Explore how Nankai Buhin, a motorcycle accessory company with a rich history and global aspirations, is adapting to changing rider demographics, embracing digital technologies, and expanding its presence in international markets while overcoming challenges like the COVID-19 pandemic. Discover their journey from racing gear to innovative products and their dreams for a global footprint.

In recent years we have seen motorcycle and accessory-related companies dealing with the changing demographic and the changing image of motorcycle riders. Increasingly biking brands are trying to appeal to a younger generation, but the age of people engaged in motorcycle consumerism has increased over the years. How is this demographic shift in the age of riders impacting your company, and what types of strategies do you have to employ to appeal to a younger generation?

Indeed, you are correct in pointing out that we are grappling with a demographic challenge, impacting both our sales and recruitment endeavors. In recent years, securing young talent has proven to be a formidable task. Consequently, we have strategically shifted our focus and embarked on a new approach by extending our recruitment efforts to non-Japanese candidates. At our headquarters, we currently employ several individuals from foreign backgrounds who play a crucial role in accommodating visitors from China and other Asian countries. Given the significant number of customers from these regions who frequent our headquarters, our international staff members effectively address their inquiries.

To join our team, prospective candidates must meet specific competency criteria. Importantly, nationality is not one of the stipulated prerequisites. Whether a candidate is of Japanese origin or not, their qualifications are thoroughly considered during the recruitment process. As a testament to our inclusive approach, we even have an Australian employee on our staff.

Right now there is a slow but steady trend towards direct-to-consumer sales where the utilization of dealerships is decreasing in comparison to the past. We are also seeing more utilization of digital technologies such as internet maintenance and virtual showrooms. How are these trends impacting your business and is your company utilizing digital technologies to provide a better customer experience?

Primarily, we operate as a wholesaler, complemented by a selection of direct retail stores. In total, our nationwide retail presence encompasses 50 shops. In our wholesale domain, we engage in the procurement and subsequent sale of products, both directly from manufacturers and through the distribution of our proprietary items. For these proprietary products, we have the capacity to engage directly with customers. This dual approach positions us favorably in the market, contributing to our competitive edge.

Furthermore, we have harnessed the power of online platforms to bolster our sales. Notably, our direct-to-consumer e-commerce sales have made a substantial impact on our overall revenue. In the realm of digital transformation (DX), we inaugurated a state-of-the-art logistics center near our headquarters three years ago. This center is equipped with automated order placement and point of sale (POS) management systems. The automated ordering system initiates replenishment when inventory levels dip, exemplifying our DX initiatives.

Within our retail outlets, we have introduced a technology called the Parts Finder. Given the intricacies of automotive parts, the Parts Finder proves invaluable, offering an extensive catalog of diverse components. Many customers frequent our stores in search of compatible parts for their vehicles, where the Parts Finder plays a pivotal role. This user-friendly machine, resembling an ATM, is typically facilitated by our staff, but customers may choose to operate it independently. While the system's accuracy is currently limited since we recently deployed it, we aim to enhance the backend system by integrating artificial intelligence (AI). This will enable the system to engage customers with more advanced queries and deliver superior solutions and responses.

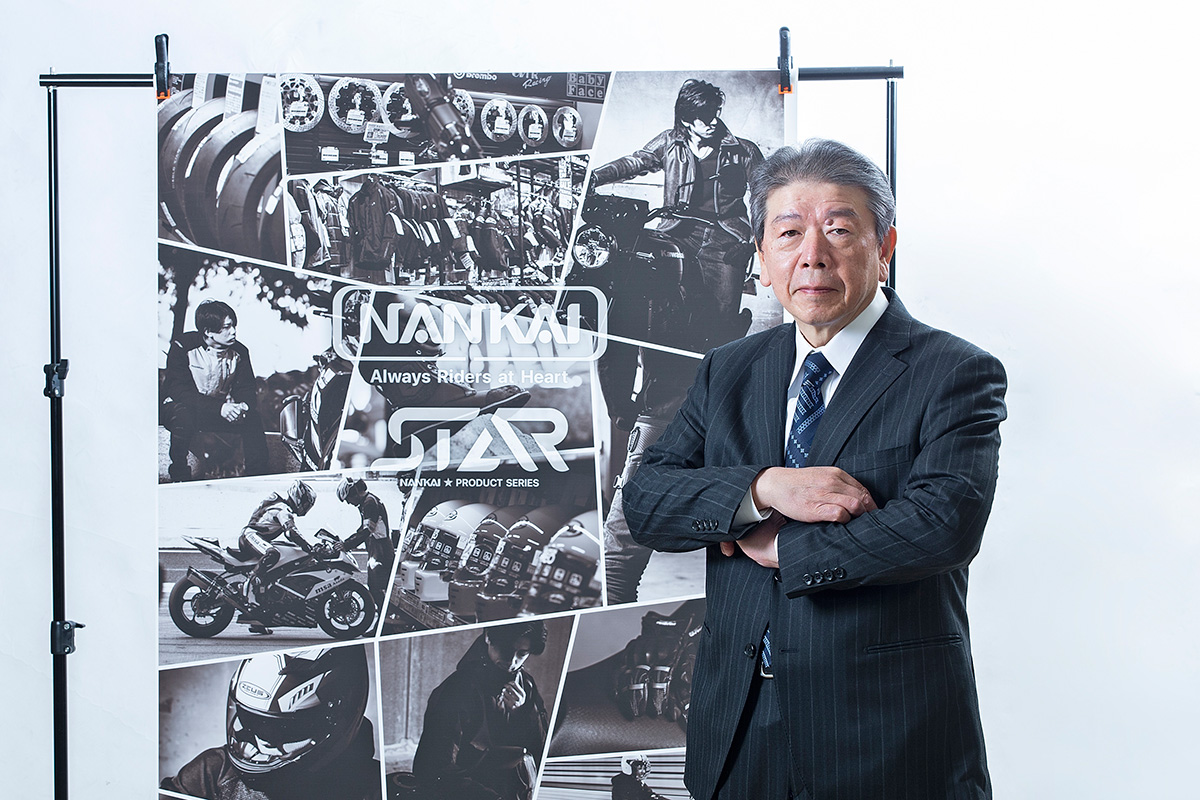

Your firm was created in 1952 and you began with a single retail store. Could you run us through a little bit of the history of Nankai Parts and some of the key milestones that you believe define your company?

Since our inception, our core ethos has remained steadfast: direct communication with our customers. This philosophy has been at the heart of our approach for an impressive seven decades. In our early years, we employed diverse strategies, including magazine advertisements targeted at motorcycle enthusiasts and the incorporation of our logo into specialized riding gear. Essentially, riders would proudly sport our logo-adorned jackets during races, and we even ventured into television advertising. However, the advent of social media in recent years has emerged as a powerful tool for enhancing our company's reputation. This platform has proven invaluable for engaging in meaningful dialogues with users regarding our latest products and features. Notably, we have recently embarked on collaborative ventures with renowned vloggers and influencers to endorse our products, a strategy that has yielded remarkable results due to their substantial reach.

As previously mentioned, our commitment to crafting our proprietary products is a cornerstone of our business strategy. We firmly believe that this approach is pivotal in driving sales growth and cultivating brand recognition, thereby attracting a larger customer base. A pivotal milestone in this endeavor occurred in 1985 when we chose to sponsor Mr. Freddie Spencer, also known as Fast Freddie. His association with our brand fundamentally transformed the perception and value of our products, facilitating our global expansion. Although we had been manufacturing racing suits for some time prior, his adoption of our racing suits sparked a trend that others swiftly followed, including Mr. Mick Doohan. At its zenith, approximately ten foreign racers proudly sported our racing suits, further solidifying our brand's global footprint.

Approximately two decades ago, the racing fervor reached its zenith. However, in recent years, the production of racing suits has dwindled as the demand waned. Nevertheless, a niche of street riders continues to favor full racing suits for their inherent coolness. Leveraging the wealth of expertise accumulated during the production of racing suits, we have redirected our efforts towards crafting our latest protectors and other accessories. In the heyday of racing, roughly 20 years ago, products related to racing, including wearable items like body armor, experienced robust sales. However, with the decline in popularity post-peak, we made a strategic decision to introduce a fresh brand, Star. This brand seamlessly combines sports, touring, all-round, and racing products, allowing us to cater to a broader customer base.

Around two decades ago, we embarked on a journey to create riding wear that offers a harmonious blend of comfort and safety. To enhance comfort, we engineered materials that are both water-resistant and breathable, ensuring comfort even amidst sweltering summer temperatures. Our quest for comfort led us to experiment with materials like Gore-Tex, renowned for its functionality, and these innovations found significant success. In recent times, we have continued our research and development efforts, culminating in the launch of a novel system enabling riders to incorporate a mobile battery heater into their gloves or jackets, providing warmth during the frigid winter months. These innovative products debuted approximately three years ago. Given the scorching summer witnessed this year, there has been a growing demand for cooling technology. Our ongoing endeavors in this realm are poised to bear fruit, and we anticipate launching cooling wear in the coming year. These products harness the power of evaporation to dissipate heat, with an expected release date set before the summer of 2024.

In 2020 we saw the beginning of COVID-19 and this created a difficult situation for citizens across the world. There were supply chain disruptions and a lot of manufacturers weren’t able to procure the components or the materials necessary in order to make accessories and vehicles. We also saw a decline in sales in the market, but fortunately, once borders reopened there was a huge recovery. As a wholesaler and a direct-to-consumer company, how did you navigate the COVID-19 pandemic? What were some of the changes you instigated as a result of the pandemic?

Our company conducts production operations in overseas countries, and the COVID-19 pandemic had a profound impact on our operations. One of our flagship products is the Intercom, a highly successful communication tool designed for riders. With a unit price ranging from JPY 30,000 to JPY 50,000, it represents a notably profitable product for us. Regrettably, a critical component of the Intercom is manufactured in China, and due to the pandemic, we faced severe challenges in procuring this component, hindering our assembly operations in Japan. Consequently, our sales experienced a significant decline during this period.

Additionally, our line of gloves is also produced in China, and the pandemic led to the closure of all Chinese ports, causing a substantial impact on our sales and overall company performance. However, despite the substantial challenges in procurement, our overall sales did not experience a significant decline during the COVID-19 pandemic. This resilience can be attributed to the shift in consumer behavior during the pandemic. Many individuals opted to avoid public transport and instead turned to personal cars and motorcycles as a safer mode of inter-city transportation. In urban areas, finding parking for cars can be a challenge, making motorcycles an attractive alternative. Moreover, motorcycles offered a low-risk form of entertainment during the pandemic, as riding alone posed minimal infection risk compared to indoor spaces such as restaurants and shopping malls. As a result, we discovered that the decline in sales due to procurement issues was offset by increased domestic sales driven by these changing consumer preferences.

Looking to the future in terms of international expansion, what regions or countries do you find most interesting and what kinds of products would you like to sell in those markets?

In our future strategy for global expansion, we intend to place a stronger emphasis on overseas sales. Historically, we engaged in the export of our components to various countries. However, the onset of the COVID-19 pandemic necessitated a temporary suspension of these activities. We are now in the process of resuming our exports to Thailand, the Philippines, and Hong Kong. While we previously exported our products to North America and Europe, we gradually scaled back exports to certain Asian and African countries due to political instability and challenges in the collection of payments.

In the past, international sales played a significant role in our business, particularly around 40 years ago when I first joined the company. Looking ahead, we are targeting select Asian countries, notably Taiwan, Singapore, China, and South Korea. Our expansion efforts will encompass a broader range of riding gear, including gloves. Additionally, we offer original helmets that are competitively priced, making them well-suited for the Asian market.

As you expand into these new countries are you looking for partners in terms of distribution or even a franchise of your own store?

Yes, we have tried this before and have had partners in local markets for trading. For us to import products from Taiwan we would have to have a partnership with a Taiwanese trading company.

We know that Nankai has participated in a lot of racing-related events. From a personal perspective, which event was a favorite for you?

I personally like touring events, and this year there was one in Suzuka that was a large-scale, 8-hour event. We even invited some famous celebrities to participate in that event.

Imagine that we come back in four years and have this interview all over again. What goals or dreams would you like to have achieved by the time we come back for that new interview?

My personal goal is to increase Nankai’s presence in overseas locations both for wholesale and direct-to-consumer. It would be a personal dream to have a Nankai shop in Paris, France.

0 COMMENTS