With more analysts and researchers covering mid- and small-cap equities than any other firm, and a unique approach to client relations, Ichiyoshi Securities has become the go-to partner for investors seeking exposure to Japan's "hidden gems." In this interview with The Worldfolio, Mr. Hirofumi Tamada, President of Ichiyoshi Securities Co., Ltd., discusses how the company achieved this leading position in the market and highlights the advantages of its 'stock-type' business model.

In March 2024, the Nikkei 225 roared past the 40,000 yen mark, crowning a record-breaking year for Japan’s financial markets, This favorable backdrop drew an unprecedented flood of foreign capital, with foreign investments in Japanese equities reaching a 10-year high. What were the core reasons for the extraordinary performance of Japan’s financial markets, and what makes Japan attractive to foreign investors today?

The most significant turning point that has attracted investment to the Japanese market was the shift from deflation to inflation. For the past 30 years, Japan experienced deflation, which offered little incentive for investment. However, with the current move toward inflation, wages have risen, creating a more attractive environment for investors. Additionally, Mr. Yamaji, Group CEO of the Japan Exchange Group is actively driving corporate reforms by enhancing corporate governance. These reforms have led to higher dividend payouts, increased payout ratios, and share buybacks. These proactive measures have attracted greater attention to Japanese equities and has made foreign investors more confident in placing their money in Japan, leading to a significant increase in foreign investments.

Japan is renowned as a country of monozukuri (manufacturing excellence), and we are currently witnessing a resurgence of the country’s manufacturing sector, particularly in the semiconductor industry. Ichiyoshi Group’s specialization and expertise lies in the creation of small to mid-cap funds, which consist of companies that are less impacted by currency exchange fluctuations. These companies demonstrate high potential and strong performance records. While Japan was in deflation for the past three decades, stock prices in other countries continued to rise. Now, the time has come for Japanese companies to elevate their stock values, and I see significant growth potential in the Japanese market.

Another crucial factor has been the surge in inbound tourism. This year, the number of visitors is set to exceed 33 million, and the Japanese Government has set a target of 60 million inbound tourists by 2030. Having more people discover and learn about Japan, and become more attached to the country, will inevitably stimulate even more active investment.

In recent months, a cloud of apprehension among investors has slowly begun to materialize. At the core of those worries has been the argument that Japan’s most recent performance is based on macroeconomic conditions and “external factors”, and that an eventual strengthening of the yen or repeated hikes in interest rates could trigger a downfall. On the other hand, analysts have argued that “internal factors,” such as the TSE’s corporate governance reforms together with the Government’s push to better the investment environment through initiatives such as the new NISA account will carry this bullish momentum forward. Should macroeconomic conditions normalize, do you believe that those “internal factors” will be enough to push the bullish momentum forward?

From a macroeconomic perspective, although there are several ongoing changes, I do not believe that changes in interest rates will significantly impact the current positive investment climate in Japan. In July, Bank of Japan president Mr. Ueda announced an increase in the interest rate to 0.25%, an increase that simply reflects recent economic growth. In 2006 and 2007, during President Fukui’s tenure at the Bank of Japan, interest rate hikes coincided with periods of economic growth. This was a successful approach, underscoring the current favorable situation for Japan. Moreover, the maximum level to which interest rates could rise is likely around 1%. Even if rates were to exceed this threshold, the increase would be gradual to mitigate any potential market impact.

It is also worth noting that the U.S. is expected to lower its interest rates soon, which would result in increased capital flows from the U.S. into Japan. Over the past year, we have seen large inflows from Chinese, European, and Middle Eastern investors, but American investors have yet to fully deploy in the country. Additionally, due to the ongoing U.S.-China trade dispute, Japan has become an increasingly attractive destination and a profitable alternative to China. This trend is expected to continue, bolstered by internal reforms and the introduction of the new NISA account for individual investors.

The increased attention that Japan is receiving is something we feel in our business. Each year, we engage in various activities, including a roadshow in North America. However, recently, more investors are visiting Japan to conduct market research. Furthermore, corporate reforms are advancing, and the rise in interest rate returns within the banking sector is beneficial for Japanese citizens without residential loans. Overall, the Government aims to foster a healthy and prosperous investment environment in Japan. The government, in close collaboration with the Bank of Japan, will continuously monitor and manage market conditions to ensure they remain positive.

Japanese equities still have room to attract new foreign capital. While European and Asian investors have been leading the charge, North American investors have yet to fully rotate into the Asian island. The U.S. had a relatively small presence for its market size, averaging just 65 billion yen in net purchases per month from April 2023 to January 2024. A potential cut in U.S. interest rates, which many analysts expect to see in the upcoming months, could help to unleash new capital from a market whose players are famous for their focus on growth investing strategies. What products and services do you offer to cater to foreign investors? How do you expect foreign investment inflows to evolve over the upcoming year?

Our business offerings to overseas investors primarily revolve around the Ichiyoshi Group. We operate the Ichiyoshi Economic Research Institute, which specializes in providing reports on small to mid-cap stocks. We produce the most detailed and informative reports in Japan, making us the leading source for small to mid-cap Japanese stock information. By leveraging this high-quality information, we offer specialized products targeting small to mid-cap stocks.

Unlike large companies that offer a wide range of products, we strive every day to achieve our goal of becoming a "name-brand boutique house" in the financial industry. This focus allows us to fully capitalize on our strengths and deliver the most suitable products to our overseas investors while earning brokerage fees. Additionally, we have an international sales division within our institutional investment department dedicated to serving the needs of global investors.

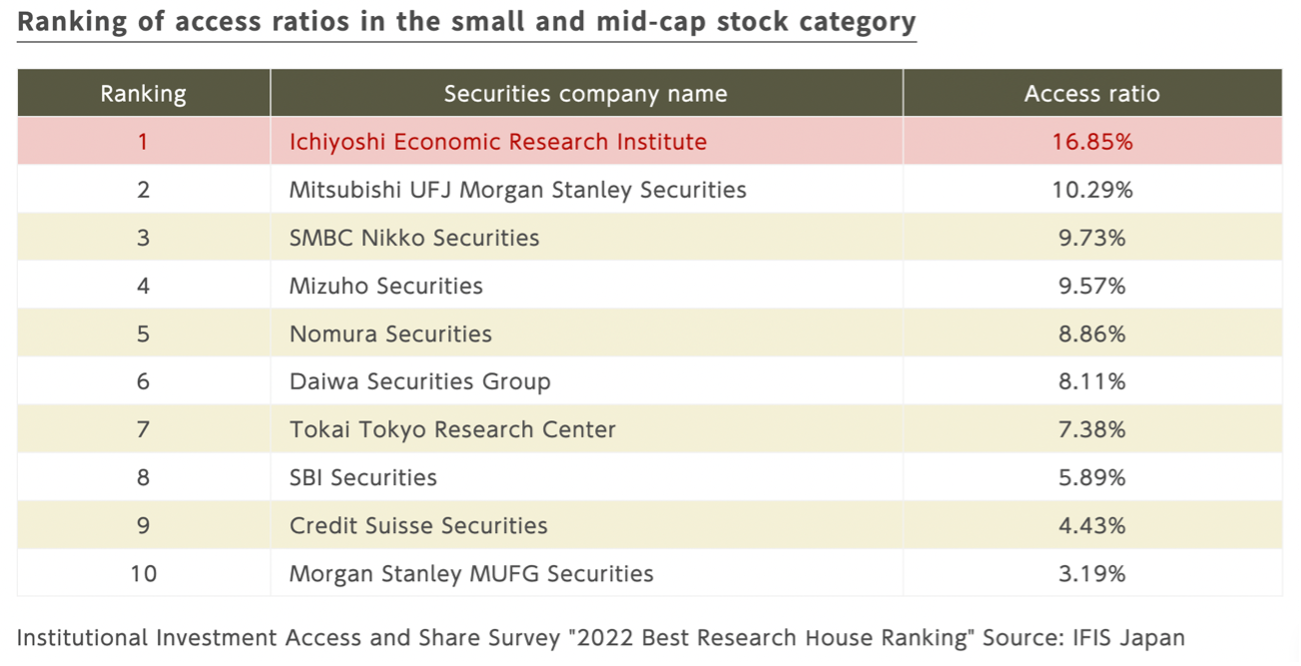

The Ichiyoshi Research Institute has the highest access ratio in the small to mid-cap stocks category, well ahead of corporate giants such as Mitsubishi UFJ Morgan Stanley Securities or SMBC Nikko for example. How are you able to have such depth in research and information gathering in front of these corporate giants?

Our uniqueness lies in our specialization in small to mid-caps. Major companies typically focus on large-caps, such as Toyota and similar firms. However, the number of analysts we have who specialize in small to mid-cap stocks is significantly higher compared to those at larger firms. We conduct face-to-face interviews and prepare company report for approximately 720 companies, which is quite extensive and highly valued, particularly by our foreign investors.

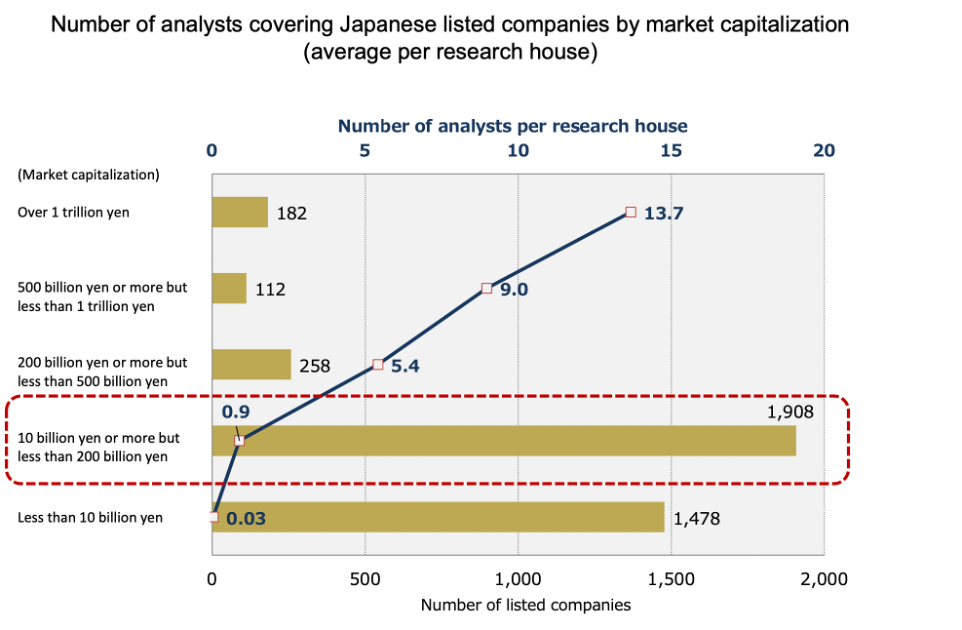

The graph above illustrates the number of analysts by companies with a specific market capitalization. You’ll notice that the number of analysts covering large-caps, companies with a market cap exceeding JPY 1 trillion, is much higher. Conversely, there are far fewer analysts for companies with market caps of JPY 10 billion or more but less than JPY 200 billion, highlighting the scarcity of analysts specializing in small to mid-cap stocks. This is where our strength lies. Our large team of analysts is dedicated to analyzing small to mid-cap stocks. This has been a significant attraction for overseas investors, who frequently request our assistance with investor relations (IR) arrangements. Since our establishment, we have concentrated on small to mid-cap equities, with our research institute providing in-depth analysis and comprehensive insights on these companies over the years.

We have also been recognized by J-Money, a specialized investment magazine. For the past 20 years, we have ranked number one in the category of small and mid-cap research reports read by professional investors.

Looking at the mid- to long-term, the TOPIX Small has outperformed both the TOPIX 100 and TOPIX Mid-400. Why is choosing Ichiyoshi Securities rather than an ETF more advantageous?

The core concept of our business is active management. Our products are designed to hold small to mid-cap stocks for the medium to long term. It is well recognized that small to mid-cap stocks can outperform larger companies, particularly when held over a mid-to long-term horizon. Active management is, therefore, a fundamental aspect of our approach and a desirable vehicle when investing in this category.

Over the past year, the TSE released a series of corporate governance reforms aimed at enhancing the fundamental appeal of Japanese companies by promoting capital efficiency and enhancing corporate transparency. Early results of these reforms have been found in the substantial increase in share buybacks. As of May 2024, approximately 9 trillion yen in buybacks has already been announced, positioning the market to set a new record for the fourth consecutive year. How do you rate the current wave of corporate governance reforms in Japan, and what further reforms would you like to see corporate Japan embrace?

There has been significant progress in Japanese corporate governance, mainly driven by the ambitious reforms of the TSE. In a few month, the TSE’s reforms have led to increases in the Price-to-Book Ratio (PBR) through share buybacks and higher payout ratios. However, these measures are often temporary. Therefore, it is crucial for companies to design a well-defined strategy to set the direction and enhance overall capital efficiency and Price-to-Earnings Ratio (PER). While many companies in our industry are taking steps to increase their PBR, it is more important to focus on a long-term vision and strategy to improve the PER.

At Ichiyoshi, we have not engaged in share buybacks or increased payout ratios merely in response to TSE's guidance, as we have been implementing these practices since the 2000s. We have consistently engaged directly with our stakeholders, building strong relationships over the years. It is essential for companies to prioritize strategic planning for the years ahead.

Over the past year, Ichiyoshi Securities’ stock price has increased by more than 30%, jumping from approx. 630 yen in July 2023 to more than 850 at the start of July 2024, bringing the company’s market cap to surpass the 31 billion yen bar. How do you review this performance? And what do you think makes Ichiyoshi Securities interesting to market investors?

The recent rise in our stock price and market capitalization reflects the market’s growing understanding of our philosophy. Since 2000, our business model has shifted from one that relies on brokerage commissions to one that relies mainly on trust fees and wrap fees. We have focused on increasing customer asset under custody and strengthening the management of client assets. Therefore, a "stock-type business model" (asset-accumulation type business model) is more attractive to us. Prior to the recent NISA reforms, the Japanese government eliminated products with high brokerage fees and uncertain benefits. This shift in mindset has highlighted the superiority of the "stock-type business model" that we have practiced for over 20 years, and the market has finally begun to recognize its value.

While our current stock price reflects some of our progress, I am not fully satisfied. Although our PBR is performing better than that of many other companies, we still see significant potential for future growth.

Looking at the future, what new products are you looking to offer?

In Japan, household assets amount to approximately 2,000 trillion yen, with half of these assets held in savings. Part of our goal is to help unlock this capital through investment opportunities that focus on mid to long-term investments. However, this concept of mid to long-term investing has yet to be fully understood and embraced in Japanese culture. As a provider of these opportunities, we aim to spread awareness and help shift the mindset of the Japanese public towards mid to long-term investments. Simplifying products is essential, particularly given Japan's aging population, where the majority of household assets and savings are held by the elderly. Therefore, it is crucial to offer products that are easy to understand, and provide more flexible and lower-risk investment opportunities for the senior generation. Tailoring specific products to meet the needs of each generation is highly important.

We envision our future product portfolio to resemble a pyramid. The base of the pyramid consists of less risky investments in stable assets. The middle layer would be composed of no-load funds with both stable and high potential assets. The top layer represents active investments in small to mid-cap stocks. Our objective is to expand the base of stable assets, offering a range of investment options that best suit the varying needs of investors.

Each investment type also generates different revenue streams. For example, for the Dream Collection of base assets, we have over JPY 290 billion in customer assets under custody. We recently released “Ichibanboshi,” a global equity fund that invests in under-valued and small to mid-size growth stocks, along with Mizunara, which pursues a high-dividend strategy. Those are the only no-load funds that can be handled face-to-face. Mizunara currently holds around 10 billion yen in customer assets under custody. In addition, Asunaro, an active small- and mid-cap fund, has customer assets under custody of over 80 billion yen, making it one of the top funds in Japan.

In the active management segment, we earn brokerage fees. However, there are no brokerage fees for our other products; we only charge trust and wrap account fees. Impressively, we cover 73.3% of our sales and management costs through these fees alone, which is a notable achievement within the industry. This demonstrates the strength and resilience of our business model, allowing us to operate sustainably without heavy reliance on brokerage fees.

In January, the Japanese government announced a revamp of the NISA, or the Nippon Individual Savings Accounts, a tax-free stock investment program for individuals. This move aims to turn the trillions of JPY held in cash by households into investments in riskier assets, such as the stock market. Yet, the most popular investment vehicle among Japanese households has traditionally been mutual funds tracking US and other global stocks. Do you believe that the NISA account will be successful in reversing that trend and driving more investment from Japanese households into Japan?

Japan is now in a new beginning. For the past 30 years, deflation made investment unattractive, leading to economic stagnation. However, the situation has changed as inflation has taken hold, and the mindset of the Japanese people is finally shifting towards investment. The introduction of the reformed NISA has further propelled household investment in Japan. The next step is to encourage Japanese individuals to invest more in domestic stocks.

I view the current environment as the second resurgence of the Japanese economy, driven by monozukuri (manufacturing excellence). In the past, rapid economic growth was fueled by manufacturing, and now, with the revival of the semiconductor industry, we are entering the second phase of Japan’s economic advancement. After geopolitical tensions and supply chain disruptions, the U.S. has strengthened its connection with Japan and encouraged a more investment-oriented mindset. Many small and medium-sized enterprises (SMEs) in the monozukuri sector possess significant growth potential, which could one day surpass even that of giants like Toyota. Focusing on this potential growth presents an attractive investment opportunity. Moreover, the shift from traditional cumulative investments to growth stock investments has altered the market landscape.

Traditionally, Japanese investors favored mutual funds with exposure to foreign stocks, such as U.S. equities. However, there is now a growing trend towards investing directly in individual Japanese companies. As a responsible investor, it is our responsibility to provide the necessary options and information, making investments in individual stocks and mutual funds more accessible to Japanese investors. Japanese investors are generally easy to persuade. Once they see foreign investors buying into Japanese stocks, they are likely to follow suit.

In the past, Ichiyoshi Securities operated as a brokerage commission-centered flow-type business, and you have now transitioned to a stock-type business model. To further strengthen this evolution, you launched your 3・D medium-term management plan in April 2023, which is targeted for completion by the end of March 2026. How will this strategic shift impact your client services and overall business sustainability?

Our "stock-type business model" clearly reflects our philosophy. We believe that retaining stocks for the mid to long term leads to greater profitability. Relying on brokerage fees contradicts our vision of long-term retention. By shifting our business model from a “flow-based business model” to a “stock-type business model”, we demonstrate that long-term ownership is beneficial and advantageous for our customers. The uniqueness of Ichiyoshi Securities lies in our personalized, face-to-face communication with clients, which ensures that we provide the most suitable financial products. Our vision is to further evolve our business model and revenue streams, aiming to achieve JPY 3 trillion of customer assets under custody. We also plan to generate additional fees from wrap accounts and investment trusts to reach a PBR of 1.2 in the near future.

For investors, the high coverage of selling, general and administrative expenses (SGA) by the "stock-type business model" revenue stream highlights the solidity and soundness of the company's management. Additionally, our high dividend payout rate is a key attraction of our business.

We have maintained a proactive dividend policy since as early as 2000, starting with a 20% payout ratio. By 2005, this increased to 30%, and in 2008, it reached 40%, or a Dividend on Equity (DOE) of 2% for a half-term, depending on which was higher. Since 2015, we have been implementing practices that the Tokyo Stock Exchange (TSE) has only recently begun to emphasize. Currently, we maintain a payout ratio of 50% or a DOE of 2% for a half-term, based on whichever rate is higher. In 2003, we established a committee dedicated to supervising and monitoring our financial status. We have also been active in share buybacks.

We are highly conscious of both our PBR and ROE and we have a clear strategy for future growth. If investors fully recognize the efforts we have made, we are confident that our stock price will be significantly higher in the future.

Please imagine that we return to interview you again in 2030 which will be a big anniversary for the company. What ambitions or objectives would you like to have achieved by then?

I am confident that by 2030, Ichiyoshi Securities will continue to stand out as a one-of-a-kind securities firm, renowned for delivering exceptional and personalized services to our clients. Our commitment to high-quality asset management, with a steadfast focus on our customers, will remain at the heart of our identity. While we recognize the challenge of competing with major industry players in terms of customer assets under custody, our unwavering goal is to be the leader in quality, offering the most attractive and tailored products.

We aspire to be like "home doctors," working closely with each household to guide their financial journey. Our vision is to create a future where, as a Japanese company, we collaborate hand-in-hand with families and investors, achieving the best outcomes together. By fostering this holistic approach, we are confident that we will not only attract more assets but also realize our ambitious goal of reaching JPY 3 trillion in customer assets under custody. We are driven by a strong belief in our growth potential and are excited about the future that lies ahead.

0 COMMENTS