Launched as a joint corporation of Computer Engineering and Graphic Products after a business integration in 2007, C&G Systems provides comprehensive software support for Japanese manufacturers operating around the world. We sat down with president and COO Seiichi Shiota to discuss the strengths of Japan’s monozukuri and the outlook for C&G’s overseas expansion.

In the last 25 years, Japan has seen the rise of regional manufacturing competitors who have replicated monozukuri processes at a cheaper labor cost, pushing Japan out of mass production markets. However, we still see many Japanese firms hold large global market shares in niche B2B fields. How have Japanese firms been able to maintain these large market shares despite the stiff price competition?

In the past, the Japanese manufacturing industry made mistakes. We were not aware of the actual size and value of our manufacturing industry and the technology that was used in it. Our technologies and skills have shifted in sync with increased overseas production. In Japan, we cannot survive with tourism and agriculture alone. We do not have our own natural resources. However, we created a prosperous economy by importing resources and materials from overseas, manufacturing value-added parts and products, and exporting them.

Japan’s manufacturing history is very long, however, its modern technological manufacturing history is very short, as it only started after World War II. One of the mistakes that the manufacturing industry made was that we did not properly value our engineers. This led to an outflow of many of them to foreign companies in places like China and Korea. Now, the Japanese manufacturing industry is facing the important issue of turning technology and skills into corporate assets, along with the stable production of higher value-added parts and products at low cost.

Our company’s motto is “We Challenge the Limit of the Productivity.” As a CAD/CAM manufacturer, we aim to become a leader in those sectors. Japanese monozukuri has evolved very quickly over the past 50 years. Going forward, to help manufacturers remain strong in the global marketplace, it is hoped that hardware and software, technology and skills will work together to increase productivity. We hope to contribute to the improvement of productivity through CAD/CAM.

When an automaker produces automobiles, for example, there are between 20,000 and 30,000 parts per automobile. If we create 100,000 units of automobiles, automaker must multiply that by the number of parts. As cars are integral to many people’s lives, the quality of each of these parts needs to be high. Japanese manufacturers aim to ensure that each product is of the highest quality possible. This gives us the edge over our regional competitors.

Our mission is to provide the software to fully support Japanese manufacturers. We provide CAD/CAM and production management software, especially in mold and die making, which is essential for mass production. About 40 or 50 years ago, 70% of molds and dies were manufactured by companies from the Europe and America. Between 30 and 40 years ago, it shifted to Asia with almost 70% of molds and dies being manufactured in Asia, and 70% of that was made in Japan. Japanese product manufacturers were very strong at that time. Our engineers and craftsmen created many of these molds and dies. However, as I mentioned earlier, we did not appreciate them, which led to them moving to China and Korea.

Today, Most of the molds and dies are manufactured in China and other Asian countries. In the past, there were about 13,000 mold and die manufacturers in Japan. However, today, this figure has been reduced by 40%, with Japan now only having between 7,000 and 8,000 die manufacturers. Currently, there are many Japanese affiliated companies in China and other Asian countries. Today, the labor cost in Japan is very high, so many companies have moved their operations to countries, where the cost of labor is lower. However, even though the location of the production is different to before, it is still Japanese companies and their affiliates that are producing high-precision molds and dies. From that perspective, it is to say the market is growing in Japan and Asia overall.

In Japan, many engineers and craftsmen are getting older, which has led to a reduction in their numbers. Companies are looking to use digital technology to preserve their knowledge and expertise. One of the tools that support this is CAD/CAM.

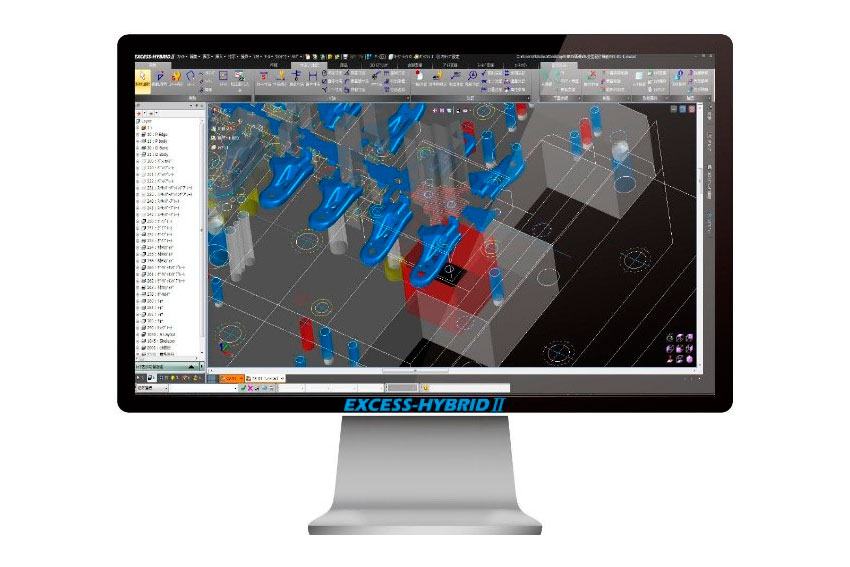

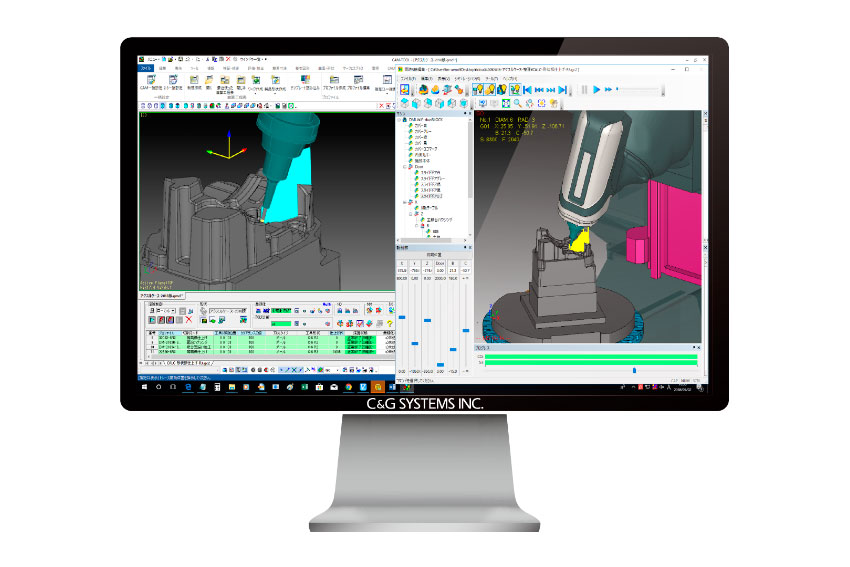

While CAD/CAM software has been a major revolution in manufacturing., many 3D design systems have been very complex. You have developed the EXCESS-HYBRID II, which is a hybrid system that can handle both 2D and 3D data, and CAM-TOOL, which is CAM for high-precision mold and die machining as well as realizing shortening lead time. Could you explain how your Excess Hybrid II and CAM-TOOL are superior to other conventional CAD/CAM software in the market?

EXCESS-HYBRID II

CAM-TOOL

Our company is a merging of Computer Engineering Inc. (CE). and Graphics Products Inc. (GP). The philosophy and passion for monozukuri is the same. Computer Engineering is focused on 2D and CAD, especially in stamping die (press die). Graphic Products is focused on 3D CAM which enables a wide variety of mold making such as injection molding or die-casting. Both companies have grown in very niche markets. Although the two companies' businesses were in the same market, they were in different product categories, making them perfect for an M&A. The overlap of the two companies’ users is only 5%. This led to us acquiring the No. 1 market share in the mold and die field immediately upon our merger.

Usually, one company acquires another one in M&A, however, to avoid talented people leaving for other firms, we first created a holding company, which allowed for CE and GP to become equal partners within the group structure.

With the combination of these two software companies, we are able to forge a great synergy and combine our strengths. By merging as CGS, it allows us to support each other in the industry, and develop technology which gives us an edge over our competitors.

Could you elaborate more on your R&D strategy, and are there any other products or technologies that you are currently working on that you would like to showcase to our international readers?

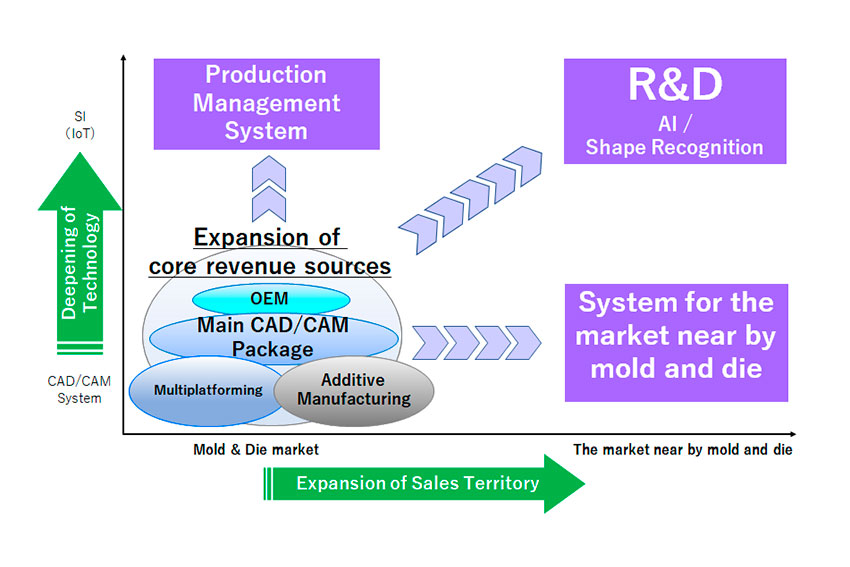

Direction of Basic Growth Strategy of CGS

This is our business market. We are one of the leading companies in this CAD/CAM market for molds and dies. Specifically, we intend to expand and develop our mold and die CAD/CAM business as a core business into the parts machining market and factory-wide optimization (AIQ). In addition, we are also promoting research and development of AI and shape recognition to meet future demands for automation.

On the other hand, as an OEM business We also provide CAD/CAM systems to manufacturers of production goods. As part of our multi-platform strategy, we will add-on our CAM to SOLIDWORKS and Siemens Digital Industries Software's NX general-purpose 3D CAD systems to expand the range of options and meet our customers' requirements.

Also, 90% of our end users keep having maintenance contracts with us. When we consider our revenue, about 60% comes from service and maintenance. We recognize that this achievement is a proof of high evaluation to our products and services.

Are you only looking to sell this domestically or also overseas?

Our strategy is "Global Niche Top". Since the establishment of CGS, we have naturally focused our efforts not only on the domestic market, but also on overseas markets. We believe that our overseas strategy is essential.

When we spoke to the president of Nissei Plastic Industrial, Mr. Yoda, he explained how working with local partners in China was the key to unlocking the entire East Asian market. What role does co-creation and collaboration play in your business model, and are you looking for collaborative partners in overseas markets?

Going forward, each company cannot do everything by itself. However, the lines between co-creation and collaboration need to be clarified. Currently, we are working in a win-win relationship with many domestic partners, which is going well for us. This is also possible to do with companies in other Asian countries, in particular, Southeast Asia.

Which field do you think that having partners in would help you to increase your market share abroad? Moving forward, what countries or regions have you identified for further expansion into, and what strategies will you employ?

Our partners are usually distributors who sell our software. Currently, we have local distributors in East Asia. We also have a local subsidiary in Thailand and Canada, and we have Technical Center in Indonesia, and are considering opening a new base in the Asian region. By expanding our sales channels in this way, we intend to further increase the ratio of overseas sales.

In opening a new base, we would like to establish a support system unique to the region, targeting areas where many Japanese companies have advanced into and where there is a concentration of manufacturing industries.

0 COMMENTS