A specialist in synthetic leather products, Ultrafabrics is a U.S.-based company that gathers various needs from customers across a wide range of industries from office furniture to aircraft, while Daiichi Kasei in Japan commercializes and produces products using Japanese technology.

Post-COVID efforts by Western governments to move supply chains away from single-country risks, such as China and Mexico, have been growing with policies such as the US Inflation Reduction Act forcing corporations to diversify their supply chains. Known for its reliability and advanced technology, Japan is in an interesting position here, especially considering how the JPY is weak right now. On top of that, Japan’s long-lasting relationships with countries like the US stand to benefit Japanese firms. However, despite these positives, Japan is facing stiff price competition from neighboring countries such as China, Korea, and Taiwan. In your mind, what are the advantages of Japanese suppliers in this current macroeconomic environment and how is your firm navigating the stiff regional price competition?

Our policy is that we don’t compete on price. If our customers make decisions based on price, then they aren’t going to select us since our products are some of the highest price points in the category. We are trying to position our products as premium as possible, and sustainability is a big part of that premium branding. Being Japanese is another aspect of premium branding. Our products are produced through the art of craftsmanship, and this is a message we try to convey to our customers. I think that our loyal customers understand that, and they see the difference between our products and those produced in neighboring countries.

In researching our market, we saw that in 2020 the overall market size was valued at USD 84 billion, and it would grow to USD 175 billion in 2031, meaning an annual growth rate is 7 to 8%. The size is fairly big, but this is the overall synthetic leather market, although the exact data isn’t there, we are pretty sure that the ratio of similar products to ours is less than 0.01%. These conventional products cater to applications such as bags, basketballs, furniture, and automotive interiors. These conventional materials are dry polyurethane and a combination of PVC. We are the only company producing wet polyurethane leather, and although other companies are producing wet types, they also produce dry types at the same time. This is because their customers want cost-effective products, but these customers are not our customers. We have customers who are only looking for premium products. Our products are very different from our competitors.

The Japanese government has set goals of achieving carbon neutrality by 2050, reducing emissions by 46% compared to 2013. In light of this, Ultrafabrics Holdings is set to reduce its carbon footprint through different initiatives such as waste reduction, recycling, and a retail upcycling brand. Can you elaborate more on your upcycling brand?

REDOW is our program to upcycle wasted material into new products. It is a platform for upcycling materials and so far you might have seen bags, but we are looking to expand this as an industrial material. We have an enlarged vision of connecting it to our sustainability target. The target right now is limiting our waste to 3% of production. To this end, reducing defects is important, but at the same time how to reapply waste for other purposes is necessary.

Recently I conducted an interview where I learned that 60% of CO2 emissions worldwide could be reduced if society switched to a more plant-based diet. Your business is pushing for sustainability, with 50% of all your branded products using sustainable-based materials. Could you tell us about some of the initiatives that you are currently pushing? Can you tell us more about your Volar Bio* product and how you can replicate material qualities using either upcycled or plant-based derivatives?

We just talked about REDOW, and having this kind of program is very important for us since we are doing our utmost to reduce waste. To that end, we are trying to maximize the use of sustainable materials as well as minimize our CO2 footprint.

The first contact with customers is always design, and as I mentioned, designers are very sensitive to these kinds of environmental issues. I think the key is that these designers are searching for a story behind the product. Sustainability is a very big part of the story of our products.

A lot of our competitors are producing products using polyester, a petroleum-based material. We are using bio-based materials and there aren’t many companies using the kinds of fibers we are. In developing our recycled-based or bio-based products, what is interesting about the engineers of Daiichi Kasei Co., Ltd. (“DKK”) is that they don’t want to make any compromises on quality. They are trying to come up with a duplicate of the original product quality using recycled or biomaterial. This is a very difficult development process, especially for Volar Bio. This is because if you put more bio content in your polyurethane, then the quality of products may change. This is the challenge we are currently facing.

I think first we need to answer the question of what exactly a “bio-product” is. This was a discussion that we had on day one. There is the USDA certification that is granted when a product contains more than 25% bio-based material. This is how we define what our bio-products are.

To achieve this we need to use bio-resins so we have worked with a resin supplier to come up with a polyurethane resin with bio content, the first of its type in the world.

*First-ever polyurethane product using plant-based raw materials and being certified by the BioPreferred Program of U.S. Department of Agriculture

Leather, whether synthetic or organic, is prized for its durability and its esthetic qualities. However, regular leather production raises concerns regarding deforestation and animal welfare, whereas synthetic leather is more affordable and environmentally friendly despite the drawbacks of the texture and the aroma. As a specialist in synthetic leather, in terms of product development, are you looking to replicate or improve on the functionalities of natural leather?

One thing our customers want is luxurious materials that look totally different from the norm. They are looking for a different appearance, touch, and performance. I’m not going to say that all designers have this mindset, but many of them do and care about their environment. They understand things such as animal welfare on a deep level and therefore are trying to move away from genuine leather.

Your eco-friendly products cater to a wide range of industries such as aviation, automotive, and furniture as well as many others. Can you elaborate on your current key sectors and target customer bases?

Firstly, our business portfolio is very unique, and nobody else is really doing what we are doing in the same way. Taking that approach is challenging, especially when you think about dealing with customers from such a wide range of industries. What they are demanding and asking of us requires different approaches for each industry. The core thing that they all have in common is that these customers are all looking for luxurious products with a good story. That story is vital and it defines why those customers are using the products.

We do have a business within the aviation industry and one of the reasons why it is happening right now is because the airline companies are looking for sustainable stories. Choosing our materials is one way to align themselves with a good story. The customers appreciate the stories we are telling with our materials, no matter what business or industry they are in.

According to the Air Transport Association, in 2019 the aviation industry emitted about 950 million metric tons of CO2; 2% to 3% of total emissions in the world. Your company is helping this industry through your latest material in the market such as your Atago which weighs 450 grams less per sheet compared with competitors’ products. What kinds of weight savings do your materials provide compared to conventional leather or vinyl chloride? Could you tell us more about this Atago product and if you are looking to implement it in overseas airlines?

We possess the required technology to make things lightweight, and compared to genuine leather, in aviation products ours is almost one-third of the weight. It does depend on the request from the customer, however, since as you understand, making something lighter can also make it weaker. You have to find a balance.

Weight-wise, fabric can be a little bit lighter than our product but our product holds advantages in lifespan and durability; our product can last more than 10 years. Fabric really can’t handle this type of wear and tear over 10 years. I think this lifespan is something that airlines appreciate in our products. They feel that by using our products they can reduce their waste, enhancing their sustainability.

You mentioned Atago, which is often used on the bottom side of airline seats. Atago itself saves about 3 pounds per seat compared to conventional materials. Again there are different factors in play here and it depends on the combination of materials that the airline uses for each seat, but I would say that Atago certainly has a significant weight reduction.

Are you looking to sell Atago to overseas aviation companies?

Fortunately, right now a lot of airline companies are our customers, especially in North America where we have a very strong network. In addition, some European, Japanese, and Asian airlines are using our products too. It feels as if we have already penetrated the market to a significant degree.

We saw from our research that you are venturing into the space industry and your fiscal year 2023 reports that you are trying to penetrate this market with your leather seats that have been cleared by NASA. Can you tell us more about this exciting venture and your goals within this industry?

Back in April 2018, our partner in the aviation sector established a relationship with the space businesses and was considering the logistics of going into space. They asked us to come up with a sample. Imagine, that if the requirements for aircraft are high, how much higher is the quality requirement for spacecraft; much higher. Our products for aviation as well as aerospace have very high performance and that performance is coming from a combination of our products. When we talk about fire-retardant (FR) we aren’t just talking about resistance to fires, there has to be a way to control smoke too.

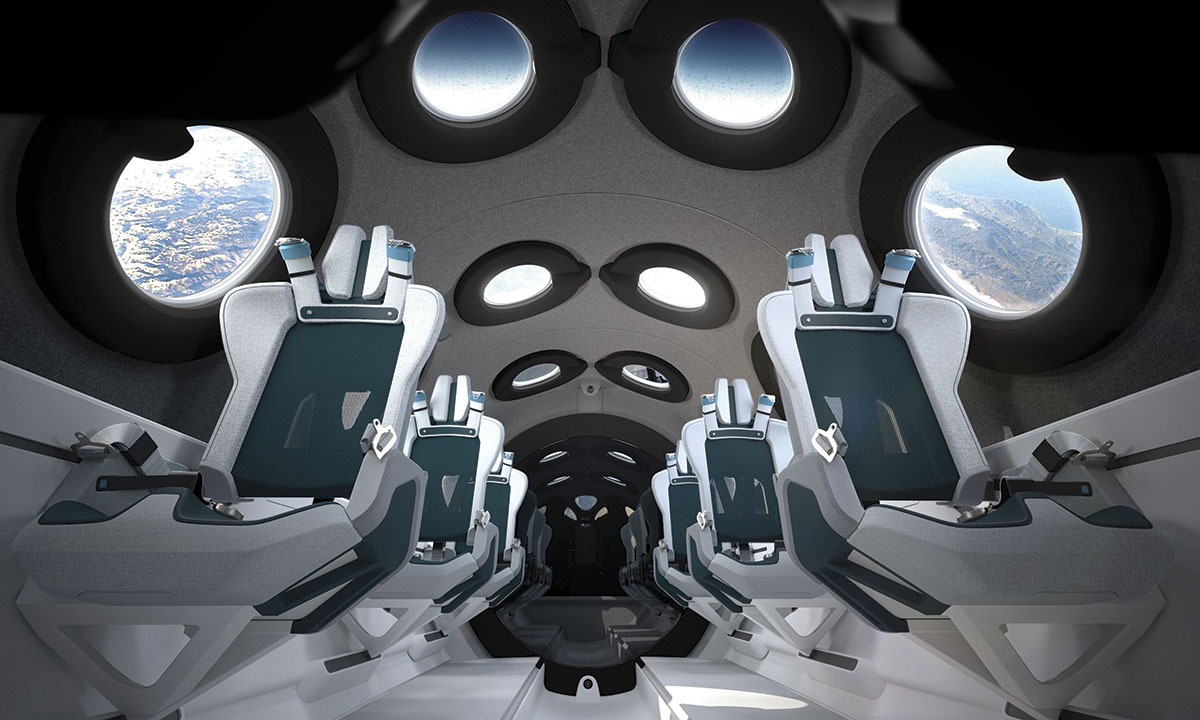

You have to remember that you are traveling to space in that interior. It should be comfortable for the passengers as well as look nice. If you look at the images, the seats are ours. If you are going to space you want to avoid dark colors, since the cabin is already dark and space itself is the darkest thing imaginable. All of these aerospace customers want white.

Virgin Galactic

Japanese companies are famous for their capabilities in developing new products and services, spending 3% of the annual gross domestic product (GDP) on R&D, a higher spending percentage when compared to America’s 2% and China’s 1.5%. In light of this, you have developed high-performance fabric solutions tailored to the specifications of any project. What functionalities are you looking to develop in the next generation of your products? Are there any upcoming products that you would like to share with us today?

Our latest developments are in products for the outdoors, and outdoor products require very high anti-UV properties. We actually didn’t develop this product for outdoor residential applications, instead it was initially developed for marine applications. Customers have had problems with conventional materials since they were exposed to high temperatures and humidity and, therefore, would deteriorate quite easily.

From there we thought more about developing products that suit the application. It took us about 2-3 years to come up with this product. We call this product Coast and our customers use it for outdoor residential as well as marine-based applications.

In the US there are many houses with pools and big gardens. Those homeowners will put furniture outside but it won’t look good. We believe that we can provide luxurious materials to cover those pieces of outdoor furniture. I think if you see the pictures you will agree that these look gorgeous.

You’ve mentioned several partnerships throughout this interview. Are you currently looking for similar partnerships or co-creation deals with other Western companies?

Yes, we are. We are always looking for partners in various categories with special technologies. The reason is that we have very good relationships with our suppliers, even though we don’t like to call them suppliers, rather we call them partners. We’ve co-developed with such partners simply because they are experts in their field. We are very fortunate to have these great companies as partners and that they are willing to co-develop products with us. Going back to your original point, a lot of Japanese companies don’t do this because they don’t like to offer information on their technology. The open innovation model is just not common in Japan. We, on the other hand, are very open, and provide our partners with the necessary information. Of course, this kind of development has to start from our side, you cannot force your partner to be open, instead, you have to demonstrate your willingness to be open and that will be reciprocated.

If we are going to be open with our partners, there needs to be a level of trust. I think our openness is honestly a differentiating point for our company since many others are not going to open themselves up to partners.

Are there any specific countries you are looking to penetrate using partnerships?

Actually, this is going to be all over the world. We are very strong in Japan from a production point of view, but we are looking for production partners in North America, Europe, and Asia.

Since 2017 you’ve had a presence in the USA with Ultrafabrics Inc. Could you tell us more about that venture?

We’ve been doing business there for almost three decades. The former president of DKK decided that we needed to do so to comply with future growth. He agreed to merge his company with Ultrafabrics, LLC (currently Ultrafabrics Inc.). At that time ownership of Ultrafabrics, LLC was acquired from the founders, Mr. Clay Rosenberg and Ms. Danielle Boecker. We were looking for an equal partnership between production, sales, and marketing, so to that end, we established this holding company as a listed company on the Tokyo Stock Exchange. We all treat each other as equal partners so there is no subsidiary structure.

This merger happened 60 years after the establishment of DKK. Why was this point in time chosen for the merger? What advantage does your holding company structure have?

After the creation of DKK 60 years ago DKK was basically in the consumer business. They were doing okay up until around the mid-1990s. At that time there was havoc created by the bubble burst and DKK tried to shift its focus from consumer businesses. DKK was looking for industrial applications for their products. Things became price-sensitive with the emergence of neighboring countries, causing the image of synthetic leather to be damaged in the eyes of Japanese consumers, and this is still the case today.

On the other hand, Ultrafabrics, LLC was successful in the marketing or sales side of things. There was in fact, an exclusive agreement (largely North America and Europe) in place around that time between Ultrafabrics, LLC., and DKK. Fast forward to 2015 and almost 90% of DKK’s business was done through Ultrafabrics, LLC. The business had grown so much and at that time we needed to think about making investments in facilities for future growth. From early 2000 up until 2016 there is almost no capital investment made by DKK. They thought that they were not seeing opportunities to make profits by themselves. They felt that they had to rely on Ultrafabrics, LLC. To grow the business by making separate investments is a difficult thing to do.

Additionally, ever since 2016, it has been clearly obvious that the domestic market is shrinking at a rapid rate. To grow we have to go abroad, and we can’t do that by ourselves. It meant that the only way for DKK to go abroad was with Ultrafabrics, LLC. We started having those discussions in 2016, one year after I joined the company, and in the following year, we merged. After that merger, we put our new lines in existing factories and we also thought about building a new plant. We are working on that right now and it is costing us about USD 40 million.

2023 was a really good year for Ultrafabrics Holdings, with a growth in net income of 16% and you expect to reach a revenue of JPY 30 billion by 2026. Can you tell us more about how you plan to achieve this target and some of the main hurdles you may have to overcome to achieve this goal?

Last year's results were definitely affected by the weak JPY, but if you look at our growth from 2020 to 2023 we more than doubled our sales, and remember, 2020 was the year of the COVID-19 pandemic. Last year we made more than JPY 2 billion of net income. This is mainly driven by automotive but aviation has seen growth as well. Although 2022 was a good year for furniture, 2023 saw a drop, so we are hoping that sales bounce back in 2024. In general, all of our business segments have been growing and we expect that to continue through to 2026.

The main application within the automotive industry is with EVs. This is coming from multiple customers. Designers for EVs are looking for non-leather luxurious options, and there are a very limited number of options in the marketplace. This is why we try to be luxurious and sustainable to support the story we can tell with our products.

If we switch to talk about office spaces, there has been a democratization of office spaces since the COVID-19 pandemic. Large firms have downsized or even switched to remote working. The whole idea of what a traditional office is has been completely redefined, perhaps not so much in Japan, but certainly in the West. What is your take on the democratization of office spaces and how does this trend affect your business?

I think it is both a challenge and an opportunity. It is a challenge because fewer and fewer people are showing up to offices, and together with that the commercial real estate market is in deep trouble. At the same time, many companies would like their employees to come back to offices, so therefore they are trying to make office spaces as nice as possible. I would say that if companies look to spend more money on office environments then there is an opportunity for us. When you think about it, if people don’t go back to offices they will spend more time at home which is also an opportunity for us.

Your firm is very specific, customizing your products to fit the exact needs of your clients. You cater to high-end brands such as McLaren and Jaguar Land Rover that stand out among many others. Can you explain the unique aspects of your customization service?

Firstly, we have staff who listen to our customers very well. Our customers tend to be at the design stage of product development, so it is important to use the kind of designer language that they understand. Their requests are very specific and very high-end. I think that a unique aspect of what we offer is the fact that we are acting as a bridge between Japan and the world. To do so, you need more than one team. Two teams are needed, one on the customer side and the other on the production side. Between these two teams, there needs to be some solid foundation. I’m not saying we are perfect in this approach, but I think we are doing pretty well. Additionally, I don’t think many Japanese companies are capable of doing what we are doing. We try to be open and try to be equal.

Imagine that we come back in 2031 and have this interview all over again. What goals or dreams do you hope to achieve by the time we come back for that new interview?

Earlier we talked about mid-term strategies, and that is essentially a promise to our shareholders and investors. I want to hit that target, but at the same time, I want to create a business that we can grow over the next two or three decades. We can’t do that by just doing the same thing, we have to change and we have to adjust. We need to go into a new market on a regional basis, we need new products, and we need to create value using our sustainable model. Who knows, there might be many applications out there that we’ve yet to consider with our products. I have goals of retaining our position as the top player in our niche.

I think one key thing we are working on right now is establishing Ultrafabrics as a global brand that speaks to sustainability. I’m not saying that everyone will have heard of Ultrafabrics, but I hope that one in three or one in four will have heard of our brand. Brand recognition globally is a goal for us moving forward.

0 COMMENTS