We learn how Daitron has become a powerhouse in the electronic industry due to its honesty and integrity when it comes to dealing with customers.

The United States and Japan have both made significant investments in semiconductor production since 2021. Japan has boosted its domestic capabilities, especially in advanced chip packaging. You have Sony, Toyota, and TSMC. The US has the CHIPS and Science Act, which has led to eighteen new semiconductor plants being created there. Global semiconductor growth is expected to be about 16.8% in 2024, and both Japan and the US are primarily driving this growth, especially with AI, data centers, and advanced manufacturing. What opportunity does regionalization and global expansion of fab capacity represent for your company and for Japanese semiconductor equipment and material manufacturers?

I see that there is an increasing trend in semiconductor firms around the world, so this is a global phenomenon. As you know, Japan is known as a base for excellent semiconductor manufacturing equipment, and as a source of materials for semiconductor production. Therefore, this trend of increasing fab activities and locations means there will be good business opportunities for us in the future. Let me tell you why.

First, we are involved in various parts of the semiconductor production cycles, and we have a good presence in the equipment business. We supply equipment for the processing of materials used for silicon wafers. We also provide solutions for handling the materials used for power semiconductors. This means that a growing fab market is an opportunity for us to sell more equipment to cater to customer needs.

Another reason we can benefit from this trend is that we also have an electric component business under our company umbrella. We provide our parts and components to semiconductor equipment manufacturers, so if they build more machines, we can sell more parts. Many of our customers are involved in machine manufacturing, including a major domestic manufacturer of semiconductor production equipment, which has a very strong market share. Since we provide electric components to them, if they ramp up their production, naturally our output will increase as well.

As you mentioned, Japan has very strong expertise in equipment and materials today. When you look back at the 1980s or 1990s, Japan was the leader in semiconductor production and had strong expertise in memory products like DRAM. However, companies and foundries failed to adapt to the vertical model that made companies like TSMC and other pure-play foundries across the world successful. As a result, today, Japan accounts for around 10% of semiconductor production, and its fabs operate according to 40-nanometer design rules. This is over ten years behind Samsung or TSMC, for example, but those things have been changing. TSMC recently announced a new fab in partnership with Sony in Kumamoto, and Rapidus is partnering with IBM. This promises to turn Japan once again into the production hub that it was in the 1990s. Do you think this is possible, and if so, what are the comparative advantages of producing in Japan?

There is a great chance of success with the direction that Japan is currently moving because the country excels in its manufacturing capability. It has a very high level of quality control. The quality of the labor force is also high compared to the rest of the world. Having said that, there are some conditions that need to be met for this to be successful. Currently, there is very strong support from the government, and there are lucrative subsidies going into these new initiatives, so one of the conditions to ensure success is that there is ongoing support from the government.

Over the past year, we’ve seen the semiconductor industry experience a significant downturn because of increased inventories and a drop in demand due to tightening monetary policy. In the last few months, however, there has been renewed optimism with increased revenues and profitability among major global foundries. World Semiconductor Trade Statistics (WSTS) expects 2024 to be a year of rebound. How do you see the evolution of the semiconductor sector over the next twelve months?

In terms of the industry trend, I would say that there will be a very strong demand driven by AI for at least twelve months and likely beyond, as we are already seeing very strong demand from AI-related projects. Speaking about the inventory trend, we have seen higher memory inventories for some time, but seeing the current development, I anticipate good progress going forward in terms of inventory control, so I expect that in six months or perhaps by the beginning of next year, the inventory level of memory will be more or less normalized. What I mean by that is that the normal order cycle will return. As for the timing in which overall semiconductor production will recover, I would say that by the summer of next year, there’ll be a full recovery of the semiconductor market.

If we look beyond the short term, most analysts expect semiconductors to balloon to become more than a USD one trillion industry by the end of the decade. This is due to legacy sectors like automotive and consumer electronics, as well as new applications like data centers and AI. What new applications do you think will be the new drivers for growth in the semiconductor and electronics fields, and how does that impact Daitron’s products and services?

Speaking of the long-term growth of semiconductor demand and seeing some of the opportunities in the market, I would say that the strong demand for AI will continue not only for five years but perhaps ten years or more, so we believe that there is a very strong demand coming from AI applications. Another area that we are paying attention to, although this may be considered part of our legacy applications, is the possibility that we can enjoy growth in the 6G large telecommunications systems demand.

As for automotive demand, I think there is a lot of opportunity in autonomous driving technology, which is in the development phase, so there is a lot of room for further development and there is a good potential that it is going to grow into a big business opportunity. For electric vehicles, although the market has been struggling recently, there will definitely be a time when the demand will pick up in the future, so we need to brace for this shift in the market to be better prepared. We also believe that there is a possibility to take advantage of the demand related to automotive batteries and battery charging infrastructure because these systems make use of electronic components, software and equipment. In order to prepare ourselves for these market trends, we need to work on technology sourcing and development.

Speaking about the equipment business, as I mentioned earlier, there is a growing demand for equipment used to handle the material for silicon wafers. One thing we are paying attention to is that there is more rigid and strict accuracy expected for these applications, so we need to be prepared on the technology side to cater to these very strict and tight demands. I mentioned that there is an increase in the demand for power semiconductor materials. Silicon carbide is a hot topic, and there is a demand for the material processing used for this. We have already started selling equipment to cater to these needs, and I believe that there will be an increase in demand for this equipment. Speaking about the communications field, we have a set of original products or equipment to offer, and we believe that there is an ongoing business opportunity in this field as well.

I also mentioned that we provide components and parts to semiconductor manufacturing equipment firms, and we expect that demand from these firms will grow. We are taking measures to source new components that cater to their needs and to meet new trends in the market. More precisely, I am thinking that we need to look for new vendors to source the parts to meet the requirements of the customers.

In addition to the equipment business and the component business, we are also venturing into the software development business, and we have already started some activities to prepare to set up these software development operations.

You mentioned that two of your focuses are on silicon wafers and on compound semiconductors, which experience rapid technological advancements. For example, silicon wafers have increased to over 300 millimeters, which poses a series of challenges for fab equipment. For power semiconductors, new substrates like silicon carbide and gallium nitride require different materials that are often very corrosive. The wafers are also a lot smaller and very brittle. How are you able to stay up to date with those technological changes, and how are you able to source the right technology?

When it comes to staying up to date on the latest technological developments, I think we have a certain advantage because we have business transactions with many companies that allow us to exchange technical information. Whenever a customer comes up with a new development, we try to facilitate information exchange so we can know what is expected by the final manufacturer of the ecosystem.

You mentioned silicon wafers and silicon carbide, and for these we try to understand the specifications required by the end customers. By doing this continuously, we try to upgrade our technology knowledge in-house to stay on top of what is happening in the market. We do this to build equipment that caters to customer needs. Thanks to the business transactions we have with equipment manufacturers, I think we have good connections with almost all key players since we handle some of their products, which allows us to develop solutions that combine the strengths of our multiple companies to cater to the market demand.

Daitron offers a range of products for diverse assembly needs. Some of these include the Daitron Automatic Visual Inspection (DAVI) Engine, which uses AI and high-precision optical imaging to automate inspections; the Daitron Advanced Laser (DAL) Pulse Engine, which provides stable, low-noise power for semiconductor manufacturing; and high-precision wafer edge grinders. Could you elaborate on the competitive advantages of your original products and how important the development of original products is to your future?

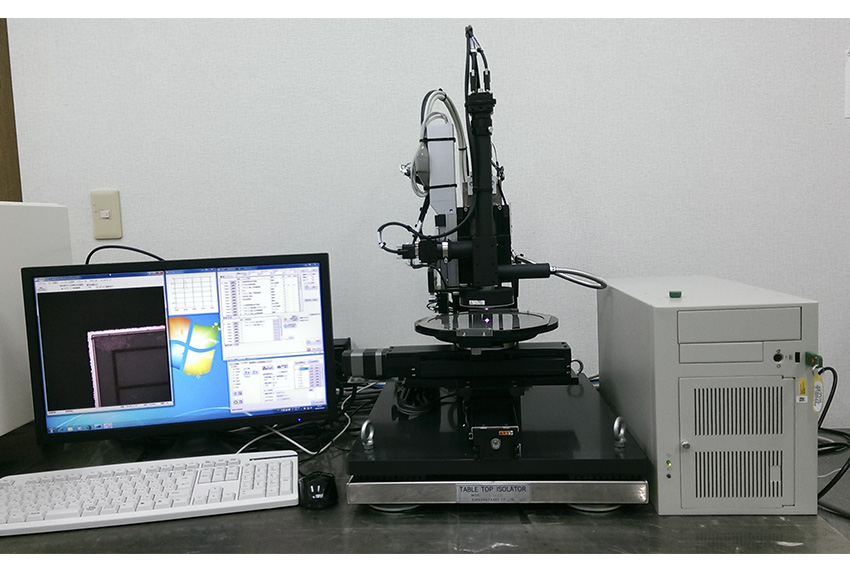

Visual Inspection System (DAVI-1200)

As you mentioned, we have a number of original products that we market. The first is the DAVI Engine, which inspects products based on their external appearance and the demand for these units is definitely going to increase as there is a strong demand in the semiconductor device process to improve the production yield and to increase the quality level. One of the key points is reliability and the ability to do automatic testing. I think the DAVI Engine that we developed with some AI functions incorporated is better in these respects than competing products in the market.

Pulse Tester (DAL Pulse Engine)

The second product you mentioned is the DAL Pulse Engine. There is an increased demand for laser diodes because more and more applications are using them. For example, they are used for automotive sensors to prevent accidents, laser cutting equipment, and 6G communications devices. Therefore, I believe our DAL Pulse Engine can serve this increased demand. There is also a trend of higher output for laser diodes, so stability is going to be increasingly important, as are electric characteristics, which means there will be an increased demand in analytics equipment to measure these characteristics. Our product can help address these needs, and we are proud to be in business with some of major laser diode manufacturers in Japan. We have over three decades of business with those companies, which has allowed us to exchange valuable technology information and helped us to introduce superior equipment to the market. Fortunately, we do not have many competitors in this field because we have a very strong advantage from this long-term relationship with those major laser diode manufacturers, so I think this is one area that will continue to contribute to our business.

Wafer edge grinding machine (CVP-3000: for 300 mm diameter wafers)

Finally, you mentioned the wafer edge grinder, and you also mentioned how the size of the wafer is increasing. This means that a special grinder is needed. Also, the recent use of different materials in wafers is a factor. For example, silicon carbide is very hard, like a diamond, so it requires a very efficient solution for handling, and our technology can uniquely meet this requirement. In fact, we patented the technology, and I think we are the first in the market to provide such an exact solution.

I believe we can keep up with the latest trends in the market and continue to supply original products that have a competitive advantage over other players. As for future product development, I mentioned earlier that we are trying to venture into software development, and I think we can leverage some AI features to provide solutions that can contribute to energy savings, automation, and precision that the customers require in the evolving market.

In these and other areas, we are keen to use various kinds of technology to advance our in-house development capability.

Your eleventh medium-term business plan (11M) aligns with your 2030 VISION. The targets are JPY 100 billion in sales and focused strategic growth, which covers digital transformation, overseas expansion, investing in human capital, and increasing your dividend from 30% to 40%. What are the key factors to make those targets a reality?

I would say that the first thing that needs to happen for this target to become a reality is for us to increase our ratio of overseas sales. We have the strength of having both trading and manufacturing, which sets us apart from the rest of the competition. We want to make sure that we seize every opportunity in the market and have a very clear focus on the areas where we can see tangible growth, using our strength in both equipment and components.

Another important thing is to enhance our ability to develop original products and increase the sales contribution of these products relative to the total revenue of the company.

A third thing that will help is that we established a new business pillar of the company, which is the software business. The effort for this is already underway, and we want to build a solid foundation for this to become another important pillar of the company.

You just touched upon internationalization. In 1986, you opened your first foreign subsidiary in Portland, Oregon, in the US, where I believe you worked. At this stage, 21% of your revenue comes from overseas, and you have fourteen overseas locations, with a new subsidiary in the Netherlands and a new office in Vietnam. What markets do you see having the highest growth potential, and where will you focus your international expansion over the next five years?

If I consider this question from a five-year perspective, I would say that Europe and North America are the two regions where we want to strengthen our business, which means that we believe that we have not sufficiently performed relative to the business potential that we see in these two markets. Currently, the proportion of business coming from China and Korea is relatively high compared to other regions, including Europe and the US, so those are the two regions that we want to focus on in the next five years. That is why we have established a foothold in the Netherlands recently, though we believe that may not be sufficient to cover all the business opportunities in that region, so we might need to explore creating some satellite offices in other European countries.

As for the current status of North America, there is a production site in the middle part of the US, and there’s a sales office on the West Coast, but we do not have any physical presence on the East Coast. To have better access to the business potential in the US, we believe that we should have some offices on the East Coast to complement the presence we already have in this vast area.

Speaking about the components business, we have not performed as well as we anticipated in Southeast Asia. That is why we’ve decided to set up a company in Singapore and have a presence in Vietnam. We want to focus on Southeast Asia to grow that business.

That is more or less our short-term focus. If I were to speak from a longer-term perspective, another region that I’m focusing on is India. I’d like to have an office somewhere in India, and we have recently started examining what the potential is in the Indian market. I think it would be good if we could set up an office somewhere in India in three to five years. We believe that India's market potential is very promising, and we expect solid market growth in electronics, including semiconductors.

Daitron was created in 1952 and has had a series of different managers and presidents. Is there a goal or objective that you would like to achieve during your time as president before turning the company over to the next management team?

I would like to make this a truly global company. What I might mean by that is that the overseas sales contribution should exceed 50% of the entire revenue, and achieving our JPY 100 billion revenue goal is a prerequisite to that.

We have built and developed a business primarily focusing on hardware, equipment, and components, and we have sold various products sourced from other companies and our original products. Going forward, as I have mentioned, our goal is to establish another pillar in our business, which is the software business, so that we can provide optimal solutions to our customers by combining our strengths in both hardware and software. Therefore, my ultimate goal is to make this company a truly global company that has the capability on both the hardware side and the software side.

For more information, visit their website at: https://www.daitron.co.jp/en/

0 COMMENTS