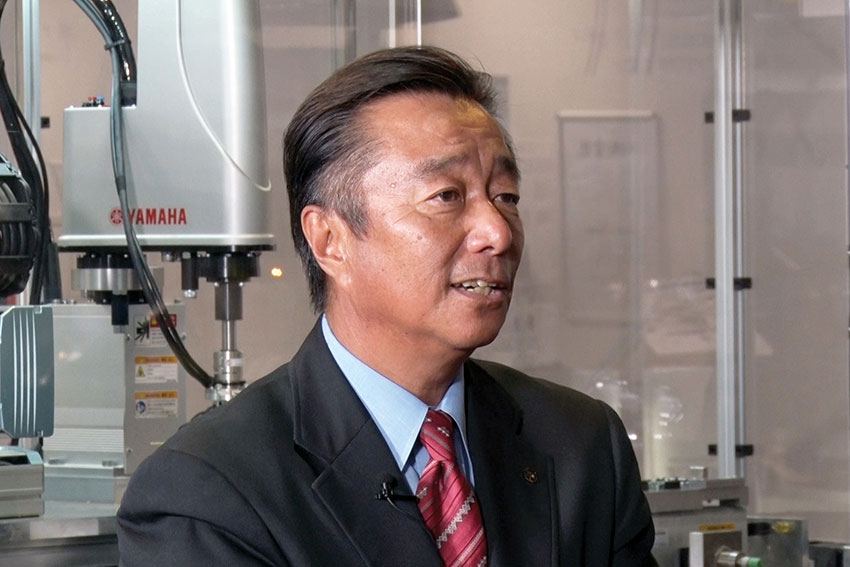

As a subsidiary of Yamaha Motor Co., Ltd., Yamaha Robotics Holdings (YRH) continues to make its investment in advanced technologies based around three core areas: back-end semiconductor manufacturing, surface mount technology (SMT), and factory automation. YRH’s competitive edge stems from integrating these – what it calls – “Three Big Worlds”, which allows it to serve its customers as an “advanced one-stop smart solution provider” by offering a wide range of products and services. In this interview, Toshizumi Kato, YRH Chairman & Director, divulges more details about YRH’s unique service offerings and their applications.

Can you please give us a brief introduction to your company?

In the 1970s we started developing small types of scooter engines and at that time the demand per year for motorcycles in Japan was around 3 million units. In order to survive in the business, we developed the robot to cut the cost, and that was how Yamaha started in the robotics business.

Our company’s structure is a bit complex because our company (Yamaha Robotics Holdings (referred hereinafter as YRH)) was born from the business combinations. Historically, Yamaha Motors Corporation (referred hereinafter as YMC) acquired Shinkawa, which in turn acquired Apic Yamada. Furthermore, Shinkawa created a new company which is now the actual Shinkawa and the former Shinkawa became Yamaha Robotics Holdings.

It is interesting to note that in the 1970s Japan was the leader in the semiconductor field. Japan remains a reliable partner in the global supply chain of semiconductors. What do you think are the reasons as to why Japan remains a key player in the semiconductor equipment field?

There are various reasons why Japan remains a leader in the semiconductor equipment field. Though the semiconductor industry requires a huge amount of investment, Japanese companies have outstanding organizational skills, good judgment, and plan very carefully before taking actions. Furthermore, Japan’s experience in the semiconductor industry is quite long, therefore the technology that they have developed is quite advanced and enough to meet the demands in the market.

It is a fact that the semiconductor industry is one of the biggest industries worldwide and it is expected that it will double in size in the near future with increasing demand coming from North America and the Asia Pacific region. How is your company going to take advantage of this growth?

We should focus on China, Taiwan, and other Asian countries, especially those markets which are emerging, and the demands are continuously growing. Of course, North America remains important, especially for new and advanced products.

Could you please explain to our international readers the core business that you have? Yamaha Motors, Shinkawa, Yamada can be a bit ambiguous to our international readers so for them to understand the core of your business, please run us through each business and the competitive advantages you hold in each area.

Our core businesses - which we call the “Three Big Worlds” - include back-end semiconductor manufacturing, SMT, and factory automation. Collectively, our group can offer a variety of products and services. These “Three Big Worlds” are integrated and that is the reason why we can make advanced one-stop smart solutions for our customers.

In the years to come the semiconductor assembly line will require safety in two lines: the overall mass production efficiency and the small but multivariate flexible manufacturing. Could you please tell us how you are able to offer these two to your customers?

Basically, our style is different compared with our competitors, they are aiming to get a global standard, but we aim to be number one to the customers. We can be flexible to each of our customers, who want to produce small quantities of various products. Our products can make such adjustments because we have developed our core technology ourselves and we can fit the specification to our customer’s needs.

Japanese companies invest massive amounts into their R&D. In 2019 Japanese R&D expenditure amounted to ¥ 19 trillion which signals to the world that Japanese companies are looking to be competitive both domestically and globally. Could you please share with us your R&D capabilities and the solutions that you are offering to your clients?

First of all, you have to understand that there are two types of manufacturing processes: modular and integral. The style of manufacturing has dramatically changed compared to thirty to forty years ago. The shift from analog to digital was first implemented in the semiconductor field and electrical goods like radios or TVs were changed from analog to digital. For new players in the market, this modular type of manufacturing is very easy because you just assemble the parts; mobile phones and computers are created through such modular manufacturing.

The integral type of manufacturing is difficult, but it is something that Japanese companies are very good at, which is evident in their technology. Manufacturing engines is very complicated and our competitors such as those in China cannot catch up with our technology because it is an integral type of manufacturing. Massive and continuous investment is necessary to be competitive in order to develop advanced technology.

With the fact that Japanese companies have unique technologies it has now become essential for them to go overseas to find co-creation partners in order to capture new markets and be competitive globally. In your specific case what role does co-creation play for your company and are you looking for open innovations?

These new innovations such as IoT and AI are very important in this day and age. We co-create with other companies to adapt to these trends in the digital world. However, we should continue to develop our core technologies with the use of innovative technologies.

In the semiconductor industry we are seeing a trend which is miniaturization as surface mounted technology (SMT) components are mounted in a higher density. Could you please talk to us about this trend and how it is affecting your business?

In a sense you can say that the growth of the semiconductor industry is all about this trend of miniaturization. With regards to the manufacturing processes of semiconductors, the cutting edge is seven nanometers of wafers created by Taiwan's TSMC, and then they have been able to develop a technology to create three nanometers, but they then reached a plateau. When it comes to the trend towards 5G or 6G networking with regards to semiconductors, there is a requirement for higher processing speed as well as greater volume.

Right now, in terms of R&D, we are at the limit to what extent we can really take our packaging. Now you see the trends in the technological sector. We are now looking to see how we can modify the chip thickness in the back-end processing of the semiconductor. We are starting to see that with the integration of SMT as well as the back-end processing of the semiconductor technology that there is a limit in terms of the front-end R&D of the semiconductor, the trend is now moving towards how to continue to develop more advanced technologies for the back-end processing. That is why the kind of devices utilized in the production of semiconductors in the back-end are starting to be required at a greater level and also more and more devices for this kind of application are going to become the latest trend.

There are more high-density modules in the integration SMT on semiconductors for back-end technology. If you were to automate factories, with SMT for example, you would need the equipment that we provide in factory automation and the industrial robots. Our group does not only have the back-end processing technology but also has all of these technologies integrating in semiconductor SMT as well as being able to cater to the factory automation and industrial robotic world – we have all of that in house.

For these reasons we will definitely be number one. Right now, not only do we have the strengths that make our group, but we also have the core technology that we continue to develop further at our disposal. We are talking about the dimensions in the physical world, the hardware and software, that we can provide as well as of this hybrid world and that would require encompassing network technology. In that field we are looking to develop co-creation partnerships with startups and those who are strong in this industry and continue to develop further.

Do you have any products or technology that you are about to release that you would like to showcase to our readers?

It is hard to disclose too much with regards to the SMT world but we are number one for the automotive sector. With the rise of EV, the automotive sector will start to see an increase in demand for semiconductors which right now it is less than 10%. We are pretty strong when it comes to the automotive world, and this is much more demanding compared to other ICT fields or communications networks.

In fact, all of our products are already utilized by the Japanese automotive makers with regards to SMT, however, we still have rooms to grow when it comes to sales in Europe. We are looking to expand our brand and sales on that end, while our inspection devices are already highly regarded and utilized by European automobile makers.

The semiconductor market is going to grow, fortunately for us we already are strong in the inspection market, and moving forward I think we will be able to utilize our machinery on a tailor-made basis. The greatest strategy for us would be to what extent we can promote our inspection devices. Allow me to explain what I mean by the importance of inspection and measurement devices in the semiconductor field. Let me use the iPhone as an example. If one out of a thousand iPhones is defective all you have to do is replace it with a new one. But if one out of one thousand cars are defective, that poses a greater risk. In the Japanese market for semiconductors, Shinkawa still holds an 80% share. Quality is a major priority especially in the automotive world and we hold a great share.

On your website there is an interesting statement, “The New Challenge Now Begins - Concentrating Japanese manufacturing capabilities into a new force”. Could you please tell us more about this quote? What is your midterm strategy to continue your corporate growth?

Our group started in 2019 and we are now focused on restructuring our facilities, the growth of our people, improving mindsets, and developing our technology. The unification of different companies poses new challenges. By combining our manpower and technology, we are now a group of manufacturers that bring a new force to create new products and provide solutions.

Can you give us a brief definition of the essence of Japanese monozukuri and how Japanese companies are able to be competitive domestically and globally through their monozukuri?

I mentioned earlier the different styles of manufacturing, modular and integral. Right now, when it comes to smartphones and similar devices are created with the modular type of assembly. But when it comes to more complex and high precision devices there is a demand for integrated style of manufacturing in which Japan is strong. To integrate all these different types of hardware, software, mechanical and electrical components require a great deal of skill on the part of the engineers, and Japan is still able to maintain the lead in this respect.

With regards to the final products that are delivered to the end-users, these may be produced utilizing the modular type of assembly, however, these products still require very advanced devices such as the ones that we create which include the semiconductors, electrical components, PCBs, and back-end processing. There is a higher requirement for that, and the technology needs to be developed even further. Lastly, it is also Japan’s strong suit for the front-end processing of semiconductors.

It is already challenging for a Japanese company to be number one in the domestic market, but it is more challenging to be a leader in the global market. Can you please talk to us more about your international strategy and how you maintain your competitive advantage?

First of all, with regards to the device manufacturers related to the SMT semiconductor field, around thirty years ago these manufacturers could maintain their business in the domestic level, but slowly as the market changed, they had to compete against overseas manufacturers.

There are two factors that could determine whether we succeed or fail: first is how much investment we put into our R&D, and second is the ability to cater to our clients and shifting manufacturing facilities overseas. In the past eighteen months since we started our group, the strategy that we have been using is cross-sales and the integration of our different offices to provide unified R&D facilities. We are trying to create these facilities in each of our strongholds overseas. Despite the covid-19 pandemic we have been progressive and able to expand the capabilities in almost all of our sites. Last year in February I went to Singapore, and I am hopeful our facility there will be completed soon. I also went to Thailand in March and although we have not been able to have an official opening ceremony with representatives from Japan going to our sites overseas, our facilities are already up and running.

There are different strategies to expand your market overseas: to go by yourself, to find local partners in a country that are difficult to operate in, and through joint ventures or M&As. In your specific case, do you have other strategies that you think would fit to your future growth in the overseas market?

As the market grows and changes there is definitely a great opportunity to expand. We are open and our current strategy and focus is to strengthen our overseas sites that we already have by integrating their sales, manufacturing, and R&D facilities. Moving forward, of course there are other strong companies around the world such as in Germany, we already have a partnership with a company there. Furthermore, we are keeping an eye on a company in Arizona, USA, that has already made a partnership and contract with Taiwan’s TSMC to supply all of their 7-nanometer wafers, however, two months later that company got a new CEO who was actually the CTO of that company ten years ago. He changed the direction of the company and decided to do it inhouse and not to rely on TSMC. The market is quite volatile. It changes overnight and we have to adapt and change our strategies accordingly.

Imagine we come back to interview you again in two or three years, what would you like to tell us? What are your dreams for the company and what would you like to have accomplished by then?

As I mentioned earlier, we are catering to Three Big Worlds - that is, processing for semiconductors, SMT, and factory automation. We are working on our strategy to be the No.1 one-stop smart solution provider in this industry. Right now, we are number three in global rankings in each world, however, we want to quickly integrate and provide solutions to become number one. We are hoping to achieve this within three years. The fact is that the only company that is present in these three worlds is Yamaha. Of course, there are sectors where we already hold the number one position such as automotive sector, but as I mentioned we are still in number three in the global scale. Our goal is to provide more innovations and climb to number one.

0 COMMENTS