A few weeks ago Indonesia’s budget airline Lion Air startled the aviation industry by finalizing a $22.4 billion deal with Boeing for 230 new 737s—the biggest-ever commercial order the U.S. plane-maker has ever taken.

Almost simultaneously, Garuda Indonesia, Lion Air’s closest rival, announced that it is to acquire up to 18 Bombardier CRJ1000 NextGen aircraft and plans to increase the size of its fleet from 89 to 154 aircraft by 2015.

Last year, Kuala Lumpur-based AirAsia placed an order for 300 Airbus A320neos and announced plans to make Jakarta its regional headquarters.

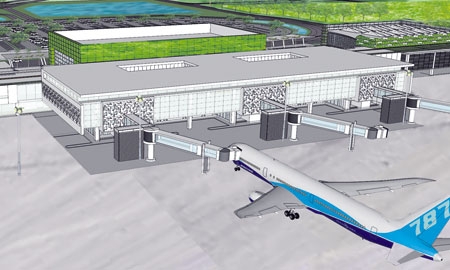

Meanwhile, Indonesia’s overcrowded airports are being turned into construction sites and plans have been drawn up for new ones, as they struggle to cope with an unprecedented increase in passenger numbers.

Expansion of airline fleets and airport capacity are not just a response to the increase demand for air travel witnessed so far. On the horizon is ASEAN Open Sky, the liberalization of aviation by the member countries of the Association of Southeast Asian Nations. Due to be implemented in 2015, this is expected to lead to another big surge in international traffic.

For the airlines, ASEAN Open Sky will open up new opportunities in the regional aviation market – hence the orders for additional aircraft. For the five international airports that will be affected in Indonesia – Soekarno-Hatta (Jakarta), Ngurah Rai (Bali), Polonia/Kuala Namu (Medan), Sultan Hasanudin (Makassar), and Juanda (Surabaya) – the lifting of regional flying restrictions makes improvements in capacity and quality essential.

“The challenge is to balance our capacity with the increased flow of air traffic and passengers. Almost all our airports have insufficient capacity, so we are having to do a lot of building.” Tommy Soetomo, President Director of Angkasa Pura I |

“Of course we are very pleased, but the challenge is to balance our capacity with the increased flow of air traffic and passengers,” says Tommy Soetomo, President Director of state airport management company

Angkasa Pura I, which operates 13 airports in eastern Indonesia. “Almost all our airports have insufficient capacity, so we are having to do a lot of building.”

He says the airports managed by PT Angkasa Pura I served 56 million passengers last year – a rise of almost 14%.

And it’s the same story at the 12 airports in western Indonesia run by the other state airport management company, PT

Angkasa Pura II. More than 62 million people passed through facilities designed to accommodate 30 million people. Busiest of all was Jakarta’s Soekarno-Hatta airport, now the twelfth biggest airport in the world, where passenger numbers soared from 12 million in 2001 to nearly 50 million in 2011 – the fastest growth recorded in any ASEAN airport.

With the economy expanding, the increase in air travel is being fuelled by Indonesia’s burgeoning middle class. And the signs are that demand will continue to rise with incomes. At the same time, Indonesia is busy marketing itself as an international tourist destination. This year it is aiming to attract a record 8 million foreign visitors.

“Indonesia has a population of 240 million and in 2010 only 10 million people traveled – because each of these people can be reckoned to have flown five times,” says Tengku Burhanuddin, Secretary General of the Indonesia National Air Carriers Association (Inaca).

“Soon we are going to have an open sky policy, and then the international traffic will grow. Asia is the fastest growing region in the world. Indonesia’s economy, in particular, is really improving, and people’s income is increasing. The main problem we have is the airport infrastructure. We have to raise the capacity, and we also need more pilots.”

Growth in passenger numbers, which amounted to double the global average last year, has sent the revenues of the airlines skywards.

These are good times for the airport operators too. PT Angkasa Pura I saw its income take off to around 3 trillion rupiah ($331 million) last year, a 23.3% rise, while its profit rose to 655 billion rupiah, up more than 17% year-on-year.

PT Angkasa Pura II saw a 12.25% rise in revenues to 3.48 trillion, with profits expected to exceed $1 trillion rupiah.

Last year, PT Angkasa Pura I signed a memorandum of cooperation with IT solutions company

SITA to install the latest Intelligent Airport technology at all its airports. Using real-time information, the technology will provide passengers with improved flight information displays and better check-in and baggage reconciliation facilities.

“The whole reason behind the memorandum of cooperation with Angkasa Pura I was to work with the airport authorities to bring the infrastructure in their 13 airports up to world class standards,” says

Damian Hickey, SITA’s regional Vice President.

“We have vast experience in what is considered industry-wide best practice, and they were very keen to work with us and bring some of those worldwide best practices to Indonesia, to bring some of these airports up to Skytrax 5-star standards.”

0 COMMENTS