“Nigerian banks are now the healthiest banks in the world in terms of asset quality and capital”

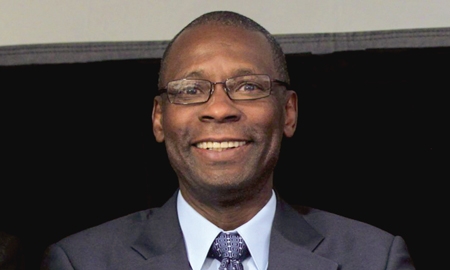

Mustafa Chike-Obi Managing Director and CEO of the Asset Management Corporation of Nigeria, AMCON

Nigeria’s banking crisis is over and a substantial recovery in the sector’s earnings can be anticipated. That is according to Mustafa Chike-Obi, Managing Director and Chief Executive Officer of the Asset Management Corporation of Nigeria (AMCON).

In a recent speech in Lagos, he declared: “Nigerian banks are now the healthiest banks in the world in terms of asset quality and capital.”

Mr Chike-Obi added: “We should wait until after the second quarter of this year before passing judgment – I will not tell you that nothing surprising can come up – but the banking crisis of 2007-2009 is over.”

Established in 2010, AMCON has been a key player in the stabilizing and revitalizing of Nigeria’s financial system. Tasked with cleaning up the banks’ balance sheets following a multibillion-dollar rescue of eight failing institutions, it has absorbed their non-performing loans, exchanging them for government-backed bonds.

AMCON is the largest domestic issuer of bonds, with assets of about N5 trillion ($30.6 billion), making it the largest institutional holder of Nigerian bank stocks. By buying up the bad loans that were crippling the banks, the corporation has enabled them to continue doing business and making new loans to facilitate the running of the economy.

Kingsley Moghalu, Deputy Governor, Financial System Stability, at the Central Bank of Nigeria (CBN), said recently that by relying on AMCON and contributions made by the banks themselves through a banking stabilization fund, Nigeria is the only country where the resolution of the banking crisis has been carried out without using taxpayers’ money.

AMCON plans to refinance its N1.7 trillion three-year bond with maturities of between seven and 10 years when the debt expires next year. The bonds to be refinanced include those issued for the purchase of non-performing loans, as well as those issued for cash. Analysts say the move will boost banks’ liquidity and test the depth of the domestic bond market.

The CBN is targeting a non-performing loans ratio of 5 per cent across the industry, after AMCON bought up the banks’ existing bad loans, compared to previous levels of 50 per cent.

AMCON took on approximately 9,000 non-performing loans and is actively engaged in recovering them through debt restructuring and chasing those unwilling to pay. It aims to resolve all outstanding debts within two years.

The corporation is also responsible for the sale of Nigeria’s three new nationalised banks, which were established when Afribank, Bank PHB and Spring Bank were bought by AMCON. The failing banks, which had been losing between N2 billion-N3 billion per month, had their assets and some liabilities transferred to newly incorporated “bridge banks” – temporary banks organised by the regulators (CBN & NDIC) to administer the deposits and liabilities of failed banks – namely, Mainstreet Bank, Keystone Bank and Enterprise Bank respectively.

“Nigerian banks are now the healthiest banks in the world in terms of asset quality and capital” Mustafa Chike-Obi Managing Director and CEO of the Asset Management Corporation of Nigeria, AMCON |

The three bridge banks acquired their nationalised status after AMCON’s purchase last year. AMCON injected N679 billion into the bridge banks to meet the central bank’s minimum capital base requirement of N25 billion and the minimum capital adequacy ratio of 15 per cent. All three banks are now profitable institutions.

AMCON’s boss has pledged that the sale process will be highly transparent, so that Nigerians consider it has been handled fairly.

Mr Chike-Obi says it is essential for AMCON to secure the most advantageous deals. “We are not a charity organisation; we want the best returns on investment.”

As a first step to finding buyers, AMCON has been selecting financial advisers to assess the banks’ worth. “We want experts to look at these banks, value them and tell us what they think we should do with them in order to create maximum value for AMCON,” says Mr Chike-Obi.

At the same time, the best interests of the financial sector have to be considered. “We must make sure that whoever takes over these banks, ultimately, is fit and proper to run a bank. We must know where their money is coming from and we must know that the management is going to be sound. So, those are the three things that we want to consider. So, until we get there, we are not in the position to seriously look at any investor interest.”

Mr Chike-Obi says all options are open: “Nothing is off the table.”

One option would be to list shares of the three banks on the Nigerian Stock Exchange, giving the Nigerian public the opportunity to invest in them.

There have already been more than 20 expressions of interest in the banks, although Mr Chike-Obi says it is too early to consider them. “We will get a better feel of who is interested when the process starts.”

He believes there are plenty of opportunities in Nigeria’s banking sector for those with “the know-how, the capital and the fortitude” to invest.

“The best measure that people use for latent banking potential in a country is the ratio of bank assets to GDP. In Nigeria the extension of credit to the economy is below 50 per cent; whereas in Egypt it is 100 per cent; in South Africa it is about 135 per cent and in India it is approximately 90 per cent,” he says.

“We believe that Nigeria’s credit extension to GDP should be around 120 per cent in the next decade. If you follow that logic, even if GDP only grows by 7 per cent yearly in Nigeria, banking assets should grow by 25 per cent per year in order for us to get there. Therefore we believe there are growth opportunities for banking in Nigeria.”

There is very little retail banking or consumer banking in the country; most banking is corporate. “When you add consumer banking, retail banking and mortgage banking together, you find that credit in the banks will grow and bank assets will grow 25 to 30 per cent yearly for the next decade,” says Mr Chike-Obi.

He says AMCON, the Central Bank and the fiscal authorities are working hard to ensure that the environment is healthy for banking assets to grow at such a rate.

“All over the world banks overstretch themselves. They get into trouble or something happens and they have to retrench. Then they are reluctant to start lending again.

“Banks have to challenge themselves to get out there and look for good loans so they can start lending again,” he says. “They should not be too traumatised by the events of the past five years.”

Looking ahead, he says that in five years time there will be fewer, but much larger and more profitable banks.

AMCON itself is expected to reach its maximum size this year and to decline as it achieves what it is designed to do and becomes a smaller part of the Nigerian economy. Its target is to bring the percentage of non-performing loans down to 5 per cent.

“My view is that the sooner AMCON reduces in size, the better it will be for the country, the financial system and the economy in general,” says Mr Chike-Obi. “I would like AMCON to consist of 25 employees just managing individual assets and the bond repayments.”

1 COMMENT

Great Article!!! Im extremely interested in this institution!!! finally somebody is doing this right!! If only other country in Europe copied this bad bank......I want to read more about Amcon and the pivotal role they are playing in the Nigerian economy. I find it a unique institution! Keep it up.