Through the provision of solutions that accelerate customer’s Digital Transformation (DX), by utilizing its cutting-edge simulation and associated technologies, Cybernet has become an indispensable partner to some of the world's leading manufacturing companies.

Why did you return to Japan from the US and take up your role with Cybernet Systems, and what is your strategic aim for the company?

My goal is to transform our Japanese company into a global entity. This objective compelled me to return to Japan from the United States, driven by the belief that even small and medium-sized collaborations can contribute to the creation of a global company. Making our company a global player is the ultimate aim.

We have always been a technology-centric company, and we take great pride in this. We focus on building quality products, fostering loyalty, and employing highly skilled engineers. This is our strength and one of our valuable assets that enable us to grow and gain global competitiveness. I'm highly committed to continue this focus as part of our strategy.

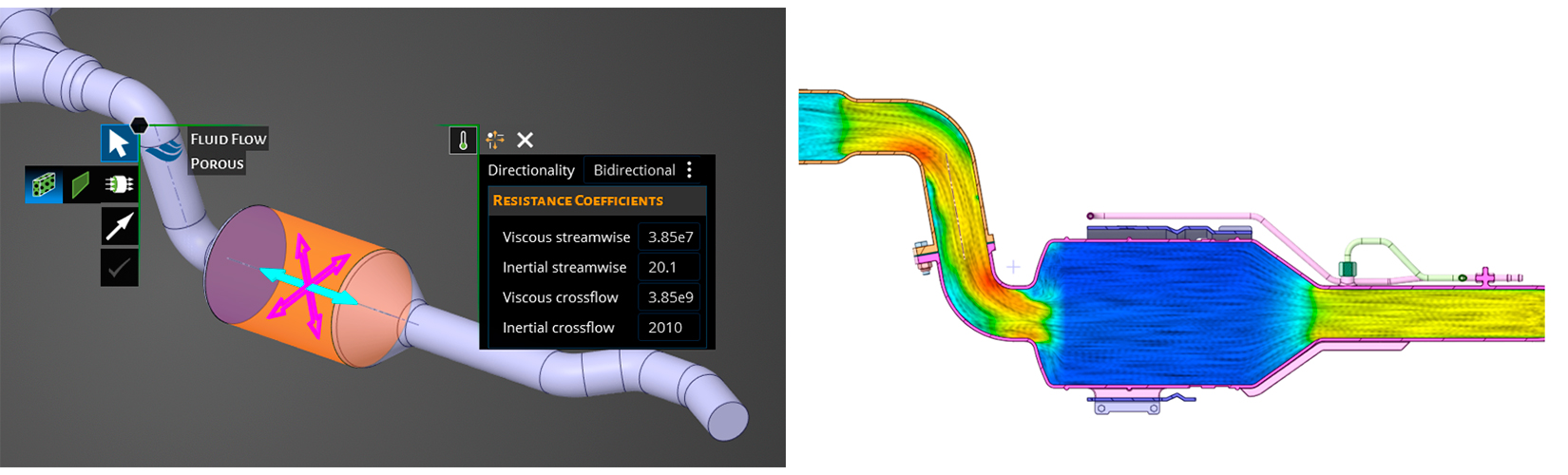

Fluid analysis of exhaust filter

Left: 3D model / Right: Result of simulation (Velocity magnitude through an exhaust filter)

What is your analysis of the current state of the manufacturing sector and your outlook for the next 12 months?

Over the past few years, not only the covid pandemic but also the trade issues related to Russian aggression in Ukraine and the situation of US export controls to China have amplified uncertainties in overseas economies. These circumstances have been making it difficult for the manufacturing industry to formulate a future outlook.

Companies must therefore adapt and transform, as the environment and global conditions change in unpredictable ways. Digital Transformation is considered an effective way to enhance the dynamic capability of the manufacturing industry, and it will also be helpful to cope with the shortage of human resources, which has been a pressing issue for the manufacturing industry.

What other technologies besides simulations do you think will further disrupt the industry in the future?

AI technology will dramatically change the product development process of the manufacturing industry. For example, in the automotive industry, when designing a car body, determining the best shape for windows, for instance, requires extensive simulation. One fluid simulation alone takes 72 hours, and typically at least 20 iterations are needed for the entire design process.

That's a total of 1440 hours just for running the simulations. That's why we offer a solution to accelerate this process based on AI, called “surrogate AI”. With this solution, AI algorithms accurately capture the behavior of the parameters and replace the expensive and time-consuming simulations.

Instead of 72 hours, it now takes only 3 seconds to evaluate a design alternative, so designers can evaluate multiple alternatives simultaneously, significantly reducing the total design time. Simulation is a white box, whereas AI is considered a black box. To design a car, we need both perspectives. However, AI helps to decide what kind of solution is most appropriate.

We need to evaluate the results of different design alternatives. Our solution provides engineers with a wealth of ideas and ways of thinking. This approach is gaining popularity in the design world. Due to our deep understanding of simulation and familiarity with the parameters, we can input the appropriate parameters into the AI engine. The AI engine is also customized for each customer's situation. This is a very unique and innovative technology we offer.

If you were to advise a young graduate who is currently choosing a career and considering the immense potential of AI, and considering your familiarity with AI and its potential, what careers would you recommend that rely on uniquely human abilities? Which careers do you believe only humans can perform, ensuring long-term job security?

I feel hesitant to advise anyone, as the landscape is continuously evolving. However, there are certain professions that AI may not replace entirely, at least not in the foreseeable future. For example, hairstylists, lawyers, and architects will likely still have a place. The deep understanding and communication skills required in these professions make them less susceptible to complete automation.

While AI may replace many tasks, the human touch and direct interaction with customers remain essential. I also believe in preserving the expertise of professions such as the role of engineers. Everything is changing, not only in manufacturing and technology but also in the human spirit, motivation, and drive. My goal is to be independent, yet flexible and always open to new perceptions. I aspire to take the lead in driving positive change.

Considering Japan's declining population and the increasing adoption of digital technologies, how can Japan continue to be a leader when it comes to manufacturing?

Simulation and SDGs will be the keys. Simulation technology enables the vision of creating a sustainable society and cities. We have also set such goals for our business and take action accordingly. For example, biodegradable plastics would be a trump card for a sustainable society. Material informatics is one of the key technologies to develop such new materials. It is a method of designing and evaluating materials using computer simulations. Other examples we have worked on with our clients are in areas such as the storage and transportation challenges of hydrogen, which is considered an important carbon-neutral option. We combine simulation with electronic methods to provide our customers with comprehensive solutions and expertise in analysis and simulation.

I'm very curious about the program you use for ADAS driver-assisted systems, how that data is all about real-life experience, and how you feedback that data into your product.

In ADAS, just like in any manufacturing process, multiple elements need to be connected, from both the virtual and physical worlds. Our design methodology focuses on the upstream design tasks, like MBSE and requirements management, as well as data collection and management, the actual modeling and simulation, data science, and last but not least, the validation and verification. We offer comprehensive consultation and implementation services in this field, beyond what other SI vendors can provide.

This breakthrough extends beyond manufacturing. As you mentioned, you are also focusing on expanding into healthcare, energy, and agriculture. When it comes to working with your customers in these new areas, you collaborate with private institutions, academia, and government entities. How does that background and knowledge help as you look to expand into new areas like health care, energy, and agriculture?

One of our proprietary products is EndoBRAIN, an AI-based medical software. It is incorporated into the colonoscopy equipment and uses AI to detect and identify tumors and cancers in the colon. We have collaborated with university professors and academic institutions, including Showa University.

If AI can support the experience of doctors, all patients will be able to receive high-quality services equally. AI can make a difference by ensuring fair and equal access to surgery. We partnered with Olympus to embed EndoBRAIN in their product, and now the product is sold worldwide.

We have a long history of working closely with medical institutions, excelling in the field of AI. We have built trust and established ourselves as reliable providers of solutions. Together with these partners, we continue to develop a visualization system that converts medical concepts into visual data, and medical software that makes judgments using AI.

Discussing visualization technology, one significant disruption and opportunity has been the introduction of virtual reality. While traditional methods like CAD/CAM or CAE involve creating a 3D representation on a 2D surface, VR has the potential to revolutionize not only the manufacturing sector but also other fields like medicine. Remote medicine or remote diagnosis, for instance, could greatly benefit from advancements in VR technology. I'm curious to know how your company intends to capitalize on VR and what your expectations are for its growth across various sectors.

Several years ago, we introduced a product called VDR, which was well-received in the market. VDR stands for Virtual Design Review, and it can display the CAD models, analysis visualizations, and CG models in a VR space as they are, without data conversion. Its key feature is that it can display and synthesize results of multiple software in a VR space, so they can be discussed while being shared by many people.

One of the advantages of checking CAD data in a VR space is that it is possible to verify and study the assembly process in a virtual, full-scale size without actually creating a mold. Since it is possible to participate in the VR space from anywhere via the network, designers and workers can share the same model and work even from remote locations, identifying necessary changes and points for improvement. As a result, returns can be greatly reduced.

As society progresses towards Augmented Reality (AR) and Extended Reality (XR) technologies and a Metaverse, we have been working on visualization technologies for many years as a pioneer in this field. We will continue to grasp the evolving situation and aim to provide innovative solutions that meet the needs of our customers and the market.

You have had quite an interesting journey since joining this company in 2019, just one year before the covid-19 pandemic struck. Along the way, you encountered significant disruptions, including the end of the Synopsis deal. Despite the challenging environment, you have also been a disruptor by introducing changes such as transitioning to a platform business model. Moreover, being a woman in Japan, especially in the manufacturing industry, where female representation is limited, sets you apart. You are one of the few female individuals we have interviewed. My question for you is, as you reflect upon the years 2020, 2021, 2022, and 2023, could you share your personal experience during that time? What are some things that you are particularly proud of, and what are some aspects you wish you had handled differently?

There have been times I wanted to be a man, as being a woman in this industry remains difficult today. There are hardly any women in this industry, especially at my level. While times may be different from the Showa era, it's still not easy today.

What I'm most proud of is that I always strive to surpass the goals set for my job. No matter how many disruptions or interruptions come my way, I never give up. There are numerous stories I could share, but the determination never wavers.

I once received an interesting question from a young woman who was hesitant to become a manager because she didn’t want to compete (with men). She felt that she lacked the motivation to be strong or to win in this kind of environment. It was shocking to me at the time, as my story has always been about women challenging men and becoming stronger than them. That's been my main drive.

However, this young woman's perspective made me realize that there's a different way. No longer limited to the Showa story, I changed my philosophy and embraced a cutting-edge approach. I wanted to break through again.

I asked the woman: “Do you think you can contribute to society?” The thing is: if you possess a broader perspective and higher perception, you may be able to contribute to society as a result of becoming a manager. As a woman, you possess a broader perspective and higher perception. The aforementioned young woman was convinced and realized she could be a manager and contribute by creating a more productive work environment and making staff happier to work with her.

This has been an intriguing and transformative experience for me over the past few years.

The past few years have been marked by significant instability in the world economy, primarily due to the outbreak of the covid pandemic. We witnessed repeated recessions here in Japan, along with the collapse of the tourism industry just as it was reaching its peak in 2019. However, on the flip side, this period presented a tremendous opportunity for those engaged in Digital Transformation, enabling them to introduce new solutions such as e-commerce, digital twins, and novel digital communication channels. Could you provide us with your perspective on this ongoing transformation? How did your company adapt to this situation, and what new opportunities arose for you?

Recently, the industry’s focus has been on digital twins, and we have been active in that field for many years. The combination of the digital world and the physical world is precisely what a digital twin is.

Many SI vendors work in the “real world”, e.g., collecting IoT data, but you also need the deep understanding of simulations and modeling in the “virtual world”, because you can see the real benefits only when you connect the two worlds. That is where our strength lies. Cybernet excels at combining MBSE (Model-Based Systems Engineering) with MBD (Model-Based Design), CAE, IoT and data platform etc.

We believe that the worldwide acceleration of DX, including digital twin, will be a tailwind for our business.

Synopsis used to account for around 20% of revenue. Why did you think now was a good moment to stop?

Synopsys had been selling their optical CAE products through their distributors, but they decided to change exclusively to a direct sales model worldwide. This is similar to what Cybernet experienced with MathWorks in the past.

If I can delve a little deeper into the Synopsis situation, despite losing a product that accounted for more than 20% of your sales, your revenue for 2022 only declined by approximately 12%, which, in comparison to the disruption caused, is not a significant decrease. Furthermore, I listened to your earnings call where you mentioned you were expecting a V-shaped recovery for this year, and you had positive results in the first quarter with 5% revenue growth. I have two questions regarding this. Firstly, how were you able to mitigate such a big change? And secondly, what factors lead you to believe that this year will follow a V-shaped recovery pattern?

We were successful in a distributor because we deal in very strong products in the CAE market like Synopsis, Ansys and MATLAB. During those days, all Japanese manufacturers were growing, so we were able to sell a lot of CAE software products.

However, we were aware of the risks of relying only on this kind of distribution business. We needed some additional business pillars, so we acquired three companies that were developing CAE software by themselves: Noesis, MapleSoft and Sigmetrix.

In the last few years, we focused on improving these three CAE development companies and made significant improvements in all areas, such as revising the roadmaps.

We also established a consulting company focusing on MBSE, partnering with leading companies in the MBSE field, and serving leading customers in the aerospace and defense industries who are adopting those technologies. These are all assets connected to our core technology.

Just like "Lead and Disrupt: How to Solve the Innovator's Dilemma" says, I believe keeping on both challenging new things and improving existing business are important for our sustainable growth.

To conclude the interview, I would like to inquire further about your international business operations. I understand that you collaborate with over 20 software vendors abroad and have offices in China, Taiwan, and Malaysia, along with overseas partner companies such as Noesis, Sigmetrix, and Maplesoft, as we discussed. Moving forward, I'm interested to know if you are actively seeking new M&A opportunities and potential companies to acquire. If so, what specific types of companies are you targeting?

Yes, of course, all the time. We are focusing on cutting-edge technologies.

And which particular markets overseas would you be looking to grow in, in the midterm?

Technology-wise, still, Europe and the United States, but market-wise, south-east Asia, in particular, Vietnam shows a lot of potential.

I saw in your financial results that the performance of the North American and European markets was very good in the first quarter of this year. Why is that?

One of our CAE development company, Sigmetrix develops its flagship product called CETOL 6σ. It is a 3D tolerance analysis software that works directly with PTC Creo, CATIA, SOLIDWORKS, and Siemens NX files. By adopting CETOL 6σ, customers can save significant time and money in multiple areas of their design process. It allows them to remove bottlenecks from their design process, reduces tolerance issues during manufacturing, and improves their ability to troubleshoot production issues. The future holds numerous opportunities, and our sales in the United States are already influenced by this trend.

Another key software product is Optimus, a simulation automation and design optimization tool. This software is highly regarded, particularly in Europe, where automotive manufacturers are among our best customers. This growth also made a contribution to our business.

0 COMMENTS