According to OPEC, prices are set to surge due to high exploration costs, while population and economic growth will also result in a spike in demand for oil

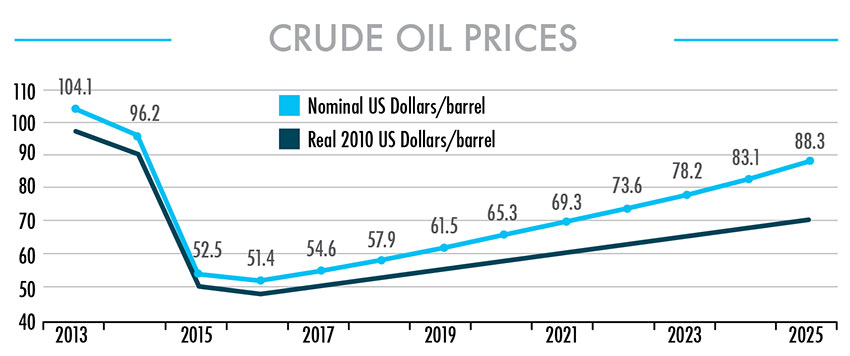

A recent report released by the Organization of the Petroleum Exporting Countries (OPEC) has predicted that oil prices are set to recover to $70 a barrel by 2020.

Brent crude oil prices have fallen from more than $110 a barrel in 2014 to less than $28 a barrel in January 2016 (the lowest since 2004) due to oversupply and slowing demand.

The report, which was published late last year, said it expected oil prices would rise in 2016 – with the price as of April 2016 standing at $37 a barrel – and in the longer term go up due to higher exploration costs.

OPEC – which currently accounts for about 30% of the world’s oil production, down from 50% in the 1970s – says it expects its market share to shrink by 2020, largely due to the emergence of shale oil produced in the U.S. Another factor in low prices, according to the report, has been weak economic growth, particularly in developing economies.

The ‘World Oil Outlook’ report underlined “huge reductions” in spending on exploration and production by the industry as a whole due to low oil prices, with many oil majors making big cuts to capital spending. Such reductions will likely see supply fall putting upward pressure on prices, predicts OPEC.

Higher exploration costs (companies are being forced to go to greater lengths in their search for oil as traditional supply sources diminish) such as deep water drilling, will also push prices up.

The current decline in oil prices, meanwhile, is driving up demand for oil. The OPEC report forecasts a rise to 97.4 million barrels a day by 2020, compared with an estimated 92.8 million barrels a day in 2015. Worldwide population and economic growth are cited as the main reasons for the spike in demand, which is estimated to rise by 50% by 2040. The increased demand could even see prices reach $160 per barrel in 2040, which would represent the highest amount ever paid for oil.

This spells better news for many of the world’s oil majors, including Mexico’s Pemex, which have been making heavy losses. “It is easy for consumers to be lulled into complacency by ample stocks and low prices today, but they should heed the writing on the wall: the historic investment cuts we are seeing raise the odds of unpleasant oil-security surprises in the not-too-distant-future,” said Fatih Birol, executive director of the International Energy Agency, sharing his insights on the OPEC report.

In order to be ready to meet oil demand in the future, Mexico will need to stimulate new investment today, not just for the good of Mexico, but for all of North America. “We will continue to increase our economic and productive integration with the United States; and, working together, we will make of North America, the most competitive region of the world,” said Mexican President Enrique Peña Nieto in his keynote speech at the IHS CERAWeek conference in Houston in February.

0 COMMENTS