The Worldfolio sat down with President Jun Okada of 3-D Matrix to get the lowdown on why there is so much excitement surrounding self-assembling peptides

There has been a considerable rise in the cost of social insurance and social expenses in Japan due to its aging population, where 28% is over 65. As such, the healthcare industry is shifting from a treatment-based model to more of a prevention-based model, from which we see the aggregation of big data and the use of numerous technologies to provide personalized treatment to individual patient profiles. What is your take on the shift from treatment to prevention and the use of digital technologies in the healthcare industry?

I am not certain whether prevention-based treatment is really starting in Japan as a business. I feel that Japan is rather slower in this regard. For example, the cervical cancer vaccine is very efficient and can significantly reduce the risk of this type of cancer in women. However, it is very unpopular in Japan. The medical industry has tried to promote the vaccine, but the media does not understand the science and the significance of that technology. Hence, they only focus on a very small adverse event which scares the population. The media are really slow in understanding the science of such development. I am not entirely sure if spending money on prevention is accepted by the population in Japan. It may be working for some people, but I cannot say if it is really successful or not.

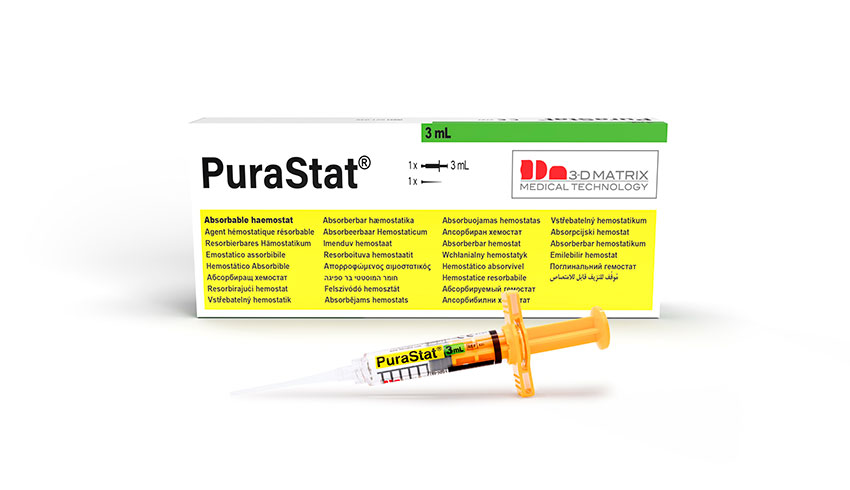

People who get hospitalized from a disease often begin to care about the process of cure or recovery. To that end, new technology may evolve. A small percentage of people who undergo surgeries experience complications. I think someone is already finding ways to obtain data about predicting possible complications and specifying the group of people at a higher risk. In our business, we deal with haemostatic material in endoscopic usage, which is our core product called “PuraStat”.

A bigger problem for hospitals and surgeons is not the bleeding during operations, but the postoperative bleeding, which is a major cost to hospitals. Doctors worldwide are working hard to identify the higher-risk patients and the best way to prevent postoperative bleeding. Some doctors conducted a clinical study that determined that our product can prevent postoperative bleeding by 50%, which has been one of our successes.

It was not something we targeted from the beginning. When doctors were trying multiple devices and methods to reduce postoperative bleeding, they found that our product, PuraStat, can work somehow. We have been rather lucky. The medical industry has been working toward prevention, and we just happened to be in an excellent position.

Antibiotic resistance is a growing issue worldwide. The UN has announced that it could be the leading cause of death by 2050, surpassing lifestyle diseases by a substantial amount. Antimicrobial peptides have emerged as a synthetic-based alternative that could overcome this issue. Could you give us your take on their use, and what roadblocks do you think are in place before we could fully adopt antimicrobial peptides as an alternative to traditional antibiotics?

Honestly, that kind of peptide is a drug, and we are doing medical devices. Medically, it is a totally different field. Our peptide is inert in the human body, with no pharmacological reactions. On the other hand, since antimicrobial peptides work as a medicine, it is totally compared to small chemicals, peptides could be safer because they eventually get decomposed in the human body. Amino acids are the components of the human body. Theoretically, peptides could be very safe in terms of metabolization. It could work as a medicine, so it could have side effects that no one can predict. That is exactly the same as the small chemicals. The safety in the metabolization would be one advantage, but a disadvantage could be in manufacturing. The manufacturing of small chemicals is cheap or almost free, but peptides are probably 10 times more expensive.

Your company, at the core, has the technology in self-assembling peptides, created in the '90s by an MIT researcher named Zhang. How does self-assembling peptide differ from similar products? How did this pipeline come to be, and how did you learn about its usage for surgical treatment?

Self-assembling peptides are different from other peptides because they self-assemble. The peptide itself is very short, about 8 to a maximum of 20 amino acids. They are inert in the human body without any pharmacological reactions. It is just the same as peptide drinks or supplements. When our peptides enter the human body, they self-assemble because of the charges. Each amino acid has a charge, plus, negative or neutral. We arrange the plus and minus amino acid in a certain way so that the peptide can electronically combine in the human body. Peptides continually combine and self-assemble into nanofibers to create a structure very similar to an extracellular matrix (ECM). The solution turns into a gel similar to collagen gel, which is a unique property. There is no pharmacological reaction, but it is like an extracellular matrix. MIT proved that this gel works exactly like the human ECM, which is the initial uniqueness of this product or technology.

MIT found this and decided to do some tissue regeneration business. In 2003, MIT and MIT professors formed a company in the US. They acquired seed money from investors , and our founder, Keiji Nagano, invested as well. He worked in partnership with the US entity and started a business in Japan around the same time in 2004.

Self-assembling peptides

The applications of peptides are wide and varied, including medical device manufacturers, cosmetics, regenerative medicines and institutions. Where do you see the most applications for your company, and what are the variations of the peptides that you have used and developed since their discovery in 1992?

Starting from the MIT days, the first indication was only tissue regeneration, initially focusing on bone regeneration, specifically dental bone regeneration. They considered the bone to be the easiest target to regenerate. They identified one sequence of peptides. Although they have produced many other types of self-assembling peptides, they decided to use the first peptide, called the RADA-16. At this point, however, they did not see surgery or the DDS market. They had a few peptide manufacturers at their hand, but the variation was limited.

Your company is targeting three medical segments which are surgical treatment, tissue regeneration - specifically for inflammatory bowel disease & radiation proctitis and drug delivery systems. Why have you identified the latter two segments as areas of interest?

We have seen a big potential in the tissue regeneration field from the beginning. It was something MIT was focused on at that time. However, we also understand that the tissue regeneration business takes more time than everybody thinks. We are very cautious in substantially investing in that field, and we are slowly continuing to do the dental bone regeneration project. We would rather take more time to better understand the clinical needs and the market. Not only that, but we have also tried to find partners; however, multinational corporations are also highly cautious in that area. At this point, nobody wants to collaborate with us in the field. Hence, we are a little bit too cautious in that area.

When we started our business in haemostatic material, especially with our relative success in the GI field for endoscopic usage, many doctors observed the fast recovery from wounds. Some have seen that ulcers get cured faster, even radiation proctitis or malignant ulcers caused by cancer therapy. They do not know how to cure this difficult disease, and it sometimes takes many years to cure it. One day, a few doctors told us that our product can actually cure radiation proctitis. We did not even know what radiation proctitis was. We were amazed to find out that our product can be a cure for a disease that previously had no treatment. The doctors were as surprised as we were. Of course, we knew that our product could also work as an extracellular matrix to help in the faster regeneration of human tissue. Still, we never expected our product to be a cure for a very complicated and malignant ulcer, such as radiation proctitis. They published two papers showing the doctors’ findings and observations. We see the reality, but we do not know the mechanism. Now, we are trying to understand the mechanism behind it by collaborating with European doctors. We also want to try many other fields in the GI drug to treat various types of inflammations or ulcers. One of our largest targets is IBD, which is an extremely difficult disease with a huge market. If we can have some positive impact on IBD, that would greatly benefit the patients and doctors. It could also be an enormous business opportunity for us. As I have said, we did not target these on our own. The doctors informed us about what our products could do. IBD was not our idea, and we did not know about it either. When the doctors got together and discussed the results, they suggested its usage for IBD. Everything was directed by specialists, researchers, clinicians and doctors. From there, we gradually expanded our indication.

For DDS, we have multiple types of peptides, and some peptides can be used as a carrier to deliver drugs. We have some initial collaborations with protein companies like BMP. Since BMP is not very stabilized in the human body, they want to do a slow release. We somehow have different types of peptides that work as a surfactant. MIT invented surfactant-like peptides in order to research a membrane protein that is not soluble in water, making it very difficult to analyze. MIT conducted research to find out how to make membrane protein get soluble by using surfactant-like peptides. One day, a doctor told us that the combination of surfactant-like peptides and nucleic acid can go into cancer cells. The doctor and us did not understand how that happened, but somehow, it was in the cancer cells. The doctor said that some peptides have the ability to go into the membrane of cancer cells through endocytosis, so the surfactant-like peptides may have a similar effect or capability that we did not know about. A year after that, we got a call from the National Cancer Institute expressing their desire to use our peptides to treat cancer. They were looking for a better carrier to deliver their nucleic acid, which is very unstable and difficult to get into the cancer cells. They tried many things with no success. Randomly, they called us with not much expectation. We did not understand anything, but we encouraged them to try our product anyway. After trying it, they were astounded to discover that it worked. Then they proceeded with a clinical study.

Another cancer researcher came to us and tried our peptides to deliver their different types of nucleic acid. They knew about the study that the National Cancer Institute did, so they had a small hope that our peptides could work on their nucleic acid too. However, they were very surprised that not only does the compound go into the cancer cells, but it seems that our peptides can go into more cancer stem cells. The big trend in cancer treatment is how to cure cancer stem cells, and we do not know how many kinds of cancer stem cells there are. Somehow, our compounds go into the cancer cell - CD44 expressed, much more than usual cancer cells. The researcher said that this solution can be one of the targets to kill cancer stem cells. Because they decided to generate their own start-up and received funding from Venture Capitals, they are now doing their clinical study combined with our technology.

We did not have to do anything. People around me just casually tried our products and discovered astounding results.

Regenerative medicines show promising preclinical results in the lab, but they often fall short when it gets to human studies. Could you elaborate on why you think regenerative medicines fall short at that stage, and what is your hope for this cancer-based treatment?

That is one of the reasons why we remain very cautious in the tissue regeneration business. Something that works in animals does not work in humans. It is very difficult to predict the results in humans from the results we obtain from animals. It is not like the adverse events in medicines. Some adverse events that occur in pigs could also happen in humans. Tissue regeneration is different because the growth of tissue is an exceedingly complicated process. We were really hesitant to go into the clinical trial for tissue regeneration, but the results we are observing now are from humans, such as the cures for human radiation proctitis and ulcers. If we see some small studies to prove the concept, then we can directly proceed with the official clinical trial. We are lucky because our product is an approved haemostat. Doctors can use our products for any bleeding in the human body and see their additional values like wound healing or reduction of adhesion, inflammation and scarring. We are in a better position to forecast tangible results in humans.

What real human treatment do you anticipate within five years?

We do not know. That depends on our researchers, collaborators, and doctors who use our products because they might find a better indication in the future. Our focus now is IBD and reduction of adhesion and delivery of nucleic acid & vaccine, among many others. All of these have been lined up in the past three or four years. We might be looking at totally different things in the next five years. The thing is, we do not have the capability to judge the potential of this technology. We do not have the specialty because it is very wide. Only top researchers in a specific area can judge the value of this technology.

Could you explain how your business model works?

First, we have a technology and patent. We collaborate with many people to identify and evaluate new applications. If we are very sure and get the human POC, we develop the pipeline and get the approval in particular territories, like Europe or the US. After which, we work with our manufacturing partners to help us produce our peptides. Peptide production is actually easy. We have two partners, one is the peptide manufacturer, and the other is fill-finish servicer who dissolve peptide into the water and fill the solutions into prefilled syringes. Our major customers of this product are surgeons or endoscopists. We sell half of it directly, while the other half is through distributors.

You have a unique collaboration-based business as you are working with more than 100 institutions, academics and businesses. How would you scale this business in the future? Would you continue that business model in terms of your BCB?

Yes. We think the potential of this technology is much more than we expected in the beginning. Our key value source is continually expanding through collaborations. Once we introduce a new product in the market, new users will see something different or even come up with new ideas, which is a major source of innovation.

Your sales, from the fiscal year beginning 2018 to April of this year, have skyrocketed. Where do you think that substantial growth comes from? Looking at the future, what are you projecting?

We are not satisfied with the past revenue growth because we had a difficult time promoting and selling our products in the past two years during COVID. Our initial target was much higher. It was to grow more than 100% annually, especially considering that our products are unique and competitive. Our market penetration is about 2% to 3%, so we wondered about the small growth. We were rather disappointed by the growth, which was only around 50% and far off from our target. Our goal was to double or triple our revenue.

You just received pre-approval from the FDA for your PuraStat gastrointestinal endoscopy. The US market for this type of treatment is the largest in the world, and it is expected to continue to grow. How have you tailored that product for that particular market? What other solutions have you created that are market specific?

Initially, we decided that haemostat will be our first product to be launched in the market just because it was much easier than tissue regeneration. Regenerating tissue means continuous observation for several months. The evaluation is very difficult because of the different growth of tissues. Defining a functional tissue is also very hard. On the contrary, haemostatis is much easier to evaluate in clinical trials. It is quite straightforward in determining whether it stops the bleeding or not. For business purposes, we were not so confident because there are already many animal-derived products on the market. They have risk of infection; however, the products were carried by large companies like Baxter and Johnson & Johnson. We do not think we can beat them, but we made a lot of tries and errors and finally we found a GI application. The endoscope market is the best place to start the business because we are in a good position.

The haemostats usage in endoscopy was not our idea at all. It was a recommendation from Japan's PMDA. We did not know about that need, but we listened to their suggestion and included it in our indication. Within five years, we discerned that endoscopic usage is the key application for us. Again, we were very lucky. We are in a great position in the GI area because we practically do not have any competitors. There is one, but it is not a direct competitor because their usage is a little bit different. Our competitor is the cautery. The way to stop the bleeding is coagulation, which involves burning the tissue. However, many doctors understand that burning the tissue is worse than cutting the tissue. Cutting the tissue heals much easier than burning the tissue. Many doctors want to reduce the usage of heat, and for younger, less-skilled endoscopists, heat is not easy to manage. Putting too much heat will kill the tissue over time. A few days after, the heat could penetrate the GI tract and make a hole, which can lead to death. They have to be very sensitive in using the heat, so they want to minimize the heat to minimize the complications. That process is established, but they still do not want to reduce it. With our products, the use of heat is minimized. This product can be used first to stop the bleeding. Only if it does not work should cautery be applied. It is less invasive with less scarring and a faster recovery for the patient. We do not have very scientific data on that, but many surgeons and endoscopists have said that our products result in faster wound healing than when heat is applied.

PuraStat

Is this compatible with the next phase of surgery-based treatment we will see in the future, where it is more robotics-based?

Currently, robotics surgery also uses heat. Since it is managed at a micro-scale, it is more precise. I think the logic is the same, more heat means worse wound healing. If they can reduce the heat, then they would see less complication as in endoscope field. We are collaborating with a robotic surgeon too. We do not see the difference in complications yet, but some surgeons believe that less heat should be better for patients.

Which are the key target markets for your midterm strategy? Where do you see the most potential for growth?

The United States is by far the biggest market. We are a global company, but we are listed in the Tokyo Stock Exchange .The majority of the shareholders are Japanese, so we want to show that we are developing a great business in Japan too.

One of the applications of self-assembling peptides is molecular electronics - the possibility to create electronic components with self-assembling peptides. Is that something that you are looking at in your business?

Not exactly. I know that MIT founders invented self-assembling peptides about 20 years ago, and they changed their research focus. One of their focus was energy, which they tried to generate leveraging their peptide technology. They worked with energy, but we do not know whether we can take that direction for our business.

Is there a particular goal that you would like to achieve during your time as the president of 3-D Matrix?

The reason I have been working at this company for so long is that I am really convinced by this technology that was invented by MIT. The inventor was a candidate for a Nobel Prize. I think my mission is to commercialize this technology as much as possible and return the favor to MIT. Most of the technologies invented in the US are carried by someone there. Luckily, the Japanese got that technology. We want to show that if Japan gets an excellent technology from the US, we have the capability to commercialize it on the same level as they can. That is the track record I want to leave.

0 COMMENTS