The Korean aluminum die casting specialist, a prolific supplier to LG, is expanding its product offerings to become a complete total solution provider.

The success of Korean conglomerates has had a positive trickle-down effect on domestic suppliers, providing them with growth momentum and core capabilities. However, in recent times, due to an increasingly saturated and competitive domestic landscape, it has become essential for enterprises to think globally to continue their growth trajectories. What are the challenges and opportunities for you in the global supply chains? How can Korean companies benefit from the ongoing realignment of the supply chain, promoted by governmental policies such as the IRA and the CHIPS Act?

I definitely resonate with your argument that the global supply chain is now being realigned. As you mentioned, the domestic market is becoming saturated. There's fierce competition not only within Korea but also around the world. This makes it even harder for Korean SMEs to maintain their competitiveness and survive. I think we need to strategically approach and more nimbly respond to these challenges by leveraging our resources. Another challenge facing Korean SMEs is the low-cost competitiveness of other developing countries. We have to target niche markets where conglomerates are not extending their reach, strengthen our collaboration with global partners, and foster technological innovation to maximize the strengths we have as SMEs.

Regarding the CHIPS Act, this legislation involves investment in semiconductor facilities built in the US mainland, as well as investments in R&D and the workforce, and providing tax credits to companies that invest in semiconductor infrastructure. I believe that joining the semiconductor alliance with the US and competing with China will provide us with significant opportunities.

Regarding the IRA, since it’s related to subsidies and tax credits for green energy and EVs, we need to diversify to be eligible for the tax credits for battery raw material procurement. We will meticulously monitor changes in the IRA and continue to prepare for it to maximize its benefits.

SeA Mechanics has diversified its application. Historically, you have developed and produced parts for the consumer electronics market, especially TVs and displays, as well as, being involved in the automotive market, where you worked with Hyundai for years. How do you plan to navigate your markets in the coming years?

As you know, the EV market is facing a significant chasm, and I believe this will persist until the end of next year. Companies that have proactively invested in EVs will develop new innovations and strategies to venture into new areas. If you consider the components we manufacture for displays, they are rollable components that can be installed not only in TVs but also in the automotive industry. We are not only specializing in die-casting but also importing raw materials from China to assemble them here in Korea, which enhances our technological sophistication.

We’re advancing our systems to produce components without manual labor by automating the processes. This automation is something I learned when I was working for HPK in the past, which manufactured cameras for phones, camera modules, inspection equipment, and laser cutters for displays. We are applying this automation to our components business to bolster our competitiveness.

One of the significant changes we're seeing, regardless of vehicle architecture, is the shift in materials. This raises new questions about the compatibility of these different materials. What opportunities does this change in materials in the automotive industry create for your company? Are you considering diversifying your products beyond your current manufacturing?

When you think about heavy EVs, they inevitably come with lower mileage and driving range. As a result, aluminum and plastic, which are lightweight materials, are being used much more prevalently in EVs. Whether it's aircraft, EVs, or small cars, the key factor is how lightweight they are. I believe aluminum materials will become more widespread as technology advances, given their high strength. Aluminum is also being applied in robotics. Therefore, I think aluminum will increasingly replace steel in new products.

We have a stable die-casting business through our partnership with LG Energy Solution. Additionally, we are expanding our business into the assembly sector, where we are also seeing revenue growth.

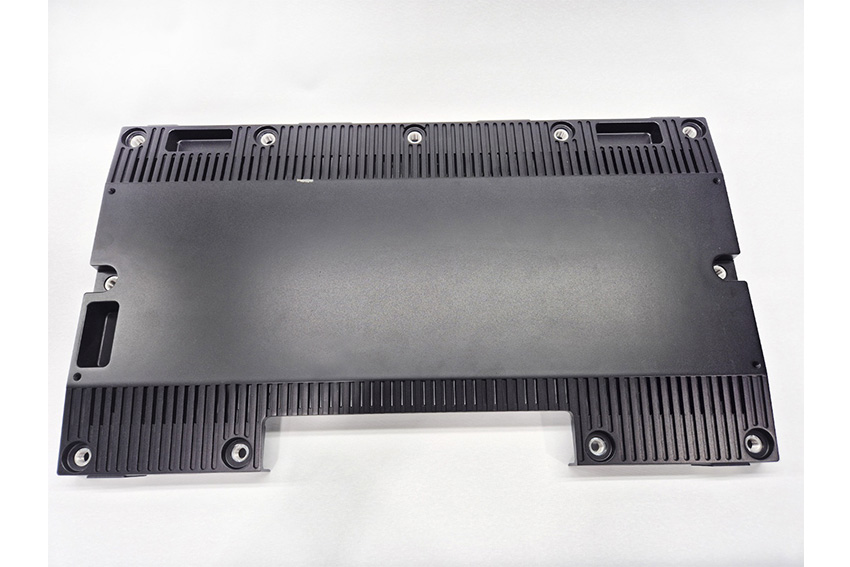

LGE Signage LDM Holder Uni Frame

LGE Signage LDM Holder Uni Frame

Established in 1999, SeA Mechanics is a die-casting specialist with extensive expertise in consumer electronics, where it holds a dominant position in manufacturing OLED TV mounting parts, and in automotive housing parts, supplying the Hyundai Partner Company for more than 17 years. Could you describe the recent evolution of SeA Mechanics and define what SeA Mechanics is today?

Actually, I'm not the founder of this company; I acquired it in 2020 and made significant investments to diversify our business. We also became listed on KOSDAQ in 2022. It was a big challenge, but we succeeded.

For the first 15 years after its establishment, we focused on becoming a top-tier electronic parts company by maintaining high performance and quality. For the next 10 years, we concentrated on components for ICEVs and green vehicles, ensuring the quality and performance of our products. In the past two to three years, building on our stable business, we expanded into modular assembly parts.

Leveraging our extensive expertise in die-casting, we have focused on creating added value through unparalleled quality and performance. To maintain uniform quality, we set up an automated assembly line and plan to establish a corporation in Vietnam for global market expansion. Due to low labor costs and the realignment of the global supply chain, we are also looking to establish operations in Mexico. Mexico will target the North American market, while Vietnam will serve as a channel for the European market. As you know, establishing a plant in the US mainland would be very costly.

With all these new developments—your legacy business devices, your advancements in the battery and automotive fields, and your move towards more modular systems—how do you expect your revenue streams to evolve in the upcoming years?

To get straight to the point, I anticipate our revenue will double in the next two to three years. Historically, 100% of our revenue came from the TV sector, and I expect this will remain stable. However, we will also see 30% of our revenue coming from the hybrid and EV market, not just from ICE cars, and 20% from other parts, including vessels and robotics.

We aim to leverage our accumulated expertise in assembly and die-casting not only in TVs but also in robotics, EVs, and vessels. We are actively identifying new application areas for our technologies. I believe Korean SMEs, with our advanced assembly processing technologies and automation systems, are well-positioned to compete on a global stage.

Your company has historically provided solutions to the display field and has been a leader in the design of up-and-down mechanisms for Stand by Me Go. As you anticipate significant growth in the automotive industry, what synergies can you create between the best technologies you've developed in the display field and the modern demands of automotive infotainment and the automotive sector as a whole? How can you bring that expertise into this new sector?

I don't foresee much of a challenge because the display technology we have used in our legacy business is quite similar to what is applied in automotive, EVs, aircraft, vessels, and robotics. The primary differences lie in durability, strength, and validation, which depend on the specific agency responsible for validation. Nowadays, people rarely see TVs fixed on the wall or ground; TVs have become much more portable. This trend towards portability and flexibility in displays translates well into the automotive sector, where adaptable and resilient display solutions are increasingly in demand. By leveraging our expertise in creating high-quality, innovative display mechanisms, we can effectively meet the modern demands of automotive infotainment systems and other related applications.

When it comes to batteries, the requirements are following quite strict safety standards. Your company is going to produce the module covers for batteries, which are crucial for housing, safety, performance, and transportation. How are you able to adapt compared to your original market focus? Is there a need to modify these processes to meet the highly specific and demanding requirements of the battery field, or is the technology the same?

The technology itself is not fundamentally different; it has been modified and upgraded. The technologies for ICEVs and EVs are quite similar. In terms of EVs, Korea is a frontrunner, and we have conducted numerous pilot tests applying ICE technology to EVs. While it won't be applied directly without changes, it will need some modifications. As you mentioned, there was a recent fire in a battery factory. However, fire-resistant technologies are currently being developed, including advanced insulators and other sophisticated measures to prevent fires. Ensuring stability and safety will take another three to five years of development.

I noticed that you have increased your R&D expenditure over the last three years from around 1% to more than 3%. What new developments have you achieved, and what new products and features have you delivered to your customers?

We are making bold and substantial investments in R&D, dedicating 13% of our total workforce to this area. While this does not directly translate into immediate revenue, we are heavily investing in Hydrogen Valve Housing, robotics, and car infotainment—areas that require significant investment. For example, we allocate four personnel to each R&D design project, including two principal researchers and two senior researchers, under the company motto and business principle of our president: "Unsparing investment will lead the way."

Our R&D efforts encompass not only component development but also automation systems. We are accumulating extensive datasets to enhance quality, reduce failure rates, and identify areas where manual labor can be replaced with automation. This serves as a strength for us, providing platform technology that can be applied not only to single components but also across various die-casting and assembly processes.

You are diversifying your offerings by adding assembly modules and processes to your portfolio. What new solutions can you offer to your customers? What new opportunities does this create for you to provide comprehensive total solutions?

Whenever we participate in R&D efforts, our clients are responsible for designing the finished products, but they may not know the granular details of the components. We have reference materials and have conducted pilot tests, which allows us to present our findings with confidence. For example, we can demonstrate at which angle a TV might fall. We call this the technology circle or technology meeting, where we exchange technological insights with our clients.

While the technology for fixed TVs and mobile applications differs, the technology we have developed can be applied to many fields, including aerospace and defense. Our unique expertise in manufacturing rollover up-and-down displays within vehicles has positioned us as a leader in this area, which is why the automotive industry is reaching out to us.

SeA Mechanics has attracted foreign companies interested in your technologies. With the growing demand for battery packs in the US and Europe, and with OEMs and new players developing their own technologies, how important is the international market for your company and what is your strategy to benefit from it?

Initially, we ventured into the Chinese market, but it didn't work out in the end. That is why we are now focusing on entering the Vietnamese market. Our primary strategy is to focus on domestic R&D and technology to release products that have been thoroughly stabilized after extensive pilot testing. No matter how low the labor cost is, we are not looking to make reckless overseas expansions. While it is time-consuming to construct the same infrastructure abroad as we have in Korea, our goal is to replicate our processes to minimize failures and mistakes.

We actively participate in overseas exhibitions to identify potential partners. Companies like Hyundai often accompany their suppliers, including us, to these exhibitions to connect with buyers. Additionally, we receive support from both municipal and government levels, which we leverage to expand internationally. We are attending many exhibitions in the US and Germany, though fewer in Korea, to broaden our international reach.

Perhaps this is somewhat related, but I recently read in Korean media that you made significant investments to expand your production capacity. Reports suggested an increase to 1.5 to two times the capacity you had in 2022. Why do you believe it was crucial to do this now? I can understand a 30-40% increase for growing industries, but doubling the current production capacity seems substantial. Why such a substantial investment at this time?

First and foremost, when our partner company selected us as a trusted supplier who consistently meets their quality standards, they urged us to embark on this journey together with our stable quality. That is why we decided to make these ambitious investments. Additionally, we received orders worth 600 billion KRW related to EVs and hydrogen. To secure these orders, we needed to enhance our production capabilities to effectively handle the increasing demand.

You became the president four years ago when you acquired the company. Have you set yourself an ultimate goal or ambition that you would like to achieve during your time as president?

On a personal note, I worked at LG's lab for 10 years before leaving in 2018. Afterward, I founded a company specializing in automation, where I served until 2020, achieving a revenue of 100 billion KRW. This company focused on manufacturing Apple’s cameras, touchscreens, and panel cutting technology. Now, at SeA Mechanics, I aim to merge this expertise with our automotive and TV display technologies to create a unicorn company with revenues reaching 1 trillion KRW.

Secondly, I aspire to promote dedicated employees within our company. Currently, there are four presidents, but I aim to expand this number to 10.

Lastly, I am committed to fostering an ecosystem where competent and competitive Korean manufacturing SMEs thrive on Korean soil, preventing their relocation overseas.

For more details, explore their website at: http://www.seamechanics.com/?lang=en

0 COMMENTS