Through insightful observations on the shifting dynamics of the US-China relationship and the role of traders in the Japanese economy, Shinshu Trading underscores the importance of adaptability and value-added services. Diversifying its portfolio into emerging sectors like battery technology and eco-friendly lighting, the company leverages strategic acquisitions and supplier networks to ensure stability and meet evolving market demands.

Japan’s industry is currently at a pivotal moment. Driven by recent supply chain disruptions from the COVID-19 pandemic and US-China tensions, multinational companies now seek to create more reliable supply chains. Japan's longstanding reputation for reliability, trustworthiness, and efficiency in production, coupled with the yen's depreciation, has led experts to argue that today is an opportune time for Japanese supplier to expand their market share. Do you agree with this assessment?

The China-US decoupling is more of a political movement, and since it is still in progress it makes it very difficult to envision how the outcome will unfold in the future. Having said that, we are keeping a close eye on the situation.

25% is the tariff currently imposed on Chinese goods imported to the US, but former President Donald J Trump has said that he would raise that to 60% if elected. Given the mutual dependence between the Chinese and American supply chains, I am dubious if this is going to happen.

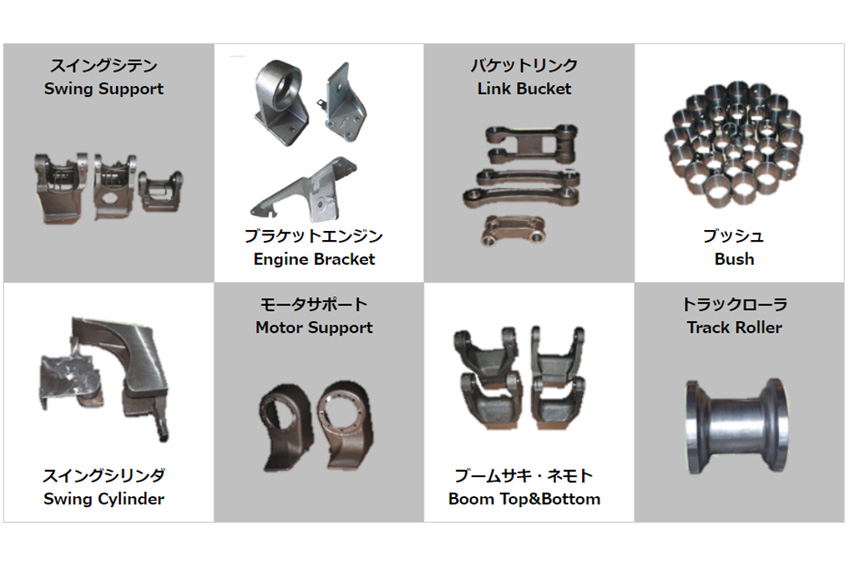

I believe in the future some industries will shift to new supply chains to avoid China and to reduce country risk. However, many industries, including casting, remain reliant on Chinese suppliers, and it is difficult to imagine a scenario where these products are completely sourced outside of China.

In the 70s and 80s, traders played an important role in the Japanese economy. Over the last 25 years, however, the rise of digital sales platforms has put into question the role of traders as middlemen. To continue growing, experts say that Shoshas (traders) need to evolve by offering added-value services, including engineering or matching services. How have you seen the evolution of traders from the 90s to today, and what do you think will be the next step of evolution in the Shosha (trading) business?

For decades, the role that traders play in supporting Japan has been a vital one. To truly understand the role of traders, one must consider that the Japanese industry is composed of many SMEs. These SMEs often have great technologies, but lack the manpower or financial strength to expand internationally and to engage in global marketing.

In this environment, the mission of traders is to create sales channels between domestic and overseas suppliers. In other words, our mission is to create a bridge that connects the Japanese market with the international one.

If suppliers were to work solely with end-users, they would only foster one-on-one relationships, thereby limiting their business model. By working with a trading company, these same suppliers can connect with a greater variety of businesses, sectors, and industries. There is a huge upside for suppliers to work with traders such as ourselves to expand their sales channels.

To be a successful trader there are three criteria that you need to meet. Firstly there is a need for talented qualified human resources, and of course, these human resources need to be well-educated and have a wide knowledge base. Secondly, traders must have access to plenty of finances. Finally, traders must have access to extensive information that exceeds the understanding of the general public. Having access to valuable information ahead of others allows traders not only to act as a middleman, but also to provide consultation, advisory, and match-making services.

Shinshu Trading is known as a trader of casting and forging equipment. At the same time, you have extended your business portfolio to include industrial equipment and machine tools, as well as lighting fixtures. Could you elaborate on the benefits of diversifying your business and what you believe to be the main growth drivers for Shinshu Trading in the future?

We started diversifying our business by leveraging on the pre-existing network of customers that we created in the forging and casting parts industry.

We began to diversify our operations when we felt that we could provide a new product that would be essential to our existing customers’ business operations. For example, customers would have warehouses, factories, and offices, all of which required sustainable and high-quality lights. The lighting business has become the main business of our steel parts business, and it can be said that we can kill two birds with one stone.

Looking at your entire product portfolio, which product will you focus on moving forward?

Batteries will become an important industrial field in the future. We are watching for opportunities to enter this industry, including M&A.

Secondary batteries will certainly be a focal point of our future expansion. While we have not fully entered the battery business as of yet, we are interested in acquiring a company that does have battery parts manufacturing capabilities.

Secondary batteries are an interesting field as they present both challenges and opportunities. Although the utilization of secondary batteries has become a global trend, challenges remain as to the recycling and sustainable discarding of used batteries. If we consider the 3Rs: reduce, reuse, and recycle; we are currently only able to reduce or reuse lithium-ion batteries. The expansion of the battery market together with the challenges the industry faces makes it an interesting sector.

What segment of the battery industry are you looking to focus on?

While the particular segment we will enter has yet to be defined, we will not focus on the provision of core battery components, rather, we will focus on auxiliary technologies and components.

To understand the global battery business, one must consider the Chinese mindset regarding secondary batteries. Globally speaking, people say that energy is a resource, which means it has to be harvested from nature, not created from scratch. China on the other hand considers that energy is not so much a resource as it is something that can be created from scratch. For this reason, China made the development of its energy sector, including renewable energy technology and battery technology, a critical target of its expansion.

We see a lot of unrest globally right now, especially around the Suez Canal. China is heavily reliant on the imports of oil, so as a national policy, the government is diversifying out of the Middle East for crude oil. I had a meeting with a Chinese official and I was able to acquire this information.

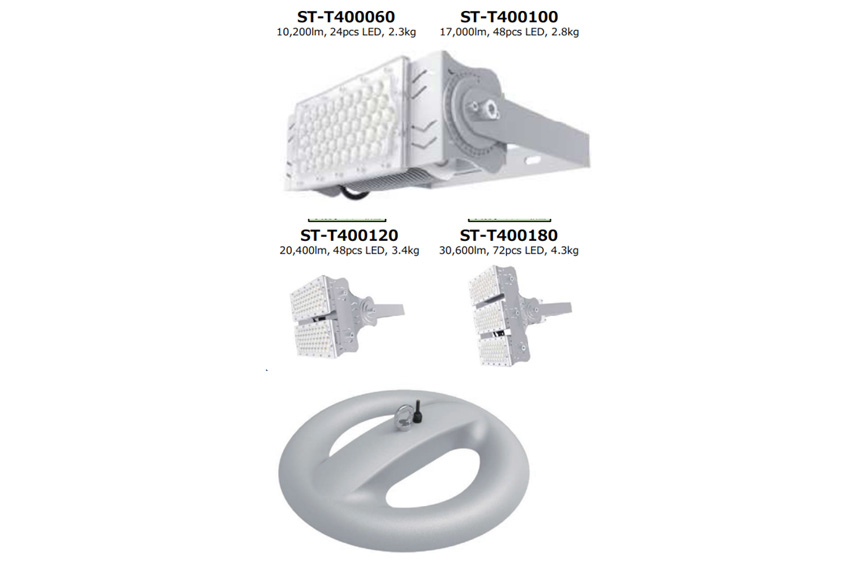

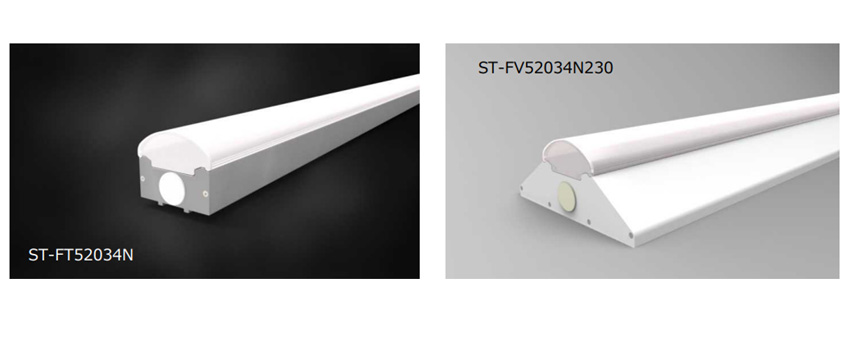

The quest for sustainable and renewable energy is the number one challenge of modern times. In 2016 you established your environmental promotion department, creating and selling eco-friendly lighting products. For example, your LED light Terasu consumes 50% less energy but is 20% more luminous than conventional lighting solutions. Can you explain your energy-saving developments and the strengths of these products?

Terasu is our electrodeless lamp, which we developed way back in 2016, and which we have replaced by eco-friendly LED alternatives. Terasu was developed to compensate for emerging LED lamps that were too bright to use in certain applications, such as inspection lines, where LED brightness limited the inspection process. However, recent LED technology has evolved in a way that allows the lamps to be dimmed. Following this development, LED lights can now be utilized across inspection lines, as well as other applications.

Now that Terasu is no longer needed, we are shifting our focus to LED, which has more energy-saving effects compared to conventional products. Some of our LED products offer a 75% reduction in energy usage compared to conventional lighting solutions.

Simple and Amazing LED Light

LED Base Light

In recent years, many countries have rolled out regulations to promote the use of eco-friendly lighting. For example, the United Kingdom in January 2023 proposed increasing the minimum energy performance for lighting to the highest level in the world, at 120 Lumens per watts (lm/W) in 2023 and 140 lm/W in 2027. Considering these changes in regulations, what markets do you seek to sell your LED products to?

In a similar fashion to our other businesses, we do not produce or develop lighting technologies in-house. Rather, we collaborate with a leading manufacturer. In this collaboration, our role is to gather information and understand the needs of various markets and industries. We then report that information back to the manufacturers, who act accordingly to create the best-suited product.

With regards to applications, we are currently targeting factories and inspection lines, as these always require new, more cost-effective, and environmentally friendly technologies.

The higher the lumens per watt the brighter the light becomes. It is important to develop technology, but at the same time monitor the brightness so that it remains aligned with the requirements and demands of our target customers.

In 2019, you acquired Tanaka Machinery, a company specializing in machine engineering and metal-cutting technology. How is this acquisition improving your company’s portfolio and what opportunities for synergy do you see coming as a result?

Our purchase of Tanaka Machinery was not driven by the need to create synergies. Instead, we see Tanaka Machinery as its entity, with its customers, technologies, and strategy.

Tanaka Machinery’s specialty is providing parts to large-scale printing equipment manufacturers. The company has its business operations and its own established relationships with major printing equipment makers, such as RICOH. We would like to maintain its business operations moving forward.

We like to think of the acquisition as more like adding a business pillar to our already existing structure. To this end, we are now focused on acquiring a battery-related company with the potential to expand and reach out to major companies.

Looking at the future, what regions or countries would you like to expand into?

To have a successful overseas expansion, we must identify markets where we can not only create sales channels but also foster a robust supplier network.

For sales, we plan to establish a company in the US in the upcoming years. Currently, all of our main suppliers are Chinese, but we are actively seeking to incorporate Indian, Filipino, and other Southeast Asian suppliers.

Last week, I visited India on business to meet with potential suppliers and partners.

What type of suppliers are you looking for?

Our core business is casting and forging components for import, so that would be our core target. If needed, setting up machine shops in a locality is also an option. Also finding new, innovative companies in the field of batteries is something we are keen on.

Over time, we have successfully diversified our supply chain. Today, we do not rely on just one supplier for any of the products that we trade. Because we have backup channels and multiple suppliers for each item that we trade, we did not have supply-chain disruptions during the COVID-19 pandemic. In comparison to many other companies, which suffered due to shortages and logistic disruptions, our operation remained constant, to the great pleasure of our clients.

We also have invested in building our warehouse in Japan, allowing us to always have ample inventory. The combination of our warehouse and our diversified suppliers network allows us to keep our business operations running smoothly, even in times of great disruptions.

Considering this, further expanding our supplier's network will be a core pillar of our expansion strategy.

The warehouse of Shinshu Trading

Some of our products: Balance weight

Some of our products: Construction machine parts

Imagine that we come back in six years and have this interview all over again. What goals or dreams do you hope to have achieved by then?

If you came back in 2030 and I was able to execute what we’ve talked about today, namely, entering the battery business and expanding our client and suppliers network globally, I would be very happy. These are my goals.

For more details, explore their website at https://www.sstrading.co.jp/index-nos.html

0 COMMENTS