In this interview for The Worldfolio, Mr. Eiji Sakaguchi, President of CBRE Japan, analyses why the Japanese real estate market remained resilient despite the COVID-19 pandemic and delivers his opinion as to the market’s future outlook.

As a total solutions provider of real estate for corporations here in Japan, can you please give us your macro analysis of Japan’s real estate market? How do you expect it to evolve going forward?

Frankly, I think Japanese real estate may be boring, but it is undeniably stable! The key word here is “predictable”, particularly in terms of the predictability of Japanese politics and the economy.

Another important point is the steadily increasing value of pension funds’ assets under management, with their valuation in G7 countries reaching nearly 25 trillion U.S. dollars in 2019. If you look at a breakdown by asset type, such as equity or fixed income, you will see that alternative investments have been steadily increasing. Generally speaking, half of all alternative investments are in real estate, which means that more and more money is coming into the sector. This trend is expected to continue with some people even saying that alternative investments will represent 50% of pension funds’ total managed assets by 2030.

Asian real estate is still “underweighted,” with market participants always looking to increase exposure. If you look at investors in APAC countries, most of them cannot invest in China, and even good markets like Korea, Singapore and Australia are just too small relative to Japan. In Japan, real estate is quite easy to access, especially in terms of titles. This is another key reason why I believe Japan is emerging as a prime target from an investment manager’s perspective. This idea is supported by the fact that large foreign institutions such as Allianz have been re-entering or coming to Japan in recent years.

If you look at domestic capital insurance companies, they suffered big losses after the bubble burst in the 1990s. After that, they had been hesitant to invest in real estate, but are finally coming back to the Japanese commercial real estate market, almost in full force.

Japanese individual investors also have incentives to invest in real estate for tax saving purposes. For example, we are seeing high net worth individuals looking to increase their exposure to Japanese properties in order to save on inheritance tax. On the supply side, institutional properties are mainly owned by major developers or REITs, so while there is so much demand from pension retail investors, the supply is limited.

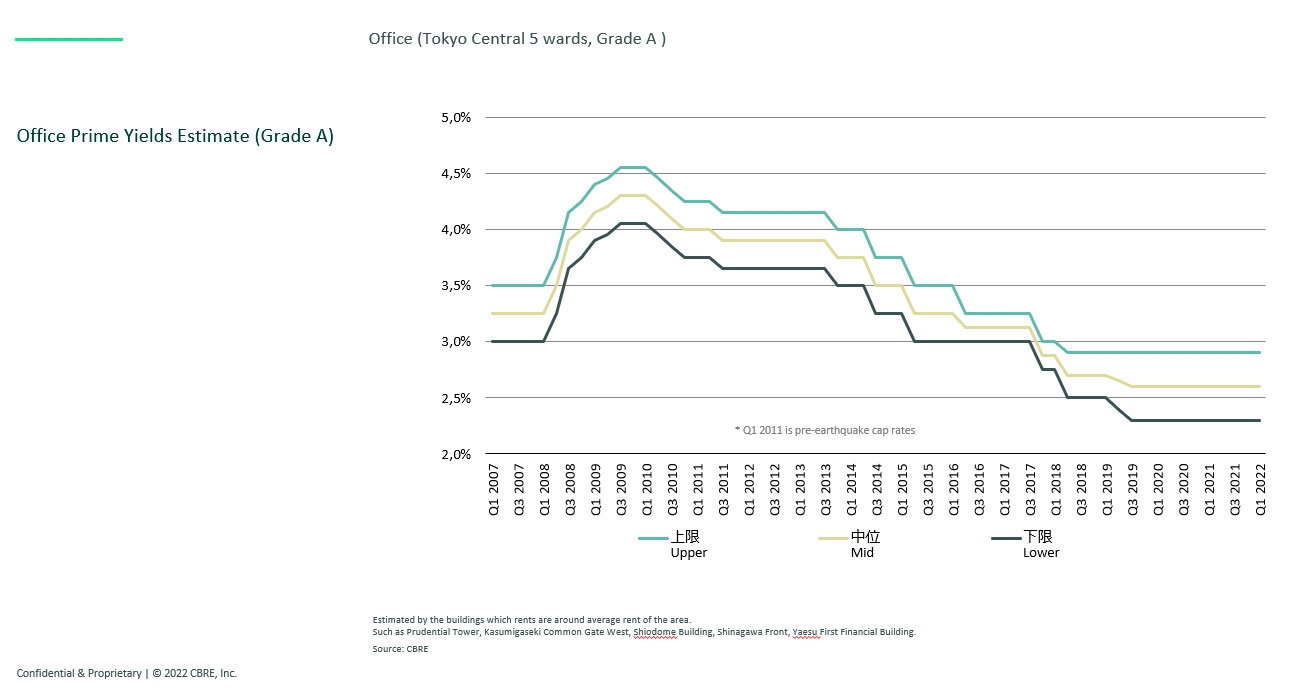

For example, private equity firms have achieved higher returns because of cap-rate compression, not significant rental price hikes. Japan has supported the industry by essentially printing “cheap money,” which is lent at an almost 0 percent interest rate.

All these facts explain why investors have enjoyed steady returns from the Japanese market.

With the coronavirus pandemic, the performance of the office sector was under intense scrutiny and Japanese media’s predictions were quite pessimistic. Yet, the vacancy rate of Type A offices in Tokyo’s major business districts has been hovering around 2%, much better than the disastrous predictions of Japanese media outlets. What is your outlook for the office sector? How long do you expect it will take for it to fully recover?

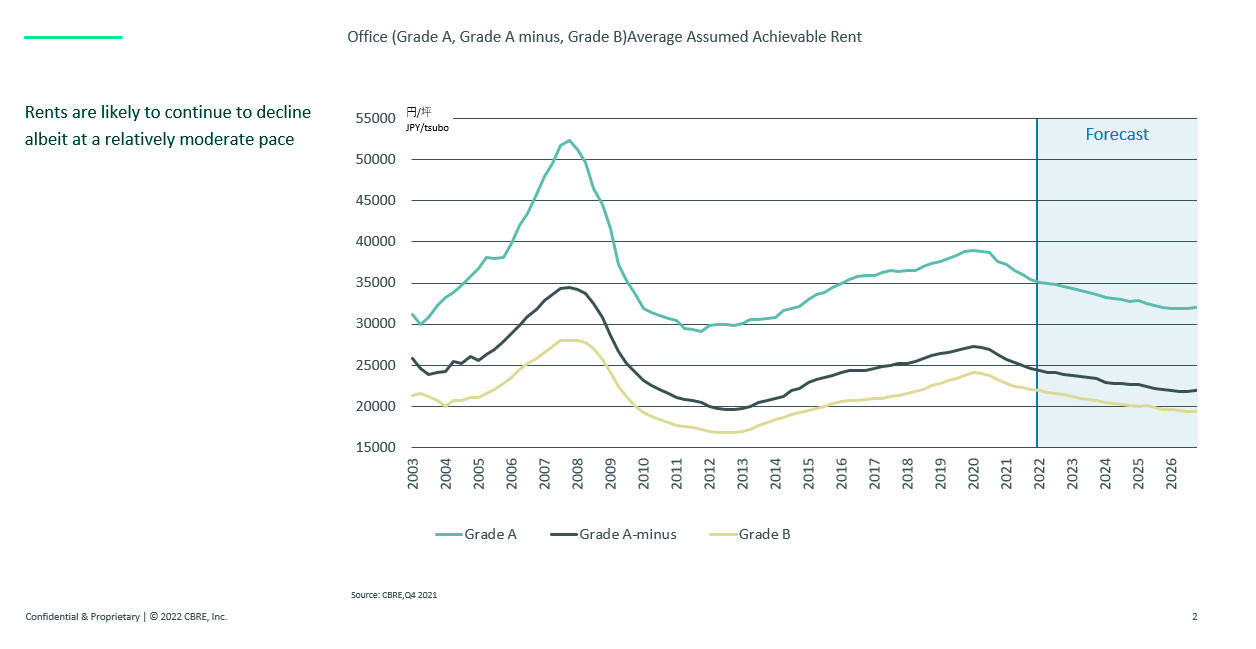

In the leasing market, there were some setbacks, yes, but not in the transaction market. In Japan, the office sector represents more than 50% of total commercial real estate value. So if you want to have exposure to Japanese real estate, you cannot avoid the office sector. If assets meet a certain criteria or quality, investors cannot ignore that opportunity, and if they continue to be afraid of the leasing market, they cannot access Japanese real estate. Given the nature of pension funds, they invest for periods of five to seven years. Based on current CBRE forecast, office rent is expected to remain relatively weak until around 2025 but likely to stabilize and strengthen thereafter. As such, investors with relatively long investment horizon are in a position to be more aggressive and to take greater risks.

With the democratization of ‘work-from-home’ measures, how do you think the utilization of office space will evolve in the future?

Shibuya is a good example of how office spaces are evolving amidst the pandemic. After the onset of Covid, Shibuya’s vacancy rate rose to 3% before coming back down. IT companies, many of which are in the Shibuya area, reacted very quickly by canceling their lease agreements. However, other companies tried to expand their space or relocate to better offices. To my understanding, about half of the IT companies considered reducing their office space in response to COVID. However, the remaining firms upgraded their offices or increased hiring. So, why would they stay in Shibuya? The answer is that they want to attract young talents.

Clearly Shibuya office market overreacted in the first phase of the pandemic and it is recovering now. But overall, not just in Shibuya, we are seeing firms relocate to higher quality facilities given that prime buildings are being rented out at a much lower price than they were 15 years ago. Relative to other countries, there's a higher propensity for management to want employees to come back to the office. As in many other Asian countries, this is also relevant in Japan, a country where apartments are known for their limited living space.

In Japan, I believe that the changes in work style and the implementation of remote working will have a much smaller impact than in other countries.

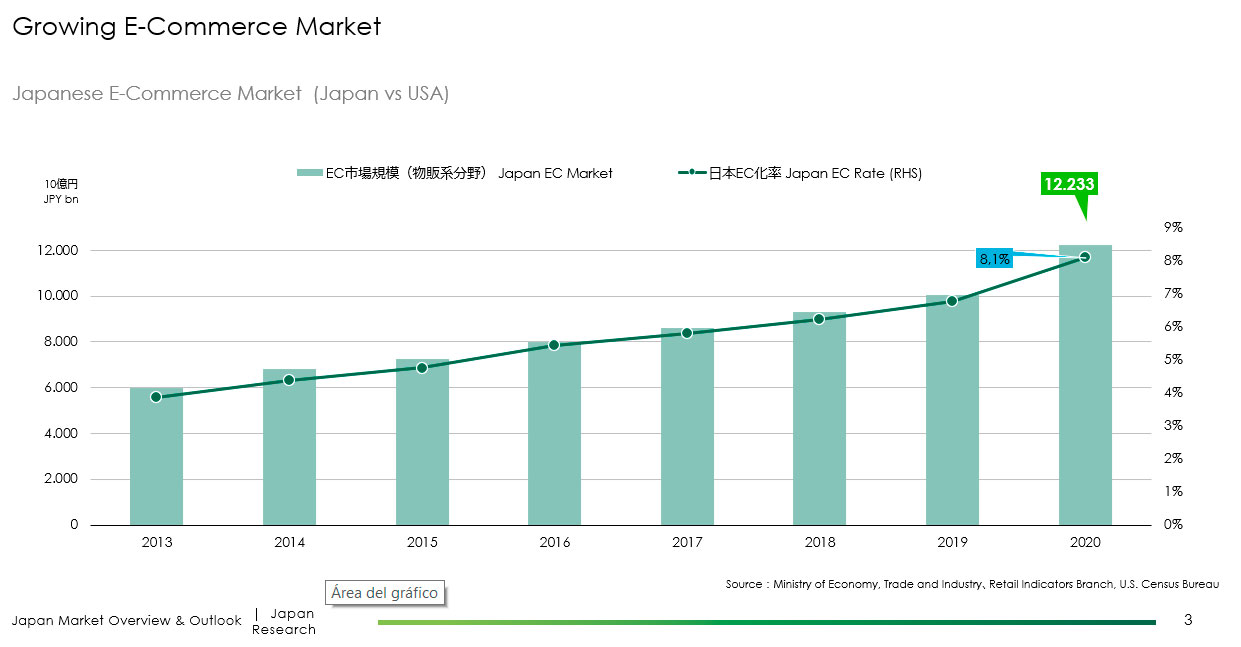

Logistics is one of the fastest growing real estate segments in Japan. In this past fiscal year, more than 30% of real estate usage was for logistic centers. Do you think that this increased logistics usage is relative to the e-commerce boom brought about by COVID? Or do you expect that the growth in the sector will be maintained?

Even before COVID, it was obvious that the logistics sector was in an uptrend. The acceleration of growth in e-commerce caused by COVID served to greatly enhance the demand for logistics as well. Meanwhile, in the Greater Tokyo Area, state-of-the-art logistics facilities only represent around 10% of total warehouses and distribution facilities. As such, it is hard for foreign investors to access such modern facilities without developing them themselves. That is why they participate in development funds run by Prologis, GLP and others. Only two other cities, namely, Nagoya and Osaka, have been seeing active developments in recent years, although both are still smaller compared to Tokyo. Development momentum is now spreading to other regional cities such as Fukuoka and Sapporo, which is a trend I expect to continue.

Until last year, logistics vacancy rates in the Greater Tokyo Area were close to 0%. However, this is due in part to the fact that landlords did not ask for significant increases in rent. This is because landlords understood that their tenants could not pass on the increase to their end users. If you look at the charts, rents have been increasing very modestly, which actually gives comfort to investors. If rents had been rising much more sharply, investors would have been more cautious in anticipation of a reversal move in rents. As companies like Amazon or Rakuten continue to grow steadily, their facilities should also expand accordingly.

Growth in demand has also been relatively slow as well; steady but slow, particularly relative to other major countries. If you look at the ratio of e-commerce as a percentage of total retail sales in Japan, it was only about 6% prior to the pandemic and only reached 8% in 2020. We are still in the process of a catch-up in Japan relative to other markets.

With ‘stay-at-home’ measures and other restrictions, the retail sector suffered during the pandemic. However, it has recently shown signs of recovery. According to one of CBRE’s surveys, over 90% of surveyed landlords revealed receiving inquiries from their retail tenants for a lowering of rents in Q2 2020. By Q2 2021 this number had fallen to 45%. To what do you attribute this positive change?

If you look at retail high-street markets that host luxury brands, such as Ginza and Omotesando, stores like Rolex have already successfully expanded, relocated, or upgraded their location during the pandemic. While the food and beverage sectors are still suffering from the pandemic, in many cases luxury shops like golf shops or “glamping” goods have been doing well in the midst of the pandemic, taking advantage of lower rents to open new stores or to upgrade their stores. In the retail sector, we are still seeing the polarization of demand.

Some argue that the sector recovery may still take some time as the demand had been driven by inbound tourists and our borders are currently still closed. However, while marginal growth had been driven by inbound tourists, more than 90% of total retail demand actually comes from domestic consumers. As such, if domestic consumer spending recovers, the retail market is likely to rebound to some extent.

How long do you expect the recovery to take?

We are forecasting that in the second half of this year, things would gradually start to normalize. However, for a full-fledged recovery back to the pre-pandemic situation, you need to have the country open to foreign visitors, and no one really knows when that is going to happen.

Some people say that even if Chinese tourists come back to Japan, they will not go shopping like they used to. Many retailers, such as drug stores are operating under that assumption, which may influence whether or not they will open new shops.

Today, Japan has a negative demographic line and a super-ageing society, a trend that is greatly affecting rural areas as young people become more inclined to move to urban centers. The population of Tokyo, for example, is still increasing and expected to peak between 2025 and 2030. How is this increased urbanization affecting the property market of Japan’s metropolitan centers?

Before COVID, we saw a trend whereby elderly citizens sold their detached houses, which were often located away from city centers, to come back to central areas. Similarly, young people preferred to live in neighborhoods that are well-connected to the city and to their offices.

The COVID pandemic altered this situation. Today, two different kinds of preferences have emerged. On the one hand, we have people that still prefer to live in well-connected and central areas. On the other hand, with the democratization of ‘work from home measures,’ some people now prioritize having spacious residences and are therefore driven to surrounding suburban areas. Today, Japanese media tend to over-focus on the latter. However, it is worth noting that the majority of people still belong to the first group, which prioritizes ‘accessibility’ over ‘space.’ For that reason, the housing market in central Tokyo is performing very well, with both new and second-hand condominiums selling well. Regardless of COVID, I expect that trend to continue in the future.

Outside of Tokyo, what property markets do you consider to be most interesting moving forward?

To me, it will be Fukuoka and Sapporo because these two cities attract a lot of tourists, which proves that they have unique selling points, which in turn means that they will attract young people as well. These cities offer great food, various activities and a lot of venues for entertainment.

From the point of view of foreign investors, one of the criticism about the Japanese real estate market is its relative lack of transparency, especially when compared to other locations. As an American company with a presence in Japan since over 50 years, do you agree with that assessment? How do you address that issue?

When I worked for Morgan Stanley, foreign investors repeatedly asked me that same question. I agree that it is a conventional view of the Japanese real estate market, but the reality is that if you have a good connection with brokers, then that information is readily accessible. And in all truth, the same can be said about western markets, where information under confidential agreement are often “open secrets” that are shared, say, in a pub. That is how “transparency” is maintained in those markets. In contrast, Japanese professionals are extremely serious about protecting confidentiality agreements and would not discuss it in an open setting, which is why foreigners often have the impression that the Japanese market is “not transparent”. However, if you are well-connected and if you belong to the right inner-circle, information is readily available. That is the reason why people hire brokers! It is because we know what is happening in the market.

In October 2021, CBRE announced the launch of a new data center business that focuses on providing solutions to data center facilities. What are your expectations for this business line?

We have been successfully involved in data center projects since 2017. We made that announcement simultaneously to the hiring of a new professional in order to further promote our business solutions.

We are one of the most successful players in this space, but due to the nature of data centers, we cannot disclose information such as tenants, buyers or locations. That being said, we are very active in both the greater Tokyo and the greater Osaka area. Our strength stems from our capable industrial team that mainly covers suburban areas, which are suitable for a data center, as well as an industrial space. From now until 2026, we expect our Data Center business to generate a minimum revenue of $5 million per year.

In 2020, the ratio of foreign investors making direct investments in Japan’s real estate stood at 38%, a 17-point increase compared to the period of January-December 2019. How do you expect the role and contribution of foreign investors to evolve moving forward?

If you look at the market for hard assets, the activity of foreign investors has been steadily increasing. However, the same cannot be said about the capital market, which witnesses less activity in comparison to that of other developed nations. In Japan, hostile takeovers or taking companies private occur more rarely than in other countries.

Last year, Starwood Capital attempted a hostile takeover of Invesco’s J-REIT. Invesco defended the hostile takeover via its own privatization transaction, which was the first take-private transaction in the history of listed J-REITs. Until that deal, the FSA and the Tokyo Stock Exchange considered taking J-REITs private negatively. While the regulation allows for J-REITs to be taken private, the institutions did not accept it because they considered J-REITs to be a financial product, not a corporation. Last year, however, that changed! Such disruptions are needed to really open Japan to foreign capital. Unless we confirm that, Japan will remain a hard asset market, which is always harder to access for a foreign entity. Capital market activity should be monitored in order to see how Japanese real estate will develop with regards to foreign investors.

In 2016, you moved from Morgan Stanley to CBRE. What advantages does your background in banking bring to your activities in real estate?

Before Morgan Stanley, I actually worked for Mitsui Fudosan. At Morgan Stanley, I was an investment banker and I advised clients on M&As and other corporate activities. As such, what I am doing at CBRE is not so different from what I did at Morgan Stanley.

The most exciting part of working at Morgan Stanley was the intelligence I could gather. Through discussions with clients and colleagues, I could have access to a wealth of information. For example, because of discussions that they held over dinner with clients, my colleagues were able to predict who the new CEOs of the well-known Japan Inc. would be! Having access to that type of intelligence and information is incredibly stimulating. What I learnt from my time in banking is that service companies must have access to information to better serve their clients. As such, one of my goals is to further grow CBRE as a company that can gather and share crucial intelligence with its clients.

Learn more about CBRE here:

CBRE Japan

https://www.cbre.co.jp/en/

Investor Relation

https://ir.cbre.com/overview/default.aspx

Financials

https://ir.cbre.com/financials/annual-reports/default.aspx

0 COMMENTS