With a focus on Southeast Asia and beyond, Webcash is strategically expanding its financial software solutions to new global markets.

South Korea, with its rich history in the high-tech industry, is home to some of the world's most innovative companies. However, the nation’s ICT sector has primarily focused on meeting domestic demand, which currently accounts for about 80% of its revenue. This heavy reliance on a domestic market—representing just 1% of the global ICT landscape—poses challenges for corporate growth and international expansion. To thrive globally, South Korean enterprises must secure a competitive position on the global stage. Could you elaborate on the current status of the Korean ICT and software market, along with its key characteristics and strengths?

First, I should clarify that my expertise lies in the B2B software sector, so my insights will focus specifically on that area. The Korean B2B software market is estimated to be worth around 18 to 20 trillion KRW. This market is largely dominated by global giants such as Microsoft (MS), SAP, and Salesforce, which hold significant shares. Following them are major domestic conglomerates like Samsung SDS and LG CNS.

In addition to these big players, there are small and medium-sized enterprises (SMEs) such as Webcash. Webcash specializes in financial software within the B2B landscape. While companies like SAP provide foundational solutions, Korean firms often step in to customize these solutions to better fit local business environments. In the financial sector, Webcash primarily focuses on developing and maintaining channel systems. These systems manage customer interactions with banks, including internet banking, mobile banking, and cash management services (CMS). Essentially, we enable seamless client-bank transactions through innovative software solutions.

You mentioned prominent foreign companies like MS and SAP, along with local giants like Samsung SDS and LG CNS. How do SMEs survive or carve out niches in this competitive landscape?

Speaking from Webcash's experience, global companies like MS and SAP, as well as domestic conglomerates like Samsung SDS and LG CNS, often lack deep expertise in financial systems. This is where we see our opportunity to thrive.

When we first entered the market in the early 2000s, internet banking systems were still emerging. We were competing with global tech giants like IBM and HP. However, these companies soon exited the sector because they found the financial software industry less lucrative than anticipated. They didn’t invest the time or resources needed to understand the complexities of financial systems. This created an opening for SMEs like Webcash, YoungLimWon, and Douzone Bizon. We grew by focusing on niche markets that the larger players had overlooked.

Would you say building strong customer relationships played a role in that growth?

Absolutely. We’ve established a dominant presence in the B2B and FinTech sectors by delivering tailored solutions for corporate banking and cash management. While YoungLimWon specializes in ERP systems, we provide best-in-class cash management solutions. Our software is often integrated directly into banks' systems and then offered to their corporate clients, further cementing our leadership position in this space. This strong partnership with banks and companies underscores our influence and success in the financial software market.

Korean companies are increasingly seeking to expand internationally as the domestic market becomes saturated and offers fewer new opportunities. With a vast global market available, would you say that now is an ideal time for Korean businesses to establish a presence overseas? What strengths do these companies possess that could give them a competitive edge in international markets?

When we look at the success of K-culture and K-food globally, it’s clear that Korea has made remarkable strides. However, K-software is yet to achieve similar success on the global stage. Despite this, I’m confident that many Korean companies, including ours, will find success abroad in the future due to the advanced technologies we've developed over time.

Initially, the motivation to explore global markets came from Korea’s highly developed ICT and IT infrastructure, which is far more advanced compared to many Southeast Asian countries. We believed we could successfully implement our solutions in markets like Cambodia and Vietnam.

However, we encountered several significant challenges along the way. The most prominent was the language barrier. Additionally, being a B2B company meant navigating complex regulatory frameworks in each region. Infrastructure and technological gaps were also problematic. The systems in these regions didn’t match Korea’s standards, which created compatibility issues.

It took about 10 years to fully understand these challenges and adapt accordingly. Now, we are ready to introduce three key products and services tailored for Southeast Asia. One key example is how payments differ between regions: while card payments dominate Korea, QR code-based payments are prevalent in Southeast Asia. This may seem like a small difference, but it has major infrastructure implications. Since Korea's payment ecosystem matured with credit cards, QR codes were not widely adopted. Conversely, in Southeast Asia, their systems were built around QR code payments from the start.

Fortunately, although the infrastructures are different, the fundamental requirements remain the same. We adapted our solutions to accommodate QR code-based systems, which has positioned us better for market entry.

You mentioned that it took 10 years to overcome those hurdles. Moving forward, do you believe Korean companies can achieve greater success abroad?

Absolutely. I believe the future holds great promise for us and other Korean companies. We now have accumulated technical expertise and valuable lessons from the past decade. Additionally, as AI-powered solutions become mainstream, language barriers will no longer be an issue.

Take ChatGPT as an example—it responds fluently in both Korean and English. This kind of AI-driven technology will break down linguistic and communication barriers, enabling more seamless global business interactions.

It’s important to select the right domain for AI application. At Webcash, we are focusing on financial management, particularly helping corporations manage funds in their bank accounts. The advantage of this domain is its universality—funds management is largely consistent across countries, unlike accounting, which is subject to local regulations.

That’s why we're developing services like the AI CFO, which we can train in Korea and then deploy in markets like Japan, Australia, and Southeast Asia with minimal adjustments.

You mentioned that Southeast Asia is primarily QR code-based. China is also heavily focused on QR code payments and is known for offering fast and cost-effective software solutions. As 2025 begins, what’s your strategy for implementing solutions in Southeast Asia while avoiding direct competition with China?

Our global strategy for 2025 and 2026 primarily targets Vietnam, Japan, and Cambodia. While we do have a branch in China, these three countries will be our key focus.

Interestingly, despite China’s reputation in technology, we haven’t encountered much competition from Chinese companies in the Southeast Asian FinTech market yet.

The Chinese market itself seems quite exclusive and challenging to penetrate, especially in the FinTech sector. We've collaborated extensively with companies and banks across Southeast Asia, but China’s business environment appears to be less open to foreign FinTech partnerships.

Given this situation, we’re not heavily focused on expanding into China at the moment. Instead, we’ll continue strengthening our presence in Southeast Asia, where we believe we can build on our existing partnerships and expertise without facing significant competition from China.

Established in 1999, when fintech was still in its early stages, Webcash has been a pioneering Korean fintech company offering SaaS services. The company is notably recognized for being the first to introduce Korea’s web-based ATM system, develop virtual account services, and establish corporate internet banking systems. As Korean companies increasingly expand globally, Webcash is not only supporting their growth but also pursuing its own international expansion. How would you describe the company’s vision?

Webcash is a software company with a core mission to integrate financial expertise and IT to create innovative financial solutions. This vision of "new finance" drives everything we do. Whether it's automation in convenience stores, virtual accounts, internet banking, or mobile banking, these evolving financial transaction methods are central to our work.

Over the past 20 years, we've consistently sought ways to make financial transactions easier for customers. We began in 1999, during the early days of the internet-finance convergence, and have been at the forefront of every major financial innovation in Korea since then.

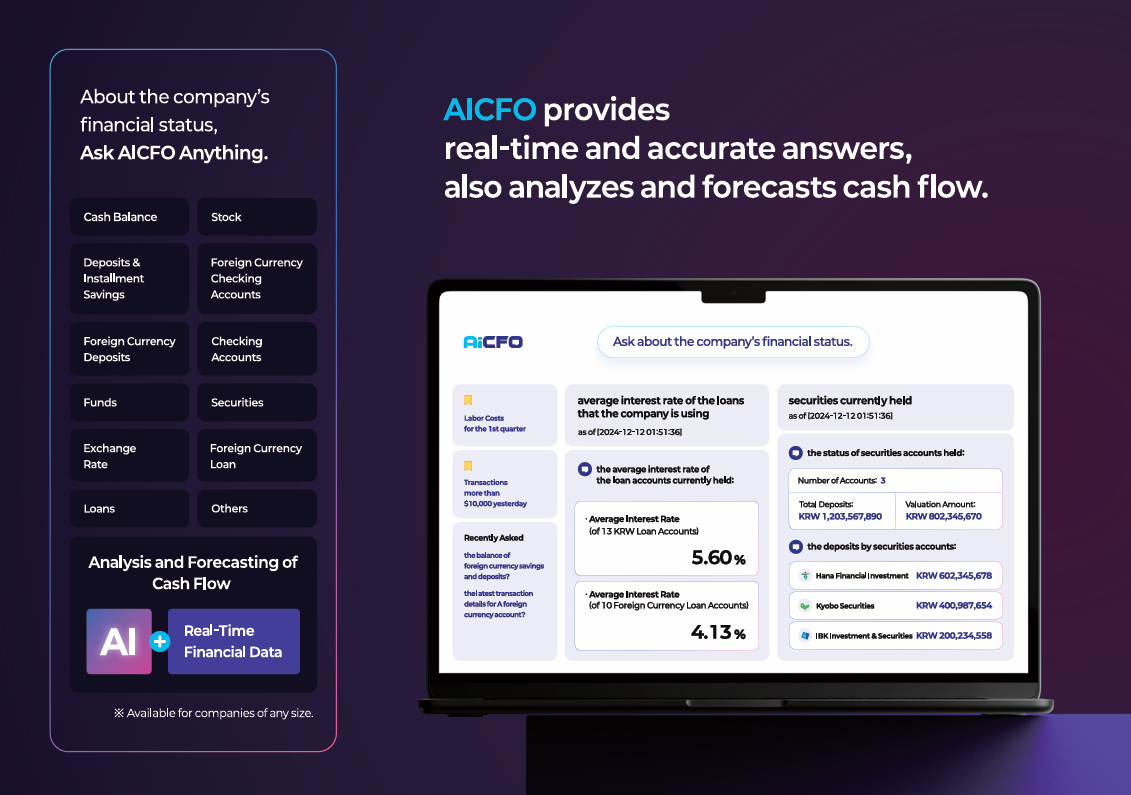

Now, as we enter the era of AI, Webcash sees a tremendous opportunity to integrate AI with finance. One of our key offerings in this space is through our product, AI CFO, an intelligent assistant designed to help corporations manage their funds efficiently. We believe that this kind of AI-driven software will shape the next generation of financial solutions for fintech companies.

This type of AI-driven software financial solution is interesting considering how the market is traditionally. Can you elaborate on what we can expect from this technology?

Every time new technology emerges, it brings new channels for financial transactions. In the early 2000s, we pioneered the internet channel for finance, and now we’re entering the AI era. The key difference lies in the technological foundation—AI fundamentally differs from internet-based solutions. It represents a paradigm shift.

Every time new technology emerges, it brings new channels for financial transactions. In the early 2000s, we pioneered the internet channel for finance, and now we’re entering the AI era. The key difference lies in the technological foundation—AI fundamentally differs from internet-based solutions. It represents a paradigm shift.

The most significant distinction is that AI interfaces don’t rely on screens. For instance, when you use Coupang or a banking service today, you navigate by touching a screen. With AI, interactions are entirely voice-based. This shift will revolutionize how we engage with financial services and manage finances.

Currently, banks operate through internet-based channels. However, within the next three years, we expect these channels to evolve fully into AI-driven systems.

Let me give you an example: suppose you're a business owner and want to know how much revenue you earned from Company A last month. Right now, you'd need to open a banking app, navigate several screens, and search for the information manually. With AI, you’ll simply ask, "How much did Company A generate last month?" and receive an instant response.

This is the future we are preparing for—where financial transactions and insights are seamless, intuitive, and powered by AI.

This is undoubtedly a significant challenge, especially when dealing with people's and enterprises' finances, where security becomes even more critical. How do you plan to address potential risks, including security breaches and cyberattacks?

Over the past 25 years, Webcash has been at the forefront of developing secure banking systems, maintaining the highest levels of security. In all these years, we have never experienced a successful hacking incident. While password leaks can pose certain vulnerabilities, we have consistently protected against direct system breaches.

Since the underlying technology behind our future offerings will build on this proven foundation, we are confident in maintaining robust security. Our data security measures are designed to operate strictly within private networks, ensuring strong protection of sensitive information.

Have you chosen to use LLM (Large Language Model) or chatbot-based models? Which approach do you think is more adaptable for your needs?

When developing AI agents, two key factors must be considered: cost and data security. We rely on open-source solutions that meet our requirements.

While testing can be conducted through platforms like ChatGPT, we cannot use it for live services since that would require sharing sensitive data with ChatGPT. Instead, we are utilizing Llama from Meta AI and Qwen from Alibaba. Qwen is particularly effective for generating SQL queries.

Given that LLMs are constantly evolving, we can adapt by selecting and fine-tuning models as needed—similar to choosing between different operating systems like iOS and Android. Webcash's focus is on developing financial AI agents, and we customize LLMs to meet the specific needs of the finance sector.

You mentioned a timeline of three years and ten years for banks to transition from internet channels to AI channels. Historically, we've seen promising technologies like VR and robotics that aimed to revolutionize interactions but struggled to achieve widespread success. How do you convince clients to embrace this shift to AI channels?

In 2001, we collaborated with KB Kookmin Bank to develop Korea's first corporate internet banking system. By the end of 2002, every major bank in the country had adopted this system. In just three years, corporate internet banking became a standard in Korea.

Fast forward a decade, and almost everyone who previously visited banks in person had transitioned to using internet banking. Except for Shinhan Bank, all other major Korean banks are currently partnered with Webcash.

We believe that if we develop and implement an AI agent with just one major bank, it will likely be adopted by other banks within three years, just as we saw with corporate internet banking.

Regarding technologies like robotics and blockchain, I don’t view them as mainstream yet. Core technologies that drive change are typically categorized as internet, smart technologies, and now AI.

Last year marked the emergence of AI powered by large language models (LLMs). This year, we anticipate a surge in domain-specific AI agents.

Webcash generates approximately 78 billion KRW in revenue. Could you share your outlook for the next two to three years?

Our traditional business has consistently delivered about 10% annual growth over the years. Since we've been operating this business for over 20 years, we anticipate that growth might slow slightly, but we still expect a steady 5% to 10% increase annually.

This year, our strategic focus is on expanding AI-driven solutions and outsourcing services.

Last year, we acquired an HR outsourcing company. Outsourcing is a growing trend in Korea, as many companies are choosing to outsource non-core functions rather than hiring regular employees. This is partly because younger generations prefer more flexible work environments and are less inclined to remain in traditional office roles, particularly in HR and finance-related sectors.

Given this trend, we see significant potential in the outsourcing industry and made the acquisition to capitalize on this expected growth.

Personally, I am deeply interested in financial data and analytics. Financial data agents extend beyond just bank funds, encompassing financial management and capital operations. To support this vision, we plan to acquire more companies in this space.

You are directly collaborating with Webcash Global, which is targeting international markets with Webcash products. How do you envision the global reach your solutions could achieve through this collaboration?

Webcash Global is an independent company with its own CEO, so I am not directly involved in its operations.

When entering global markets, we typically collaborate with local ERPs (Enterprise Resource Planning systems). For example, in Vietnam, we have a branch and a partnership with a local software company. We also work closely with banks in the regions we operate in.

In Japan, we established a joint venture with MJS, a prominent ERP provider. This kind of partnership is crucial for the B2B sector. From our past experiences, we’ve learned that cooperating with local banks and technology companies is essential for success.

Webcash primarily focuses on domestic FinTech, while Webcash Global handles the international sale of Webcash Group products. However, FinTech solutions that work well in Korea don’t necessarily sell well overseas. That’s why we localize and tailor our offerings to fit the needs of each region.

For our readers, could you summarize in one or two sentences the key message you’d like them to take away from this interview?

Software is a catalyst for transforming workstyles. By integrating software with financial operations, we help companies redefine how they manage their finances.

Much like Coupang revolutionized the shopping experience, we aim to introduce a new financial workstyle for businesses, leveraging AI to drive that transformation.

For more information, please visit: https://www.webcash.co.kr/

0 COMMENTS