&Do Holdings, a key player in Japan’s real estate market, has seen substantial growth through its diversified services, including House-Leaseback, property buying and selling, and a growing franchise network. The company aims to enhance market transparency and cater to Japan's aging population with innovative financial solutions like reverse mortgages. With plans to expand its franchise model domestically and in Southeast Asia, &Do is positioning itself to transform the Japanese real estate and financial sectors.

Sustained by low interest rates and the lifting of COVID restrictions, Japanese land prices jumped at the fastest rate in 15 years leading into 2023. Attracted by this performance, the yen’s devaluation, and low interest rates, total foreign investments in Japanese real estate saw a 45% uptick in the first half of 2023 according to a Coldwell Banker Richard Ellis (CBRE) report. Supported by large purchases in the warehouse and logistic segment, Singapore became the first source of foreign investment, totaling almost USD 3 billion, followed by the US, Canada, and the UAE. Considering the current global macroeconomic environment, what makes Japan so attractive to foreign investors?

I too am very surprised to see so much foreign investment pouring into Japan, but I think it shows the high expectations towards the normalization of the Japanese economy. Japan has experienced a long period of deflation, but the Bank of Japan (BOJ) is taking aggressive and substantial steps to continue normalizing the economy, a sign that foreign investors are looking forward to a normalization of the Japanese economy

I am also convinced that the Japanese economy is moving toward normalization. During the deflationary period, banks were reluctant to extend loans, but now, through pressure from the Bank of Japan, banks are beginning to extend loans, as I feel in the course of doing business!

In recent months, Japanese media and observers have voiced their apprehensions as to the performance of the real estate market for 2024-2025. At the core of their argument has been the possibility of rising interest rates. While the BOJ’s revision of its negative rate policy was expected, investors fear that the continued devaluation of the yen could force the BOJ to produce further rate hikes. Market players are also on edge over the risk of oversupply in certain asset classes, especially as projects from large developers are to be completed in the upcoming months. How realistic do you believe these threats to be, and what is your outlook for the year 2024?

The overheating of the market is controlled by the interest rate which acts as a break. I believe that the BOJ will raise this interest rate appropriately. As for the banks, they are still skeptical about financial movements, and last year I could feel that they were trying to limit the amount of loans they were giving out, but with the rise in stock prices and pressure from the BOJ, I believe that rising stock prices and pressure from the BOJ will lead to more lending. We see no problem with interest rates rising as a brake on market overheating amid normalization.

Following a decline in 2020, the population of Tokyo’s Metropolitan area reached a record high in August 2023, driving demand for residential facilities. Furthermore, the price for new condominiums in central Tokyo doubled between March 2022 and March 2023, with luxury housing also experiencing a surge in demand as new projects targeted at high-net-worth individuals have started to become more prevalent. How do you expect the demand for Tokyo’s housing market to evolve? What advantages does your pre-built home brand, SHIRO, offer in comparison to similar products?

The phenomenon of rising prices always starts in the center of Tokyo. From there, the phenomenon spread to other regional cities across the country. The same cannot be said for the more populated and less popular regional cities, although the metropolitan area is exceptional.

As for our SHIRO brand, it is a new detached housing development, the key to the brand is simple yet functional designed houses for those that are seeking this sort of approach.

Founded in 1991, &Do Holdings now offers a variety of services under a six-axis business strategy. These include the firm's largest two businesses: House-Leaseback and real estate buying and selling; as well as new revenue generators, such as the franchise, brokerage, and renovation business. What advantages does this diversified service portfolio offer to &Do holdings? Looking at the future, which division do you believe has the highest growth potential?

&Do Holding's core business is in the residential sector, with 705 stores (as of April 2024) currently operating under the HOUSE DO brand. Japan has traditionally had real estate companies catering to the wealthy, as represented by giant conglomerates, but few national chains or franchises catering to the masses. What we want to do is currently in progress, our goal is to establish 1,000 franchise stores throughout Japan, from Hokkaido to Okinawa, and to make the price an open market, that is, to increase the transparency and soundness of the market. The sole purpose is to make the price an open market, essentially making the market very transparent and healthy.

To achieve this mission of a transparent and healthy real estate market, we are now building a franchise network as infrastructure, just as we build roads and railroads when we build a city. Once we have an extensive network of over 1,000 stores, we will be able to immediately assess and dispose of real estate in any area. This is something that is not being done in Japan today. Right now it is happening that an owner sells a property for 20 million yen because the market is dark, when 30 million yen is a fair price. Making the market open and accessible to people will increase the transparency and health of the market.

Our strength is that we are a company that can evaluate the fair value of real estate such as house leasebacks and reverse mortgages, which we are promoting in cooperation with financial institutions, and we also have sales channels.

In 2006, &Do Holdings started its franchise business, which provides information and educational tools to small and mid-sized enterprises entering the real estate sector. On top of providing training and conferences, &Do leverages IT technologies, introducing the web system management “DO NETWORK” and offering property search portals. As of December 2023, &Do had attracted over 700 stores and now aims to reach 1000. Why should an SME deciding to enter the real estate market choose to work under &Do franchise business? What steps must be taken to reach your target of 1,000 stores?

There are several franchises for rentals, but there are few options for franchise chains for buying and selling. The reason for choosing us is that we offer the expertise that I have accumulated in actually running the business since its inception. Other companies have no room to enter because their areas are saturated, and even if they have available areas and can franchise, they only offer their brand and do not have the know-how to teach companies with no real estate experience. There is no reason for us not to grow with all the potential that we have.

Japanese people indeed take a lot of time to make decisions, therefore it is hard to convince them to enter but still there are so many possibilities for us to grow.

As for major real estate companies, they don’t do any sort of franchising model. Despite this, I want to encourage them to make a franchise scheme that would enhance the market a bit.

Would you like to take this business model outside of Japan, and if so, what locations do you consider most appropriate?

We started applying our business model overseas five years ago in Bangkok, Thailand. We are now up to five stores, and next, we are considering expanding into Indonesia and other countries.

The Japanese buying and selling real estate market is considered 30 years behind the US, and Bangkok Thailand is considered 40 years behind Japan. Indonesia is even further behind, being considered 20 years behind Thailand. We want to take our know-how and contribute to the development of local areas, especially in Southeast Asian countries. Having said that, the US is much more advanced than Japan so we don’t have any intentions to go to the US.

As for Bangkok, there was no company there that bought secondhand housing, renovated that housing, and then sold it again to the market. This business is highly appreciated by locals, so we want to continuously develop this area and make local contributions.

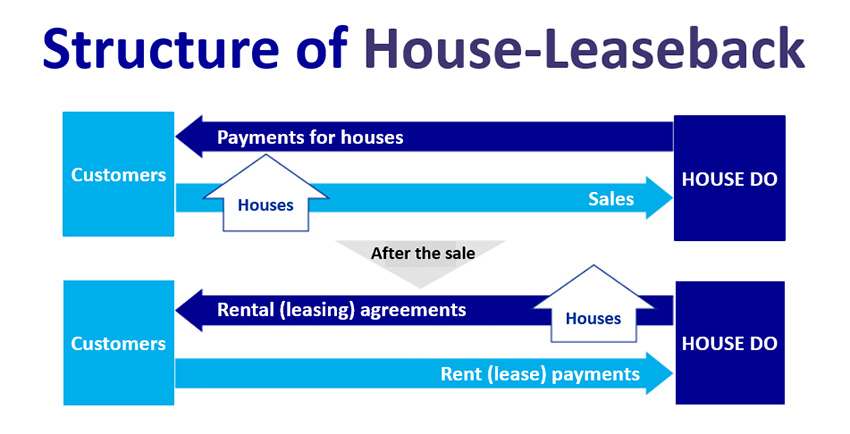

&Do’s second largest business segment by revenue is House-Leaseback. This model follows a sale-and-leaseback system in which the company purchases a property before leasing it to the original owner, allowing the owner to remain living. This system is used both for individuals in the housing market, as well as a corporate service to SMEs. In your latest earnings results for quarter two of the 2024 financial year, you reported a 24% year-on-year increase in this business division. For &Do’s customers, what advantages does this House-Leaseback model offer in comparison to the traditional “buy and sell” business model?

The reason for the proliferation of our House-Leaseback model is due to challenges with the financing structure for the elderly in Japan. I believe this is due to the problem of salaried workers' loans in the past, but non-bank lending companies are regulated to provide loans to individuals up to 1/3 of their annual income. They acquired their own homes and paid off their loans while working. Many of them used the money to pay off the loan and have real estate but little cash. They now only have their pension to live off of and sometimes that is not enough. They cannot go to a bank to borrow money since a bank will only give out a loan to those with paid work. As an option or solution that we provide, there is our House-Leaseback scheme. We have about 3,000 contacts from individuals per month referencing our House-Leaseback scheme so obviously there is a market for it.

It works by first having us evaluate the property that the borrower is living in. We purchase at 70% of the evaluated price. We then lease the property at 8% per annum as a house rent fee. If you wish to repurchase, you may do so at any time without a time limit by adding 15% to the amount already repurchased.

There are several competitors in this field these days, but many of the other companies have fixed deadlines for tenants to buy back their properties under fixed-term leases with expiration dates, or are vague about the amount of money they are willing to buy back. We are very clear about the amount we are buying back and we do not set a buyback or lease expiration date for the property as we sign a standard lease agreement. It isn’t a fixed-term lease, rather it is an unlimited, continuous renewal term of the lease to create more assurance with the owners.

How do you anticipate the demand for such services to evolve in the upcoming years? Why are &Do Holdings better equipped than banks or other real estate companies to cater to this particular demand?

The purpose of providing financial and real estate products is to help senior citizens who are struggling to acquire loans. It is almost as if the House-Leaseback is an inevitable form of receiving the loan. It also highlights our Reverse-Mortgage scheme which should come before House-Leaseback.

We are in the business of guaranteeing reverse mortgages in partnership with financial institutions. We evaluate the real estate that will serve as collateral and guarantee the bank's debt so that the bank can provide the loan. Once the person passes away we sell the property and use that as payback. The LTV(Loan to Value)ratio for Reverse-Mortgages is 50% whereas for the House-Leaseback it is 70%. People who need money should first go for a Reverse-Mortgage and then if they need more they can go to our House-Leaseback.

I think a strength that we have here at &Do Holdings is that we have all-encompassing capabilities in-house. Being able to take care of everything from evaluation to selling in-house gives us deeper economic merit and makes us price-competitive. By improving the flow of funds, we would like to contribute to Japan's efforts to end deflation.

&Do’s largest business segment is traditional real estate selling and buying, which experienced substantial growth in recent times. According to your latest earning results for quarter two of the 2024 financial year, net sales increased by nearly 70% to reach JPY 18.9 billion, while operating profits jumped by more than 40% on the backdrop of a stark increase in the number of transactions. What are the main reasons behind this impressive growth? How do you plan to continue growing this business segment, and what type of asset classes will you target?

The reason why there has been a drastic increase in profits this year is that during the COVID-19 pandemic, we purchased that has been released by many property owners. These are now bearing fruit, especially the commercial facilities that we have purchased. As for future growth potential, we are focusing on enforcing our Reverse-Mortgage Guarantee Business scheme. It is also important that we strengthen our traditional business as well; currently, the second-hand market is becoming more active in Japan, so purchasing second-hand detached houses, renovating them, and then reselling them is something that we want to strengthen.

With the strength of nationwide appraisal and disposition, &Do would like to expand to guarantee not only reverse mortgages but also various types of real estate-backed loans, including those for business use. In the future, we would like to create a world where real estate can be liquidated and conveniently utilized by working with financial institutions to establish an online mechanism that allows customers to have a line of credit secured by their real estate, and within that line of credit, to freely obtain and repay loans.

From what we’ve seen during our interviews, Japanese people are very conservative when it comes to financing options and investments. Aren’t you struggling to convince people to go forward with these types of financing solutions since they might see them as risky or unproven?

Japanese people are indeed very conservative and I always question myself why there aren’t any other companies offering reverse mortgages like ourselves. It is such a lucrative market and it is good for the people of Japan as well. A regular mortgage is 100% of the value of the house, but a reverse mortgage is 50%. Our products are well received in the market at the moment, so although there are questions as to why, we feel now is an incredible time to push forward and keep pursuing our goals. It is my lifelong mission personally to take this company and change the financial and real estate markets in Japan to make them more open and accessible to everyday people.

For more details, explore their website at https://www.housedo.co.jp/and-do/en/profile.html

0 COMMENTS