daughter has started working for the company. On an employee level to have three generations work in one company is a sign that we are doing something right. If he was going home every day and complaining about his job I’m pretty sure that his daughter would not want to work here. This is one sign that points to the fact that we have created a work environment and business that employees can take pride in. If 30 years from now people can still point to us and say that’s a company that they would like to work at, I would be very happy.

0 COMMENTS