Nissan Spring looks to build on over 3 generations of success as it looks towards its centenary.

Due to the COVID-19 pandemic, we have seen several logistic disruptions and China’s gradual isolation from the global supply chain paradigm over the last three years. Numerous experts posit that these developments may hold advantageous implications for Japan. Beyond the established reputation of Japanese enterprises for their reliability, it is noteworthy that the exchange rate between the Japanese yen and the US dollar presently resides at a historically reduced level, thereby engendering a heightened cost competitiveness for Japanese goods. From your perspective, do you deem Japan to be favorably positioned to capitalize on these substantial transformations? Furthermore, how do you imagine the prospective role of the Japanese industrial sector unfolding in the forthcoming years?

The traditional business model in Japan historically adhered to the keiretsu framework, wherein major Japanese manufacturers maintained affiliations with smaller subsidiary entities. Although this model yielded success in its time, the prevailing landscape is undergoing transformation. In recent years, the growth trajectory of the Japanese economy has exhibited a notable deceleration. Naturally, our business operations are intricately interwoven with the prevailing economic climate of the nation.

In light of the aforementioned considerations, it is worth acknowledging that numerous domains persist where our springs and products retain significant utility, particularly within the dynamic sphere of Asian markets. Concurrently, the foreign exchange landscape remains beyond our direct purview, constituting an uncontrollable variable that necessitates adaptation. While grappling with these multifaceted challenges, our Thailand operations continue to unveil opportunities within select domains.

Today, the greatest challenge that Japan faces is its demographic crisis. As the world's most aged society, the nation experiences an annual attrition of approximately one million individuals over a five-year period. This scenario engenders two substantial challenges for enterprises. Firstly, the domestic market has contracted, marked by a reduced populace and potential consumers. Secondly, procuring and engaging skilled human resources capable of actively participating in the manufacturing process at the gemba, particularly for chushokigyos in regional areas, becomes progressively arduous. How is your company facing this demographic problem, and what challenges and opportunities is this creating?

Undoubtedly, the prevailing challenges tend to overshadow the positive aspects. The demographic reality of a shrinking population, characterized by an aging majority, is undeniable. This demographic shift has resulted in a societal structure carrying certain asymmetries, engendering intricate constraints for businesses operating within this context. The implications of this demographic trend indeed manifest as significant hurdles that need to be navigated.

Japan has garnered global recognition for its illustrious brands, such as Sony and Panasonic, which have become synonymous with innovation and quality. Nevertheless, the veritable strength and competitiveness of the Japanese industrial landscape are rooted in the extensive network of SMEs, which remarkably constitute a staggering 90% of total employment and contribute to over 50% of the nation's manufacturing output. Could you give an overview of your esteemed company, including the diverse industries that your company serves and the clientele that benefits from your product offerings?

Two key pillars underpinning the success of prominent Japanese brands, such as Sony and Panasonic, are their unwavering commitment to cost-effectiveness and uncompromising quality standards. From a personal perspective, Japan's steadfast dedication to quality can sometimes seem abnormal. Nevertheless, a very high level of quality is often requested.

Drawing a comparison, my experience with automobiles of German and American origin revealed instances of recurring component malfunctions, necessitating prolonged overseas procurement intervals spanning three to six months. In this context, the revered reputation of Japanese brands such as Sony, including automakers like Mazda, stands bolstered by the intrinsic excellence embedded within the products of SMEs. The paramount role played by these high-quality SME components cannot be underestimated, constituting a foundational bedrock upon which the remarkable achievements of these brands are built. SMEs have been instrumental in shaping the triumphant trajectory we observe today.

Our clientele portfolio contains a diverse spectrum of manufacturers in multiple sectors, such as construction and agricultural equipment, automotive, exterior-related products, medical equipment and other specialized industrial machinery.

Nissan Spring was founded in 1947 and has since evolved into a distinguished manufacturer specializing in springs of diverse configurations and dimensions tailored for industrial utilization. Could you provide an overview of the historical trajectory of Nissan Spring, elucidating the key milestones that have played a pivotal role in shaping the company's journey?

Interestingly, our founder's origins trace back to a background as a skilled blacksmith, a craft that, during the Showa Era, experienced a waning demand for swords. The exigencies of war led him to join a prominent spring manufacturing entity; however, the factory endured the impact of bombing during that tumultuous period. Subsequently, He evacuated to Noda City.

A discernible parallel emerges between the artistry of swordsmithing and the precision required in spring manufacturing. Both involve the malleability of iron or steel under the transformative influence of heat. As the broader Japanese economy embarked on a course of recovery in the post-war period, our company's growth mirrored this resurgence. This was paralleled by an ascending demand for machinery components and springs, further propelling our evolution.

The legacy of leadership within our company spans generations. Commencing with my grandfather's tenure as president, a role he effectively held for more than a decade, the mantle was subsequently assumed by my father in 1972. An important juncture arose in 1976 when my father astutely procured a strategic parcel of land within this industrial enclave. This prescient decision not only facilitated the expansion of our factory's operational capacity but also artfully harnessed the promising momentum of Japan's thriving economic landscape at the time.

A remarkable testament to this era's dynamism is the midyear surge of 10% in sales, a testament to the incredible vitality of that period. It is compelling to consider the lineage from which our enterprise emerged. My grandfather's formative experience within Mitsubishi Steel Group, a famous spring manufacturing entity, served as a cornerstone upon which he thereafter embarked on an independent path, founding our company. This endeavor laid the foundation for fostering enduring partnerships with neighboring businesses. Among these, entities such as Bosch, previously recognized as Diesel Equipment Company, Mitsubishi Steel and Hitachi Construction Company, stand as venerable associations that have been meticulously nurtured over the course of seven years. These relationships are the bedrock of our client base, signifying a legacy of enduring trust and collaboration.

Diesel Equipment Company, a very interesting company, was founded before the war. Government directives significantly influenced its establishment, which emphasized the imperative for diesel engines, a crucial resource during wartime operations. Our company forged a strategic alliance with them during this period.

Our expansion initiatives led to the establishment of our company in Akita Prefecture in 1992. Afterward, in 2005, we embarked on a significant endeavor by inaugurating Nissan Spring Thailand. The sales performance of our Thai subsidiary surpasses the cumulative sales of our Noda & Akita operations, indicative of the heightened demand and robust business landscape prevalent in Thailand.

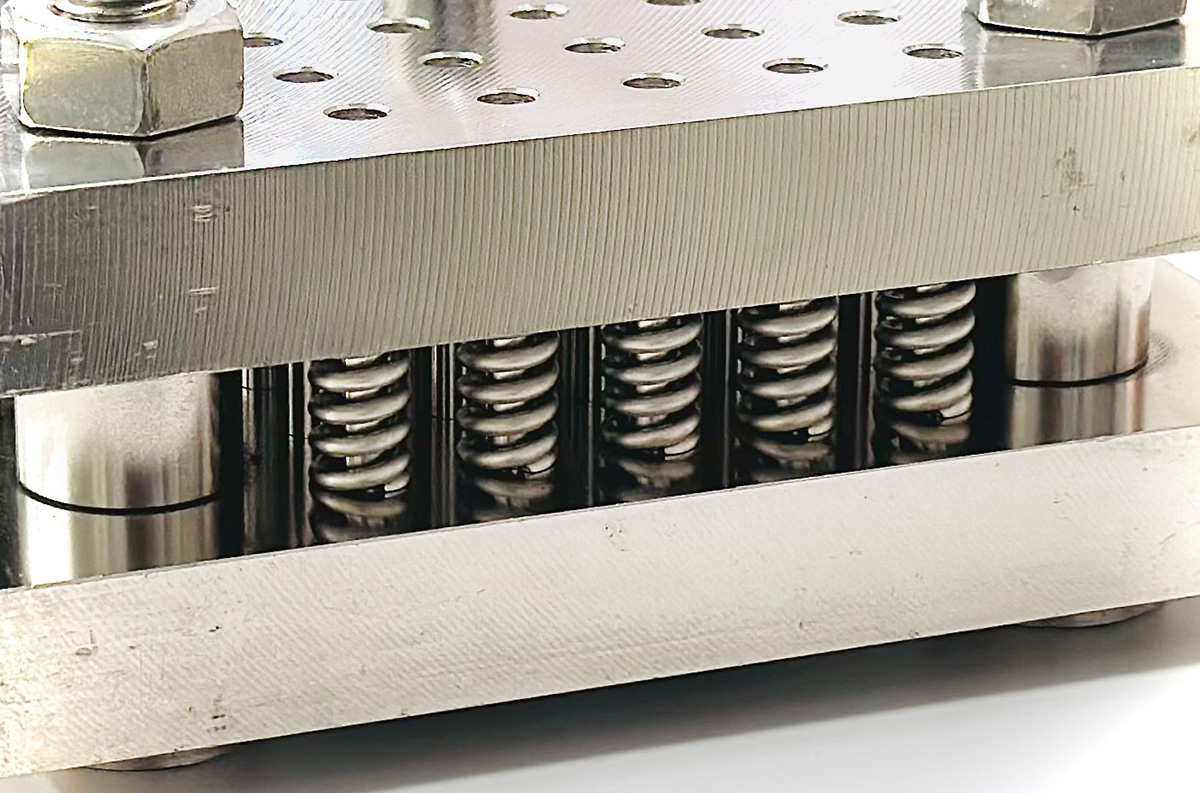

Cold-formed springs play a critical role in demanding applications such as engines, transmissions and suspensions, where they are exposed to challenging conditions characterized by elevated temperatures and substantial tensile forces. Could you elaborate on the specialized techniques and innovations your company has developed to ensure that your cold-formed springs exhibit exceptional durability and resilience, enabling them to effectively endure and perform optimally within these rigorous machine environments?

Diesel engines, as a consistent requirement, necessitate the presence of injection pumps for fuel supply to the engines. Nozzle springs must endure exacting conditions characterized by elevated temperatures and humidity inherent to engine environments. Over time, prolonged exposure to these harsh conditions precipitates exhaustion, ultimately compromising the springs' performance.

Bosch extended an invitation to manufacture nozzle springs for their diesel engine injection pumps. The inherent challenge lay in crafting nozzle springs imbued with attributes that could withstand rigorous heat exposure without succumbing to exhaustion. Collaborative deliberations ensued as we undertook a joint exploration to engineer nozzle springs aligned with Bosch's specific requisites.

Diesel engines always require injection pumps to supply fuel to engines. Nozzle springs must endure difficult, severe high temperatures and humid conditions in the engines. They easily get exhausted over the years, affecting their performance when subject to such conditions. When Bosch asked us to produce nozzle springs for their injection pumps for diesel engines, they didn't know how to make nozzle springs with properties that could withstand high heat and not get easily exhausted. We discussed a lot together and explored ways to develop nozzle springs that cater to their needs.

In the intricate manufacturing domain, an essential phase involved replicating the authentic operational milieu by subjecting the springs to a controlled environment simulating the engine's conditions, such as subjecting them to a furnace. The meticulous nature of this procedure renders it a daunting endeavor, deterring many large enterprises from its pursuit. However, we embraced this challenge with unwavering resolve.

This deliberate commitment, exemplified by our willingness to engage in such an intricate and specialized process, has unequivocally fostered our growth and honed our proficiency in this realm. It underscores a key facet that has driven our journey forward, contributing significantly to our evolving expertise and success within this field.

Nozzle springs

The Creep-tempered (Correct) technology is designed to facilitate a gradual and controlled process. Its underlying principle involves strategically inducing a certain degree of spring exhaustion during manufacturing. This preemptive approach mitigates the overall wear and exhaustion springs may experience when integrated into the end products.

Creep-tempered technology

Considering the road ahead, which application or market sector do you perceive to possess the most promising growth potential for your company? Furthermore, are there emerging industries you are contemplating entering as part of your strategic expansion endeavors?

Nowadays, there is an escalating environmental consciousness, particularly evident in the pronounced shift toward EVs. This trend is poised to extend its influence to the construction machinery sector as well. Within this evolution, it is prudent to acknowledge that future opportunities within our domain might conceivably diminish. Even so, I believe we can survive and remain relevant in the market. I am convinced that our business and technological acumen possess the potential to yield meaningful contributions to the next generation of society.

The aggregate volume of components dedicated to automotive engines constitutes a substantial proportion—between 30% to 40%—of the entire car components. In the context of a prospective paradigm shift away from traditional engines in favor of EVs, our hiring strategies and supplier relationships will be significantly affected.

In the context of the ongoing shift observed among automakers and construction machinery manufacturers from conventional combustion engines to EVs, a discernible reduction in component count emerges. Moreover, the adoption of advanced lightweight materials such as aluminum or CFRP is gaining traction to optimize vehicle weight. Do you believe there is an opportunity for Nissan Spring in this regard? How does your company envision its role in facilitating this transition and capitalizing on the resultant opportunities?

The transformation toward vehicle electrification can potentially impact our business, as conventional engines may eventually require fewer components. However, it is important to recognize that widespread vehicle ownership, particularly in African and Asian countries, continues to confront economic constraints. While the emergence of Electric Vehicles is gaining traction, the challenges in establishing robust charging infrastructure, especially in developing nations, alongside limitations in driving range, remain significant barriers. It is plausible that a complete displacement of combustion engines by EVs is not imminent.

It is a common belief that EVs are entirely devoid of CO2 emissions. While this claim might hold true for individual EVs, a comprehensive view of the entire industry, considering factors such as electricity generation and component manufacturing, presents a more complex picture. A myriad of interrelated variables influences the overall ecological impact of EVs, rendering it imprudent to assert their superior environmental-friendliness.

In a personal capacity, I believe that Japan's hybrid cars represent a preeminent ecological alternative on a global scale.

Envisioning future horizons, what new markets would you like to expand to? Can you tell us more about your international strategy and how you anticipate orchestrating this expansion over the forthcoming three to five years?

In our Thai operations, 80% of our business is attributed to the automotive sector. We proudly serve esteemed entities such as Sony, Panasonic and Mitsubishi Electric, all recognized leaders in electrical equipment manufacturing. Our collaboration involves integrating our precision-engineered springs into their units, which are subsequently incorporated into their final products before being dispatched to their destinations.

The evolving Chinese risk landscape has significantly influenced the developing dynamics within the industry. This paradigm change has induced a profound transformation, prompting the broader industry to reevaluate its supply chain strategies. While the ultimate product assembly may still transpire in China, there is a discernible trend of relocating component production beyond its borders.

Simultaneously, our domestic presence within Thailand is experiencing a discernible growth in orders. Situated in close proximity to neighboring nations such as Cambodia, Laos and Myanmar, we are actively considering extending our market reach to these countries in the foreseeable future.

As you lead the company as its third-generation president, is there a particular overarching goal, strategic objective or ambitious aspiration that you are determined to realize within your tenure before facilitating a seamless transition to the succeeding executive leadership?

Assuming the presidency of this company at the age of around 36, I am now 66 years old, marking a tenure of three decades. The prospect of my retirement, though not imminent, is on the horizon. Among our ranks, there exist exceptionally capable individuals who adeptly navigate the intricacies of our business operations. Throughout my presidency, a paramount aspiration has been cultivating an environment that fosters employee well-being, offering competitive compensation, bonuses and conducive working conditions.

To realize this vision, a concerted effort is required to bolster our order volumes, revenue streams and profitability. The symbiotic relationship we share with Japanese banks, underpinned by my role as president, underscores an important dimension that warrants attention. The implications of transitioning leadership to an alternate custodian remain uncertain.

When it comes to capital investments, our strategic course is guided by meticulous assessments of our assets and financial standing, crucial elements in our engagement with lending institutions. Within Japan's financial landscape, banks commonly stipulate guarantees from company presidents or representatives. I am resolute in my commitment to fulfill these responsibilities diligently. It is imperative that we cultivate a track record of successful external business outcomes, which in turn would influence banks' perceptions of our standing. This transformation could lay the groundwork for an eventual transition of company management to the succeeding generation, an eventuality I anticipate with a blend of strategic anticipation and deliberate preparation.

0 COMMENTS