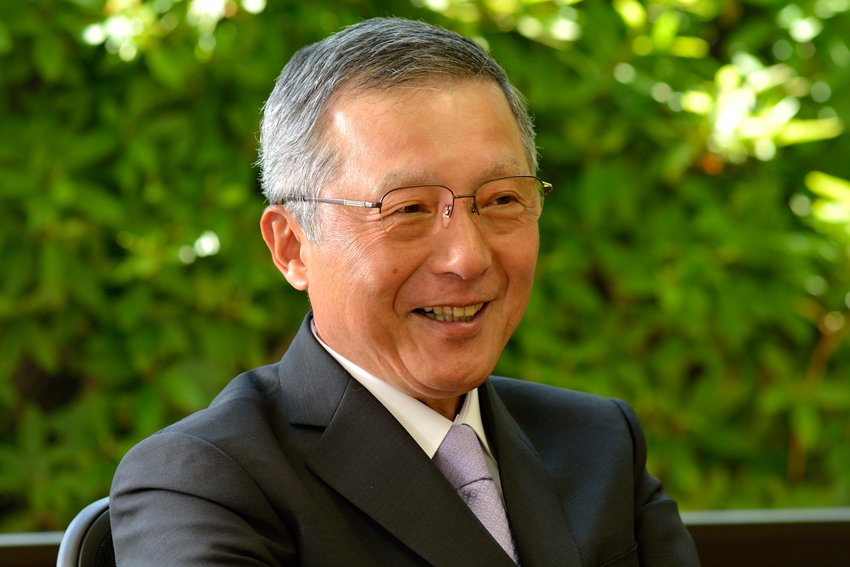

A leader in multichannel pay-TV broadcasting and satellite communications, SKY Perfect JSAT Corporation features the world’s first Ultra-HD 4K-dedicated commercial channels under satellite-based pay-TV broadcast and is Asia’s largest satellite communications operator. Representative Director, President & CEO Shinji Takada provides an insight into the next generation of broadcasting and the company’s focus on where current and future growth potential lies.

In October 2008, the merger of JSAT Corporation, SKY Perfect Communications Inc. and Space Communications Corporation resulted in the creation of SKY Perfect JSAT Corporation. Now, SKY Perfect JSAT is the largest satellite operator in Asia. Fiscal year 2015, your income rose 24.8% to 16.8 billion yen, exceeding the target set at the beginning of the year, achieving your highest operating income, ordinary income and profit since the company was established. What have been the key drivers behind this growth?

Before answering these questions, I would like to talk about our company history. Thanks to the liberalization of telecommunications in 1985 in Japan, private companies could go into telecommunications business. Ultimately, three companies, SKY Perfect Communications, JSAT and SCC merged in 2008, to become SKY Perfect JSAT. Before the 2008 merger, however, there had been originally four satellite communications companies and four broadcasting companies, respectively, and they merged by that time.

At a first glance, it seems that we enjoy a monopolistic situation and, consequently, we should have been able to generate a bigger profit. However, this is not the case. Even if we do not face competition coming from multi-channel pay-TV broadcasting, we still face other competitors: firstly, we have a Japanese public broadcaster, NHK. Also, there are five major TV networks that run their business depending on advertising revenue and are operating on a free-of-charge basis. They provide free-of-charge broadcasting services which includes satellite broadcasting services as well. Therefore, we do business in the satellite broadcasting business, but we have to compete against these free-of-charge and public broadcasters as a pay-TV platform. This explains why despite there are 50 million households in Japan, we only have 3.5 million households as our subscriber base.

We also face competition from pay-cable-TV broadcasters. The difference between us and our cable competitors is that they are able to re-transmit their programs from NHK and other terrestrial broadcasters that offer these free-of-charge services. We are not allowed to do that. In comparison with the US, where there is a large subscriber base for cable-TV services, Japan cable-TV subscribers only account for 50%. The rest is digital terrestrial broadcast. The fact that we are not allowed to carry terrestrial broadcasts programs is preventing the growth of our subscriber base.

NHK is financially healthy in their operations. In regards to other free-of-charge terrestrial broadcasters, their business model is based on advertisement commercials. They were doing so well that they are able to allocate their budget to content production. That is part of the background that explains why there are not as many subscribers to pay-TV multichannel in Japan as there are in the US.

Our five-year mid-term plan covered 2011 to 2015. It ended in March 2016 with the record number you mentioned in your question. Going back to it, to understand the reason why we have been able to perform well last year, we need to take a look back to 2011, when all TV broadcasters were digitalized. Virtually all Japanese households started to use the new TV sets which contain SKY PerfecTV! tuner. With that, every Japanese household has a SKY PerfecTV! tuner, thus we got rid of one of the hardware barriers. This has led to an increase in our subscriber base and also driven the market cost down. Which means we would be able to allocate those funds into the content production budget, raising our customers’ satisfaction level.

Another reason explaining why we were able to perform well on the satellite communications side is because our services have been used by government entities and also as part of the business infrastructure of large enterprise customers as well. This allowed us to enjoy a stable business. Due to an unfortunate natural disaster in 2011, an earthquake, the need of satellite communications increased, as it is the strongest and most reliable communications system under these circumstances.

Another growth area for the satellite communication was in the mobility area, especially in airlines or ships. Those are some new demands we have been able to be in tune with. Regarding the coverage area for satellites, in the Asian area we seen some economic growth, as Asian nations are experiencing a boost in demand.

In your mid-term management plan, you count on a significant increase in revenue from temporary sales resulting from the launch of a satellite for the Ministry of Defense in the space and satellite business during fiscal year 2016. How is the increasing assertiveness of Prime Minister Abe’s government in the international arena affecting your business as a government contractor in the area of defense?

Actually there are two Ministry of Defense-related satellites that are being procured as a PFI (private finance initiative) business and for which SKY Perfect JSAT has played primary role. That has been officially announced. One of these satellites was set to be launched recently. However, due to an incident during transportation, we were not be able to launch it in the course of this fiscal year. However, PFIs are also becoming more and more important in our portfolio. This is what changed our business models. It is not just about a direct impact coming from the security national policy by Prime Minister Abe, but we can definitely say that there is a hike in the needs for satellite communications that might be useful for national security in general. One part might be for pure satellite communications and others for information reconnaissance. Whatever the needs might be, there is a huge hike interested for users in those areas.

The number of devices connected to the internet is expected to reach 50 billion in 2020. Annual global IP traffic is thus expected to grow an average of 20% per year until 2018. How are you capitalizing on this trend and how do you think the Internet of Things (IoT) will boost your business in the future?

From our perspective, satellites have a wide coverage. We will be able to catch a lot of data that is on the move, on mobility spaces. By capturing all of that, using satellites is going to become a very convenient way of tracking all of these data. Not only geo-stationary satellites, but we are also going into low Earth orbit satellites and non-geo stationary satellites as well. By using all of these in combination I believe that wider opportunities are going to appear for us to be able to capture the information that is coming out of devices and connect the different data. This is going to be a door opener for a wider business opportunity for us for sure.

Smartphones, developments in the IoT and artificial intelligence (AI) will lead to the appearance of new services in various fields, including communications, broadcasting, and space, which should cause an intensification of competition in your existing domains. How are you planning to enhance your products and services differentiation to better compete at the international level?

Starting from the satellite side, the number of satellite fleets that we will be able to launch is limited. There is also a limit in the number of orbital slots associated with those satellites. With regards to some of the coverage, we are going to be capturing data. Some of the data might be completely depleted in certain areas. But there might be other areas in which global information connection might be needed.

With all of these in mind, there will be areas in which we will not be able to act alone. We are very strong regarding partnerships for instance. For example, we have already jointly held satellites with Intelsat with whom we have one new project ongoing. When we think about the new business model that is going to be needed in this upcoming age, what we can do alone is going to be limited. So the key for operators will be on how are we going to be forming business alliances with other entities. We are very strong on that.

On to the broadcasting side, the new on-demand players have already arrived on Japanese soil, such as Netflix and Hulu. In terms of broadcasting services, they will be our competitors. From the content-holders’ perspective, they are interested in increasing their viewership, therefore they would be providing their programs to different types of platforms.

A subscriber of either satellite broadcasting or home networks would be able to enjoy all the contents on the internet, including mobile devices. As long as you are subscribed to larger platforms, you will be able to enjoy on the internet as well. For us, viewer satisfaction on the internet had been a priority project in addition to broadcasting. It is because in Japan there was a copyright issue associated with broadcasting contents on TV, though. The majority of the contents whose copyright for broadcasting and rights for providing on the internet were different. It was difficult for those contents to be provided through the internet. But we were able to overcome that hurdle to be able to provide as many programs as possible.

You are starting to offer new products. For instance, thanks to your partnership with Gogo, they will be offering passengers on all JAL domestic flights 15 minutes of free Wi-Fi on each flight. Plus, you will provide Wi-Fi service for ¥500 per day at five cottages in the so-called Northern Alps in Nagano Prefecture. As you know, the Ministry of the Environment and the Ministry of Tourism have a strong plan to promote these areas among international visitors. What kind of other innovations and next generation services are you most excited about going forward?

In terms of broadcasting, I think we can regard ourselves as front-runners in 4K broadcasting. We started test broadcasting in June 2014. We are the world’s first provider of 4K contents in a legit manner, as we had been prepared before the 2014 FIFA World Cup Brazil. In March 2015 we were able to provide a full-fledged commercial in 4K. The problem is that the required 50-inch TV to appreciate 4K can be regarded as a very large TV considering the size of a regular Japanese home. In any case, half of those 50-inch large screens are 4K ready. Up to 2020 there are going to be more movements towards ultra-high definition for TV broadcast contents as well. We have been a front-runner in terms of providing this high definition in this broadcasted content – this is one innovation we have had. Also, we will able to provide not only the high resolution, but high brightness HDR broadcasting; we plan to start it this October.

When it comes to free-of-charge broadcasters, even if they try to convert their content to high-definition, that is not directly connected to the revenue stream. Whereas for ourselves, if we are able to provide a full quality service, then the users would be willing to pay. This is the reason why we would be challenging ourselves to use innovative technology: that matches our strategy of growing our subscriber base. The Japanese government also has the 2020 Olympics and Paralympics in mind regarding their efforts towards the increase in the quality of broadcast images. By 2018 there is also a policy that says there should be more penetration of 4K, even 8K. In order to support 4K and 8K broadcasting, we are going to launch a satellite called JCSAT-15 in one year or even earlier. This satellite actually carries transponders that serve 4K broadcasting.

Ahead of that, on a wider horizon, they have the wish to be able to include 5G mobile to improve Japan’s connectivity. We hope that we will be the one of the entities that are going to be front runners in these initiatives.

You are already present in Indonesia, Myanmar, Singapore and Thailand, operating channels in local languages. What are your priorities in regard to your international expansion?

Going back to our history, we provide a Japan dedicated broadcasting channel called WAKUWAKU JAPAN. Indonesia was the first country to receive it. What supports this endeavor is a satellite transponder, JCSAT-13, which was launched in 2012. There was a company in Indonesia that wanted to launch a multi-channel pay-TV platform called The Big TV. Before that, they decided to purchase transponder capacity, and that was carried to the JCSAT-13. It all started from that. When we try to sell it, we have to look at the media situation and the landscape in each of these countries.

In any case, we are experiencing a growth in demand for satellite users. In the early 2000s, Korean dramas were very popular. On the contrary, Japanese content was only profitable in Japan and it was not really exported. Koreans had the competitive edge because their content was already there. In that race, the Japanese government wanted to be able to promote Japanese content and services abroad, either by re-broadcasting content or by creating specific types of content, such as animations or game characters, as you saw the Prime Minister Abe in Rio as Mario. The government wanted to take the initiative to boost Japanese content penetration in overseas markets to raise our competitiveness.

The history of WAKUWAKU JAPAN is associated to those efforts, as it started as something to support the ‘Cool Japan’ initiative by the government. Since then, we raised the capital to make it a business entity in 2015. We own a 60% stake, as the other 40% is held by the Cool Japan initiative. The content for this channel is provided by NHK, and five major networks like Fuji TV, NTV, and TBS in Japan.

And with all of this Japanese-related content, we tried to think about the programs as something that is going to be viewed by local people. Thus we have adapted content depending on where it is going to be broadcast.

Of course, you have a very close relationship with the US market, especially regarding your providers, such as SSL, Lockheed Martin or SpaceX. In fact, SpaceX has recently launched two satellites for you. How are you promoting your products and services in the US to find new customers partners and investors there?

This question covers a large area, so I will go into parts. I will start with the satellite side of our business. As I mentioned before there are two joint held satellites between ourselves and Intelsat. The stake we have depends on who owns the orbital slot, but whatever the case might be, it would be difficult for us alone to conduct these activities in the US market. Therefore, these satellites are used to cater to our customers and Intelsat customers; this is one of the businesses on the communication side. The third joint satellite is going to be launched at 169º East longitude, which is operated by Intelsat. This is going to be actually a High-Throughput Satellite: its capabilities are going to be higher than traditional ones.

On the broadcasting content side, I mentioned WAKUWAKU JAPAN, but towards 2020, we want to build interest towards Japan, so we hope to launch it in the US as quickly as possible. There, some of the broadcast content of Japan in the past was mainly only for enterprise customers. We do not want to provide programs as they are broadcast in Japan. We want it to be something that triggers understanding of Japan. Japan has more than Kyoto and Tokyo, there are other areas and smaller cities that have their own unique charm. We want Americans to get a better and deeper understanding of Japan as a country. Through these programs, they might come visit those areas and even enjoy the food and experience the local culture first-hand. We want to be able to entice them to do it. In terms of which platforms this channel is going to be carried on, I understand that the US broadcasting media is already mature, so it is going to be difficult for a new entrant to come on board, but we want to do it and we are in negotiations already.

You were appointed as President of SKY Perfect JSAT in 2011. This year you celebrate your fifth anniversary of your presidency. What do you consider that have been the main accomplishments of your presidency? If we come back in five years, where do you want SKY Perfect JSAT Corporation to be?

Before I became president, I used to work in the broadcasting industry, at Nippon TV, the oldest broadcaster in Japan. Since I became the president, over the last five years, several favorable factors have contributed to our growth. Having said that, I believe that one of the biggest accomplishments that I achieved is making this company able to enjoy a stable and continuous growth in terms of operating profit. Before becoming president, SKY Perfect JSAT was experiencing a lot of volatility – sometimes we were good, sometimes were not – versus the sales and revenues levels; there were times when our margin was low. But we have been able to turn that into a stable growth trajectory. We have achieved an important cost reduction as part of that as well.

On the broadcasting side, I mentioned about investing into new technologies. As a pay-TV platform, we want to be able to make the content stronger, because the subscribers pay money to enjoy our services.

On the satellite side, even if the traditional geo-stationary satellite was the foundation of the satellite communication business, we would expand further than that. It might be on lower-orbit satellites or non-geostationary satellites. Also there is a large business opportunity in the outer space sector as well, including the Internet of Things. We want to be able to spend our budget on going out and exploring those opportunities.

In a nutshell, what would you like to share about your company?

I talked about our history. And I believe we are a unique entity in the world because we own an operation network of satellites, and at the same time we also do business on the pay-TV multichannel. Because we have these different businesses, we want to be able to use that so we can get a competitive advantage. We would like to challenge ourselves to provide new services. So, I hope that you would be able to look to us, to see what we will unveil on both the satellite and broadcasting sides. Since we are a unique entity with unique resources, if there is anyone interest in making an alliance, we are looking forward to hear from them.

0 COMMENTS