Korloy stands as Korea’s premier cutting tool specialist, leading the market with its customized solutions for difficult-to-cut materials used in the aeronautics, automotive, and medical industries, leveraging its comprehensive in-house production capabilities.

The success of Korean conglomerates has had a positive trickle-down effect on the SME sector, providing them with growth momentum and core capabilities. However, in recent times, due to an increasingly saturated and competitive domestic landscape, it has become essential for SMEs to think globally to continue their growth trajectories. In order to achieve this goal, Korean companies will need to find their place in the global supply chain. How can Korean companies compete against their Japanese and Chinese counterparts? What is the role of Korean SMEs in the global supply chain?

Firstly, the realignment of the global supply chain has presented new opportunities for Korean companies, especially those with key technological innovations in areas like clean energy, batteries, and semiconductors. However, many SMEs might face challenges in finding their position amidst this supply chain realignment. Due to fierce competition in the Korean industry, SMEs will need to develop innovative products or compelling services based on their unique technologies or flexible creativity, qualities often constrained as companies grow larger. This agility enables SMEs to gather insights and approach customers or markets more effectively. Given their survival in the competitive Korean environment, SMEs possess the ability to thrive internationally. Nevertheless, they must leverage this ability by reaching out to diverse clients to avoid overreliance on a single market source, which can pose risks as markets evolve rapidly.

Moreover, in a landscape dominated by multinational corporations (MNCs), SMEs can enhance their competitiveness through collaboration, tapping into MNC networks and resources to explore new customer bases. However, maintaining their own customer base post-collaboration is crucial to prevent customer migration to MNCs. As SMEs venture into international business, securing reliable local partners is paramount. While localization aids in market penetration, listening to partners' needs and ensuring prudent investment in shared ventures are essential to sustain long-term partnerships. We have nurtured enduring relationships with our overseas distributors, some of whom share our enthusiasm for business growth. However, others may diversify into unrelated ventures once sales reach a certain threshold. Therefore, continuous education and introduction of new business applications are pivotal to retain partners' interest and ensure mutual success.

You mentioned the flexibility of SMEs, which serves as a competitive advantage fostering innovation. How do you assess the innovative spirit of Korean companies compared to those in China and Japan?

Three years ago, I would have confidently stated that Korean companies were ahead in innovation. However, recent developments have shown shifts in the landscape of Chinese and Japanese companies. It's challenging to determine a clear leader in innovation now. In China, despite the hurdles in collaboration due to governmental restrictions, many companies are venturing beyond domestic markets to international arenas, displaying a notable innovative mindset in adapting to their circumstances. Japanese companies, while traditionally perceived as rigid, exhibit a different form of innovation by swiftly responding to significant changes. They prioritize important matters over urgent ones—a distinction often overlooked by some Korean companies, leading to delayed responses. This strategic approach of Japanese companies to embrace pivotal changes appears more innovative than the reactionary focus on urgent matters.

When you mention that Korean companies often confuse urgent and important matters, could you provide further elaboration?

This issue is deeply intertwined with the environment of the Korean industry, particularly in the context of SMEs engaging with MNCs, typically through OEMs and ODMs agreements. Initially, smaller companies enter into business relationships with MNCs as part of their supply chains. The dilemma arises when these large MNCs prioritize cost reduction, accompanied by demands for exceedingly short delivery lead times. In responding to these demands, SMEs tend to prioritize solving immediate challenges over addressing long-term strategic goals. By "important problems," I refer to aspects such as diversifying the client base or strategizing for long-term growth. Despite the Korean industry's significant scale within the nation, it's imperative for companies to extend their reach to the international market for sustainable growth. However, the urgency to meet the tight delivery schedules and cost-cutting requirements imposed by MNCs often leaves SMEs with scarce resources and time to invest in long-term expansion plans. This dilemma resonates with the situation in China as well. However, China's vast domestic market offers more alternatives for SMEs, allowing them to explore diverse business opportunities. In contrast, while Korea boasts a substantial domestic market, it pales in comparison to the scale of Japan or China, leaving Korean SMEs with fewer options for immediate diversification or expansion.

The metal cutting industry is a thriving yet often overlooked sector. Continuous innovation is essential for improving production efficiency in major applications such as automotive and aerospace. Recently, we have witnessed growing demand for metal parts in other sectors such as the oil & gas industry, medical devices (due to the global aging population), and even the defense industry (due to geopolitical tensions). Looking ahead to the next 3-5 years, which applications do you foresee as the primary drivers of growth?

There are essentially two categories to consider: industries already at the forefront of growth and those emerging anew. While your question pertains to future changes, it's important to acknowledge that even the leading industries undergo their own transformations. Let's differentiate between the two. Aerospace and automotive have consistently driven growth and remain indispensable in metal cutting processes. However, a significant shift is underway with the emergence of the drone industry. This sector is forging strong ties with aerospace and automotive, particularly through concepts like UAM (urban air mobility) or AAM (Advanced Air Mobility). The boundaries between drones, electric vehicles, and airplanes are blurring, potentially paving the way for a cohesive mega-industry. While aerospace and automotive are already substantial, if these boundaries dissolve, drone, airplane, and automotive companies could collectively tap into an even larger market, albeit with intensified competition. This convergence could bring about significant changes compared to other industries.

Additionally, there's a notable emphasis on the renewable energy sector, particularly in recent times. The demand for metal parts in wind and solar power plants is on the rise. In the case of solar power plants, the need for adjusting solar panels to optimize energy absorption necessitates specific metal components, thereby fueling demand in the metal cutting industry. This shift towards renewable energy sources also acts as a catalyst for change within the metal cutting sector.

Furthermore, the medical devices and equipment market is expanding, driven by the aging global population. The increasing need for medical devices spans from implants and dental prosthetics to wearable medical devices. This burgeoning demand not only affects the quantity of metal parts required but also prompts innovations in the materials used for manufacturing. Thus, the medical sector presents yet another avenue for transformative change within the metal cutting industry.

You mentioned the increasingly blurred boundary between the aerospace and automotive industries. As a metal cutting manufacturer, how do you perceive the opportunities within these two sectors for the future?

Adapting to evolving materials is indeed a necessity for us as manufacturers. However, despite the shift from conventional steel products to newer materials like CFRP or silicones in these industries, the demand for cutting products utilizing conventional materials remains prevalent. Therefore, I view this transition as an opportunity rather than a loss.

Could you walk us through your journey and the pivotal milestones that positioned Korloy as a leader both in Korea and on the global stage?

Let me start with a brief overview of Korloy's history. My grandfather initiated this venture back in 1966. At that time, he already had another successful trading business between Korea and Japan. In Korea, there's a tradition that successful individuals are highly esteemed upon returning to their hometowns—a kind of homecoming in glory. When my grandfather returned to his small hometown in the Southeast region of Korea, where most livelihoods revolved around farming, he felt compelled to create employment opportunities. Recognizing the need for a manufacturing enterprise, he decided to establish a cutting tool company. Fortunately, my father shared a keen interest in manufacturing. Despite studying advanced physics at Seoul National University, he had a passion for assembling mechanical and electrical components to construct radios and other electronic devices. Thus, my grandfather's foray into tungsten carbide tools marked the inception of our company.

Upon assuming leadership, my father identified a gap: many large companies were reliant on imported tools, predominantly from Japan, Europe, or America. Sensing an opportunity to localize these tools, he made it a company objective. Our philosophy has always been to engage extensively with customers to tailor our products to their specific needs. While our tools initially may have lagged behind competitors in overall quality, our emphasis on customization fostered loyalty among customers, who eventually transitioned to our products. This customer-centric approach has been integral since my father's era.

Tragedy struck in 1996 when my father passed away at the young age of 45, leaving my mother, Mrs.Yun, to inherit the company. Shortly thereafter, the Asian Financial Crisis of 1997 engulfed Korea, precipitating a collapse in the domestic market. Faced with limited prospects at home, Mrs. Yun, the current Dine Group’s Chairwoman, astutely pivoted towards international expansion to bolster our overseas sales—a decision that proved prescient. Globalization remains a cornerstone of our strategy. As our international revenue surged, we intensified efforts to enhance our quality standards, aligning our operational and research processes with those of global industry leaders. This encapsulates the essence of Korloy’s journey thus far.

I find it fascinating to observe the internationalization process of SMEs, a trend that seems relatively new in the market. Many companies here were established around the year 2000, and now they are taking the bold step to expand globally. To gain a better understanding of your business, which spans various segments, I’m curious to know: in your experience, which industries constitute the largest portion of your client portfolio? Furthermore, how do you envision this evolving in the future?

Historically, the automotive industry has been our primary source of business in my generation. However, with the transformation from conventional engines to electric motors and electric cars, it's clear that identifying a new primary market is imperative. Nonetheless, I firmly believe that there are abundant opportunities in international markets waiting to be tapped. Additionally, aerospace has emerged as a significant sector for us. Given the evolving landscape where boundaries blur between industries such as aerospace, drones, and automotive, I see aerospace as a key area for our future growth and thus, it's one of my focal points for expansion.

Aeronautic companies and engineers are constantly looking for lighter materials to save structure weight and improve aircraft performance, with aircrafts like the Boeing 787, or the airbus A350 which largely made of carbon-fibre-reinforced polymers. While engines parts are still using Inconel, titanium, or stainless steel, fuselage and wing parts, initially made from aluminium, are now converted to materials such as carbon fibers, or glass fibers. Korloy offers a total solution to aerospace industry, with the Super Endmill or the high-pressure coolant tool for machining difficult-to-cut materials, as well as the ND2100 diamond-coated Endmills for glass fiber and carbone fiber. Could you elaborate further on recent developments aligning with trends in the aerospace industry? And where do you perceive the greatest opportunities for Korloy—difficult-to-cut materials, glass ceramics, or your new 3D materials?

The aerospace industry continually grapples with the challenges posed by difficult-to-cut materials and CFRP. Moreover, there's a growing trend of using composite materials, combining various elements to create composites. Consequently, many of these applications require our tungsten carbide tools, as well as CBN (Cubic Boron Nitride) materials or PCD (polycrystalline diamond) tools to effectively machine these diverse materials.

Our range of tools includes tungsten carbide variants with various coatings tailored for specific applications. For instance, we utilize diamond coatings, which involve applying a thin layer of diamonds onto solid material tools, enhancing their capability to process a wide array of materials, including CFRP. These tools find utility not only in aerospace but also in other industries grappling with difficult-to-cut materials, such as the medical sector.

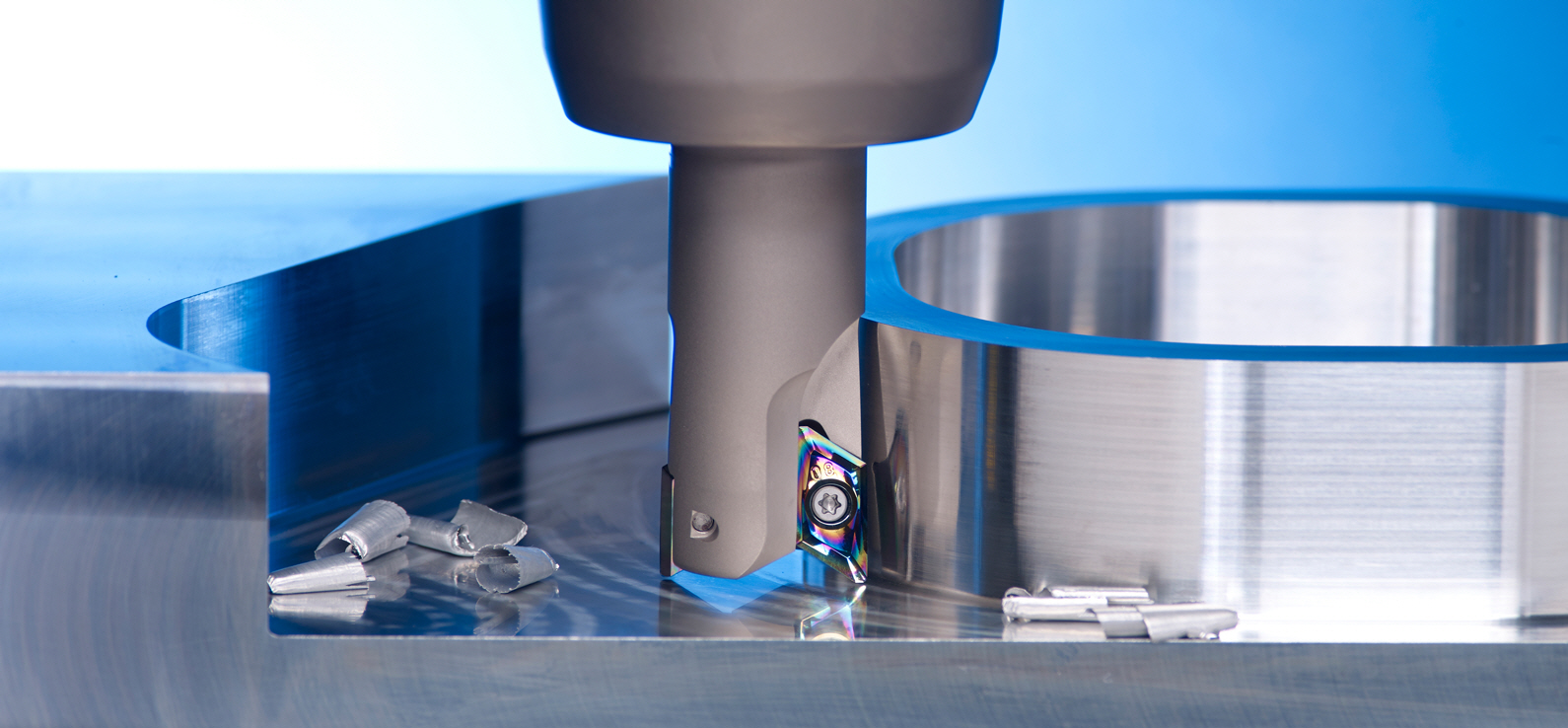

DLC-Coated Inserts for Non-Ferrous Metals (Pro-X Mill)

Your company has diversified into various segments, with a key focus on the international market. Domestically, you stand as one of the leaders in Korea, with Taegutec being your main competitor. However, on the global stage, the competition is fierce, with players like S/V, Iscar, Kennametal and many others vying for market share. Given this competitive landscape, what are your key competitive advantages against international competitors, particularly in securing market shares in industries like aerospace?

Our approach to this challenge is multifaceted. Firstly, we recognize the critical importance of consistently introducing new products to align with market trends. This entails accurately anticipating shifts in industry dynamics and developing innovative solutions accordingly. Our strategy hinges on nurturing deep relationships with our customers, ensuring that we not only deliver exceptional products but also provide comprehensive support services. Even amidst the challenges posed by the COVID-19 pandemic, we've maintained close communication with our clients through video conferences, facilitating everything from sales meetings to quality improvement sessions and product training.

Furthermore, our commitment to global expansion has been instrumental. Despite the pandemic, we expanded our presence by establishing a branch in Russia in 2020. Since 2007, we've been steadily building our network of overseas branches, with our latest addition being in Mexico in 2022. Currently, we operate 10 branches, including two manufacturing facilities in China and India. These international outposts serve as the linchpin of our global expansion strategy, enabling us to bolster our overseas revenue streams effectively.

You mentioned the importance of staying close to your customers to listen, analyze, and predict market trends effectively. Responding to these trends swiftly from a manufacturing perspective is crucial. We discussed your coaching solutions, which represent the forefront of your ability to tailor products to meet customer needs. Could you delve a bit deeper into your production and manufacturing capabilities? How pivotal is the ability to customize solutions rapidly for your clients, not only to secure business but also to assure them of your reliability as their needs evolve?

Our production process typically involves a lengthy cycle from design to final production. Hence, it's paramount for us to streamline this cycle as much as possible. Simultaneously, maintaining constant communication with customers regarding desired delivery times and actual production timelines is equally crucial. As previously mentioned, we maintain relentless communication with our clients. Furthermore, we've been undergoing digital transformation in our manufacturing processes since 2019. Incorporating IoT and digital technologies enables us to monitor and collect data on our manufacturing processes, enhancing efficiency and enabling data-driven decision-making. We utilize this data analysis to optimize our processes and find the best solutions. Subsequently, we feed this information back into our research and development sector for deeper analysis.

To facilitate rapid customization and prototype development for our clients, we've established our own pilot line within the research and development department. Previously, creating initial samples or prototypes involved navigating our existing manufacturing timeline, which often proved challenging. Therefore, the introduction of our pilot line enables us to provide customers with samples promptly, aligning with their delivery requirements without fail.

How much does it reduce your production cycle?

It doesn't significantly impact the entire production cycle. However, it enables us to swiftly respond to our customers' urgent requests by providing prototypes. Initial iterations often require several attempts to meet customer specifications, necessitating a process of elimination and expedited timelines to achieve the desired outcome. The pilot line, situated within our research and development department, allows us the flexibility to experiment with various digital technologies. Unlike the manufacturing section, where implementing new IoT equipment could disrupt production cycles, the pilot line operates independently, granting us the freedom to explore different digital solutions. This experimentation paves the way for insights that can potentially minimize future failures when integrating such technologies into the manufacturing domain.

With this dedicated production line for R&D and customization, you have the option to pursue two distinct approaches in engaging with customers. Firstly, you could develop specific products and include them in your catalog, providing customers with standard code for easy selection. Alternatively, you could maintain a close relationship with customers, offering continuous customization. In your opinion, what competitive advantages do these two approaches offer compared to Japanese or European competitors?

Our competitive edge lies in our close relationships with customers and our ability to respond swiftly. However, the recent addition of the pilot line has introduced a new dimension to our capabilities. By accelerating the prototyping process through this pilot line, we not only meet our customers' needs more promptly but also enhance our research and development efforts by reducing lead times for prototype production. Therefore, the primary aim of this pilot line is to streamline the cycle time for research and development and prototype creation.

Is that how you're able to introduce so many new products, such as the injecting coolant?

Developing new products has always been ingrained in Korloy's culture. The introduction of the pilot line is aimed at expediting this process. Korloy has consistently prioritized customizing our products for our customers. When I was starting out, I noticed delays in the process. At the time, the prevailing sentiment was that cycle times couldn't be shortened. However, I was determined to find a solution. Exploring options like digital transformation, widely adopted by larger companies, seemed promising for reducing cycle times. The idea of implementing a pilot line was born from this exploration.

Moreover, over the past five years, we've implemented a POP MES system through smart factory initiatives. Additionally, rapid new product development is a key focus for our R&D efforts. We recognize the importance of speed in bringing new products to market. As products mature, our R&D department ensures we're prepared by having processes in place to develop new products swiftly.

In 2022, Korloy achieved full recovery after the COVID-19 pandemic, reaching 214 billion KRW in revenue, reflecting a 17% growth compared to the previous year. Additionally, Korloy’s operating profit is high at 25 billion KRW, tripling compared to the previous year. With a presence in over 80 countries, including established footholds in Europe and the United States through robust distribution channels, where do you foresee the main drivers of growth using your smart factory and R&D in the international arena?

While Korloy has indeed solidified its presence in Europe and the United States, the next three to five years present diverse opportunities for growth across various international regions. In the Asia Pacific market, India stands out as a key driver of growth, expected to surpass other markets due to its rapid expansion potential. Europe, despite being a relatively mature market, holds promise for Korloy, particularly in regions where we've recently witnessed significant growth, such as the UK, France, and Germany. Although these markets aren't emerging, they represent new territories for Korloy's expansion. Another market with considerable growth potential is Turkey.

Latin America, especially Mexico, emerges as another promising market given its significant industrial presence. While our current presence there is minimal, we're optimistic about tapping into this potential, underscored by the establishment of a new branch in 2022.

Additionally, the Middle East region presents an intriguing opportunity, not only in energy and resources but also in burgeoning manufacturing sectors. With a focus on onshoring investments and setting up new factories, this region is poised for growth, particularly in metal cutting. The strong historical ties between the Middle East and Europe, coupled with India's burgeoning influence, could further bolster growth prospects in this region. As India emerges as a significant player, its proximity and growing economic stature may enhance its support for the Middle East, potentially reshaping regional dynamics.

You mentioned the challenge of establishing distribution channels, particularly in international markets such as the UK, Germany, and France, as well as in emerging markets. Distributors play a pivotal role in bridging the gap between customers and your company, aiding in better understanding local needs. Could you elaborate on the main challenges Korloy has faced in building distribution channels in these markets?

Securing reliable partners is paramount, and ensuring their sustained commitment to the business is crucial. As I've mentioned earlier, many partners tend to diversify into other industries, which can pose challenges. Recognizing this firsthand, we've come to prioritize the establishment of local branches for localization purposes. While Korean employees are certainly capable, there's a limit to their effectiveness in international markets without a deep understanding of local cultures and ways of thinking, a challenge particularly pronounced from our headquarters in Korea. Localization is key. For instance, our office in Chile is staffed by a Chilean employee who boasts extensive industry experience and unwavering loyalty. Recognizing his expertise, we transformed his company into our local branch. His profound understanding not only of Chile but also of neighboring countries has been invaluable. Across Latin America, subtle cultural differences exist among nations. For instance, Brazil aligns closely with Portuguese culture, while other countries lean towards Spanish influences. This nuanced understanding is essential for successful market penetration and growth.

You are a third-generation leader of Korloy, a superior medium-sized company with a significant global footprint. As the third-generation leader, what legacy do you hope to leave for Korloy by the time the fourth generation takes over? What achievements are you aiming for? Additionally, what role do you envision Korloy playing in the global supply chain?

My aspirations as CEO have evolved significantly since assuming this role. When I was a sales manager, accompanying the Chairwoman (Mrs. Yun) to an international exhibition proved enlightening. There, we met the president of Walter AG, a prominent German company. The president inquired our CEO about Korloy's vision and goals. At the time, my focus was primarily on figures—cutting costs, boosting revenue and operating profits, and expanding market share. This mindset predominated my thoughts. However, our CEO’s response was unexpected; she articulated her goal for Korloy as fostering employee happiness. It was a philosophy centered on happiness management, ensuring employees felt fulfilled and content in their roles. Initially, I found this response somewhat emotional, perhaps more aligned with a nurturing than a CEO mindset. Yet, upon further reflection, I sought clarification from the CEO. Her explanation resonated deeply: amidst a 24-hour day, with 8 hours dedicated to sleep and 8 to work, one's quality of life hinges significantly on workplace satisfaction. If work is a source of misery, it taints half of one’s waking hours, profoundly impacting overall well-being. The CEO's perspective struck a chord; I realized its profound truth.

The distinction between doing what one loves versus what one must do became clear. Passion and dedication thrive when aligned with personal interests, whereas mere obligation yields lesser enthusiasm. This epiphany underscored the essence of leadership: recognizing that as CEO, I couldn't master every facet of the business. My role was to assemble a team of experts, individuals whose expertise complemented mine. I aimed to create an environment conducive to their optimal performance, fostering a corporate culture that prioritized employee happiness. While adequate compensation contributes to satisfaction, it's only part of the equation. In Korea, interpersonal conflicts, not workload, are often cited as the leading cause of job dissatisfaction. Therefore, nurturing positive workplace relationships became integral to our corporate culture. Thus, my overarching goal as CEO became fostering a culture where everyone found fulfillment in their work.

Distinguishing between what employees want and what they need to succeed is crucial. My focus is on providing the latter. Despite our company's relative size and resource constraints, I strive to equip our team with the tools necessary for success, leveraging digital technology and automation in manufacturing and R&D. Introducing digital innovations into our workflow, a rarity in many SMEs, aims to streamline operations by minimizing manual tasks. Recent initiatives include the adoption of collaboration tools like groupware and MS Teams, aiming to enhance efficiency and connectivity within our organization.

For more details, explore their website at https://www.korloy.com/en/main/main.do

0 COMMENTS