Through quality manufacturing, Princess Toraya continues to operate a brand that is beloved and timeless in the eyes of the Japanese people.

Despite fierce competition from European brands, Japan offers much to the fashion and lifestyle sectors through examples like Komatsu Matere. Furthermore, many Japanese brands like Uniqlo and Muji have succeeded in overseas markets. With that being said, what are the advantages of Japanese fashion and lifestyle brands today, and what added value do they bring to their customers?

The strength of Japanese brands lies in their attention to detail and the high-quality production on offer. In fact, these elements reflect the core characteristics of Japanese people, who tend to be diligent, serious, and sincere. Their sincerity is conveyed through the production of products. Another unique feature of Japanese brands that are successful globally is their generationless and genderless designs. You mentioned Uniqlo and Muji, and their designs are very universal, meaning items are very adaptable to both men and women as well as children and senior citizens. This sort of universal usage is certainly attractive to Japanese brands, which are further supported by a high-quality production style.

Japan has a rapidly shrinking population and an aging society. In the next 15 years, one in three people will be over the age of 65. With this population decline, we see two core issues: a shrinking domestic market and a labor crisis. What have been some of the challenges of this demographic shift, and how has your firm reacted to them?

The decline in population is a great issue for Japan and our company. With the shrinkage in the domestic market, we also see a decrease in people’s purchasing power. This means that it will become inevitable that we must look overseas to compensate for domestic loss.

As for the Asian population, the demography of the structure changes, so it is essential to focus on where most of the demography resides and target the masses to develop our products.

Have you had to adapt your designs to cater to an older generation as the population ages rapidly?

We feel it is important to focus on where the masses reside, and I think it is very difficult to develop products that target this older generation you mentioned. Oftentimes, even if we target a specific age range with a product, they won’t purchase it. Rather, more senior citizens would prefer to purchase products targeting those of middle age. We also see vice versa occurring.

With this in mind, we must maintain our brand integrity and send out a brand message that is appealing to older generations.

One of your brands, Dakota, debuted in 1969, a casual brand that encompasses products like handbags, tote bags, and wallets, and the success of the brand led to Dakota Black Label, a brand targeted towards a more male consumer base. Considering there are many different bag options, why should consumers be looking to purchase a Dakota bag compared to other brands in the market? What is your strategy to further grow Dakota in the future?

We are grateful that Dakota is recognized as a casual brand, and thanks to its long-standing history, Dakota is widely recognized in the Japanese market for its casual usage. We have various products in the Dakota lineup, including purses, tote bags, backpacks, and many more. Among all these products, a common theme is present: the idea of being casual. It has been up and down over 55 years, but by keeping this casual brand message, we have been able to survive and thrive.

The parents and grandparents of customers considering purchasing our products also know the Dakota brand, meaning that Dakota is a brand known across a wide range of generations in Japan.

Dakota has a flagship store in Ginza, and from both a retailer and a customer perspective, a lot of emphasis is now being put on in-store experiences. When we spoke with the president of TSI Holdings, he spoke about how they were using technology to enhance in-store experiences for their customers by creating virtual avatars to interact with them. Regarding your flagship store, can you tell us how you are creating unique in-store experiences for your customers?

We highly value the in-store experience of our customers, and in our flagship store, we have displayed our product lineup. Our staff will thoroughly explain our bags, their functionality, the material, and any other attractive elements of the bags. Since leather is one-of-a-kind, consistency is impossible, and therefore, we suggest that customers come to the store and feel the products they are purchasing. We do have online sales, but we have had experiences where customers have returned products because they imagined it feeling different. We understand that online sales are critical, but at the same time, we need to figure out a way to better balance the actual in-store experience and the online shopping experience to maximize customer satisfaction.

Although we talked earlier about Japan’s shrinking demographic, there are also opportunities with Japan’s increasing inbound tourism numbers. Thirty-three million tourists are expected to visit the country this year, up from pre-pandemic records. In addition, with a weak JPY and tax-free reductions for tourists, Japan has become very attractive for shoppers, and tourists can now take advantage of this economic situation to bring back quality Japanese products and accessories. What business opportunities do you see for your firm to leverage on inbound tourism?

The number of inbound tourists is immensely growing, so the question becomes whether they are purchasing Japanese bags when they come to Japan. With the depreciation of the JPY, they prefer to buy more European brands since they are now cheaper in Japan. We feel we need to prioritize sending out a message about how good the Japanese quality is. Raising awareness and stirring preferences would push more to purchase a Japanese bag.

It is key for us to produce bags that encompass all the goodness of the Japanese concept and convey that to the world through social media.

Dakota Black Label designs

Earlier, you mentioned how the population decline means that you need to look overseas for new business opportunities, meaning that you want to sell to foreign countries. Internationalization also means upturning the status quo for your business operations, which could mean more collaborations with foreign designers and partnerships with local artisans. Regarding the internationalization of your business, what critical aspects have you identified for change in the coming fiscal years?

Our company's internationalization is still in the very early stages. We had previously considered expanding into overseas markets, but we decided not to for several reasons. There are many obstacles, such as registering copyrights, and it is a huge challenge to enter the global market. At the same time, the domestic market is experiencing instability, so we have prioritized stabilizing the Japanese market before internationalization.

You made the point of balancing in-store and online sales. E-commerce has seen exponential growth worldwide, especially in the post-pandemic world, with Japan now becoming the fourth largest e-commerce market. How are you leveraging e-commerce in your business model, and what plans have you made with e-commerce in mind to help grow your business?

First and foremost, raising brand recognition is vital for the success of both in-store and online sales. With that brand recognition, we are also strengthening our online sales platform. Not only do we show photos of the products, but we also place more importance on telling our commitment toward leather materials.

These days, people purchase designer handbags as an investment, especially with brands such as Louis Vuitton and Hermes. Hermes Birkin bags have reportedly appreciated an average of 40% annually over the past few decades. We understand that you don’t create designer handbags, but as someone involved in the handbag sector, could you tell us your thoughts on this trend? Do you believe handbags can be considered a legitimate investment going forward?

Personally speaking, the value of a handbag lies in using it. The handbag was created with an intended function to be carried by hand. Rather than a point of investment, the true value of a handbag is drawn out when people actually use the handbag. Of course, there are very rare cases like the Hermes Birkin that are very expensive and exclusive; therefore, the price will go up. For our company, however, we would like to stick to normal, casual bags.

Princess Toraya recently collaborated with Spanish designer Sybilla Sorondo Mielzynski on women’s wallets. Are you looking to partner with more international designers or material makers?

We are constantly open to collaboration and partnerships. However, we have to have the same direction or vector, and we really don’t want to change our philosophy or policies in order to collaborate with other brands or designers. We must share the same values with a partner.

You began your Hong Kong operation in 1990. Moving forward, are there any other regions or countries to which you’ve identified potential further expansion?

Hong Kong is not our production location, and we don’t have any sales channels there. If there is any opportunity, I would not deny the chance, but at the moment, we don’t have any immediate plans for overseas expansion.

If I had to select a location for growth potential, Europe would pose good opportunities for our firm since it really is the home of fashion.

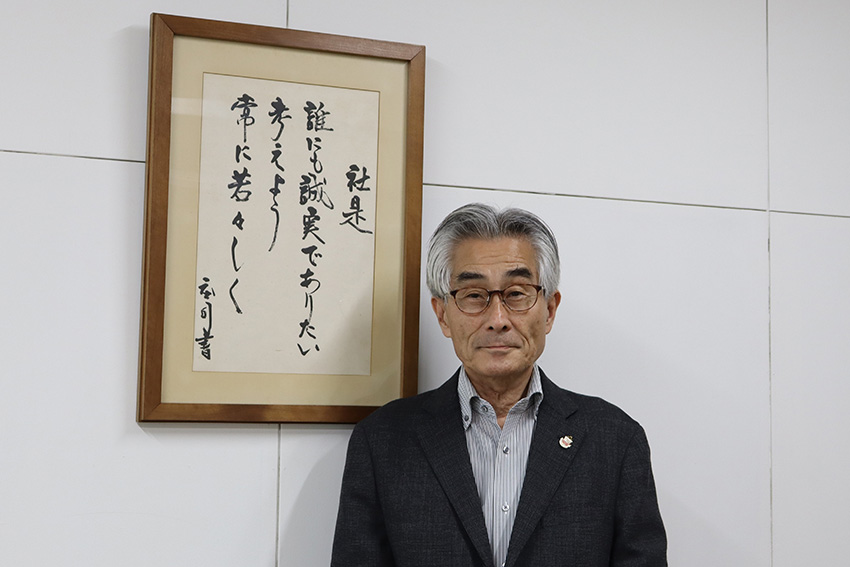

Imagine that we came back on the last day of your presidency and had this interview all over again. What goals or dreams do you hope to achieve when you are ready to pass the baton onto the next generation of Princess Toraya executives?

My time as president is coming to an end soon, and it is my mission to create a robust structure before passing the company on to the next generation. It is also important to elevate the awareness of our other brands besides Dakota. These other brands still have a lot of leeway to grow. I want as many people to recognize our company name as possible and associate that name with quality casual bags and accessories.

For more information, visit their website at: https://www.princessbag.com/

0 COMMENTS