The Ministry of Finance and the World Bank predict real GDP growth to fluctuate within the range of 3 to 5% between 2015-2018

When David Granger became president in 2015, he brought with him a “fresh approach” not only to Guyanese politics, but also to the country’s economy. This approach has breathed new life into what is traditionally one of the Latin America and Caribbean region’s least well off countries, with the nation set to become one of the continent’s best economic players this year. Indeed, analysts are predicting a growth recovery that will make it one of the region’s top five performers and one of the fastest expanding – not bad for a country of less than 800,000 people. Foreign direct investment (FDI) inflows are on the rise, growing by 19% in 2014 alone. It’s a fitting recovery for a country celebrating its 50th anniversary this year.

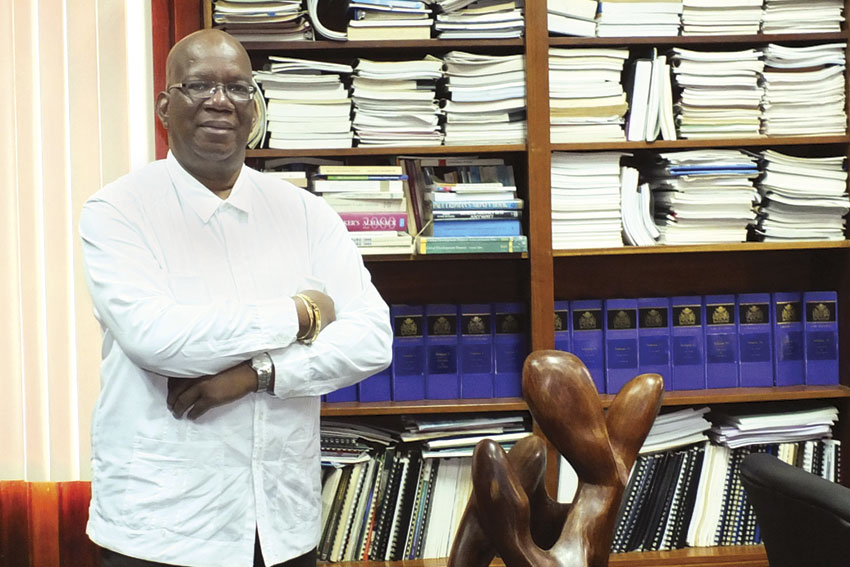

Winston Jordan, Minister of Finance, says last May’s elections heralded a new day for the Guyanese people despite a number of crises on the domestic and international fronts since then. “In all cases, President Granger has shown the discipline and mettle, a calmness and level of maturity that were visibly absent in the past 23 years of the last administration. Our fresh approach to governance is one that people can associate with, one that resonates with them.”

Granger’s government intends to be closer to the people, says Mr. Jordan. “What we want is the voices of the people informing policy formulation. Overall, our approach is about the inclusive, accountable and transparent governance that was so sorely lacking,” adds the minister.

Guyana’s political revival has added momentum to an economy that was already posting average annual growth of 4.6% over the last eight years. It is expected to grow at a similar rate to 2018, says Gobind Ganga, Governor of the Bank of Guyana. “Growth will continue over the next few years, and hopefully hit double digits within five years as oil production comes on line. We have more of a diversified economy than many of our neighbors in the region, and that along with the macroeconomic stability that has been achieved over the last ten years will win investor confidence, spurring further growth.”

Guyana became a member of the CARICOM (Caribbean Community) Single Market in 2006, a move that positively affected its export markets, and it has shown positive growth almost every year since then. It also joined UNASUR (Union of South American Nations) as a founding member in 2008.

Still, weaknesses in infrastructure must be overcome in order to continue this forward push, and strengthening the country’s institutional foundations for greater financial sector development is a priority. Though the country ranks on par with regional destinations in investment protection according to the World Bank, efforts to improve legal and regulatory reform to improve security and facilitate bank credit to the private sector are ongoing and have included a recent anti-money laundering bill.

“Efforts are being made to tackle many of the impediments to investment. What we need is another generation of reforms to modernize the financial sector, improve our laws on acquiring and transferring land and investment promotion. In other words, to create a transparent incentive investment legislative regime for investors,” says the Minister of Finance. The Guyana Stock Exchange, the newest exchange in the CARICOM region, must particularly be more fully developed by implementing and adhering to international best practices.

In regard to Guyana’s continued economic development, going forward, the country appears to have a trump card up its sleeve (or off its coastline to be more precise) that it has yet to put on the table. The Guyana Suriname basin has been identified as having the second highest resource potential among the world’s unexplored basins, and Exxon – the US based oil and gas giant – made a major discovery there last spring.

Exxon’s find and its potential for the Guyanese economy is set to further underscore the close relationship between Guyana and the United States, in which exports to the U.S. account for over a quarter of the country’s total.

“That percentage will definitely increase once ExxonMobil goes into production of oil,” says Mr. Winston. “The U.S. is an important trading partner. Indeed, a large part of our diaspora population lives in the U.S. so we will always see and treat the relationship with the U.S. in a beneficial manner.”

The Minister of Finance stresses the importance of U.S. investment to Guyana’s fast growing economy, and the fact that the country’s huge potential also has plenty to offer American companies looking at doing business there.

“What I want Americans to know is that Guyana is open for business,” he says. “Yes, we might be small relative to most other countries in the region, but we are an important bridge between the Caribbean and South America. Add to that our historical links to North America and we have a country that is ideally situated and suited for investors...whether it’s oil, whether it’s bauxite, manganese, rare earth metals, gold, diamonds, extensive forest, rich agricultural land and warm hospitable people who speak English as their first language. We welcome investment of all kinds to help us develop.”

0 COMMENTS