As a software quality specialist, Suresoft provides automation tools for testing and verification & validation services, driven by a mission to deliver software solutions that ensure a safter future.

Korea has built an impressive ICT ecosystem, with both major players and smaller firms contributing to its growth. Competing against global giants like Microsoft has been a significant challenge. From the perspective of Korean ICT firms, what lessons have they learned from competing in markets like China and the U.S.? How have these experiences helped them expand internationally?

Korea is well known for its technological advancements and strong infrastructure. However, when it comes to ICT and software, we have not yet achieved the same level of success as in hardware and manufacturing. While Korea has excelled in hardware and core technology, our market share in software and AI remains relatively small.

Korean ICT companies are increasingly recognizing the need to enhance and redefine customer experience through software. By leveraging Korea’s robust infrastructure, we are transforming the software experience for users. This includes advancements in mobile banking, e-government systems, and gaming. Through these innovations, we are not only improving user experiences but also developing proven technologies based on extensive field experience within Korea.

Many Korean companies first establish success domestically before expanding to global markets. However, at Suresoft Technologies, we take a different approach. While leveraging strong infrastructure and enhancing user experiences are common strategies, we focus on Korea’s key industrial strengths—automotive, shipbuilding, defense, and nuclear energy—by integrating IT solutions into these sectors. This allows us to bring innovation to already competitive global industries.

Looking at the historical milestones of Suresoft Technologies, we see a clear trajectory of localization and technological independence. Korea has long been a leader in manufacturing and construction across industries like automotive, railways, and nuclear energy. However, when it comes to instrumentation and control technology, we traditionally relied on foreign expertise across key sectors.

Over the past 30 years, Korea has made significant strides in localizing these critical IT and software technologies. Suresoft Technologies has played a key role in this transformation by verifying and ensuring the quality, reliability, and safety of localized software solutions. We have contributed to the development of localized Electronic Control Units (ECUs) for vehicles, control systems for railways, and instrument control software.

From this perspective, I believe Korean IT firms have adopted two key strategies to succeed in the global market. First, they build on Korea’s strong infrastructure and proven user experiences to expand internationally. Second, they integrate IT solutions into Korea’s already established and globally competitive industries, positioning themselves as key players in niche markets worldwide.

AI is now surpassing human capabilities in programming in certain aspects, leading to a major shift and disruption in the industry. Since you specialize in validation and verification (V&V) software, a critical area, AI's influence is likely to extend into your domain as well. How do you see AI redefining your field, reshaping the way we program, validate, and control software systems?

AI will have a profound impact on software V&V, and we view this transformation in two key areas. First, AI will drive unprecedented productivity improvements in software V&V. Traditionally, software validation and verification have been highly labor-intensive processes, and we have continuously enhanced productivity through automation. With AI, we have already observed productivity gains of 30–70% in automation. This means AI is set to revolutionize productivity in software V&V by expanding from Continuous Integration/Continuous Deployment (CI/CD) to Continuous Verification (CV). In other words, AI will enable real-time software verification during development, allowing for real-time optimization and faster deployment.

Second, beyond software V&V, AI validation and verification (AI V&V) will present both significant challenges and immense opportunities. As AI adoption grows, ensuring its safety and trustworthiness becomes critical. Many countries are establishing regulatory bodies and institutions dedicated to verifying AI’s reliability and security. I believe that validating AI models and AI systems will be one of the biggest challenges of the future, but at the same time, this shift is expected to create demand for new verification methods and business model.

At Suresoft Technologies, we are preparing for this future with two core technological approaches: "Test by AI" and "Test of AI." Test by AI refers to AI-powered testing, where AI enhances and optimizes traditional software V&V, leading to a productivity revolution. Test of AI focuses on developing AI V&V solutions that assess and ensure the safety and trustworthiness of AI systems themselves. These are the two key areas we are currently investing in.

Could you elaborate on the "Test of AI" approach? Perhaps provide an example of how it will be applied in real-world scenarios?

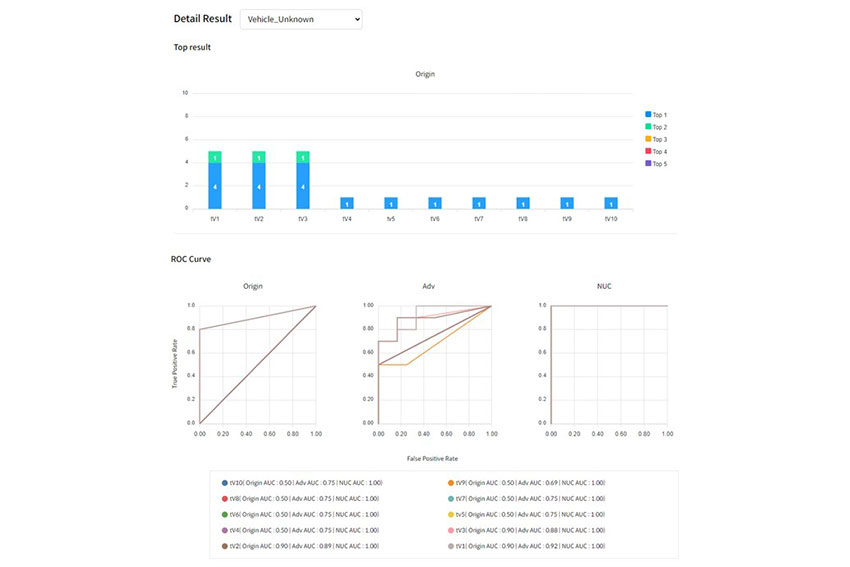

There are several ongoing research efforts exploring methods to verify AI safety and trustworthiness. One example is adversarial testing, where we deliberately introduce malicious or modified data into AI training datasets to evaluate how the AI responds. This process helps us determine whether the AI system produces harmful or biased outputs that could negatively impact users.

By analyzing adversarial test data, we can identify vulnerabilities in AI models and develop solutions to mitigate risks. This is one of the key areas we are actively working on, as ensuring the reliability of AI systems will be crucial for their widespread adoption in safety-critical industries.

Do you believe that V&V will eventually be adopted uniformly across all software-dependent industries, or are there specific sectors where automation is more critical, driving greater investment in cutting-edge technologies?

I don’t think this is a question of industry, but rather one of necessity. As software scales in size, the complexity and volume of V&V increase exponentially. This is because software systems don’t operate in isolation—they interact with each other. When there are n software components, the complexity of V&V increases roughly by n². This exponential growth makes automation essential in all V&V processes.

This is especially evident in the automotive sector, where software size has surged due to autonomous driving. With increased functionality, the complexity and volume of V&V have skyrocketed. However, other industries are also evolving, incorporating more user experience (UX) enhancements and features, which leads to larger software footprints. As a result, automation is becoming indispensable across all sectors where software validation is required.

The concept of the software-defined vehicle (SDV) is a groundbreaking shift in automotive technology, disrupting traditional industry dynamics. Previously, Tier 1 suppliers played dominant roles, but now, external companies—many of which had no prior ties to the automotive industry—are entering the space and reshaping the supply chain. How do you foresee the evolution of the industry in response to SDV developments, and how will this impact the need for V&V?

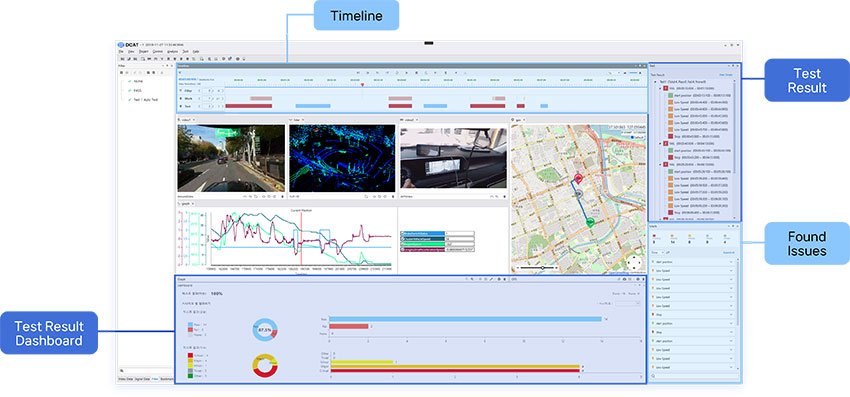

DCAT Analyzer

With the emergence of SDVs, we are seeing a shift toward centralized software architectures. Initially, SDVs operate with a core platform software that serves as the central control system, while other software components work alongside it in an integrated manner. I believe this centralized platform will continue evolving, incorporating more features and becoming increasingly sophisticated.

Many OEMs and car manufacturers are now prioritizing the integration of platform software, leading to a transformation in vendor roles. In Korea, companies are divided into two groups: those with software expertise and those without. Companies that possess strong software capabilities are actively contributing to platform software development and key software modules, while those lacking software expertise are being relegated to hardware-only roles.

As a result, companies that were previously unaffiliated with the automotive industry—focusing solely on software and AI—are now finding significant opportunities in the sector, fundamentally altering the industry ecosystem. This shift has also created growing demand for software verification, as the increasing number of software components in SDVs requires rigorous validation for safety and reliability. Companies like Suresoft Technologies are seeing more opportunities than ever in V&V.

Unlike in the past, we are now playing a more active role in the evolving automotive ecosystem. Many of the companies entering this space were not traditional automotive suppliers, but as they integrate their software into vehicle systems, they are utilizing virtualization, simulation, and digital twin technology to ensure seamless integration. We actively contribute to this transformation, providing test beds for new software features and functionalities through virtualization, simulation, and digital twin solutions.

Here are some of our key solutions. First, we have conventional software V&V solutions. We continue to expand our core V&V offerings. Second, we have AI-powered testing solution named ALIRA-AI. This represents an extension of our Test by AI initiative, leveraging AI to optimize the software testing process. Third, we have an AI verification solution called VERIFAI-M. It is a solution developed under Test of AI, designed to verify the safety and trustworthiness of AI-driven applications. Last, we have SDV-specific solutions, such as AUTORACT, AUTOSIM, and SIMVA. These solutions focus on virtualization, simulation, and digital twin technology, specifically tailored for the automotive sector.

While these technologies have strong applications in SDVs, they are not limited to the automotive industry. Our AI-powered verification solutions can be applied across multiple sectors, ensuring safety, reliability, and efficiency in a wide range of software-driven systems.

Founded in 2002, Suresoft Technologies is a leading provider of software automation verification platforms, specializing in the development and deployment of automated tools to ensure the safety of high-reliability, high-risk software. This commitment to creating safer software has driven the company’s international expansion and ultimately led to its KOSDAQ listing in 2023. Could you walk us through the key milestones that have shaped Suresoft Technologies’ journey and solidified its position in the industry?

We categorize our milestones into two key areas: technical milestones and business milestones.

From a technical perspective, we operate in what is known as the mission-critical industry. Every software system we work with is designed to perform a specific, critical function, and failure is not an option. This requires verification at every stage, including model verification, code verification, and system verification. The process begins with model verification, followed by code verification, and finally, system verification—each playing an essential role in ensuring overall reliability.

Developing and perfecting these verification technologies has been a long and rigorous journey, with each stage taking over five years to refine. Achieving a comprehensive lineup of model, code, and system verification solutions is one of our most significant technical milestones.

Building on this foundation, our second key milestone was expanding our expertise across multiple mission-critical industries. We began with the automotive sector, then extended our reach to railroads, nuclear energy, and aerospace—each representing a progressively higher level of criticality. The rationale behind this sequence is based on the potential impact of system failures. For instance, a software failure in a vehicle might endanger a handful of people, whereas a failure in a railway system could affect hundreds. In the case of nuclear energy, a catastrophic failure could have consequences for thousands or even millions of people.

Over the past 15 years, Suresoft Technologies has systematically expanded from automotive into these highly regulated, high-stakes industries. This historical progression marks a pivotal milestone for us.

Looking ahead, our future milestones will be defined by how effectively and rapidly we integrate AI into V&V. The development of Test by AI and Test of AI will be key drivers of innovation.

VERIFAI-M Report

Additionally, while we’ve reached key milestones—establishing a full technical verification suite and expanding into critical industries—we cannot afford to be complacent. To remain at the forefront of the industry, we must continuously push the boundaries of AI-driven solutions and ensure we lead the next era of software verification.

You described how technical expertise has driven business growth and how the two have reinforced each other. As you further develop Test by AI and Test of AI, where do you see these technologies taking Suresoft Technologies from a business perspective? What are your expectations for their future impact?

In terms of industry adoption, more critical sectors tend to be more conservative. They prefer to wait until new technologies, such as AI, are fully validated before integrating them. Because of this, we anticipate that the automotive industry will be the first to adopt AI-powered V&V solutions. Once AI technology proves its reliability in automotive applications, we expect railroads and nuclear energy to follow, and eventually, the aerospace sector will also embrace it. This progression aligns with the risk tolerance and regulatory nature of each industry.

From a geographic perspective, I believe that Korea will be the first market to adopt AI in V&V. Historically, Korea has been open to acting as a testbed for emerging technologies, making it an ideal starting point for AI-powered software verification. Following Korea, we anticipate strong interest from China, as China frequently monitors technological advancements in Korea and is quick to adopt proven innovations.

By strategically introducing AI-driven V&V solutions in these markets, we aim to solidify our leadership in next-generation software verification and expand our reach in global markets where demand for V&V is growing.

Last September, former U.S. President Biden mentioned the potential ban on Chinese software, causing significant disruption across the industry. Companies were forced to seek alternative suppliers, such as German firms, which are often more expensive. Now, with the Trump administration reaffirming plans to implement this ban, do you see this as a challenge for your expansion into China? Or do you view it as an opportunity to highlight Korea’s technological capabilities and gain global recognition?

This situation presents regulatory challenges but also opens up new strategic opportunities. We align with relevant regulations and government guidelines. However, when it comes to software V&V technology, we do not supply our solutions directly to China. Instead, we focus on monitoring and verifying Chinese software, which actually presents new business opportunities for us.

At the same time, we are actively pursuing overseas expansion through Vietnam, working with Vietnamese companies to integrate our software V&V solutions into their products. This strategic move not only broadens our market reach but also strengthens our presence in Southeast Asia.

Additionally, many Chinese automakers are now entering the global market, striving to meet international safety and quality standards. This shift creates new opportunities for us, as these companies seek advanced verification and validation solutions to ensure compliance with global regulations.

Regarding SDV, you have three key products: AUTOSIM, AUTORACT, and SIMVA. AUTOSIM and SIMVA focus on simulation, while AUTORACT is for system verification. Could you elaborate on the advantages of AUTORACT and explain how it differentiates itself from competitors, such as Siemens, which offers a comprehensive solution suite?

SIMVA and AUTOSIM are designed for virtualization and simulation. When testing software in a simulated environment, the first step is virtualization—meaning the software, which is originally intended to run on a physical automobile, must be adapted to run in a cloud-based environment for testing purposes.

SIMVA handles this virtualization process, enabling software that is designed for a physical vehicle to operate in a cloud-based test environment. AUTOSIM takes the process further by simulating interactions between various automotive software components. For example, if you develop a braking system, it must be tested alongside related systems like the powertrain and transmission. AUTOSIM allows for these integrated simulations, ensuring that individual components work harmoniously within a complete vehicle system.

Once software components are virtualized and simulated, the next step is interactive system verification, which is where AUTORACT comes in. AUTORACT is an automotive interactive testing solution that provides realistic test scenarios for evaluating how different software components interact with one another. It allows developers to simulate real-world driving conditions, test system responses, and verify safety, performance, and reliability.

What sets AUTORACT apart from competitors like Siemens is its high level of automation, adaptability, and integration with AI-powered testing. While Siemens provides comprehensive engineering solutions, AUTORACT is specifically optimized for automotive SDV testing, offering more flexible, efficient, and scalable test environments tailored to modern software-defined vehicles.

One of the biggest challenges in automotive software today is that it’s no longer a one-time development process where you create software, install it in a vehicle, and consider it done. Cars now receive constant over-the-air (OTA) updates, but not all vehicles are connected at all times, and sometimes updates are applied to certain components while others remain unchanged, creating a highly complex environment. How do you adapt to this reality, where software validation isn’t a one-time simulation but an ongoing process? How do you support your customers in managing continuous verification?

That’s precisely why continuous verification is so critical. Many developers are familiar with continuous integration and continuous deployment (CI/CD) environments, but in the Software-Defined Vehicle (SDV) era, they must also adapt to the concept of continuous verification.

Whenever a software update is made—no matter how small—it must be tested against the entire vehicle system to ensure it doesn’t cause unintended side effects. A minor software modification could negatively impact other systems, potentially leading to major safety risks. That’s why we provide the AUTOSIM environment for automotive software developers.

With AUTOSIM, developers can test their software in a virtualized simulation environment tailored to specific vehicle models. We provide customized simulation environments for major auto brands, allowing developers to test whether a new software update functions correctly within the specific vehicle ecosystem.

How did you develop such a comprehensive and detailed understanding of each automotive environment? I assume you work closely with Hyundai and Kia to gather this information. Can you explain how this collaboration works?

Working directly with automakers and OEMs is essential. Without access to their internal vehicle architectures, we wouldn’t be able to build an accurate and complete simulation environment.

That’s why we have established strong partnerships with leading Korean automotive manufacturers, allowing us to develop detailed digital twins of their vehicles for simulation purposes. Moving forward, we are also looking to expand our collaborations with Chinese OEMs, to provide similar simulation environments for their vehicles.

You’re not just another supplier to these OEMs—you’re becoming a critical partner by providing the platforms they use to test their entire software ecosystem. Are you the sole provider of simulation environments for Hyundai, or are there multiple vendors involved?

We serve as a key partner supporting the simulation platforms of leading Korean automotive manufacturers. We assist in virtualizing and simulating their development environments for advanced software testing.

However, expanding these services to other OEMs requires a long history of collaboration and trust. To create a simulation platform for a specific automaker, we must understand every intricate detail of their vehicle systems, which takes years of cooperation and refinement.

Let’s say I’m a foreign Tier 1 supplier that wants to work with Hyundai. I have a software platform. Would I need to go through your simulation environment to test and verify my software? Do you provide this service to external companies?

Not at this time. Korean automotive manufacturers maintain confidential and tightly managed simulation environments. Access to these platforms is restricted and granted only to designated partners, and we operate within these controlled ecosystems.

To put it in perspective, consider mobile platforms like iOS and Android, which are highly open—any developer can create and deploy apps for those operating systems. Korean automotive manufacturers, on the other hand, operate a selective access model for its simulation environment.

When we develop and provide test platforms, they are delivered exclusively to a restricted partner network. If a foreign company wants to test its software on a Korean automotive simulation platform, it must first gain approval from the platform’s administrator.

It would be beneficial for the broader automotive ecosystem if more Korean automotive simulation platforms eventually evolved into open models, enabling wider industry participation and fostering innovation among developers. However, for now, they remain selective and cautious in opening up their platform.

The future seems to point toward a mindset of standardization or open source in the automotive sector. Are there any automotive manufacturers currently embracing this approach?

I’m not entirely sure. There is definitely concern among automotive manufacturers about the use of open-source software. Whenever we verify their software, they often ask us to confirm whether any open-source components are included. This shows that they are cautious about incorporating open-source software into their systems. As part of our verification process, we not only assess the model, code, and system verification, but also check whether any open-source code is embedded in their software. This reflects their wariness toward open-source adoption in the sector.

Suresoft Technologies’ revenue has doubled from 31.5 billion KRW in 2020 to 63 billion KRW in 2023. The majority of this comes from coding solutions for industries such as automotive, defense, aerospace, and energy, with growing demand in robotics and medical technology. How do you foresee the evolution of Suresoft Technologies in the next three to five years? What is your vision for the company’s growth?

Every year, we set a goal to grow by 25%, but there are fluctuations depending on the industry. Looking at the automotive industry over the past five years, we’ve consistently met our 25% growth target from a software perspective, and we expect that trend to continue. So, the automotive sector remains a strong area of growth.

However, other industries show more variability. In defense, while there are growth opportunities, it’s a relatively steady sector and not as prone to rapid growth. It’s harder to achieve that 25% growth in defense because of its more stable nature.

The nuclear industry, especially after the Fukushima incident, saw a decline. Many countries were cautious about building new nuclear power plants. But I foresee a turnaround in the nuclear sector. The growth of AI has accelerated the need for more power, and now we’re seeing more nuclear power plants being built, including Small Modular Reactors (SMRs). This trend provides new opportunities for growth in the future.

As for aerospace, we see positive signals. The Korean government has recently established a new organization to promote the aerospace industry, with significant investments in R&D projects and new initiatives. This could present substantial growth opportunities in the coming years.

In summary, while we continue to target 25% growth annually, this year, due to political instability in Korea, many large companies are hesitant to initiate new projects. As a result, some things are being delayed. Despite this, we’re still seeing positive signals for growth this year.

The goal of this report is to unite the voices of different Korean ICT leaders and gain their insights. From your perspective, what message or insight would you like the leaders to take away from this interview?

The Korean domestic market is relatively small, and I believe more entrepreneurs should focus on the global market. However, I’ve noticed that university students and younger generations tend to be more risk-averse compared to our generation. When I was in university, I used to read Newsweek and was constantly inspired to think globally.

I would encourage younger generations, especially university students, to embrace entrepreneurship, take more risks, and develop the passion and ambition to expand rapidly and pursue big goals. It’s essential to have the mindset to think beyond borders and aim for excellence on the global stage.

For more information, please visit: https://www.suresofttech.com/eng/

0 COMMENTS