JINUSHI's CEO emphasizes Japan's safety and comfort as key investment attractions. JINUSHI provides real estate financial products that invest only in land. Its unique model has proven to generate stable cash flows even during market crises and is now expanding, including trials in the U.S. JINUSHI envisions significant growth and broader industry influence in the coming decade.

Sustained by very low interest rates and the lifting of quota restrictions, Japanese land prices saw a huge uptick in the first half of 2023. This was sustained mostly by foreign purchases where 45% of it was coming from foreign-based buyers. There were large purchases in warehouses as well as in the logistics segment, especially from Singaporean and Canadian-based buyers. Could you give us your take on the global landscape and why you consider Japan so attractive when it comes to investment?

There are no other countries like Japan. It is a safe, and comfortable place, and I believe this is the strength of Japan. I feel that the worth is underestimated globally and domestically. Japanese should realize Japan’s charm.

For a long time, Japanese companies have had a seniority-based culture, which made it difficult to have a young CEO.

In recent years, however, an increasing number of companies have undertaken structural reforms, and more younger managers are rising to the top. As for myself, I just became the president of JINUSHI, the second president in 2022, and I am still in my 40s this year. The contemporary managers share the sense of crisis that Japan will be left behind in the world if nothing is done. Many things will change in the Japanese market in the future, and it will become more and more interesting.

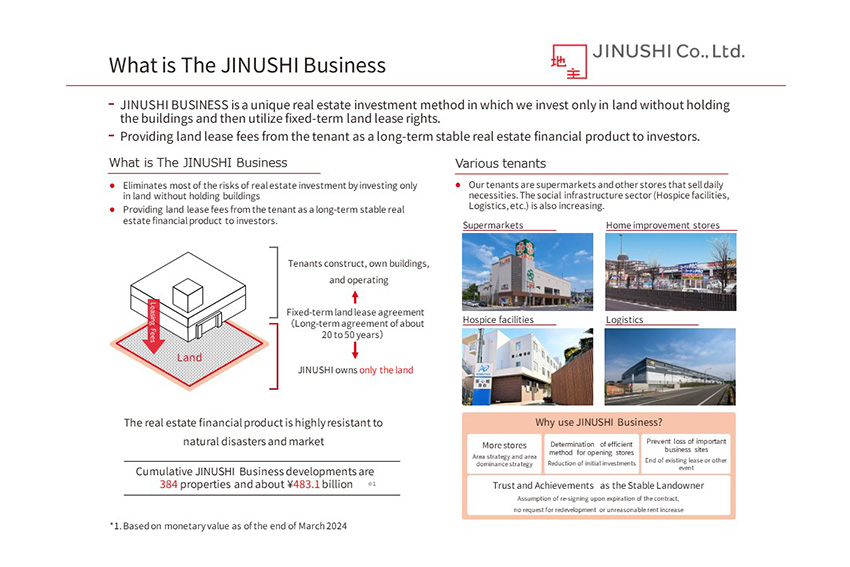

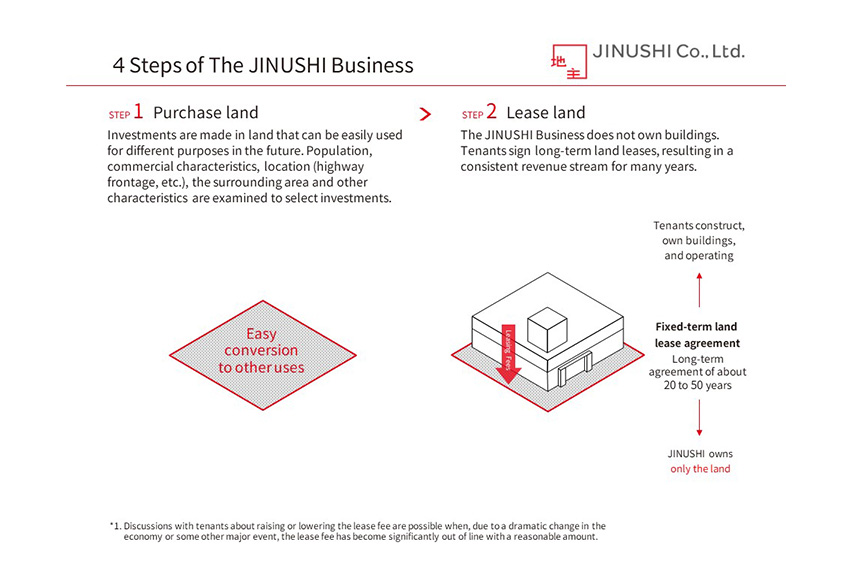

Fundamentally you purchase land and then lease it out based on a long fixed-term land lease agreement. Later you sell it to investors. What is unique about your business model is that you only invest in the land. Throughout this whole process, you’ve never constructed or owned the buildings that are used on your properties. When compared to other business models, what are the advantages of your approach?

Our business model was born from an experience of failure. In a previous job, I was involved in the real estate department at Kanematsu; a well-known Japanese trading company.

We had leased the building to a tenant Net sale exceeded JPY 1 trillion, but this tenant went bankrupt, and we had great difficulty in re-tenanting the building. It was because the building was designed to meet the needs of bankrupt tenants only. At that time, we wondered if this outcome might not have occurred if only the land had been leased and the risks inherent in the building had been eliminated.

JINUSHI is the maker of real estate financial products that invest only in land by utilizing fixed-term land lease rights. We purchase land and then lease it. We never construct or own buildings. We provide the leased land to investors as a real estate financial product that can be expected to generate long-term stable profits. Our business is something that nobody else does. This new business model, “JINUSHI Business,” was created in the year 2000.

This "leased land market," which we created ourselves through the JINUSHI business, is a market that will continue to expand in the future. What I feel from 20 years of experience is that if you strongly believe in the righteousness of the business, that business bears fruit. Corporate bonds provide a stable yield but lose value when the issuer goes bankrupt. Our instruments, however, provide the same stable income and keep the high-value land even if the tenant goes bankrupt. In a typical real estate scheme, developers seek to profit by developing buildings and creating cities, while our goal is to create real estate financial products. This is not the business that normal real estate companies like. This is why no companies are doing what we are doing. Interestingly, whenever the market crashes it sheds a light on our products that provide stable income. Lehman Shock, the COVID-19 shock, and other market crashes; all shed light on what we are doing.

Recently, since many have realized the upside of leased land as a financial product, more real estate developers trying to create products like ours. This is a welcome sign. We do not want to monopolize the market. We have dared to sell our products to outside parties to promote the quality of our bottom line and encourage other players to enter the market. The market environment is exactly as we envisioned it, a growing market. To be competitive in a growing market we must have tools or an advantage that differentiates from other companies.

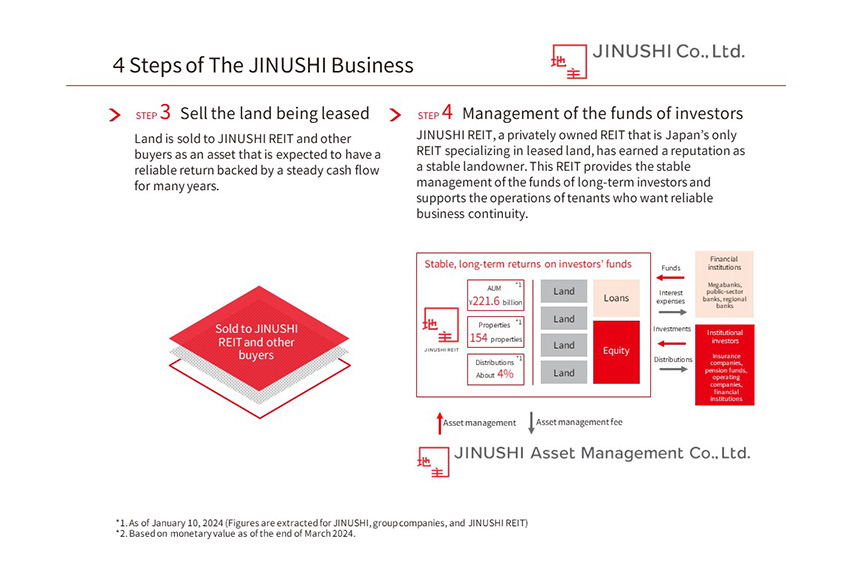

In 2017, we established a private REIT, JINUSHI REIT, specializing in leased land. Currently, The AUM has grown to JPY 220 billion. We want to grow this REIT to JPY 500 billion, JPY 1 trillion, and beyond. As JINUSHI REIT grows, we aim to be a major landowner in Japan. The significance of our company's existence will increase.

To be able to have this stable cash flow model you need to find tenants. As you have said, the risk and the cost of the associated building and maintenance are not yours, it's the tenants. Furthermore, at the end of the contract, the tenants often must return the plot to vacant. What are the advantages from the tenant's point of view?

At first, we wondered if this business model was applicable since it has been a Japanese standard that the land and the building lease come together. Now, however, many tenants are beginning to see the advantages of working with us. With Japan's population declining overall, it is becoming increasingly important for tenants to be able to locate and efficiently open new stores or bases in areas with an increasing population. By partnering with us, tenants can own buildings that can be freely designed and renovated while eliminating the need to invest in land. They can accelerate store openings while enjoying financial benefits.

It's also attractive to tenants that we remain a stable landowner. The developer may evict the tenant and develop another building once the contract expires. For the tenant, this means risking the loss of an important base of operations. But we never evict tenants as long as they continue to pay their lease payments, and we assume that if they want to re-sign at the expiration of their lease, we will do so. We can remain as a long-term stable landowner because we can continue to hold the land on JINUSHI REIT. We are increasingly recognized as a potential long-term area business partner, and many tenants are contacting us.

In 2016, you launched JINUSHI Private REIT Investment Corporation, Japan's only private REIT specializing in leased land, and began operations the following year. But only at % of J-REIT Assets, only 2.3% are leased land assets. Do you think the leased land market will expand?

I believe that real estate companies want to show their presence by building structures and being involved in adding new value. It is out of the norm in the real estate business to have a business model like ours. However, compared to the previous, this ratio is increasing. Some REITs are looking at leased land, with some having leased land assets of 40%.

When we talk about financing, Japanese banks have been historically known to be quite conservative, and it can be difficult sometimes to unlock financing for new and innovative types of products. Often the same can be said about investors; Japanese investors are famous for being a bit risk averse, especially when compared to those in the US. What do you do to explain the advantages of the JINUSHI model to banks and to the market itself?

You understand the Japanese market very well. For 20 years we had a headwind against us. We are continuing to show our expertise with our track record and keep explaining. In the beginning, we couldn’t get any loans from any banks, and at first, having somebody else’s property on the land meant that the price or the value of the land would depreciate by half.

Since we couldn’t secure any loans, what we did before purchasing was find the tenant and have an agreement with the buyer of the land. Nevertheless, believing that the right thing will always be spread, I have personally visited all banks, companies, and investors to explain the strengths of JINUSHI Business. The Lehman Shock, the Great East Japan Earthquake, and the COVID-19 epidemic provided an opportunity to illuminate our business model. Despite major market fluctuations, our products' long-term stability was recognized. The leased land market was not there initially but is now well established. When launching JINUSHI REIT, I visited more than 300 financial institutions, mainly regional trust banks, over four months. Talking directly to the manager, who has the right to the decision, was key to gaining their understanding. That's how I finally raised JPY 15 billion from 30 investors. The probability of obtaining investment was only 10%. Now, cause our products are well-known, it is 80%. You can see how people now understand the strength of our business model. Now is the time to accelerate our presence in the market.

In your mid-term target, you have set the AUM of the JINUSHI REIT at JPY 300 billion from now. What will be the key drivers for achieving this number?

The key is that we’ve developed a business model that grows by itself, so within two years, it will reach JPY 300 billion, and in five years, we can foresee exceeding JPY 500 billion. We have created a scheme that grows itself with an increasing number of tenants. That is why we are focusing on diversifying our tenants. Over the past two years, we have raised 30% more tenants, however, we feel that our strengths, functions, roles, and services that we provide to tenants are not truly understood in the market. Therefore, I meet directly with the tenants and explain to them, and with this, there has been an increase in contracts.

As mentioned earlier, more and more tenants are finding it rational to own only buildings, not land, which is difficult to add value to. In many cases, tenant managers are also sympathetic to the fact that the land lease fees they pay indirectly contribute to the management of assets such as domestic pension funds, in other words, they are contributing to society.

Tenants were traditionally supermarkets, DIY stores, and drug stores for your company, but now you’re targeting social infrastructure such as hospices or nursing homes. Besides visiting, how do you increase your share in the market? Ten years from now, what will be the breakdown of your tenants?

Currently, 80% of our business is more lifestyle-based tenants, but I’m envisioning increasing social infrastructure to achieve a 50-50 split. As our company's visibility grows, the number of tenants should increase proportionately.

You have partnerships with bank-owned leasing companies such as SMFL Mirai Partners and M.L. Estates. What does this mean strategically?

As part of our efforts to strengthen our financial position, we have adopted a bridge scheme whereby we sell our products to leasing companies, who hold them for a certain period and then sell them again to JINUSHI REIT. In addition, the relationship with the bank is helping to develop potential clients who need off-balance-sheet schemes for land to tenants, a strategy focused on in the mid-term management plan.

Is JINUSHI Business something you could only do in Japan, or is this something you could replicate in the United States, for example?

We have established a subsidiary in the U.S. and are testing whether the JINUSHI business can also operate there.

Last year was a great time to purchase US properties due to the country's high interest rate environment. Now, many people are speculating that we are slowly reaching the end of the cycle and that inflation is gradually being taken down. As such, many experts believe that in the second half of this, perhaps, we’ll see a big rebound in the US property market. How does this affect your American strategy? Can you tell us about some of the locations you are targeting in the US?

We have our base in Los Angeles, and as a trial basis, we have invested JPY 5 billion. The US has a growing population, and the execution of the contract is assured like Japan. We want to grow continually, but right now we are still in the testing stage.

Ever since the 1990s bubble burst, retail investors in Japan have been reluctant to invest in certain asset classes. If we talk about money under lock and key, it is now up to around JPY 2 quadrillion, which is in government bonds or savings accounts, which are losing year on year to inflation. Unlocking this money could be a huge tailwind for capital markets here in Japan. Could you give us your prediction on how this situation will play out?

You are correct. We have started targeting retail investors and their financial reservoirs. We want to start small and grow big since we have experience with our REIT; JINUSHI is looking to leverage its past experiences. Our business model is very clear for private or individual investors and convincingly shows that there is no risk from the building or its management. The Japanese market presents some challenges in terms of acquiring new investors unless you have experience, but we, fortunately, have already gathered experience with our JINUSHI REIT.

You’ve made sweeping changes recently by abolishing your shareholder benefit program to increase your shares from JPY 55 to JPY 85. Could you tell us how you expect investors to react to these changes? How sustainable is this very sharp change in dividends?

We introduced the shareholder's benefit program to target listing our company on the Tokyo Stock Exchange. However, our company has grown to a stage where we can clearly show our strength through our business model. This was why we abolished the benefits and decided to only focus on the dividends. We hope to increase our market cap to JPY 50 billion and then to JPY 100 billion as soon as possible by increasing the number of shareholders who expect our profit growth and by increasing the liquidity of our shares. We will continue to aim to increase dividends through profit growth.

Imagine that we come back in ten years and have this interview all over again. What goals or dreams do you hope to achieve by the time we come back for that new interview?

In ten years, I envision our company as playing a major role not only in real estate but in many industries across the board. JINUSHI REIT would probably be around JPY 1 trillion, so with that, the recognition of our company would continue to expand. I believe that if you have a strong belief and determination, you can achieve anything.

For more details, explore their website at https://www.jinushi-jp.com/en/

0 COMMENTS