Specializing in niche areas like glass manufacturing, Ikeda Glass focuses on high-quality products, responding to rising demand from industries such as construction and automotive. While domestic production remains its core, the company is open to overseas expansion, particularly through technological collaborations and software exports. With a focus on sustainability, the company is enhancing energy efficiency in its production processes and exploring solutions for carbon-neutral housing.

Right now is a pivotal time for Japanese makers. Policies like the US Inflation Reduction Act are forcing corporations to diversify their supply chains for reliability and to reduce country risks, with nations such as China. Japan is known for its reliability, advanced technology, and a weak JPY, so for the time being Japan has never been a more cost-effective option. This means that Japanese firms have an opportunity to expand their existing global market shares. Do you agree with this sentiment, and in your opinion, what do you believe to be the advantages of Japanese companies in this current macroeconomic environment?

It is true that the global supply chain is being restructured, especially with trade friction and the war in Ukraine affecting the global chain. We do not have direct sales channels overseas, but there have been instances where, for example, stainless steel has been imported from Russia when new equipment is being installed, and the current situation has resulted in price, lead times, and time to procure the materials needed for these pieces of equipment. There are many factors affecting our company at this time of global turmoil.

Japan has a high percentage of small and medium-sized enterprises (SMEs) compared to all enterprises in other countries, and the strength of such enterprises is that each of them has a specialty or extremely high level of expertise in a particular field. In our case, we are experts in glass, and we are proud to say that we are one of the best in our field. Because this specialization is a highly niche area, we try to understand the needs of our customers and make sure that we do not over-qualify, that is, that we do not cost too much. At the same time, however, there is a demand for high quality within the industry.

When it comes to changes in the supply chain, I think companies are thinking differently. In the past, the focus was only on price, favoring production in China or Vietnam, but after COVID-19, as a result of the increased complexity, I believe that stable, high-quality supply is now more important than anything else. Not only industrial companies, but also construction companies are demanding high quality glass, and we have been receiving an increasing number of inquiries recently.

Japan is known worldwide for its aging population, and experts are now predicting that by 2050 the population of Japan will dip below 100 million due to low birth rates. This has created a labor crisis as well as a shrinking domestic market. From your perspective, what have been some of the challenges and opportunities you’ve seen as a result of this demographic shift, and how are you reacting to these changes?

While aging is considered a serious problem, we must always keep in mind the fact that advances in modern medicine have increased people's life expectancy and enabled them to live longer and healthier lives. Therefore, we have restructured our organization and systems so that we can continue to employ more senior workers under more flexible work arrangements and wage levels. This has helped to mitigate the loss of our workforce.

When it comes to production, improving operational efficiency is essential, and DX is one of the keys to achieving growth not only in factory production, but in business operations as well. Automation is important for labor savings, and we are actively using industrial robots and co-working robots. On the business side, we are actively exploring the use of AI, although there are some difficult issues such as security.

Importantly, the purpose of human labor is changing. It will be about how to control robots and AI and how to best manipulate this technology to increase productivity.

The size of the market will certainly shrink, but I believe that along with that, there will be a reorganization of the industry itself. M&As within the industry will also increase positively. Basically, it will be survival of the fittest. In order to maintain market share and stay in business, we need to be needed. As for our company, we are trying to hone our expertise and take a leading position in this niche.

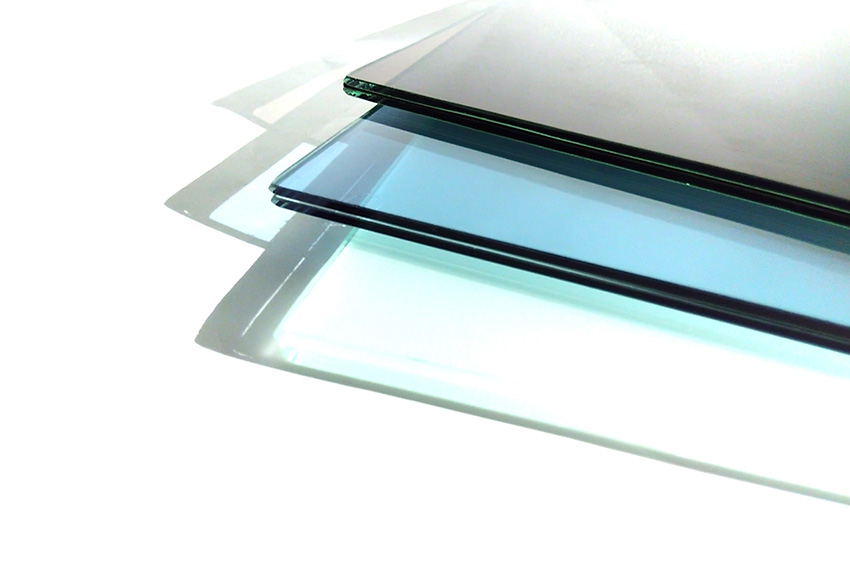

Architectural glass products

You mentioned the possibility of M&As. To that end, we know that your company isn’t only focused on national markets, but also reaching overseas markets. Would you be interested in expanding overseas? If the answer is yes, which locations are you interested in and what strategies would you employ to do so?

Of course, if the opportunity arises, we would like to actively develop our overseas business. At present, however, we do not have a clear overseas business strategy in our management plan. Basically, everything I am going to say here is my personal view. Our current business portfolio is centered on domestic production, with overseas operations profiting from the procurement of materials and semi-finished products. We have been doing business with China and Taiwan for more than 20 years now, and as the demands of our domestic customers have diversified, so has our overseas procurement supply chain. We believe that having a base that can respond to diversified procurement and supply schemes is one possibility for the future. However, there would not be much business merit in taking our current business model overseas as is.

Another experience we had in the past was an invitation from a client to expand overseas. The client was going to expand into the U.S. and asked us to go with them. We declined the offer. Instead, we entered into a technology licensing agreement with the customer and provided them with all of our assembly equipment and technology. I believe there is potential for overseas expansion in the soft side, so to speak, and for technological alliances.

From the perspective of software export, there is also potential for overseas development of digital software. We are currently developing a new digital tool in-house related to the optimization of glass production. Once this software is completed, we believe it will be an interesting overseas business to sell our know-how to the world.

Throughout our interviews, the theme of collaboration and partnerships often comes up as a way of penetrating new markets as well as co-developing products. What role do partnerships play in your business model and are you currently looking for new partnerships with either domestic or overseas companies?

First of all, partnerships are crucial to our business. One example of a jointly developed product is one we co-developed for the military. Unfortunately, we don't know exactly what it will be used for, but this glass has 60 layers of coating treatment on both sides. To develop this type of glass, we worked with a coating company. We are always looking for new partners, both national and international, to meet our customers' needs and to expand our product range.

The glass industry’s size is estimated to be worth about USD 217 billion in 2023 and is expected to reach above USD 230 billion in 2024. How do you see the next 12 months playing out for your firm and the industry as a whole, and what would you say are the main growth drivers from your perspective?

A recently emerged global trend in glass is also emerging in Japan. In the building industry, there is a growing demand for high-performance double glazing. In addition, the need for carbon neutrality has made residential insulation extremely important. In this housing sector, window glass is currently being retrofitted to improve thermal insulation. At the same time, the automotive industry is undergoing dramatic changes, especially with the advent of the CASE (connected, automated, shared, and electric) era, which will change the way glass is used. There is now a need for more functional glass. Although we do not develop materials, there have been announcements of glass that can also function as a display, as well as glass with 5G antennas. In the near future, automobile windows may become display windows. Another thing to remember is that once Level 4 of automated driving is realized, drivers will no longer need to look outside to drive at all times. In order to respond to these changes, we will need to develop new machining and component assembly technologies that are compatible with cutting-edge technologies.

With regard to the domestic building industry, there has been an improvement in profitability. This reflects the results of reforms within the industry. The cost of each item has increased, and the profitability of glass manufacturers has improved. However, this does not necessarily indicate an increase in demand; demand may be declining. This building industry is our specialty, so we are paying attention to what will happen in the near future. Since most window glass in Japan is still single pane, as Japan moves toward carbon neutrality, replacing window glass with double pane will not only save energy, but will also promote the reduction of CO2 consumption in homes. Demand for window retrofits is a major driving force in Japan.

Your company was founded in 1943 and has emerged as a strong player in the window and glass industry of Japan. Today you provide various panes of glass for various industries. Among all the different fields you cater to, which do you believe has the most potential for future growth? Are there any new business sectors that you would like to cater your products to?

Our strength lies in the fact that our business is broadly involved from upstream to downstream in the value chain. Since the needs of the end user are downstream, we are able to grasp the needs of our customers in close proximity to them. At the same time, since we operate broadly from upstream, we have a high capacity to respond to and shape those needs. We supply products to three main sectors: construction, automotive, and electronics. We see growth potential in each of these industries. Our strength lies in our comprehensive industrial applications, which allows us the flexibility to meet the needs of any application. We are constantly researching and developing new solutions that we apply to leading edge technologies.

With regard to automobiles, we understand the needs of complete vehicle manufacturers and provide technology to them. Recently, inquiries from automobile manufacturers have become more sophisticated, and include, for example, the assembly of cameras. In addition to providing stable assembly at a high level, we also want to be able to make proposals that go beyond the design stage. I believe that having both the ability to make proposals and the ability to execute them will be the key to moving our company forward.

For construction, likewise, we want to have this ability to make proposals for environmentally sound housing systems. Currently, what is happening is that people who want to build a housework together with a maker or a general contractor, but we want to have a voice in providing a comprehensive solution and making housing more environmentally sustainable. We have expertise in glass obviously, but beyond that, we understand energy efficiency and can propose new methods.

In terms of sustainability, the material is highly advantageous, partly due to the megatrend trend of de-plasticization. On the other hand, the manufacturing process of double-paned windows and tempered glass requires a lot of energy. To reduce carbon dioxide emissions, we want to be active in the use of solar energy. Of course, generating solar energy alone is not enough, so we want to use as much green energy as possible in our production plants, in combination with energy-saving and energy-storage technologies.

Japan, like the rest of the world, is facing an energy crisis. In addition, your company faces the challenge of delivering highly effective isolation solutions, and your double-glazed products are commonly employed in windows that showcase various structures in order to create substantial isolation effects. What material and design considerations are you employing in your spacer that is present in your double-glazed glass products? How does your spacer contribute to the overall insulation performance?

The technology of insulating glass is not unique to our company but rather was pioneered by American and European glass manufacturers. We have taken their experience and applied it to our products. However, we were the first to introduce this technology to the Japanese market, and about 50 years ago, we went on a tour of Europe to Germany and Italy, countries that were at the forefront of these innovations. We brought that equipment back to Japan and began installing insulating glass processing equipment.

What innovative technology have you introduced to your clients that you are particularly proud of? Can you give us an example of a very innovative glass that you have been able to implement?

Our business model is based on customer requirements. We do not have R&D facilities to develop original ideas, but we hope to do so in the near future. One example is non-reflective glass, which has applications in several industries. This is the glass used in fish finders, which is resistant to salt water and has a coating that does not reflect light. I believe our strength is our ability to combine existing technologies and create something new from them. The results are being used in the fishing industry around the world.

Picture Suggestion: No-Reflection Glass for fish detection

The next glass I would like to talk about is "anti-fingerprint adhesion glass. It is not smudged by fingerprints and can be used for entertainment purposes such as game enclosures. It has a double coating and, interestingly, this type of glass has an extremely high domestic market share.

In recent years, more and more of our glass is being used for railroad interiors. Railcars are designed with various innovations in terms of design and functionality, and our glass is used for display covers for advertising and luggage racks in the cars.

On recent trips to Europe, I’ve come across triple-glazed glass and it makes me sad to come back to Japan and see only single-layered panes. Fortunately, there are government subsidies available now, so I would like to create products that make window renovation easier and more affordable.

Imagine that we come back in four years and have this interview all over again. What goals or dreams do you want to achieve by the time we come back for that new interview?

Our corporate philosophy has always been to value people, and that includes both customers and employees. We believe that human resources are a company's best asset. Now, more than ever, we are pursuing a strategy of valuing our people and making them our strength. By the time you return, we hope to have created a more comfortable working environment where our employees can feel pride and joy in their work. I am sure that four years from now, the fact that we have so many talented people will be a strength that other companies will not be able to imitate.

For more details, explore their website at https://www.ikedaglass.co.jp/

0 COMMENTS