As the EV battery manufacturing industry matures, Sejong Technology is leading the way in EOL inspection through automation and digital technology.

I would like to gain a deeper understanding of the potential of Korean SMEs on the global stage. Do you believe now is the right time for SMEs to expand overseas? What challenges and opportunities do you foresee based on your experience and future market trends?

First and foremost, I believe this is an excellent opportunity and a strategically favorable time for Korean SMEs to expand into the global market. However, speaking broadly, for many Korean companies, it might already be a bit late.

At Sejong Technology, we began focusing on overseas markets in 2019, initially targeting European countries like Germany and France. Last year, we expanded our efforts to the United States, where we engaged with numerous potential clients.

Looking specifically at the Korean battery industry, there are many companies with over a decade of expertise. Over the years, we have accumulated significant know-how, experience, and achievements, which give us a competitive edge in entering global markets. When companies like ours expand internationally, we bring strong capabilities and differentiation that position us for success.

Of course, competition is intense, particularly from Chinese companies. However, in my view, the market segments that Chinese companies are penetrating differ from the markets we are targeting.

You mentioned that Chinese companies focus on a different market segment. Could you elaborate on which markets they target and why they are different?

I cannot speak for the entire battery industry, but in our specific sector, there is a distinct difference between our target market and that of Chinese companies. The key differentiator is price.

Price is a crucial factor in purchasing decisions. In many European countries and the United States, clients demand fully automated machinery that aligns with their cultural expectations, safety standards, and environmental regulations. In contrast, Chinese manufacturers tend to produce more cost-effective equipment that often does not meet the strict safety and environmental requirements of these regions.

This disparity presents a significant opportunity for us. If we examine the global market, some companies prioritize affordability and opt for lower-cost Chinese suppliers, while others emphasize stability, safety, and quality—factors that align well with Korean manufacturers' strengths. Our target customers are those who value premium-quality, reliable, and compliant equipment over just lower costs.

The European market is expected to rebound in the coming years due to regulations pushing consumers toward electric vehicles. Looking three to five years ahead, do you believe the dominant battery manufacturers will prioritize investing in high-quality, automated equipment, or will the industry shift toward a more cost-driven approach? What is your perspective on the market’s evolution?

Based on my experience, European countries operate with a fundamentally different approach compared to Korea. Safety is their top priority, serving as the foundation for any technological decision. Additionally, automation is highly desirable due to Europe’s high labor costs—companies view automation as a necessary investment to reduce long-term expenses.

Currently, Korean equipment is significantly more expensive than Chinese alternatives. However, in the long run, the cost savings generated from automation will make these higher-quality machines a worthwhile investment for European companies. As a result, we expect more European firms to choose Korean suppliers over time.

Of course, Chinese manufacturers will continue developing their technology, and we anticipate they will eventually offer fully automated solutions as well. However, when that happens, their prices will also rise. Within the next three to four years, we predict that the price gap between Chinese and Korean-made equipment will narrow considerably. At that stage, the key competitive factor will shift from cost alone to simplicity, quality, and reliability.

Europe has a growing number of startup battery companies, some of which prioritize affordability over quality. However, larger, well-established companies remain focused on safety, performance, and reliability. Our strategy is to partner with these larger firms that have the financial resources to invest in high-quality, fully automated equipment rather than competing in the lower-end segment. This approach aligns with our long-term business vision.

I’d like to explore the battery industry from a technological perspective. Korean pouch-type batteries have demonstrated exceptional performance and safety, while Tesla’s cylindrical standard has shown promise in cost reduction. How do you view the evolution of battery form factors over time? And how do you compare pouch, cylindrical, and prismatic types?

First, there are clear differences between the US and European markets. In the US, pouch and prismatic batteries dominate, accounting for around 80% of the market, while cylindrical cells make up only about 20%. In contrast, Europe leans more heavily toward prismatic batteries, which represent approximately 50% of the market, followed by pouch-type batteries at 30% and cylindrical cells at 20%.

Given these market dynamics, our business strategy is primarily focused on cylindrical and prismatic battery formats.

When Tesla introduced cylindrical cells, many industry experts predicted a significant expansion of the overall battery market. However, even after two to three years, the market has not grown as much as initially expected. While we estimate cylindrical batteries to hold around 20% of the market share, I personally believe the actual figure may be even lower.

Sejong Technology, established in 2009, specializes in assembly and inspection equipment for the battery formation process. Notably, the company is recognized for developing Korea’s only automatic insulation tape attachment equipment for square-type secondary batteries. Could you briefly walk us through the company’s history?

I began my career at Samsung SDI in 2000, where I spent over a decade in the equipment development department. During that time, I was involved in the development of various types of equipment and gained in-depth knowledge of the battery industry.

Headquarters

After leaving Samsung SDI, I founded my own company in 2008, even before the rise of EV batteries. At that time, we focused on mobile and small batteries, particularly those manufactured by Samsung SDI, to which we supplied our equipment.

In 2013, Samsung SDI transitioned into automotive battery production, and we were selected as a key partner for their battery wrapping equipment. Developing this equipment was extremely challenging—Samsung SDI had previously approached multiple companies, but none succeeded in meeting their requirements. Eventually, they turned to us, and we successfully developed the technology.

From 2013 onward, we became a key supplier to Samsung SDI. It took about two years to fully stabilize the manufacturing process, but since then, we have continued strengthening our partnership and expanding our supply agreements.

You built a strong relationship with Samsung SDI, but since expanding overseas in 2019, you’ve also been working with Northvolt and other international clients. What’s the secret behind your rapid growth and success in global markets?

When we developed our equipment in 2013, all of the core technology was proprietary to Sejong Technology, and we secured patents to protect our innovations. Samsung SDI recognized that this technology belonged to us.

However, in 2018 and 2019, Samsung SDI significantly reduced its investments, leading to a sharp decline in our sales. Since they were our largest client, this posed a major challenge for us. We approached Samsung SDI and explained that if their investments decreased, we would need to find new customers to sustain our business. They understood our situation, and that’s when we began looking overseas.

One of our first international clients was Northvolt. Although Northvolt has since gone bankrupt, they were instrumental in helping us establish a foothold in global markets. Meeting with European companies, we actively introduced our technology, shared our product catalog, and built relationships with new clients. This proactive approach was key to expanding our business and positioning Sejong Technology as a strong global player.

The Western market often overlooks the fact that Korean SMEs are hidden champions—possessing the advanced technologies that have fueled the growth of large conglomerates. You mentioned that Sejong Technology has developed its own proprietary solutions, particularly in end-of-line (EOL) inspection equipment, which plays a critical role in ensuring the safety and quality of new batteries. Could you elaborate on the performance achievements of your equipment? What are the latest technologies you have recently commercialized?

EOL inspection equipment is essential because it handles the final quality check before batteries are shipped. If our inspection fails to detect defects, the potential claims and losses for our clients can be significant. That’s why it is crucial to develop equipment that is highly reliable and precise.

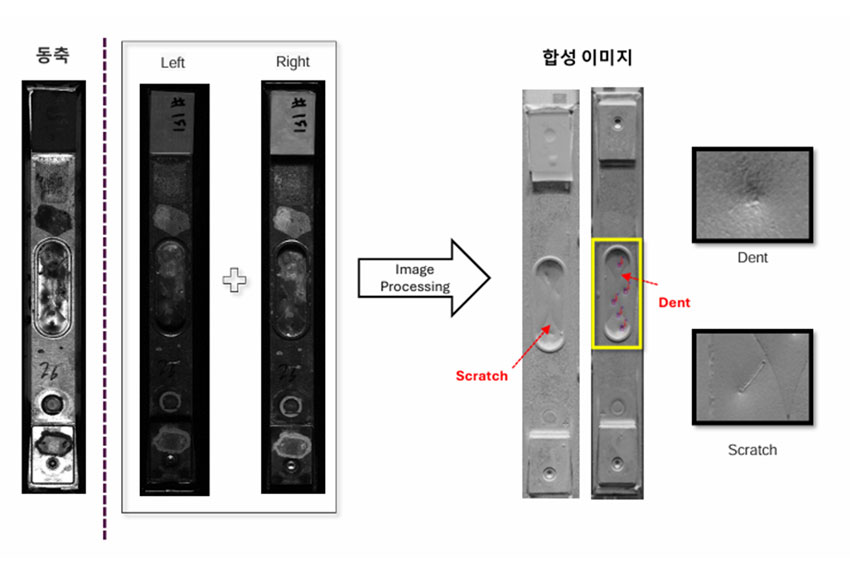

EOL inspection equipment

Since 2020, we have integrated AI-driven deep learning into our inspection systems. At that time, AI was just beginning to gain traction in the industry, and we saw an opportunity to enhance inspection accuracy using machine learning algorithms. There are numerous possible causes of defects, and our deep learning models continuously learn to identify and classify them. The system analyzes video footage of battery cells, detects anomalies, and sorts out defective products.

Over the past four years, we have accumulated a vast dataset that has allowed us to refine and optimize our AI-powered inspection technology. However, no inspection system in the world can achieve 100% accuracy. To prevent any faulty products from slipping through, our system adopts a conservative approach, flagging potentially defective products for additional manual inspection.

Currently, about 3.5% of inspected products require manual rechecking. Our goal is to reduce this to below 1%, which would significantly lower labor costs—a key priority for our clients. Once we achieve this level of efficiency, our technology will provide an even stronger competitive advantage in the market.

In battery inspection equipment, there are two main approaches: visual inspection, which has inherent limitations, and 3D scanning, which requires heavier data processing. I understand that your system combines deep learning with a 2.5D approach. Could you explain this in more detail? What are the key advantages of your technology?

Our system currently integrates both 2.5D and 3D inspection technologies. Since most defects occur on the battery surface, we need precise surface analysis. However, our clients also want detailed information about the position, depth, and height of defects.

There are two main types of defects: Hollow defects (indentations or depressions in the surface) and protruding defects (raised imperfections on the surface). A purely 2D system can only capture flat images, which makes it impossible to measure defect depth or height accurately. To overcome this, we use laser and multi-angle camera imaging to collect shadow data from four different perspectives. By analyzing the shadows and reflections, we can estimate the height and depth of surface defects.

However, 2.5D technology alone is not sufficient for fully quantifying defect dimensions. That’s why we are actively incorporating 3D scanning into our system. Many of our clients require more advanced, highly detailed defect analysis, so we are developing sophisticated algorithms to enhance detection accuracy. Our goal is to create an industry-leading inspection system that meets the growing demand for high-precision, fully automated quality control.

I’d like to shift the conversation to the investment you received from the Hyundai-Kosnet joint venture in 2023 and 2024, totaling over $1 million. This funding is expected to help boost productivity, R&D, and technological advancements. Could you elaborate on how you plan to utilize these investments? What strategies are you committing to for future growth?

First and foremost, we are investing in multiple areas. One major focus is on hiring more engineers and strengthening our R&D efforts. Additionally, in December last year, we completed the construction of our new facility, which required a significant financial commitment.

Looking ahead, the requests from our clients are becoming increasingly sophisticated and stringent. To meet these evolving demands, we must continuously develop cutting-edge technology and enhance our capabilities. A substantial portion of this investment will go toward ensuring that our equipment meets and exceeds industry expectations, solidifying our reputation as a leading provider of advanced inspection solutions.

Sejong Technology closed its 2024 fiscal year with KRW 68.2 billion in revenue, marking another year of double-digit growth, despite the relative stability of the battery industry. With this new investment, how do you envision further growth? Given that you’re diversifying into sensors, prismatic and cylindrical batteries, and even all-solid-state batteries, do you believe growth will come from technological diversification or client expansion?

There are two main strategies for growth. First, expanding our product portfolio to increase orders from existing clients. Second, expanding our client base while leveraging our current technology and products. Our primary focus is on the second strategy—broadening our client base. Over the past decade, we have perfected our EOL (end-of-line) inspection technology, and I firmly believe that we hold a competitive edge over other companies. As we enter the global market, our technology gives us strong positioning.

There are significant opportunities worldwide, particularly with the rise of battery startups in Europe, the US, and Southeast Asia. Expanding our client portfolio is, in many ways, the easiest and most effective path forward.

As you diversify your client base, do you see EOL inspection equipment as the key attraction, or do you plan to promote your other technologies as well?

Our initial strategy is to attract clients through EOL inspection equipment, as it is our core technology. Once we establish trust and long-term relationships with new clients, we can introduce them to our broader product range. By following this approach, we ensure that our expansion is sustainable and that our clients see the full value of our expertise.

At the beginning of this interview, you mentioned that some Korean companies might be expanding overseas too late, but for Sejong Technology, it is not too late. You already have international subsidiaries in the U.S., Hungary, and other locations. What is your global strategy? How do you plan to leverage these overseas offices through partnerships with local companies and clients?

Our primary focus is on the European market, which has a well-established equipment industry. However, very few companies specialize in secondary batteries, giving us a unique competitive advantage.

To successfully enter foreign markets, we prioritize partnerships. Rather than approaching new markets alone, we collaborate with well-known local companies to establish credibility and expand our sales efforts.

We have built strong partnerships with companies like Tesa (Germany & U.S.), a global manufacturer of industrial tapes, with whom we have an MOU, and ISRA Vision (Germany), a leading company specializing in vision inspection technology, also an MOU partner. We are currently conducting joint sales efforts with both of these companies.

Additionally, we have actively participated in international battery exhibitions. In Germany, we attended multiple battery expos, co-exhibiting with our partners. In the U.S., we shared a booth with Tesa at last year’s exhibition. In March this year, we will participate in an exhibition in China, once again partnering with Tesa and ISRA. This collaborative approach has been key to our successful overseas expansion.

This interview is part of a roundtable discussion featuring different voices in the industry. You mentioned that Sejong Technology is one of the smallest companies in the sector, but as we’ve discussed, your role in the battery supply chain is critical—EOL inspection is the final and most crucial step. To conclude, what key message would you like our readers to take away from your contribution to this report?

Above all, I want to express my deepest gratitude to our employees. I’ve been in this industry for 17–18 years, and throughout this journey, I’ve had the privilege of working alongside incredibly dedicated and talented individuals.

In equipment manufacturing, engineers are the backbone of success. Their hard work, innovation, and team spirit have been fundamental to Sejong Technology’s continued growth. The trust and strong relationships within our company have shaped our success.

In Korea, many people worry about finding stable, long-term career opportunities with reliable and reputable companies. At Sejong Technology, we strive to be that kind of company—a place where employees feel secure, valued, and motivated to work hard toward a shared vision of excellence.

For more information please visit: http://www.sejongt.co.kr/en/main/index.html

0 COMMENTS