Established in 1961, Maxell started out as a battery manufacturer, with its name, originally derived from “Maximum Capacity Dry Cell”, having long become synonymous with high-quality Japanese electronics. ‘All-solid-state batteries’ have been earmarked as the next generation of battery innovation. Always at the forefront of battery development, Maxell aims to establish the world’s first mass production system of small-size all-solid-state batteries through established micro battery and lithium-ion battery manufacturing processing technologies, as explained by president Keiji Nakamura in this interview with The Worldfolio.

In recent decades Japanese companies have faced a lot of criticism from international media for having lost their innovative edge or spark that fueled the monozukuri miracle that we associate with the '70s and '80s. Many called the Japanese business structure to be rigid and inflexible to compete in a globalized economy. Yet, in fields of advanced technologies, business-to-business (B2B) markets and niche fields, Japanese companies are continuing to excel and innovate. What is your response to this line of criticism? Where do you think the strength of Japan's industry comes from today?

In the 1980s, Japanese manufacturers had outstanding competitiveness in the global market. However, since the collapse of the “bubble economy” in 1990, Japanese manufacturers have tended to be obsessed with improving their successful technologies rather than producing innovative technologies. This is partly due to the fact that, as a result of the maturation of the Japanese economy, people's values have begun to diversify, and it has become difficult for everyone to share the same goals and move forward. From a management perspective, it seems that the company did not have a strong strategy or passion of denying past success amid severe global competition, allocating management resources in the strong businesses through "Selection and Concentration," and securing global competitiveness. As a result, the company was unable to secure its initial Japanese advantage, particularly in high-growth businesses with large investment such as lithium-ion batteries and semiconductors, which support automotive electrification. On the other hand, I think that the strengths of Japanese companies continue to be secured in technologies and industries where the delicate alignment of goods and information is the core. This includes hybrid vehicles that involve delicate linkage between engines and batteries, and some semiconductor manufacturing equipment. Maxell is also planning to grow by leveraging its Analog Core Technologies of "mixing", "coating", and "forming" as the source of its competitiveness.

Both automotive and electronic components are two areas that traditionally have been the strength of Japanese manufacturers. Today, around 30% of the cost of the car comes from the electronic components and materials inside. In the next 10–15 years, it is estimated that more than half of this cost will come from electronic components. What is your outlook on the sector? What opportunities does further vehicle electrification represent for Maxell and how do you plan to capitalize on these changes in the automotive sector?

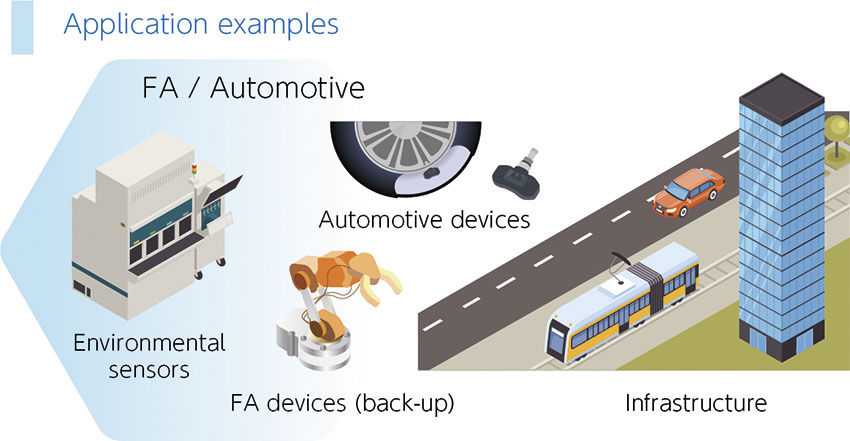

In the past cars had only basic functions including running, turning and stopping. Now, there is more value added to cars such as enhanced safety and entertainment. There are also non-basic functions such as car sensors and those controls. These are semiconductor-related products that will continue to increase in demand. I am sure of that. In the past, batteries were only used for starting engines, but now batteries are used for sensors like the puncture sensors which are for the enhanced safety feature.

Regarding enhanced safety, we can expect business opportunities in in-car camera lens units as well as automotive LED headlights including adaptive driving beams that reduce the light towards oncoming cars, while still producing a sufficient level of illumination.

Another sector that you are targeting is the healthcare sector. You have already established yourself with products that are both very visible to consumers such as the ozone bacterial deodorizers and not so visible devices such as batteries in medical devices. What strategy are you employing to further penetrate the medical sector?

Our strategy centers around the batteries for the medical field. There is big growth potential for these products. If we want consumers to recognize the value of our products, our products should be highly safe and reliable. Otherwise, we will have no chance of beating other Asian competitors who offer cheaper products. The ultimate goal is to make our products safe, secure and reliable to be used for different medical applications.

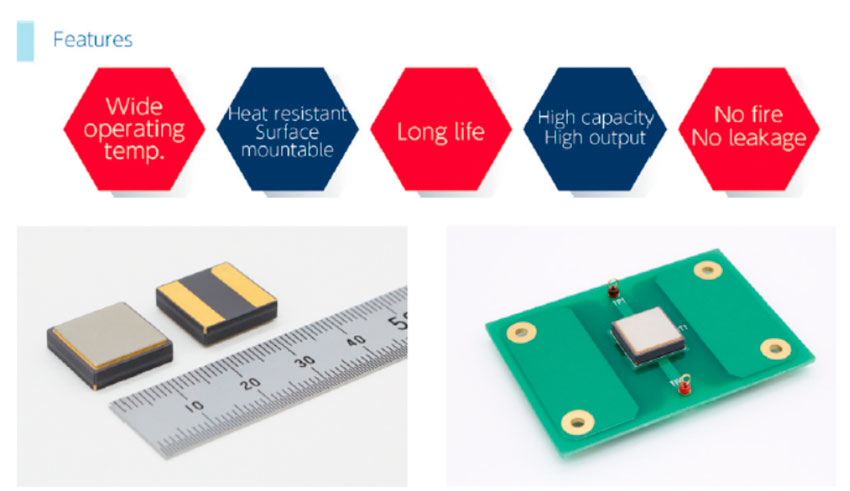

Left: Ceramic packaged sulfide based all-solid-state battery. Right: Image of surface mount

We recently had an interesting conversation with Mr. Yukita of Asaka Riken, a company that specializes in LIB to LIB recycling of lithium and lithium-ion batteries used in electronic appliances. He said that there are two main challenges in recycling. First is the risk of contamination. Lithium can seep into the ground and can be toxic and damaging to the environment. Secondly, when firms recycle or reuse their batteries, they opt for very rough methods such as crushing or burning to only recover valuable materials like cobalt or nickel. What is your firm's policy on the sustainable use of your battery products?

We are working very hard to develop a new product that is environmentally friendly. Batteries have different voltages and applications. They usually use materials that are not environmentally friendly because they need to be able to collect power as much as possible from these materials. We are developing batteries that use materials that are less toxic so that they can dispose of the batteries easily. We intend to use them in the medical field so that we can minimize or even eliminate the environmental impact of our products.

The American market has a need for environmentally friendly medical devices. Medical equipment for surgery and treatment normally needs to be sterilized, so heat-resistant batteries are needed for the sterilization process. There is demand for this product so we want to increase production. Rechargeable batteries are normally not accepted by the medical market because when the batteries are charged there can be potential contamination or secondary infection. Single-use batteries are preferred.

What synergies and advantages were you able to create amongst the Maxell group companies and how can you leverage the strengths of your different companies to tackle your three target areas of healthcare, IoT and mobility?

Maxell started as a dry cell manufacturer. The company name “Maxell” comes from maximum capacity dry cell. In the '60s, big Japanese companies had their own dry cell manufacturing division. Companies like Panasonic had Matsushita Battery and Toshiba had Toshiba Battery. Maxell is an English name which I think shows the company's spirit and desire to enter the global market with quality products since its foundation. Dry cells use negative and positive powdered materials. If the manganese dioxide powders are mixed very well, the performance is very good. This mixing technology is applied to other products. We mix the magnetic powders well to be coated on the base films to make videotapes and cassette tapes. By mixing well, we can provide good quality tapes that produce great sound and images. This is what differentiates us from our competitors. We acquired excellent molding technology for the cassette and videotape resin cases. Videotapes have been replaced by CDs and DVDs which use optical pickup lenses, so we can still take advantage of our molding technology. This lens molding technology is now used in producing in-car lenses and LED headlamps. As front-line activities of Maxell technology, we are trying to make clearer images by cultivating the lens business, or working on image recognition technology using AI. Maxell products might look irrelevantly diversified but they are very relevant in terms of technology. For example, Maxell Frontier produces lens and LED headlamps and image recognition technology. You can see the synergy between the companies in this regard. Ube Maxell Kyoto coats inorganic film on the separator and sells it to car battery manufacturers. These are necessary products for ensuring safety and are produced by the technology used for our magnetic tapes. Thus, we have technical linkage with each group company.

Can you tell us more about the role that collaboration plays in your firm? Are you currently looking for or have interest in collaborations with any companies overseas that you can share with us?

We are now working with North American partners to co-develop medical batteries, these companies have strong technologies. For product development, we are leading the commercialization of small-sized all-solid-state batteries so we are forming ties with material manufacturers for these batteries. All-solid-state batteries are going to be used in EV drive batteries so it attracts a lot of attention. I personally think that it will take time to develop all-solid-state batteries for EV drive. We are working on small-sized all-solid-state batteries for other applications, which I think is more feasible to be commercialized.

Are you actively pursuing new partnerships or collaborative opportunities?

Yes because things are changing rapidly nowadays. Once we start a new business, we would need a large volume of resources at once. The internal resources are not enough to start a new business, so we take advantage of the technology and strengths of our company and our partners.

We usually collaborate when launching a new business. When developing technologies, we sometimes work on our own and at other times we work with universities and research institutions.

You have a very diverse international profile and a long history of having an international presence in North America, Europe and Asia. As you look towards the future, is there a particular market or region that you consider a key part of your international strategy?

The key market for us is the one that recognizes the value of safety, security and reliability that is important for Japanese manufacturing businesses. This means that the key markets for us are North America and Europe.

You already have a strong presence in both North America and Europe. And you have been in North America since the late 1960s. You have a long history there. What is your strategy to further penetrate these markets now that you have already identified your key product areas and key markets?

I decided to join the company because I was inspired by Maxell products including videotapes, cassette tapes and floppy disks. B2B products are our main focus at present. We plan to continue business-to-consumer (B2C) products as far as we can maintain revenue and sales. This is important for Maxell branding. We want to expand our B2B business in the three areas of mobility, IoT, and healthcare.

You gave us an in-depth overview of Maxell's history and present challenges. If we come back to interview you once again on the last day of your presidency, what goals and dreams would you like to have achieved by then?

Maxell's DNA is its technology. We place great importance on our technology. If you look at the products, they might look irrelevant but there is related technology behind all of them. Even though the product changes, we want to maintain the excellent technology that leads to our growth. In 2020, we established our Mission, Vision, Value, Slogan and Spirits (MVVSS). As stated in our Mission, I want to make this company indispensable to sustainable society. Now, we are seeing next-generation technologies. I want these products and technologies accepted by the community and the people. Our partners also share the same ideals and values, so I want our partners to think that Maxell is an essential part of their businesses. Our slogan is to be a company within the future.

0 COMMENTS