Angola’s progress in economic reconstruction and development has been remarkable since the end of the 27-year civil war in 2002. Boosted by its expanding energy and mining sectors, Angola recorded double-digit economic growth from 2003 to 2008, before demand cooled during the global recession. With oil production and international prices again on the rise in 2011, and in turn boosting public investment and domestic consumption, real GDP growth is predicted to reach as high as 8.1 per cent during 2012.

Generating about 90 per cent of Government revenues, Angola’s energy and mining sectors are the key drivers of its economy. The republic now vies with Nigeria as Africa’s biggest oil producer and Angola has become the world’s fifth largest diamond exporter. However, the Government is keen to avoid an overreliance on its two prize sectors for such a large proportion of its revenues. Helped by a recent energy boom, which has given the Government substantial surplus revenues, Angola has embarked on a policy of economic diversification. As a result, the country has seen massive new public and private investments in infrastructure, transportation, telecommunications, banking, tourism and agriculture.

Ernst & Young recently identified Angola as one of a selection of African countries with good potential for foreign direct investment (FDI) over the next five years. In its 2011 Africa Attractiveness Survey, the company points out that in addition to its oil and mineral wealth, Angola’s growing middle class will also be attractive to investors looking for new markets between 2011 and 2015.

One of the many steps taken by Angola’s Government to spur economic growth and to encourage greater private-sector participation in Angola’s development was to launch the National Private Investment Agency, or ANIP.

In addition to providing potential investors with a first port of call and to making the investment process easier, the agency has spent the past few years monitoring the Government’s ambitious public works programme. The initiative is building up Angola’s transport, communications and social services infrastructure, which suffered many years of neglect during the civil conflict that followed the country’s independence from Portugal.

ANIP’s main priority has been to ensure that the public investment programme continues without any disruption, as the agency believes Angola cannot expect private investment to come unless basic infrastructure is in place, such as roads, telecommunications, railways, ports, airports, energy production and distribution systems, water, sanitation schools and hospitals.

Over the past eight years, ANIP has been involved in the start-up of more than 1,200 projects, with a total value of more than £3 billion. More recently, the agency has been encouraging interest in projects over a wider spread of sectors, rather than concentrating on the capital-intensive oil and mining industries, which add much to GDP but do not generate sufficient employment to the benefit of the average Angolan. As such, the country still has a high unemployment rate, around 28 per cent according to African Economic Outlook, and the Government has made reducing joblessness one of its priorities.

In order to achieve economic diversification, the Government has the following strategy: first to continue with its basic infrastructure programme – which has multiplying effects on the whole economy – then to facilitate the role of private investment. It also intends to finally develop some labour-intensive industries. The Government believes this way Angolan families will feel the benefits of the so-called peace dividends.

According to ANIP, private investment in projects outside the oil and diamond sectors has been rising steadily, totalling £746 million in 2008 and rising to £1.12 billion in 2009 and £1.49 billion in 2010.

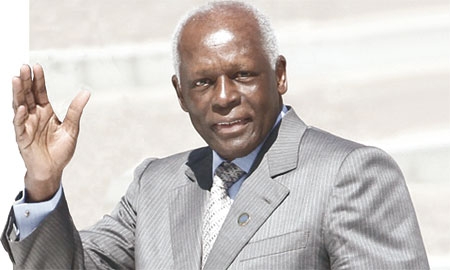

In May, President Jose Eduardo dos Santos praised the opening of a new Special Economic Zone (ZEE) in Viana, Luanda, saying, “It is a step forward on the long road of the reindustrialisation of our country.”

‘THE NEW SPECIAL ECONOMIC ZONE IN LUANDA IS A STEP FORWARD ON THE LONG ROAD OF THE REINDUSTRIALISATION OF OUR COUNTRY.

IT IS A HISTORIC LANDMARK FOR THE DEVELOPMENT OF THE NATIONAL ECONOMY AND THE REVIVAL OF DOMESTIC PRODUCTION OF GOODS AND SERVICES’

JOSE EDUARDO DOS SANTOS,

President of Angola

|

He added, “It is a historic landmark for the development of the national economy and the revival of domestic production of goods and services.” Similar initiatives are under way in the industrial centres of Futila (Cabinda), Soyo (Zaire), Catumbela (Benguela), the Matala (Huila), the mining area of Cassinga (Huila) and the agro-industrial perimeter of Pungo a Ndongo (Malange).

ANIP promotes Angola’s potential abroad through road shows, workshops, seminars and other forums to spread the word internationally about the vast changes that have reshaped the country’s economic environment and made it a much more open landscape for investors. It also has plans for more trade and investment missions from British companies in Angola, in order to enhance the understanding of the opportunities in Angolan markets and its economy.

UK Ambassador to Angola Richard Wildash says, “Economic reform is at an early stage, as are many processes in a country that emerged from a devastating and protracted civil war only nine years ago. The investment law of 2003 was a good start and was followed by steps to improve access to foreign exchange and easier transfer of funds; this has just been replaced with a new law that takes the process further. It is important that the various responsible authorities now work in a concerted way to remove barriers to doing business.”

A new private investment code was announced in May by ANIP that provides incentives such as tax breaks and reduced red tape, as well as greater authority for the agency to approve the code’s incentives. Any local or foreign entrepreneur with an investment plan is encouraged to approach ANIP as a first step, as the agency can provide valuable sector analysis, investment information and help identify business opportunities, regardless of the size of the investment.

ANIP is authorised to help investors solve any logistical, organisational or legal issues that might arise, such as obtaining visas, finding accommodation for workers or arranging meetings with relevant Government ministries, making it a one-stop shop for anyone wishing to get involved.

The agency is modernising its systems, to make it even easier for investors to explore the country’s opportunities. Furthermore, ANIP can now directly approve any project worth less than £3 million. For larger investments, ANIP will prepare a dossier, including financial, economic and technical analyses to be submitted to the council of ministers for approval.

According to the Government, the agency is preparing an ambitious programme using sophisticated technology “that will enable ANIP to follow any proposal more consistently, to give investors the ability to submit proposals electronically. That means the investor will not need to come in person to ANIP to submit his or her proposals, but will interact with us electronically.”

Angola is now ready, after the intense efforts of the Government and ANIP, to welcome investors. The legal framework has been modernised, infrastructure is being developed and the country’s people are eager to take advantage of Angola’s many natural resources. Angolans have decided to change and to adopt a new economic model, one that is market oriented and which gives investors a free hand and incentives, making it the perfect time to invest in Angola.

Through ANIP, the Government is extending “a warm welcome to British companies to come to Angola, explore existing opportunities and contribute to the diversification of the economy, to promote Angolan exports outside the mineral sectors and also to contribute to the reduction or substitution of imports.”

And as an old African proverb goes: “The best time to plant a tree is 20 years ago. The second best time is now.”

0 COMMENTS