The interview discusses the challenges and complexities of Japan's regulatory framework, particularly in the medical and dental sectors. Despite recent improvements like the sakigake system and the PMD Act, regulatory processes remain slow, hindering innovation and market entry. Sangi, a hydroxyapatite provider, exemplifies these challenges, navigating regulatory hurdles while expanding internationally. Their skincare business, leveraging hydroxyapatite, shows promise, with plans for further growth and expansion into new markets.

One of the big criticisms of the Japanese medical sector has been a slow regulatory process, which is on average three to five years slower than its counterparts in Europe and America. But there have been some changes over the last 10-15 years. You have the sakigake system as well as the PMD Act. From your point of view, how would you rate Japan’s regulatory framework today and what are some of the improvements you would like to see?

We cannot speak about the medical area, drug development for example, because we are not into that. With the coating process for drug delivery that we have been working on, we have had some interaction with Japanese medical companies but the work has not progressed to the regulatory stage, so we would not be able to comment on that. In the field of cosmetics, which we are now entering, things are not too bad because you just notify, and as long as you have ingredients in the product that are approved, then that is a pretty simple process.

Our biggest headache is iyakubu gaihin, Japan’s so-called “quasi-drugs,” which is not a category that exists in a lot of countries. In Europe, all toothpastes are cosmetics and there is no way around that. In Japan, there is one product registered as a drug for periodontitis, which is in the form of toothpaste, and when they advertise themselves as toothpaste, the toothpaste manufacturers get upset, saying “You are not toothpaste,” though for all intents and purposes, the customers believe it is. So that one is separately regulated, but not very effectively. We ourselves are moving into the field of medical devices for dental use and that has been a bit of a headache in some ways. We have one product that has been on the market for years now as a cosmetic for professional dental use. It is for restoring enamel after processes like bleaching scaling and so on which can damage the teeth, but we are not allowed to say that officially as we still cannot get it approved as a remineralizing agent. So it is sold as a cosmetic and it sells very well, as dentists know what it does, but we are not allowed to put that in writing anywhere. We can only explain it orally to get the message across, which is a bit like the situation with our toothpaste in the beginning too. We couldn’t say anything for 13 years until our ingredient was officially approved as an anti-caries agent. Till then it was the word of mouth and consumer experience. People realized that it really did work for them. Finally after presenting all the lab data and doing field trials as well, we managed to get approval, but it took 13 years. However, it was pretty revolutionary to achieve approval for a new substance that can help prevent tooth decay

Regarding medical devices, we tried for years to get approval for the product I mentioned we are still selling as a cosmetic, but there was (and still is) no category for ‘tooth remineralization’ as such. When we first started applying, there was at least the category “Others,” but that was also finally dropped. There were various discussions trying to fit us into existing categories which were inappropriate, and finally, that product has never been approved. We sort of dropped back for a while, but I think we are going to take it up again now, because we want to settle the issue, and competitor products are beginning to appear, in some cases registering themselves as “Abrasives,” a category where it’s easy to get approved, then making formal claims in their brochures and websites of remineralization and other benefits that we obediently have refrained from making ourselves. At least if the authorities are notified in such cases, they do take action, and such companies are obliged to withdraw their illegal claims. In one case recently, the perpetrator was a leading Japanese dental supply company. They registered as an abrasive, but were making the kind of claims we would like to do for our product. When the authorities were notified, at least their home page and brochures were ostensibly changed.

The approval system is good in one sense because once you get your approval, as we have for the active ingredient in our toothpaste, no one can come near you. In Europe for example, it is a notification system: you just report that your product is going on the market in six months, and that this is what it does and you start selling it. You have to have data proving that your product does work in the way you claim it does. The authorities can ask at any time to come and check your data, so it needs to be there, but the only time they would ever do that is if somebody challenges your product claims. It is a very different system from that in Japan or the USA. Like the Japanese Ministry of Health, Labor, and Welfare, the FDA is also very strict. You have to apply for approval and that isn’t easy, though possibly easier than in Japan. But in either case, once you get the approval, people will not start attacking your product, claiming it doesn’t do what it claims. The regulatory environment is different depending on the country.

Our first approved medical device is a cream for the relief of hypersensitivity now on sale to dental professionals and to which Japanese health insurance applies. It is a very similar product to the one we have been selling for years as a cosmetic but in this case, we had clinical work done, i.e. anti-sensitivity trials, which is an easier benefit to prove than surface repair. People either feel pain or they do not and you can show very clearly in vitro that the exposed dentinal tubules are being filled and coated, making the mechanism also clear. That’s much easier to prove than a 20-second procedure on the tooth surface that improves the enamel, and that didn’t exist before. There was a precedent for the anti-sensitivity cream, another company’s product using a different material but doing something similar. If somebody already has approval it makes things easier. To be a look-alike, you know, is not so hard. But one of our company policies is to try to put new things on the market and that means regulatory approval can be a serious barrier.

Regarding our Powder Jet Deposition (PJD) product, surprisingly, it did not take as long as we expected. This involves a mechanical unit creating the pressure to spray the hydroxyapatite powder onto the teeth, where it creates a new layer of tooth enamel up to a hundred or so microns thick. This device has been approved, but from a marketing perspective, I feel we are still at the prototype stage. There are still problems to iron out, and if you imagine your first televisions and computers, which were laborious-looking instruments, I feel that we are not ready to go to market yet. We are making good progress on perfecting it, and as the method of action and the procedure have all been approved, the next approval we put it through should go smoothly because the basic principles have already been accepted. PJD was initially the brainchild of a couple of Tohoku University professors, one in dentistry and the other in engineering, who were old-school friends. They were having a drink, talking about their work one night, when the engineer mentioned sputtering coatings for semiconductors, and the dentist said “If only you could do that for the teeth.” The result was some ground-breaking research which showed that you could. Putting it into shape was our job, because we started supplying the powder and ended up taking on the whole project. We received quite a lot of government support, which is one area where the Japanese are very strong, though it was a bit of a seesaw process. The Japan Science and Technology Agency (JST) initially supported the process, of funding the university, and when that funding ended, we applied again as a company, and finally, the university received another grant to do the clinical trials. So the funding was sort of back and forth. But once the clinicals were done and we went into the regulatory submission phase, it was entirely up to us. Frankly, the approval didn’t take as long as we expected, especially as a new category had to be created for the process, which had no precedent before. Now we are working very hard to create a streamlined, marketable version, a beautiful piece of apparatus any dentist would be proud to own, with any quirks in the system smoothed out. We are looking forward to seeking approval again at the next level.

APAGARD M-plus

APAGARD series

Regarding the PJD method, it is a very new kind of treatment with the creation of new enamel layers. You are still streamlining it and waiting to take it to market. Do you personally believe that this could become very widespread in the future in the field of dental care?

It really should, because it is very simple. One of the most immediate commercial applications will be whitening of teeth because whitening is now much in demand. While it isn’t big in Japan yet, in countries like South Korea, the USA, or Europe the market is huge. Current whitening processes such as bleaching, abrasion, or even applying a resin coating to teeth are not good for the tooth enamel, whereas our process will strengthen the enamel while improving its shade. Interestingly, once you apply the new layer of enamel it is slightly rough, so you have to polish it after you have done the coating. Once it is applied, it will never wear off. So that is the area we look forward to most in terms of return on investment. In the case of children, for example, who have crevices on the surface of their teeth where decay often starts, resin sealants are often used to cover them. But you can get seepage into the tooth surface below the resin, because it’s an unnatural substance on the surface of the teeth, so our system, using the same substance as tooth enamel, should be just fabulous for protecting children’s teeth. where the decay can often start. We know PJD is also extremely effective against hypersensitivity, which was one of the things we tested in our clinical trials.

There are custom formulations for toothpaste that can be made based on the genetic data of someone’s sensitivity to certain products. There is personalization when it comes to esthetic enhancements as well: teeth whitening and other treatments for example. How else are you adapting to this personalization trend?

We are not doing that much with our medical devices, but with our toothpastes they all contain our proprietary Medical Hydroxyapatite, which is approved as an anti-caries agent in Japan. Our APAGARD brand was billed initially for whitening and there is definite evidence that Medical Hydroxyapatite can improve the whiteness of your teeth, but only to the level of your original whiteness. People have different tooth shades, but we are confident that we can restore a person’s natural whiteness with our toothpaste.

One annoying thing about Japanese marketing is that you have to put something “new” on the market every couple of years. If you look at KitKat or Coca-Cola, what they are doing in this country is amazing. I would love to be just the plain, pure white remineralizing toothpaste that we originally produced, like a kind of gold standard, but you always have to add this and that, extra ingredients, changes in packaging. One of the first variations we were asked to produce was toothpaste for smokers, which was our number two product in the 1990s. The convenience stores requested it because they were big tobacco sellers in those days. So we included an ingredient that removes nicotine and launched it as smokers’ toothpaste. Then we produced another with added ingredients for periodontal problems and another for hypersensitivity. However, in Japan, we are not yet allowed to say that our ingredient relieves hypersensitivity.

First, we provided evidence from clinical trials. But they were not done the way the authorities wanted, so we had to start them over again. Most of our clinical work is done in the USA, where we have an amazing professor, who even during the pandemic recruited almost 200 subjects to participate in a trial which he completed in just over six months. That would be inconceivable in Japan, where we would still be negotiating with the university. We looked around, and in Japan, it was going to be double the cost, so we went ahead, knowing his group would do a good job, and they did. We got excellent results. But before starting the trial, we had to have constant interaction with the authorities here to make sure that what we were planning to do would be okay. Of course, they never say yes; they would raise issues, and remind us to think about this and think about that. So we know where the danger points are. One of them was “If you do this testing in the USA, would it apply to Japanese? Is tooth sensitivity the same in Japan as in the USA?” Quite several subjects in the trial were ethnically oriental, but who knows? We’ve submitted our application, vetted it as closely as we could, and are now awaiting the response. It was submitted in September, and you can usually expect a first response within six months, which is a big difference compared to the FDA. Here there is a sort of nervousness about approving things that have no precedent.

One example is a toothpaste ingredient that we developed which promotes the remineralization effect of our Medical Hydroxyapatite. But when we included it in our toothpaste, we couldn’t describe its effect or identify it as a promoter, because of regulatory restraints. The only way we could explain the increase in remineralization was by increasing the amount of Medical Hydroxyapatite in the toothpaste. The authorities ruled that a substance with a promoting effect would be an active ingredient, requiring a whole new regulatory process involving clinical trials and safety protocols that would take years. At that point, the ends don’t justify the means.

We have another unique product billed as a conditioner for your teeth, just as you apply a conditioner to your hair after shampooing. It is wonderful stuff, with clinical data showing its remineralizing benefits, but in Japan, it has to be classified as “liquid toothpaste,” which means that by law we have to show a toothbrush and instruct users to (again) brush their teeth.

I think to summarize what I’m trying to get across here, the industry as a whole is hamstrung by the regulatory process as it applies to iyakubu gaihin or Japan’s “quasi-drugs,” with a whole minefield of obstacles to navigate.

In a previous interview in 2021, you stated that you would like to see growth in your skincare business, which as I’m sure you’re aware, is a very competitive market. How has your skincare business developed over the past two years and do you anticipate any further growth going forward?

It is touch and go, but when you interviewed us in 2021 we were determined to make a go of it and that hasn’t changed. Our toothpaste manufacturer at one point developed its own range of skincare products which I thought were fantastic, but they unfortunately dropped out after five years. We’ve just reached five years this year and though we’ve yet to break even, I am confident that we will, and things are already looking up. Even with our toothpaste, it took nearly a decade before we were able to cover development costs. Every year our skincare output is growing and this year’s sales were double last year's.

One particular product that’s doing very well is a facial scrub that contains hydroxyapatite. I personally love this product and my Australian friends love it too. It has taken off and we are planning to do more advertising this year. I would say that the goal is to break even within 10 years.

When it comes to skincare, there are some major differences between Asians and Westerners. Asian skin is a lot more sensitive because of a thicker dermis, and due to a thinner stratum corneum it can scar more easily too. When it comes to your skincare products, how are you adapting to cater to different types of skin?

It’s not something I’ve thought about too much before, however, you are correct that there are differences. Honestly, Japanese skincare products are very popular in Europe, and we are already seeing interest in our products from Europe too. This is a topic we will start looking into.

What other applications are you envisioning for hydroxyapatite?

I think we are going to put more of an effort into medical devices because we have a couple in the pipeline right now. We will never go into the field of bone fillers, since I feel it is too far advanced and there is too much going on there right now.

But we are beginning to sell more hydroxyapatite, supplying different types for a variety of applications, such as catalysts, food supplements, and chromatography. We don’t supply our toothpaste ingredient to anybody – that’s too precious – but we do produce OEM toothpaste for other companies, and we can also provide hydroxyapatite to pilot projects if required. We are getting a lot of requests now for all sorts of applications including for use in inks and in plastic surgery.

This year marks a significant year for Sangi, your 50th anniversary. Sangi started in 1974 as a trading company but has since grown to become a large hydroxyapatite provider, offering solutions across a wide range of applications. What do you believe has been the biggest challenge that you’ve had to overcome during Sangi’s 50 years of existence?

We went through some tough times in the beginning, then some amazingly good times, and at one point we saw a massive increase in the number of experts we had working in our research laboratories. But there were also management problems, and we saw the emergence of competitors seriously eroding our peak period market share. I think there were a lot of misconceptions about our product originally, as at first, we weren’t able to label the ingredient as doing what it does, i.e. prevent caries.

Things were slow for a while too since we had to establish credibility, which for a while we lost as a result of undercutting, resulting in a sort of price war. Gradually though we began to restore our image, and our market leadership. I think honestly speaking, however, that regulations have been one the biggest barriers we faced. It takes so long to get anything approved in this country and that holds back Japan’s competitiveness.

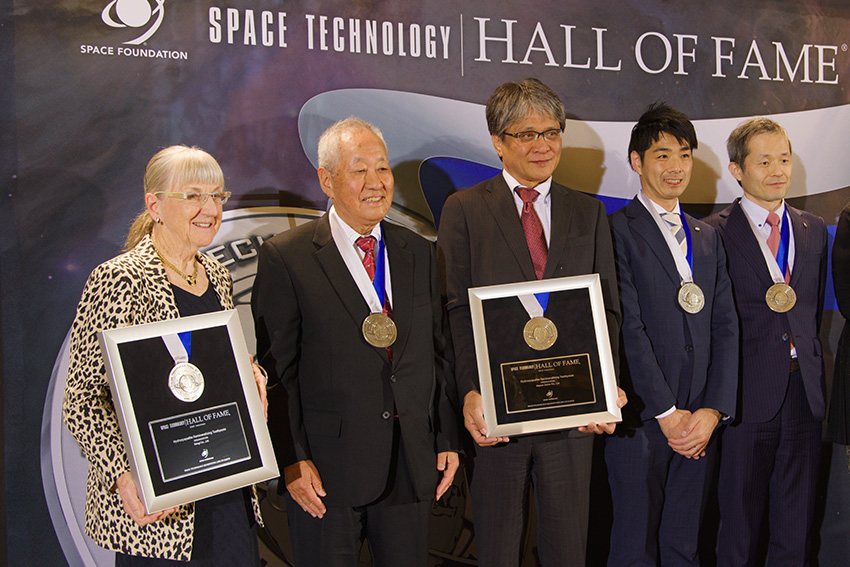

But the most gratifying thing was that this year, in our 50th anniversary year, Sangi was inducted into the US Space Technology Hall of Fame, the first Japanese company ever to receive this honor. It was in recognition of the fact that Sangi developed its remineralizing toothpaste – starting with APADENT in 1980 – after acquiring a NASA patent in 1975 for a chemical reaction to deposit hydroxyapatite, the main component of tooth enamel, on the surface of teeth. When the dentists who tested it complained it didn’t work, Sangi’s founder suggested rather than intraoral synthesis, why not simply put hydroxyapatite in toothpaste, so it could strengthen the teeth during everyday tooth brushing. And that’s how the world’s first hydroxyapatite remineralizing toothpaste was born. It was a long road to government approval, but since then we’ve come a long way to make hydroxyapatite our core competence over a wide range of applications. And it all began with Sangi’s encounter with NASA technology.

HAP+R Skincare products

In 2010 you started exporting your products and in 2017 you established a subsidiary in Germany as well. How have your international operations progressed in the last two years and are there any new markets that you’ve identified for potential future growth?

During the pandemic, one of our fastest-growing areas was overseas. Domestic sales leveled off for a while although people still clean their teeth no matter what is going on. Basically, sales in Japan were flat but stable. Now we are exporting to almost 30 countries and overseas sales comprise about 5% of our business, which is quite significant when you think about it.

When it comes to international operations, are you looking to set up another international base like the one have in Germany?

No, we will continue to rely on our overseas sales partners because honestly, our partners in the countries we sell to are amazing. We don’t market our products in each country ourselves – Germany is the only exception to that – as our partners locally do a fantastic job in generating sales. They understand their markets better than we do, and the requirements for each market are very different, so it wouldn’t make sense for us to set up another overseas base.

Imagine that we come back and interview you again on the very last day of your presidency, is there a goal that you would like to have achieved by then, either personally or business-wise?

My husband and I are not getting any younger so we need to have a succession plan in place. That’s a key priority. But there are several projects – like our PJD – that we would like to see up and running both domestically and internationally in the next few years.

Space Technology Hall of Fame Award Ceremony

For more details, explore their website at https://www.sangi-co.com/en/

0 COMMENTS