A Japanese company that sells uniforms on the domestic and international markets, Chikuma looks to take care of the planet and give something back to society.

We think Japan is living a very interesting time. The supply chain disruptions caused by the COVID-19 pandemic a few years ago and the tensions between the US and China, accompanied by the weak yen and the high-quality products that Japan has to offer, put Japan in a position to finally offer once again very price-competitive products. This brings back a lot of activity to Japan. Do you agree with this premise? What do you think are the key advantages of Japanese companies within this current macroeconomic environment?

In general, I totally agree. The main advantage of Japanese manufacturers is that they are able to provide a stable supply amid strong concerns about country risks, such as the current problems in Ukraine, the U.S.-China issue, and the unstable economic situation in China, and that they can always do business with confidence due to their thorough quality and delivery management. The weak yen is causing an increasing number of Japanese manufacturers to shift their production from overseas to Japan, and we believe that now is the right time for Japanese manufacturers to take on a major challenge.

Our international operations faced significant challenges during the COVID-19 pandemic. We encountered disruptions in logistics and geopolitical issues, such as political unrest in Myanmar and lockdowns in Vietnam and Shanghai. Thanks to the understanding and cooperation of our customers, we managed to overcome these difficulties.

Our primary product is uniforms, accounting for 95% of our business. As these are essential for workers, timely delivery is crucial. Many general apparel companies, especially traders, were heavily affected by delayed goods, leading to customer cancellations and compensation payment. Fortunately, being in the uniform industry, we were considered essential and maintained our customer relationships throughout the three-year pandemic.

The COVID-19 disruption persists today, with material shortages and rising prices. The 40% depreciation of the yen has made importing more challenging for Japan. Consequently, companies are bringing production back to Japan, but there are limitations in domestic fabric production capacity. This has led to rising costs, material shortages and delays in the apparel industry, affecting yarn and fabric production, and ultimately finished products.

As we celebrate our 120-year history, we deeply value the strong network and partnerships we've built with our suppliers. Through their support, we successfully navigated Japan's busiest season, starting on April 1st, which sees high demand for uniforms, including those for students, police officers, and firefighters. Unlike the industry's general delays, we were able to fulfill all orders on time with the support of our dedicated suppliers.

To address this ongoing situation, we acquired a major garment manufacture company in Fukui Prefecture last July, providing us with a stable manufacturing base. With this strong foundation, we are gearing up for the upcoming busy season and preparing to expand our domestic and overseas exporting business.

What is the importance of partnerships within your business model, and are you looking for new partners to help with your overseas expansion?

In overseas markets, a reliable partner who knows the area is essential to building a business. We are looking for human resources through various channels to develop new business and new markets. We believe that the best way to acquire human resources is through introductions from existing clients, distributors, and trusted partners. We also value encounters at trade shows and other events.

Partnerships play a critical role in our business because it’s like nurturing an extended family. We've forged a robust supply network in uniform production that spans not only domestic companies but also production facilities in Vietnam, Myanmar and China. Rather than focusing solely on cost or area, our primary emphasis lies in identifying dependable partners and cultivating enduring relationships. Remarkably, we've been collaborating with the Myanmar factory for 15 years and the Vietnam factory for over two decades, and we've had a presence in China since the 1980s. These longstanding, steadfast relationships continue to be the bedrock supporting the progress of our business.

In your opinion, what makes a partner of choice? What kind of qualities are you looking for in a new partner?

Trust and shared values are essential in our partnerships. We view our partners as integral members of our extended family, and our aspiration is to cultivate enduring relationships with them. We have grown together, embodying a win-win philosophy. In Japanese, we describe this as "coexisting and flourishing together," underscoring the importance of mutual benefit in our partnerships.

We began as an importer of fabric for UK men’s suits 120 years ago. Over time, our business evolved, and due to the depreciation of the Japanese yen, we recently ceased our importing activities. Instead, we have shifted our focus to exports, particularly targeting Italy, France, Germany, the UK and the US.

Within Japan, we have established strong relationships with suppliers such as THE

JAPAN WOOL TEXTILE CO., LTD., a wool fabric manufacturer, and TEIJIN LIMITED, TEIJIN FRONTIER CO., LTD. Additionally, we have partnered with suppliers in the Hokuriku region. These steady connections have enabled us to act as mediators, facilitating the export of their products to overseas companies.

Recently, we became members of the Association of Textile Exchange, a global organization certified to recycle products. We are utilizing this platform to seek new partnerships and expand our network.

Japan's aging population creates two major issues: a shortage in the labor force and a shrinking domestic market. How much must Japanese companies such as yourself look overseas to overcome this labor force shortage as well as ensure long-term business success?

School uniforms in Japan, particularly those for middle school mandatory education, traditionally featured black jackets and pants for male students, reminiscent of army uniforms, while female students wore navy sailor-type uniforms with skirts. However, with the increasing prominence of LGBTQ issues in Japanese education, there was a significant shift in uniform models for middle schools two years ago. The discussion around gender identity has gained traction as a societal concern. Despite the existence of designated uniforms for male and female students, approximately 700 middle and high schools across Japan made substantial changes in March of the previous year to align with this societal shift. This marked the most significant alteration in uniform history and this trend is expected to continue over the next five years and the market is expected to revitalize. To put this in perspective, in previous instances, the maximum number of schools making changes stood at 400, and these changes were typically prompted by different factors.

Interestingly, despite a 2% decrease in the overall student population on average, our uniform business has experienced growth. We achieved a 4% increase in revenue last year. Our business strategy is now aimed at elementary school students, as only 10% of them currently wear uniforms, leaving a substantial 90% untapped market potential. Collaborating with our supplier, THE JAPAN WOOL TEXTILE Co.,Ltd., we have embarked on a long journey to penetrate the elementary school market and promote uniform usage through our registered brand and education program, FUKUIKU.

Moreover, there has been a notable resurgence in the demand for company and business uniforms following the COVID-19 pandemic, particularly in the service sector. Japan has witnessed an influx of tourists due to the weakened yen, resulting in increased demand in sectors such as service and accommodation. This growing demand extends to industries with which we already have partnerships, including airlines, railroads, hotels, restaurants, cab services, and tourist bus companies. Additionally, the upcoming Osaka Expo and the establishment of an IR Casino are expected to further boost uniform demand. The service sector, therefore, presents significant growth potential for us.

As a challenge to a new business field, we developed Chikuma's unique , " チクマノスマファ(chikuma-no-smafa)" through collaboration with Makita and Teijin. For example this is a uniform made for the hotel in Nara Prefecture, so the design is based on a deer.

Does it need to be charged?

It works with batteries which need to be charged and lasts for eight hours. It's light.

HP https://chikuma-no-smafa.com/

Electric fan wear

Is this only for Japan's domestic market, or are you also looking to market this product to other countries?

The world's largest uniform exhibition, known as A+A, takes place in Germany every two years during October. In two years’ time, we have plans to showcase our business and products at this prestigious event in collaboration with other companies. Notably, our fan-equipped jackets are manufactured in Vietnam, allowing us to directly export them to countries like Germany at a competitive cost advantage. Many Japanese material companies are exhibiting at this exhibition. Our participation in this exhibition will be key to our overseas expansion efforts.

In the late 90s, we saw the emergence of fast fashion with companies like Zara and H&M replicating some very high-end fashion at a cheap cost and at a very quick pace. However, it is said that around 10,000 pieces of clothing end up in landfills every five minutes. Can you tell us more about how you are transforming your operation to meet the growing environmental expectations of the clothing industry with this kind of product?

We've established a recycling loop that distinguishes us as the only Japanese company capable of collecting and recycling the items we produce, transforming them into new products for resale. We take great pride in our 28-year history as pioneers, having had an environmental department within our organization since 1995.

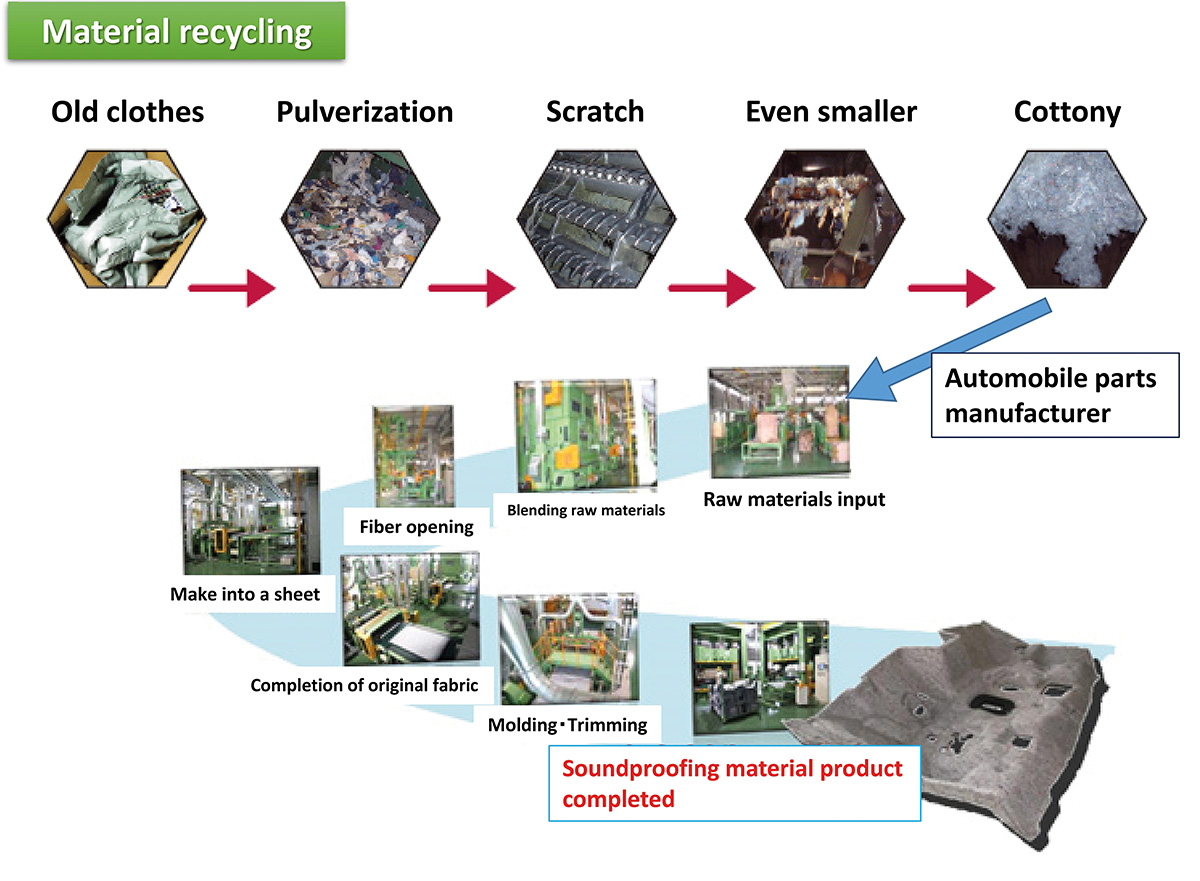

In Japan, regulations stipulate that products must be discarded or recycled under the jurisdiction of each prefecture or municipality. However, due to our certification and approval from the Ministry of Environment, we are authorized to transport our discarded products across prefectural boundaries to our recycling facilities in Shizuoka. Here, we employ shredding, crushing, and processing techniques to convert collected clothing into felt, which finds applications in automobile interior materials.

Furthermore, we entered a joint venture with an automotive interior company in Kitakyushu 12 years ago. Through this partnership, we repurpose collected clothing (apparel store collections, uniforms manufactured by other companies, etc.) into automotive interior materials, including shock-absorbent and soundproofing components.

There are several partnering companies participating in this recycling loop. For instance, we collected uniforms from Nagoya Subaru and repurposed them into car interiors. Concurrently, we calculated their CO2 emissions reduction achieved through recycling to assess their contributions to decarbonization and calculated greenhouse gas emissions according to the GHG Protocol.

Material recycle flow chart

During COVID-19, many physical retail stores greatly struggled. However, Japan had a significant rebound through e-commerce developments over the last three years. How has your business adapted to take advantage of this e-commerce rebound recently to overcome the COVID-19 situation?

The COVID-19 pandemic prompted significant transformations in our approach, leading to the development of a groundbreaking school uniform system. Traditionally, school uniform dealers would either visit schools or have students visit their stores to take precise measurements for each individual. However, the pandemic imposed limitations on such close contact and assembling students in one location became challenging.

In response, we designed a system that allows students to register using full-body photos. This system intelligently recognizes and suggests the appropriate size for each individual. We are actively promoting this software system through an e-commerce channel.

This enables dealers to collect individual student data and place direct orders with manufacturers. With this innovative system, the risk of human error is eliminated, and the complex supply chain has been streamlined. Over the past three years of dealing with the challenges posed by COVID-19, our business model has evolved, and we aspire for this system to become one of the pillars of our operations.

Fukuiku is a new fashion education concept based on three pillars: “health, safety”, “sociality” and “environment”. Can you walk us through this concept? How can it apply to society beyond the school setting?

The Fukuiku concept represents a unique program dedicated to educating others about clothing, and it is a registered term by Chikuma. As we approach our 20th anniversary next year, commemorating our establishment in 2004, we remain committed to imparting knowledge to students about the profound significance of clothing. We emphasize its connections to health, safety, effective communication, social engagement and environmental sustainability.

Annually, we deliver this program to over 300 schools, leveraging the expertise of our specialized FUKUIKU educators. Chikuma boasts an extensive network of uniform dealers spanning every prefecture. Through these partnerships, we actively work towards raising awareness and fostering education about the multifaceted roles and possibilities of clothing.

In the past, students often attempted to modify their uniforms independently, sometimes resulting in inappropriate alterations. Recognizing this, we supported local schools to educate students on the proper way to wear their uniforms. Furthermore, we expanded our curriculum to include giving the opportunity to study about various fabrics, the processes involved in clothing production and shared values related to health, safety & environmental responsibility.

Imagine we come back in five years for your 125th anniversary and have this interview all over again. What would you like to tell us? What dreams and specific goals would you like to accomplish over the next five years? How would you like to be seen in the global market?

To achieve the long-term plan spanning until 2030, we have made a midterm plan to be accomplished within the next two to three years. In the first phase, from 2023 to 2025, our primary goal is to achieve the same level of sales and profitability as in 2019, the most recent high prior to the COVID-19 pandemic outbreak.

While the pandemic significantly impacted our profits, we are now on a path to recover to that same level of success. Building upon the accomplishments of the first phase, we will initiate the second phase next year (2026 to 2028), focusing on the final steps required to attain our 2030 goals based on our accomplishments this year.

A key priority in our strategy is the establishment of robust production capabilities, ensuring a stable business foundation that enables us to efficiently export our products to overseas markets. Furthermore, we aim to prominently showcase our recycling systems, namely “CHIKUMA NO ROOP” and “FUKUIKU”, to enhance our brand presence and position ourselves as a sustainable and environmentally responsible company in international markets.

0 COMMENTS