It is no wonder Colombia has financial experts talking, particularly following its 2011 investment-grade hat trick – an important milestone for the country following decades of social, political and economic struggles and disputes. Standard & Poor’s, Moody’s, and Fitch all raised the South American nation's debt rating to investment grade. “Colombia is the only Latin America country that has never defaulted on an external debt commitment,” CNN reported Alberto Bernal of Bulltick Financial as saying last June in its coverage of Fitch’s upgrade.

After losing its investment grade status in 1999, the country remained haunted by ghosts of the economic crisis it had experienced. Throughout the 1990s, Colombia grew at a healthy rate and was labeled one of the top emerging markets. At the end of the decade, however, it witnessed a turn of events: banks presented unhealthy balance sheets and required government intervention, the economy fell 4%, and by June 2000 unemployment surpassed 20%.

Colombia is the only Latin America country that has never defaulted on an external debt commitment. CNN

reporting on Fitch’s

upgrade last June |

Since then, prudent economic policies have become the guiding philosophy to Colombia’s stability and sustainable growth, keeping it off dramatic roller coaster booms and busts. Coupled with an increased resiliency to internal and external shocks, Colombia is becoming an example to follow on the path to financial sustainability.

Between 2002 and 2007, the country’s economic growth rate picked up, averaging over 5%, a result of a boost in foreign investments attracted by improvements in domestic security, prudent monetary policy, and export-led growth.

A series of agreements and pacts contributed enormously to building the prosperity that followed Colombia’s economic crisis. Of particular impact was the Andean Trade Preference Act (ATPA), which was enacted as an American effort to help four Andean countries, one of which was Colombia, in the fight against drug production by expanding the countries’ economic alternatives.

In its pursuit of economic diversification, Colombia also signed a number of bilateral trade and investment protection agreements with Canada, Mexico, Chile, Peru, the Andean Community of Nations, and Mercosur, among others. Free trade zones were established in the country, 23 of which are permanent. Four of these are located in coastal territories and have easy access to the main ports, including Barranquilla, Cartagena and Santa Marta, while others have been placed at strategic points to meet the demands of individual sectors. Zona Franca de Bogotá is one such zone that proves the success of the scheme.

In 2011, the year that the greater part of the Western world protested its despair of the credit crunch, Colombia added to its list of trade partners with its most important free trade agreement (FTA) to date with the United States, and continues in the process of negotiation with European Union.

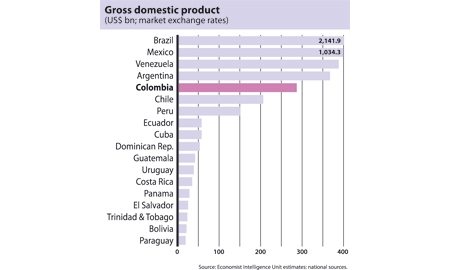

Lured by the country’s economic reforms, investment became one of the key drivers of growth that contributed to Colombia’s recovery. From 2002 to 2009, private investment grew by 25% annually. And although the country’s growth slowed somewhat during the global recession, Colombia performed better than the combined average 3.6% of other Latin American countries.

1 COMMENT

UNASUR is dead, i think the future is in the Pacific Alliance.. .