Atsugi, headquartered in Kanagawa, is Japan’s leading stocking brand specializing in the manufacture of pantyhose, socks and lingerie products.

It is our view that Japanese manufacturing is living in a very exciting time. We saw supply chain disruptions caused by Covid all around the world, and we see continued tensions and decoupling between the US and China. As such, multinationals around the world are looking to diversify their supply chains to be more reliable and risk-averse. Here enters Japan, a country known throughout the world for its advanced technology, for its high reliability and now and never before for its weak JPY. Do you agree that this current climate is a great opportunity for Japanese manufacturers? Why or why not?

Regarding Japan’s position within the current global economic environment today, I believe that Japanese manufacturers’ strengths lie in the fact that they are widely known for providing safety, trust and high reliability. They are Japan’s main strengths. Japan’s technological strength lies in its ability to modify products as well as the high levels of processing technology that Japanese companies have been able to develop. With regard to Japan’s business culture and its manufacturing expertise, there can be both strengths and weaknesses. For example, in cutting-edge technology, Japan was the industry leader at one point. However, they were not able to maintain that leadership position. I believe the reason for this is that, while Japanese manufacturers are good at developing new ideas, in the past, they struggled to market those ideas in a way that was relevant to the needs of the customers. That is an area that is not their strong suit. Japanese manufacturers do excel at producing and providing high-quality goods, and they are able to ensure both functionality and quality. However, oftentimes they may not fully match with the needs of the customers.

This issue has been detrimental for some Japanese businesses and their ability to grow and maintain leadership positions overseas. What we see is that they are often not able to fully grasp the relevant market needs of the customer base. As a result, they may actually produce products that are too high in quality and too difficult to adapt to the needs of the customers. The customers may not require a product that is as high in quality as the products that the Japanese manufacturers make. What often happens is that Japanese manufacturers prioritize safety and security. As a result, the costs are higher, and this leads to them losing their competitiveness globally. When Japanese companies go overseas, they may begin by working with Japanese companies at the start. However, they are not able to maintain that sense of consistency.

You mentioned that the main challenge for Japanese companies overseas is not being able to recognize or meet the relevant needs of each market. We know that your company has been in Shanghai in China since 2001. We would like to know how you approached that challenge of being able to comprehensively understand the local needs in China. What were some of the main lessons or takeaways of your 20 years of experience in that region?

One of the reasons we have been able to achieve solid success in China was that we entered the Chinese market early and partnered with suitable retailers. We built a strong sales network in collaboration with department stores, mainly in Shanghai. As of 2001, department stores had much more power than e-commerce. After understanding the local needs from them, we were able to sow the seeds and branding in the early stages by selling Atsugi as high-end products at department stores, and even now that e-commerce has become mainstream, our products are still highly regarded in China. On the other hand, we are currently focusing on sales through e-commerce to increase our visibility in the market.

Looking at the Chinese market, they are strong when it comes to technology. In the past they were not as technologically advanced as Japan. However, they have rapidly caught up and even exceeded Japanese companies in certain businesses. Chinese IT literacy is also high, and they have been successful when it comes to online business and ecommerce platforms. They are much more progressive and advanced than Japan in that regard. Today, ecommerce is growing rapidly, and we are seeing that the department store business is shrinking. We are aware that the new customer bases are doing their shopping online. Therefore, we are looking to strengthen our online presence going forward.

I am very curious to hear about this in a little more detail. Covid was a very interesting time in terms of its impact on physical retail stores and department stores and this shift to e commerce especially in Japan where there has been a big ecommerce boom over the last three years. This was especially the case for products like yours such as stockings, with many working women no longer needing to wear stockings when they were working from home during that period. Could you tell us a little more about how Covid in Japan impacted your activities and how you responded to that challenge?

When we look at the demand for stockings in Japan, 30 years ago, 1.2 billion pairs were sold. There was a huge demand for stockings, and it was a booming business back then. We then saw the numbers shrink considerably, and by 2020, that number had decreased to 140 million pairs. However, in 2021, the number rose again to 170 million pairs, and right now we estimate that the number this year will be over 190 million pairs. That is one-sixth of the number in its peak time. Covid has had a big impact on working styles, and we see that post-Covid, between 20% and 30% of the workforce are now engaged in remote working trends. We do not believe that this will revert back to the time before Covid. Therefore, when we look at the stockings business today, they are no longer something that is required to go to work. Rather, we see people buying stockings for their functionality and secondly for their aesthetics and fashion purposes.

The primary sales point for stockings is their functionality. We are gearing our R&D to adapt and respond to the types of functions that our customers are seeking in wearing stockings according to the changing seasons or the climate. For example, in hot weather, they are seeking stockings that will make them feel cooler, while when the weather is cold, they are seeking stockings to help them keep warm. We are very grateful that we have reached our 77th year in business here in Japan, and we are very proud to say that we have been able to maintain a high level of recognition and trust from the Japanese population. We are also proud to be widely known for providing a strong sense of safety, security and ease.

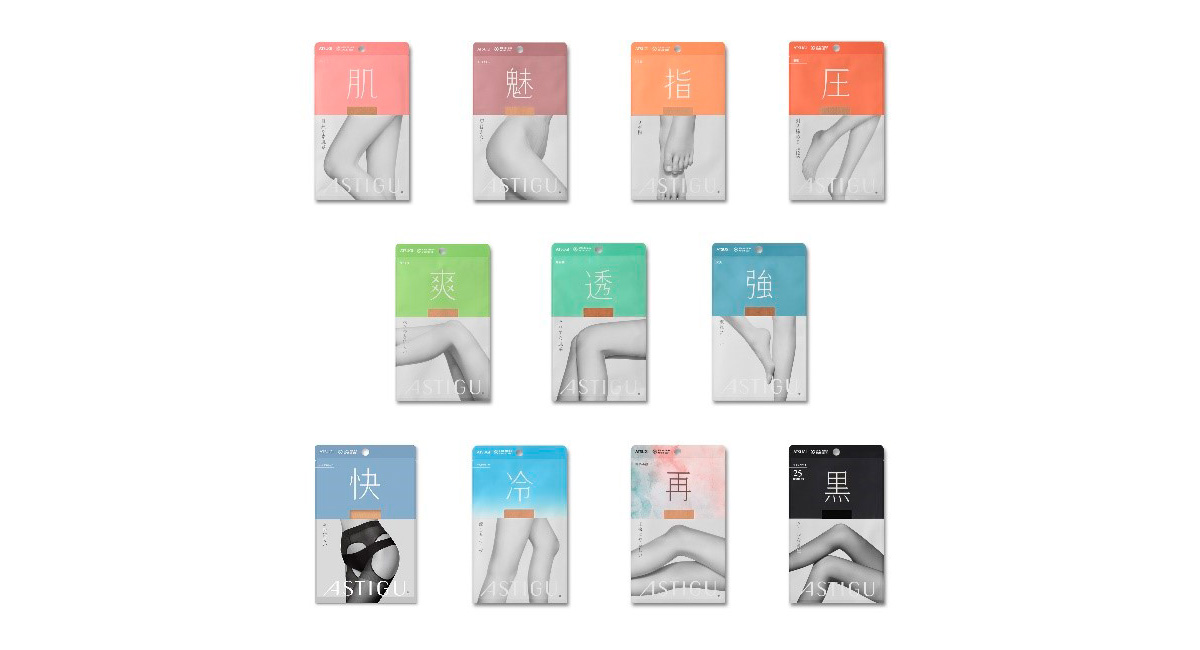

ASTIGU, Atsugi’s main brand leading the Japanese stocking market

With regard to how we can strengthen our ecommerce business, one aspect to consider is that in Japan the economy has grown as a result of the Japanese mindset that if you produce something that is of high quality then it will sell. We lived through that era for a long time, and have been able to grow into the business that we are today as a result. However, we are no longer living in that era and business is no longer done like that. Today, not only do you need to produce a high-quality product. You also need to be able to communicate how good that product is. The important thing is to provide the value that customers want. For that purpose, we need sales and marketing capabilities, which we are currently trying to develop.

While it is true that Japan’s population is shrinking, there are lots of new markets such as FemTech for example, which is an interesting new trend. Also, products for the elderly and the disabled are new markets other interviewees were exploring. Are you more focused on these advanced countries with more niche needs or more focused on developing countries with a large young working population?

China is definitely an important market for us as it continues to grow. We are looking to strengthen our ecommerce visibility in the Chinese market. We will do so by focusing on our advertising and promotional efforts in China.

When it comes to our R&D and which business divisions we are strengthening, we are looking to expand our work in the healthcare sector. The reason for this is that we have our special pressure-applying technology which allows our socks to work as pressure socks. Our technology allows you to apply pressure in different areas of the sock which means that we can create socks that are good for the circulatory system. We are now working on advancing this technology to improve our socks’ effect on the circulatory system and the nervous system. This also helps in coping with various illnesses and challenges that older people may face.

Another area that we are focusing on is developing female-care products. We want to adapt the various technologies that we have developed to create female-care products, stockings and socks that are soft for the skin. This will allow us to create even better products for women. Our thread processing technology can be applied to create the most comfortable female-care products that are close to the skin, for example when women are at various stages of life.

ASTIGU Kai, the panty-less stocking

For example, take a look at these panty-less stockings. When it comes to wearing traditional pantyhose and underwear, you first wear the underwear and then wear the pantyhose on top. When you go to the restroom you have to pull both of them down, and when you are on your period for example, it is very annoying to pull both layers up and down. We therefore developed a product which allows you to keep your pantyhose on and wear your underwear on top of the pantyhose, as there is a hole in the panty area. This means that you do not have to keep pulling down all of the different layers, and only need to pull down your underwear when you need to use the restroom. This makes it a lot more convenient and less stressful, and we have received a lot of good feedback from our customers.

Water absorbing shorts

We have also applied the excellent touch technology cultivated in stockings to female -care products. These are shorts with water absorption. As one of the ways to help women deal with various leaks that occur in life stages, we created underwear that utilizes six layers of absorbent technology. If you were to create six layers, you would imagine that there would be a lot of different threads required. However, our products are made of cotton on the skin-contact side and have no seams, making them extremely soft. They are gentler on the skin compared to wearing chemical non-woven napkins.

It is amazing how there are six layers, yet it is still very flat.

Thin absorbent crotch

Yes, it is very thin. They are also washable unlike napkins or pads which are disposable. They are washable and used repeatedly, they are more environmentally friendly. We have made some of the products more fashionable by having the outer part made of lace.

When it comes to environmental efforts and producing more sustainable products, there are many challenges when you are working in the apparel industry. This is something that is very important to focus on today. There are many problems related to mass waste, and finding ways to reduce the overall amount of waste is a big challenge. Large fast fashion brands have to change their policies and the way they do business. Although we are in the apparel category, we consider our products more as functional wear that supports people’s health and hygiene. Therefore, from that perspective, I believe that our products are not in the same category as fast fashion.

It is interesting to hear how you have managed to shed this reputation. I feel like stockings and socks definitely have a reputation for being a very disposable item.

Our products do ultimately end up in the garbage. However, we are actively focusing our efforts on creating some viable recycling projects. Currently, we have seven stores which we directly manage. In those stores, we have projects to recycle the stockings that people bring in. However, collection is small at the moment, and we are currently working with recycling companies to see what else we can do moving forward.

Environmentally friendly package of ASTIGU

We are also working to reduce the environmental impact of our product packaging. For stockings, we are developing a new style of paper-based packaging. This not only makes it more environmentally friendly, but also more convenient. The packaging has been improved so that the stockings can be removed by simply opening the top, making them even more convenient for women who have to go to work early in the morning.

In terms of your international expansion, where do you plan to go from here, and how do you plan to communicate your strengths and technologies?

I would like to share some numbers with you in regard to the stockings business in China. The demand in China is growing. I mentioned earlier that 30 years ago, there were 1.2 billion pairs sold in Japan. Currently, China is at 1.7 billion pairs. In the next seven or eight years, it is forecasted that this figure will rise to 2.6 billion pairs. In 2015, the number of pairs sold in China was only around 1.1 billion. This demand is growing in tandem with the growth of the country. Most of the economic growth there has been centered around the cities, and we are seeing that lots of rural areas are becoming urban centers. As the economy is continuing to grow, we are seeing the same trend in our business there. Therefore, our overseas strategy is still primarily focused on how to expand within China, and how to strengthen our online business there.

In Europe and North America, the markets are much more mature when compared to China. When we considered where would be best for the allocation of our limited resources, we decided that it would be more profitable and viable for us to put all of our efforts into the Chinese market. We have received some requests from other neighboring Asian countries such as Taiwan and South Korea. We will cater to those needs as they emerge.

In regard to how we plan to expand our operations in China, I mentioned earlier that we had built two factories there. That is the base for our manufacturing. We also had a factory in Aomori Prefecture in Japan. However, we shut it down last May, and all of our manufacturing is now done in our two factories in China. We are currently building a third factory in China. The reason for this is that one of our factories is dealing with strict environmental standards. Therefore, we need to shift our operations. In addition to meeting new environmental guidelines and standards, we are in the process of converting our third factory into a smart factory. You may be wondering why we are based in China and have all our technology and expertise in China, despite the fact that labor costs are rising in China. However, if we can create a smart factory that is completely labor-saving, labor costs will no longer be an issue, and we will be able to produce anywhere in the world, even in China or Japan, where labor costs are even higher. This smart factory is scheduled to be completed in June 2024.

Your company is this year celebrating its 77th year anniversary. Imagine that we come back in three years’ time for your 80th year anniversary and have this interview all over again. What would you like to tell us? Is there any specific dream that you would like to have accomplished by then?

Just this past May, we refreshed our brand image. Our logo, which was all capitals until then, was changed so that only the “A” is capitalized and the other letters are lower case. I believe this gives it a softer feel. We also reestablished our purpose and vision. Our purpose, meaning of existence is “For the present and a future that are comfortable for skin and heart.” Our vision is to be a feelwear manufacturer that stirs emotion through skin comfort. We want to produce clothes that are comfortable for the skin and resonate with the users beyond the conventional category of hosiery and underwear. We decided to create a tagline that delivers the message that we want to contribute to enriching the world by providing products that are soft to the skin and thereby enrich the heart. We are hoping to roll out this fresh brand image for our company going forward.

0 COMMENTS