As a prominent provider of camera modules for smartphones, Cammsys draws on over 20 years of experience collaborating with Samsung. Leveraging this expertise, the company is spearheading the advancement of enhanced and intelligent solutions for AI-driven surveillance systems, drone modules, endoscope cameras, and temperature sensors.

Through the success story of Korean MNCs who have dominated both consumer markets and high-tech industries, Korea saw the emergence of domestic suppliers. As the Korean industry continues to grow into a key global player, critics claim that the SME sector might find itself “sandwiched” between new and established manufacturing powers that will limit their international expansion. To what extent do you agree with this argument? How can SMEs better diversify their client base and reduce their dependence on Korean MNCs?

It's true that Korea finds itself sandwiched between emerging and established manufacturing powers, a situation also mirrored in countries like the U.S. and China themselves. Additionally, even within countries like Vietnam, competitiveness can vary compared to neighboring nations like Cambodia. This global challenge affects the entire industry, regardless of location. Despite appearing at the top of the food chain, the U.S. faces its own structural constraints and endeavors to overcome them.

In such a challenging landscape, survival hinges on a company's ability to innovate and adapt. Collaboration and innovative thinking are essential for staying ahead of competitors.

Drawing a parallel to the automotive industry, where cars are categorized into high-end, middle-end, and low-end segments, our products may not always compete on cost alone, but they consistently deliver unrivaled quality.

There's a misconception that manufacturing facilities in developing countries are outdated and labor-intensive. However, this isn't necessarily the case. Many factories in these regions, including those of Samsung, are highly automated. Consequently, latecomers face significant challenges in catching up with established players like us, given our advanced assembly lines, technological expertise, and commitment to producing high-spec products. This serves as a distinct advantage for us in the market.

In recent months, international governments have rolled out trade policies aimed at promoting supply-chain realignments. This policy is creating opportunities for Korean enterprises, as it positions them as an attractive option for the creation of compliant supply-chains. What opportunities does this global realignment create for Korean companies? How well positioned is Korea to benefit from these strategies?

Firstly, I'd like to address the terminology used in the IRA, which stands for Inflation Reduction Act. However, this name may be misleading. Can subsidies alone effectively control inflation? The U.S. government seems to be incentivizing companies to stimulate economic growth, perhaps using the term "inflation reduction" to facilitate the legislation's passage through Congress.

Undoubtedly, this is a pivotal moment for Korean SMEs, as the U.S. administration is actively incentivizing Korean companies to engage in mutually beneficial expansion. While conglomerates spearhead their entry into the U.S. market, SMEs stand to benefit from this collaborative expansion. However, it's worth noting that subsidies primarily benefit conglomerates and often do not trickle down to primary or secondary partners like SMEs. Additionally, the upfront costs associated with establishing factories in designated regions may lead to increased inflation.

If the entire supply chain relocates to the U.S. mainland, it signals a broader ecosystem shift. Consequently, for Korean SMEs considering a move away from this ecosystem, reshoring back to Korea may prove challenging and costly. Despite significant opportunities for Korean companies, the potential risks to the Korean economy are substantial.

Korea's manufacturing landscape faces challenges such as strong labor unions and a less business-friendly environment. Consequently, many Korean companies opt to relocate to the U.S., attracted by the states' more flexible labor markets and generous subsidies.

What potential do you see in the subsidies aimed at promoting the EV industry in the United States, a sector that has traditionally lagged behind countries like Korea and China?

In my view, the decline in competitiveness within the U.S. automotive industry over recent decades cannot solely be attributed to a lack of subsidies. Rather, it reflects a failure to provide tailored solutions that align with customer expectations. For instance, Hyundai Motor Group excels in addressing customer pain points, such as offering automated features that block outside air before entering tunnels. While seemingly minor, these features meet specific customer needs. Conversely, if we examine Tesla, their glove boxes operate abruptly, lacking the meticulousness and smoothness typically associated with Korean or Japanese automakers.

German automakers have successfully tailored their solutions to meet the needs of Korean and Chinese markets, showcasing a deep understanding of local expectations. However, this level of customization is lacking among U.S. automakers. The sheer size of the U.S. market may have fostered complacency among domestic automakers, whereas Korean SMEs perceive global expansion as essential for survival due to the comparatively smaller domestic market.

From your perspective, what do you anticipate will be the most significant growth segment within the camera module market? Moreover, which specific sectors are you prioritizing among those you mentioned earlier?

As we cannot predict future developments with certainty, our strategy involves maintaining a broad focus across various fields. However, our primary emphasis lies in camera modules. Leveraging our existing camera technology, we aim to develop advanced products, such as the thermal sensor modules mentioned previously. Our goal is to identify sectors where we can effectively integrate our core technologies.

While competitors like MCNEX may concentrate on electric cars given the enormity of the automotive industry, we adopt a diversified approach, exploring opportunities from different angles. If there's a sector currently devoid of camera modules but likely to require them for diverse applications in the future, we stand ready to enter the market and provide our camera solutions.

How has your partnership with Samsung enhanced your competitiveness over your competitors in Korea, or in China? Furthermore, as you navigate global markets to sustain growth, how crucial is diversifying your client base and collaborating with international stakeholders?

Our partnership with Samsung began during the launch of their Anycall series in the early 2000s, a time when phones with camera modules were non-existent. We proposed integrating small, low-pixel camera lenses—a groundbreaking move. At the time, Samsung's Anycall series wasn't yielding substantial revenue, prompting them to accept our proposal, marking the world's first release of smartphones with camera modules.

Despite Samsung's in-house production capabilities, which incur high costs, including overhead expenses, they still rely on external partners like us. This reliance underscores the inefficiencies of their internal production lines, necessitating cost reduction through partnerships.

Regarding diversification, our revenue heavily relies on a few major clients, an imbalance we recognize. Therefore, we're committed to expanding our portfolio into areas such as drone modules, endoscope cameras, AI-driven surveillance systems, temperature sensors, and fingerprint recognition technology. We're exploring partnerships for military-grade unmanned vehicle cameras and discussing supply agreements with companies producing armed robotic systems. Additionally, we aim to broaden our client base for the CUBS system.

Last year, in 2023, Cammsys’ CUBS technology was showcased at an exhibition and subsequently released. Could you provide insight into the development of this technology and other ongoing projects applied in industrial products? Moreover, how do you expect CUBS to fare against other SOC monitoring technologies?

Initially, our focus was on developing an ultrasound fingerprint recognition sensor, leading us to conduct extensive research. Unfortunately, we encountered challenges during mass production, despite success in the research phase. However, leveraging this foundational technology, we pivoted towards creating ultrasound-based battery cell diagnostics.

While battery diagnostics can be performed using existing methods such as X-rays or CT scans, these approaches are often complex and costly. In contrast, our ultrasound diagnostic technology offers a non-disruptive solution, capable of detecting changes in the physical properties within battery cells. Consequently, we've established collaborations with major Korean battery and automotive manufacturers.

Our sales and growth opportunities are closely tied to client usage of our battery diagnostics product. Clients may integrate our diagnostics into their inspection processes, utilize it for individual cell checks in engines, or implement it for routine maintenance in finished vehicles.

The adoption of our battery diagnostics system stems from the inherent risks associated with lithium-ion batteries, which are flammable. However, advancements in battery technology, such as improved lithium iron phosphate (LFP) batteries or the transition to all-solid-state batteries, may mitigate these risks, potentially reducing the necessity for diagnostic systems.

CUBS is the new Cammsys’ Ultrasound Battery Scanner

The recent announcement of the new Samsung S24 Ultra implementing a new AI powered camera revolutionized the way devices, such as mobile phones, and by extension robots and home appliances, will see the world. Those new features such as zoom, noise reduction and detail enhancement are shuffling the cards of how camera modules should be thought of and designed. In this context of AI integration, how does Cammsys adapt to this revolution?

Given our specialization as a hardware company rather than a software entity, we're embracing the AI trend by forging partnerships with specialized firms in the field. Collaborating with companies like a Japanese NPU specialist and those specializing in AI algorithms enables us to cater to the evolving expectations and needs of customers in the AI-driven camera landscape.

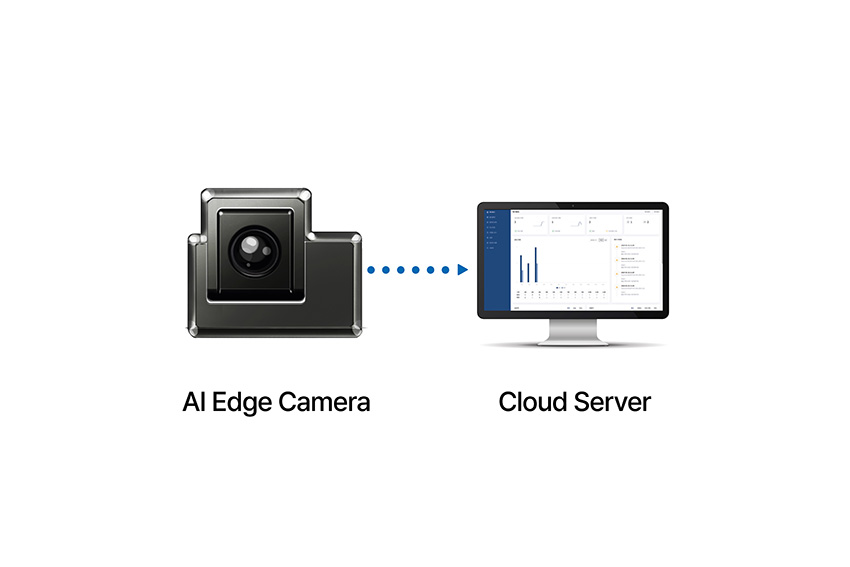

Consider security cameras, for instance. With human monitoring being impractical around the clock, we're exploring the development of cameras capable of transmitting signals or alerts to relevant agencies in response to unforeseen or unusual events. This proactive approach aligns with our commitment to harnessing AI to enhance the functionality and effectiveness of our camera solutions.

Cammsys’ AI system Camera

Cammsys’ AI Edge Camera integrates the AI Platform

Let's address a question on the record. You've emphasized the importance of your product lineup in attracting customers to evaluate and integrate your technology into their end-user products. Could you outline your current product lineup, focusing on those you consider most competitive and the one you're most proud of?

Despite our unsuccessful commercialization efforts, I take immense pride in our ultrasound fingerprint sensor. It represents the pinnacle of our technological advancements and research. Personally, I believe it boasts unparalleled recognition speed compared to competitors developing similar technology. Additionally, I must highlight that Cammsys excels in delivering prime quality across all our products, without any compromises.

Mr. Kwon envisions Cammsys achieving extraordinary revenue growth from this year 2024

Cammsys is a sizable company, evident from your impressive revenue exceeding half a billion dollars in 2020. However, you operate in a market prone to cyclical fluctuations influenced by various external factors. Considering this, looking ahead five years from now, what are the goals and objectives you've set for Cammsys? What do you hope to achieve by then?

We envision achieving extraordinary revenue growth, driven primarily by our ability to attract new customers. The majority of our substantial revenue will likely stem from these new customer relationships currently in development. While the smartphone market has reached maturity, we remain committed to finding innovative ways to navigate and thrive within this landscape. Simultaneously, we recognize the enduring stability of the smartphone industry, which serves as a dependable source of cash flow for our diversification efforts.

Expanding upon our technological expertise within the smartphone industry, we aim to venture into new sectors. For instance, we're actively engaging with home appliance manufacturers, recognizing numerous opportunities for camera module integration in products like refrigerators, ovens, and washing machines. Our strategy involves leveraging these diverse sectors to generate additional revenue streams and drive sustained growth.

Cammsys Headquarters

For more details, explore their website at https://www.cammsys.net

0 COMMENTS