Founded in 1969, the OEM specialist uses innovative design and technology to manufacture brassieres that allow women to move without the worry of discomfort.

It is our view that Japan is at a very exciting time for manufacturing. On one hand, we have had major supply chain disruptions in the last three years, caused by the COVID-19 pandemic as well as tension from the China-US decoupling situation. As a result, we are seeing many multinational groups try to diversify their supply chains with a focus on reliability. This is where Japan can enter; a country known for decades of high reliability, trustworthiness, and short lead times when it comes to production. Now, with a depreciated JPY, it is our view that there’s never been a more opportune moment for Japanese manufacturers to meet the pressing needs of this macroeconomic environment. Do you agree with this premise, and why or why not?

As the COVID-19 pandemic gradually subsides, it has ushered in new business opportunities for exporters with overseas markets. However, for companies like ours, which engage in the production and import of goods from abroad, the situation remains challenging.

Our primary business revolves around OEM production of women's underwear. Following our customers' specifications, we manufacture these products in our own factories located in China and Vietnam. We source materials both locally in Japan and from overseas suppliers, importing the finished products to Japan for distribution to our customers.

The recent disruptions caused by the COVID-19 pandemic severely impacted our operations. We had to temporarily halt production at our factories in China and Vietnam to ensure the safety of our employees and implement rigorous product disinfection measures, disrupting our supply chain for materials. Simultaneously, international geopolitical tensions led to a surge in energy prices, resulting in increased costs for raw materials and transportation. Coupled with the depreciation of the yen against other currencies, our overall earnings environment deteriorated significantly.

Nevertheless, these challenges have prompted us to adjust our strategy. We have been progressively increasing our reliance on local sourcing of materials closer to our overseas production facilities. Previously, our overseas material procurement accounted for approximately 20% of our total, driven by our commitment to quality. However, we have since raised this ratio to around 50%, reflecting our adaptation to the evolving business landscape.

It seems your company runs off this business model of producing a majority of your manufacturing overseas and then selling it here in Japan. How did the supply chain disruptions of COVID-19 impact your business and what strategies or policies did you employ to deal with the disruptions?

We saw a significant impact from the COVID-19 pandemic in the form of disruptions throughout the supply chain. In fact, during one incident we had no choice but to suspend all operations in our Chinese and Vietnamese factories in accordance with the COVID-19 countermeasures of each government. Fortunately, we were able to gradually recover from those disruptions and I can say that the Vietnamese factory is back to normal now.

When we established these overseas factories we transferred all our technology to them as well as dispatched Japanese employees to those local markets to educate local employees there. We make concerted efforts to maintain the quality levels in these locations to the same standards as in Japan.

In fact, we do not source materials locally within these markets. Approximately 50% of our materials are imported from Japan, while the remaining 50% are procured from our esteemed partners in China and Thailand. These partners have maintained a longstanding collaboration with our organization.

Were the disruptions from COVID-19 part of the motivation to implement this strategy of producing more in Japan?

COVID-19 wasn't the sole catalyst for our decision to transition production to the domestic market. Our usual practice involved shipping materials procured in Japan to overseas factories. However, when the pandemic hit, these materials encountered delays at multiple ports. Under normal circumstances, we could swiftly deliver materials to a local factory within a week, but the pandemic extended this timeline to over a month. This disruption has undeniably had a substantial impact on our operations.

From our past experiences, we have gleaned insights that guide our current strategies. Presently, we are exploring the procurement of materials in vicinity to our offshore manufacturing units. Specifically in Vietnam, we are in search of a reputable supplier.

You mentioned your core market is Japan, and this is a market that is going through an incredible demographic transformation with its aging and shrinking population. When we talked to other clothing and lingerie brands they said that there are some silver linings to be had given the situation. Even if the total number of people was shrinking, new markets were emerging such as products specially made for the elderly, the disabled, and for femtech solutions. What impact is Japan’s aging population having on your activities in the domestic market and what opportunities do you see emerging from this demographic shift?

Japan is approaching a significant demographic milestone, with the largest group in the population set to reach the age of 65, and a substantial portion of this demographic will be comprised of women. Our company specializes in OEM (Original Equipment Manufacturer) products, with a primary focus on women aged between 30 and 40. We acknowledge that this market segment is experiencing a decline in numbers.

However, there is an intriguing opportunity emerging when we examine data related to the increasing presence of women in the workforce. Presently, over 70% of women in Japan are actively participating in the labor market. A closer analysis of this statistic reveals that more than 50% of women in their 60s are part of the workforce. Interestingly, when we consider lingerie options for this age group, they often tend to be basic and lacking in embellishments.

Our company is driven by a strong desire and interest in introducing products specifically tailored to this unique demographic. Furthermore, given that aging populations are a concern not only in Japan but also in other countries facing similar challenges, we aspire to be pioneers in addressing this sector, which could potentially lead to overseas sales opportunities.

Your company walks a really nice line between quality and comfort. The Twin Cross is probably your most famous technology. We’re eager to hear more about the unique features and manufacturing technology behind the Twin Cross, particularly in regard to its innovative weight distribution system, as well as the significance of its comfort, functionality, and environmental friendliness. Could you tell us more about the development history and unique advantages of the “Twin Cross”?

Twin Cross is a product that builds upon a fundamental core technology by incorporating additional functionalities that stem from this core concept. The central technology behind Twin Cross revolves around a side support design. This concept was developed by capitalizing on the human body's susceptibility to front-back pressure while being comparatively resilient to pressure from the sides.

When individuals cradle a baby in their arms, they instinctively reach out from the sides of their bodies. Similarly, items like shoes, hats, and glasses can become uncomfortable when subjected to significant front-back pressure, leading to discomfort over time. Recognizing this aspect of the human body's response, our company utilizes this inherent characteristic in designing patterns for brassieres and girdles. Our technology complements this design philosophy, resulting in products that offer "mobility," "comfort," and an exceptional "fit".

Furthermore, this design approach enables the creation of bras that shape a beautiful bust without relying on excessive lining materials or wires. In addition to this core technology, Twin Cross is a patented product engineered to provide separate support and adaptability to the movements of the left and right breasts. This further amplifies the aforementioned three characteristics.

As a result of these innovations, Twin Cross has emerged as a best-selling product, with over 4 million units sold since its inception in 2004. In addition to Twin Cross, our company has introduced other top-selling products, some of which have secured a place in the Guinness Book of Records for over four decades.

As a manufacturer committed to crafting healthy and comfortable products, both domestically in Japan and on the global stage, we remain dedicated to collaborating with our customers to deliver products that contribute to the well-being of women and society as a whole.

In the late 1990s and early 2000s, fast fashion reached its zenith with retailers like H&M and Zara perfecting a business model of incorporating design elements from high end fashion houses and reproducing them as quickly and cheaply as possible. While convenient for the consumer, the industry leads to an incredible amount of waste, with more than 10,000 clothing items filling landfills every five minutes.

Could you tell us more about how you have transformed your operation to meet these environment expectations?

Consumers are displaying a growing awareness of environmental concerns, and within the realm of women's underwear, we actively incorporate materials that utilize recycled yarn and natural resources like organic cotton. These materials have a reduced environmental footprint throughout the entire lifecycle of our products.

Furthermore, while our core product, women's underwear, serves as a practical everyday necessity, our commitment to high-quality craftsmanship results in exceptional product durability. This longevity translates into prolonged product use, and we take pride in the environmentally friendly aspect of our offerings.

Additionally, we have developed "sanitary absorbent panties," a Femtech product designed for repeated use, which we distribute both domestically and internationally. Particularly in the Femcare sector, our female executives have spearheaded a dedicated department this fiscal year. This initiative aims to cater to the evolving needs of working women, extending beyond menstrual care, as previously mentioned.

Moreover, having attained the "Kyoto Environmental Management System Standard (KES)" Step 2 certification, we are actively engaged in environmental management efforts geared towards fostering a "sustainable society" and ushering in an "era of zero emissions."

You’ve mentioned how up until now the domestic market has been your focus, but ever since the COVID-19 pandemic, we have seen a boom in e-commerce both in Japan and overseas. There is a growing appetite around the world for made-in-Japan quality products. Do you have any interest in capitalizing on that interest and expanding the range in which your products are sold?

E-commerce is now a worldwide market, and we would like to seize this opportunity to bring our own brand to customers all over the world in the near future.

Imagine that we come back in six years’ time and have this interview all over again in 2029. What goals or dreams do you hope to achieve by the time we come back for that new interview?

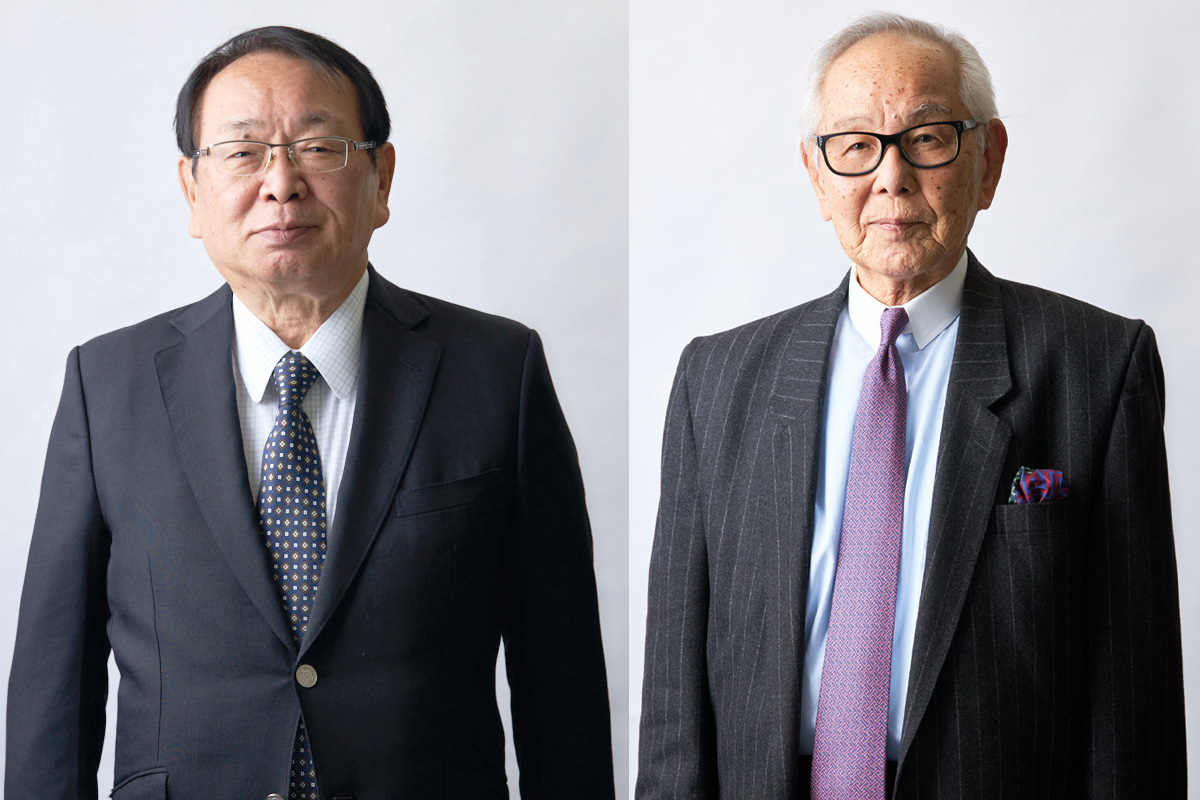

Although everyone says that I look very young for my age, I turned 91 years old this year, so I don’t think I can continue running the company forever. The hope is that soon I will pass on the company to my son, daughter and grandson who will lead Quadrille Nishida into future success.

0 COMMENTS