In this interview we learn more about SBI Global Asset Management and their innovative solutions to global asset management and investments.

Could you give us a quick introduction to SBI Global Asset Management and some of the background behind your company’s establishment?

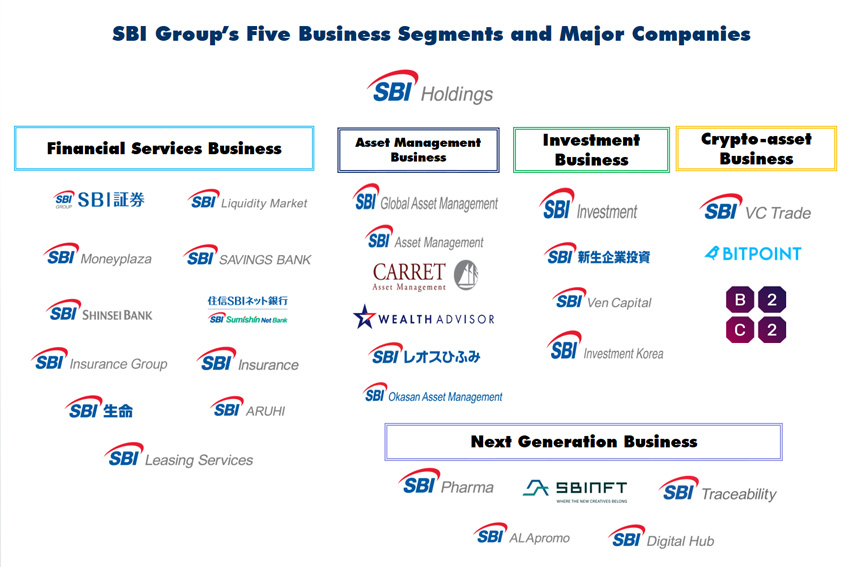

Our company began as Morningstar Japan and was founded in March 1998 as a joint venture between the US Morningstar and SOFTBANK. The SBI Group foundation was founded a year later in 1999, and only on July 8th this year did we hold our 25th anniversary celebration. You might now be thinking why Morningstar was established before the SBI Group. Mr. Yoshitaka Kitao, Founder and CEO of SBI Group, had anticipated at the time that SBI was going to be established, so one year before, he decided to create this joint venture between Morningstar and SOFTBANK. SBI Securities was also known under different names before being brought into the fold. His idea was to form an ecosystem of investment rating company, securities, banks, insurance firms, investment firms and so on in SBI Group.

I think a key element that separates SBI group from our counterparts, any traditional financial institutions such as Nomura or Daiwa Securities, is our establishment—the fact that we didn’t start off just with securities but with many functions in place, such as banks and insurance firms. By leveraging our group’s synergies, we can contribute to customers in our entire group by offering them a wide range of products and services.

I have been the president for this period of time for Morningstar Japan, and in March 2023, we returned the Morningstar brand to establish SBI Global Asset Management. There was an alignment of interests, with Morningstar wanting to utilize the brand globally, and with our company, we wanted to focus more on asset management. I personally believe that asset management is the last frontier for financial industry. What I mean by that is that I believe asset management will be the part that grows the most from here on out. Since I’ve got 25 years of experience as the president of this company, I have been able to observe the industry trends. I came to the idea that we should focus more on asset management, which is the last frontier.

Right now, the Japanese market is going through some major changes from macroeconomic factors. This is because of a lot of factors, such as corporate governance reforms, shareholder returns, and inflation. I also believe that there has been a drastic change in the mindset of individual investors. There is a push from the Japanese government to move away from savings and towards investments. While people say that Japan is still okay, I think now is the time we are going to see if it's a positive or a negative era.

There are two sides to the Japanese financial market. Firstly, you have the pessimists who say that the recent performance of Japanese stocks and markets has mainly been based on big macroeconomic conditions, including the JPY devaluation, the low interest rate environment, and a bullish American economy. On the other hand, more optimists argue that there have also been a lot of internal reforms, such as the introduction of NISA, governance reforms, and overall change in mindset. Should macroeconomic conditions normalize, will those internal reforms be enough to carry Japan forward?

Overall, I do think it is okay to say that it is a bullish trend; however, over the past two years, any listed large companies have gone up supported by Index Funds, but I think now the importance is placed on individual company situations. Companies that are able to have internal reforms in a good manner will see growth and those that cannot will lag behind. In the future, segmentation will become more clarified.

Companies like Nomura or Daiwa Securities are doing more face-to-face services, and whether they will be able to survive in the future is something we need to think about. SBI Securities, for example, made a “Zero Revolution” last September, and that means that we made our commissions zero from that point. Nomura or Daiwa, on the other hand, have customers that are old age, so when those customers are replaced by the younger generation in the future, more of those younger customers will open accounts with SBI Securities because of the zero commission. In addition, people are becoming more digital, using their smartphones and the internet. There are bound to be big changes in the industry, resulting in winners and losers. This difference is going to become more clarified.

Over the past year we’ve seen investors choose indexes. Do you think that is going to be reversed in the near future?

Until now, Index Funds have been more popular because the investment fees have been lower. The Nikkei 225 expense ratio was 0.1%, whereas if you were procuring from traditional asset management firms, the expense ratio was over 1.5%. Vanguard in the US is popular for the exact same reason. What we have to think about from this point on is whether the performance can really keep up. When we compared active and index up until now, it was okay for people to go with index because of what I mentioned earlier about winners and losers, so from here, I do believe there is going to be a change.

I do believe that the JPY depreciation was something very big. Back in 1989 the Nikkei average was JPY 38,950, and we surpassed that this year. At that time the USD to JPY conversion rate was about JPY 160, a very similar situation to this year. It shows evidence to support the idea that the devaluation was a big factor.

Let’s compare the differences now between 2024 and 1989. Back in 1989, companies like Toyota, Panasonic, and Hitachi were strong, and we had more exports compared to imports. However, nowadays we have more imports than exports. Toyota and Honda are not performing as well, and while their performance is supported by the JPY devaluation, the sales volume is not growing. Not only do we rely on imports for energy and food, but also digital imports such as Apple, Meta, Amazon, and Alphabet. Of course, Japanese consumers buy those products in JPY, but Amazon Japan, for example, will pay Amazon HQ in USD. With the digitalization trend, there is a structural change happening, resulting in a lot more imports. I do believe that the JPY devaluation situation will continue for some time.

It is important to think about how much we can utilize the digital world. Right now, Japan is relying on overseas markets for digital products, but this needs to shift, and it needs to try developing the digital sphere domestically. This is now about nurturing or developing start-up companies or entrepreneurships here in Japan. The Entrepreneurship and the venture spirit is something that we don’t have as much of anymore, especially when compared to the US, and this is something we must try to bring back in order to keep up. SBI Group itself came from this spirit. We were able to cultivate new industries and companies throughout our 25 years, and we are very proud of our growth. We are able to do these kinds of things, but I think other Japanese companies need to follow suit.

You mentioned the need to change the mindset, particularly in terms of investments. The NISA, for example, could be a great move from the Kishida administration if it could move just a fraction of Japanese household assets. Despite the solid framework, the challenge it faces is that historically, Japanese people tend to invest in overseas indexes or funds. What do you think is the role of asset managers and companies such as SBI Global? What products are you offering to promote Japanese investments in Japan?

I do believe this is a responsibility on our side, and in the past, traditional face to face advice companies would recommend products to customers, basically doing lots of minute dealings. Customers would see that due to the commission fees, their assets weren’t rising that much. Instead, SBI take a customer-centric approach, meaning that if the customers are not earning from this, it doesn’t make sense. We tried to suppress the commission fee as much as possible. This is how zero commission fee came to be. I think we were able to bring down the hurdle that was in the way for individuals. On top of that, however, there is a need for education and a long-term perspective as well as a diversified perspective. I think educationally, SBI changed things.

In September 2023, we were able to get our Indian stock fund to JPY 70 billion, and in December 2023, we launched another fund called the Japanese Stock High Dividend Fund. Japanese investors really like high-yield investments, so they will go for NTT or Banks with relatively high dividend yield. At that time, the lowest management fee of Japanese Stock Index fund was a 0.11%, but we were able to bring that fee down to 0.09% even though the fund is active fund. That was revolutionary. We were telling people essentially that it is not whether index or active, but whether cost is cheap or not. We can bring the fees down even though it is active fund. As a result, we were able to bring in JPY 80 billion with this fund.

Why isn’t everyone doing it?

Put simply, because of the fees. The big companies have over 1,000 employees, whereas, on our side, we only have 60. With a significantly smaller size, we are able to be more flexible, and our structure isn’t as complicated. We have launched our unique index funds wrapping iShares ETF or Vanguard ETF and have only simple active funds, say, high dividend yield funds, which allow us to keep the headcount down. This is why I’m saying that we are revolutionizing asset management.

SBI Global AM offers a variety of investment products, including fixed-income instruments like corporate bonds, government securities, and many more. Looking at the future, what kind of products are you looking to offer, and how is SBI Global AM’s portfolio positioned as a partner of choice for institutional investors?

Japanese investors tend to follow others' trends. When they see lots of others going for the S&P 500, they then decide to follow. If literacy goes up in the future, more people will want to make their own choices. What we want to do as SBI Global Asset Management is to become the investment infrastructure into that world, catering to those needs and allowing clients to have each of their different needs completed within our firm. Right now, people are going to invest in the products of different asset management firms, but it would be ideal if we could consolidate all of that in our group’s products.

Also right now, people want to invest into emerging countries, particularly high growth stocks, but the expense fees are so much high, at around 2%. We want to bring that down so that people go with us for these types of assets.

One of the big challenges for having these bespoke asset classes in different regions is that you need to have a level of research and understanding of various different regions and markets across the world. Your company has recently created some very innovative products. With the idea of becoming an investment infrastructure to worldwide cross-market investments, what is going to be the role of partnerships in overcoming the challenges I mentioned?

Our big concept is what we refer to as an open alliance. Other financial institutions, for example, will often acquire a company, and then they are tied to prefer that company in their portfolio. We take the open alliance perspective, basically teaming up with strong companies in each field or region. This is what we did with Pimco, Vanguard, Black Rock, Man Group, KKR, Franklin Templeton and so on. By doing this, we are able to provide products to customers at a low cost.

I’ve been talking about retail investors so far, but the same thing applies to institutional investors. For those in particular, we are managing large sums of money for them. Let’s talk about private placement funds, and in these cases the investors do not know about the cost. Let’s say they get proposal from some asset management companies for this, they will encounter a high fees there but they won’t know about it. Public investment trust funds, on the other hand, are open and transparent. Since private placement fund is not transparent, asset management companies have charged relatively high cost, but here at SBI, we are trying to bring that cost down. This is all to serve and contribute to the customers.

You spoke before about financial literacy and the importance of gaining public trust. Do your media solutions play a role in this? We know that SBI Global AM offers media solutions like advertising and financial platforms for companies as well as consulting services. You help companies optimize their market presence and align advertising campaigns with current trends and consumer behaviors. What future developments can we expect in media solutions, and what role does it play in contributing to the overall growth of partner companies?

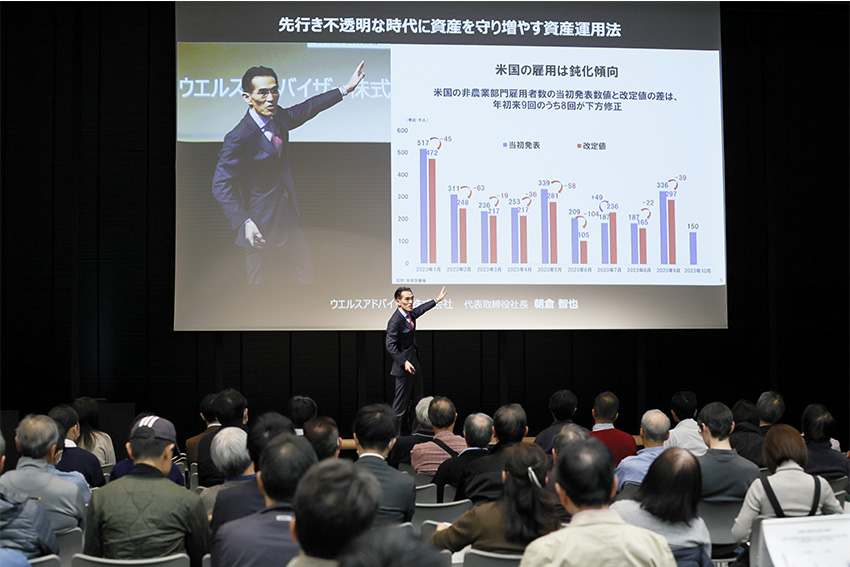

We have two main pillars of our business, financial services and asset management. For the asset management part of our business, things are quite simple since we provide a fund, giving customers as many opportunities to have their portfolio comprehensively under SBI. Before going into the fund, literacy is very important. We have our website and a smartphone application. I’ve also personally published a lot of books on this subject. I have an X account, and I have often made presentations on the investment seminar and appeared on the major TV. It shows that I’m trying to reach out directly. It is the belief that if this educational activity is disseminated, it will inevitably expand our fund.

I believe that the reason why my presentations have become popular is because I tend to take both sides rather than just push products. I sometimes give a lot of warnings, and I’m quite honest about negative factors. Logic is something that customers can understand, and once they get their heads around it, they can invest. This approach has led to trust among people who are listening in, which also leads to those people trusting in SBI Global AM. It has created a great flow of people deciding to go with our fund.

In our research, we saw that in 2019, you acquired Carret Asset Management in the United States of America. In particular, this company specializes in foreign bonds. What strategies do you have in place to attract more foreign capital and clients within the upcoming year?

The background of Carret Asset Management was that their founder was a person called Mr. Allen, and in the past, we had done business together. It was their side that wanted to divest the company.

Carret Asset Management is strong in municipal bonds, and compared to US national bonds, these municipal bonds have a much higher yield. They were already doing quite well with US institutional investors so we wanted to leverage on this business synergy. Going forward I believe you will see more alliances, partnerships, joint ventures, and acquisitions from us.

SBI Securities customer base has now reached 13 million people, which is more than twice as much as traditional major securities firms such as Nomura or Daiwa. There is a huge difference not only in the number of customers but also in the growth rate. For SBI securities, every year, double-digit growth happens in terms of the number of accounts. Within the group as a whole, while there might be overlap with the insurance firms and banks, there are over 50 million customers within the group. That’s a huge number, and it is probably why overseas institutional investors want to come to SBI, leveraging on the group.

SBI Global AM has maintained a PBR of 4.15 and a price-earnings ratio of 32.12, which both indicate a solid market valuation and strong investor confidence in your future growth prospects. Can you elaborate on the specific management practices that have led to such a strong return on equities (ROE) for SBI? What are the key growth prospects that you see in the future for your firm?

I think simply put, the expectations for our future are very high. Compared to other asset managers, or even the financial industry overall, our PBR and ROE reflects how high the expectations are. For 15 consecutive years our company has increased both profits and dividends. There are only three companies in Japan that have done this, with the other two being Pan Pacific and Nitori. Looking at our past record, the market has placed this expectation on us.

Imagine that we come back in ten years and have this interview all over again. What goals or dreams do you hope to achieve by the time we come back for that new interview?

I think that there are going to be different paths for companies to take here in Japan. Normally speaking, in a country with a shrinking population, it means that, unfortunately, growth will shrink as well. However, to repeat a sentiment that I’ve said many times today, companies with passion and entrepreneurship will survive and thrive in this situation. We are a company that fits this profile. From this point on, I think that SBI Global AM will continue to take on the reorganization of Asset Management industry, something Mr. Kitao, CEO of SBI Group has been doing for 25 years now. This is my dream job, and I want to do the best for each and every investor who puts their trust in our company. In the next ten years, I truly believe that Japan will start to move in a positive direction, and SBI Global AM will be a winner in that scenario.

For more information, visit their website at: https://www.sbigroup.co.jp/english/

0 COMMENTS