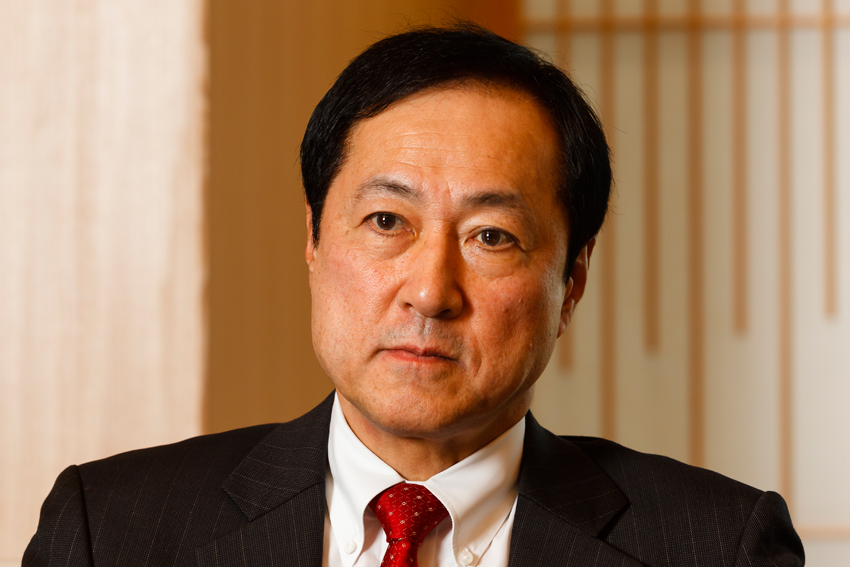

How imminent is the next major financial crisis? What value can a major Asian financial institution offer someone looking at doing business with Japan? And how are business and finance models evolving? Yasuhiro Sato, President, Group CEO and Member of the Board of Directors of Mizuho Financial Group, Inc., provides an in-depth insight into the global finance industry and the unique competitive advantages Mizuho can offer its clients, particularly in indentifying opportunities.

What would you say has been the impact of Abenomics on the financial sector or specifically Mizuho?

When you compare the figures of the pre-Abenomics and the figures after Abenomics, you can see that the currency price and stock price has been improving quite rapidly and significantly. This is why I think Abenomics has mostly helped us to get out of the deflation mindset. It helps the mind change.

More importantly, because of the stock price increase that figures show, individuals as well as corporations will be able to have more significant confidence regarding the future, which means that we can be more active. We can spend more for the future growth. That’s a big change that we can allocate to Abenomics. Of course, it is a good thing for the banking industry because as long as clients have faith in the future they will use their money and they will take action and the economy will grow.

The other result of Abenomics is the deregulation in various industries, especially agriculture and nursing. Of course there is also the TPP and Mr. Abe has been working significantly on the deregulation of the Japanese market, which is directly related to the TPP. But nationally, the Japanese market will suffer from this TPP negotiation, as long as we don’t have the strongest agriculture industry here, to be able to export the Japanese agriculture overseas. If we were more competitive, then we might be able to overcome this kind of negative impact from the TPP negotiation.

Let me give you an example. Now, Chinese people are getting rich. They prefer to have Japanese products. Not machinery or textiles: it could be foods, saké, and animation, all of which is called “cool Japan.”

For instance, Larry Fink, the chairman of BlackRock and a very good friend of mine, came to Japan in his private jet to eat Japanese peaches. They are delicious, very juicy and soft. This is what is happening, Asian people are now about to understand how good, how delicious Japanese agricultural products are. The time has definitely come to export this kind of Japanese agriculture overseas. However, there are certain regulations to do that, but Mr. Abe has now destroyed this kind of regulation by getting involved in the TPP. So, yes, de-regulation is the second keyword for Abenomics.

Finally, I think corporate governance is strengthening. The number one objective of Abenomics is definitively to have strong corporate governance. For instance, in the Japanese stock market, there are many cross-holding transactions around which are not accountable for the investors. Prime Minister Abe is now trying to unwind this kind of cross-share holding customs, which are quite accountable for the investors, and this is one of the reasons why the stock market has been gradually increasing at the moment. This has been strengthening corporate governance, and to target the ROE benefit from these Abenomics growth strategies. I would say that all of them are stimulating the Japanese industries in the private sector, which is also good for the financial institutions. Lending money has been increasing quite a bit, which is good for us.

Deregulation will be able to take significant advantage of providing financial advice to agricultural, nursing, and PPP transactions. We can arrange the financial structure for the airport and the road infrastructure and so on.

So to answer your question: yes Abenomics has helped us to get out of the deflation mindset, and has particularly helped financial institutions like ours.

Considering you’ve called your style “sustainable, customer-oriented banking”, what opportunities does Japan’s ongoing social and cultural transformation present to Mizuho?

I used to be a member of the Industrial Competitiveness Council under the Prime Minister, and there have been many discussions about deregulation. Mizuho is now a leading bank to conduct this competitive growth strategy, especially regarding agriculture. We are indeed the number one banking institution to promote the new agriculture business. For example, we are going to set up a joint venture with the GIC – Gulf Investment Corporation. The project will export Japanese agriculture to GCC countries. We are going to build some factories there. The point is definitely to export Japanese agriculture, of course, but more importantly the GCC countries are looking for some industrial bases in order to employ more young people in their regions, because unemployment is a big issue there.

As long as we can build some factories to deal with Japanese agriculture, then we can hire their young people in the GCC countries. This is just one example. We are one of the front-runners conducting this kind of growth strategy for the Japanese government.

The second example is the robot industries. Mizuho is one of the founders of the robot advanced technology organization lead by the Japanese government. This organization is promoting the consolidation of robot-related technology and introducing interested overseas users to highly qualified Japanese robot products and so on. Having said that, through this organization, Mizuho is playing a role for advertising the Japanese Abenomics philosophy.

Actually, our company name, Mizuho, means “harvest.” Harvest comes from the rice. As you know, Japan is the biggest rice producing country in the world. Rice is the main dish for Japanese people. So the harvest is not meant only for us, but for the clients and for the country. The country of harvest. In that sense, Mizuho means Japan, so Mizuho Bank means the Bank of Japan. Moreover Mr. Abe is now saying that Japan is a ‘Mizuho country’, so this is a very specific name to represent Japan. We are strongly destined to promote this kind of growth strategy cooperating with the government.

Throughout Abenomics, Mizuho has played a vital facilitating role for Japanese companies who would like to expand internationally, such as Softbank’s $20 billion takeover of Sprint, as well as earning a reputation of being one of Asia’s leading and most trusted M&A specialists. Do you expect more activity in this field, helping Japanese firms take on the world?

Well, for large companies who have tremendous amounts of cash, they can develop their strategy thanks to the positive influences of Abenomics. It is time to consider truly how to use this excess of cash. Most large companies in Japan are seeking investment opportunities overseas, like Softbank, or Japan Tobacco, LIXIL – almost all of the large companies now seeking for the investment opportunities. We are looking for some of the investment opportunities in Asia to have some stake in commercial banking in Asia. We can introduce these investment opportunities to important Japanese acquirers, like Softbank. The reason why we can do this is that Mizuho has a very specific team, called the Industrial Research Division. We cover more than 20 different industries.

For instance, when I was at BMW, I prepared some materials written by the Industrial Research Division. This was not just the analysis of the stock market. We covered the future of the motorcycle, not only the current automobile industry, but also electric vehicles, hydrogen, engines, cars… The reason behind that is that we are very close to almost all the auto companies as well as chemical producers. Only Mizuho can have such a tremendous amount of information about the strategy of each industry, as we do not belong to some specific Zaibatsu group. We are, in a way, a neutral financial institution, different from Mitsubishi or Sumitomo. That’s the reason why only Mizuho has this Industrial Research Division.

That’s the reason why they like to use Mizuho. It is one of our biggest strengths.

There is a second strength to take into consideration. We have the capability to judge business risk. We have quite good people in terms of risk management. Our non-performing asset level is less than 1%.

Do you think this is well communicated internationally? How has Mizuho positioned itself to be a trusted local partner to help companies that want to come into Japan and start operations?

Well, there are a couple of possibilities depending on the industry. We have so many non-Japanese clients in the world and sometimes the CEOs of those clients come to Japan and want to know what is going on in Japan. More importantly, they would like to know what is going on in China at the moment. We have 18 offices in China, and we have a very close relationship with the Chinese government. There is so much implicit information in China. For instance, they announced a 6.9% GDP growth, which was suspect. Based on the usage of electricity, payment of tax, and other figures that I have at hand, I think that the real GDP at this moment might be something around 4.5%.

I’m not a person to believe in destiny, but the bankruptcy of Lehman Brothers was in 2008. Before that, the biggest market turmoil from the IT bubble was in 1997. So, just 10 years before the bankruptcy of Lehman Brothers happened. Before that the big financial fall out was Black Monday, which was in 1987. So that is also just 10 years before the IT bubble. Ten years down the line we experienced the big market turmoil. We are now eight years after the collapse of Lehman. So having said that, two or three years from now will be very critical. I’m not saying that it will happen exactly in 2018, but we are going to have a big market turnaround; we have to watch very carefully and look for some signs this big market turmoil.

Telling you more about that, I would say that one possibility is China. The other one is the sudden increase of the US interest rate. By that, I mean that even the non-Japanese clients would like to know such types of observations from Mizuho or the knowledge of the industry or the prospect of China… They definitely need to have a trustable Asian financial partner to collaborate with them. That is the reason why they are coming to see me or to why they come to Mizuho, because we can give them a certain visibility about the future.

Regarding the destiny or role of Japanese SMEs, our most important role is to introduce overseas business opportunities to Japanese SMEs. We have more than 40 overseas offices in Asian areas. We can offer business matching and transactions between Japanese SMEs and Asian SMEs. We also have a certain specific private department to take care of this kind of matching. For the SMEs, we have excellent financial services to introduce these partners into overseas activities.

Given the insights you have into the Chinese economy, this is a big question mark for a lot of global investors: are you worried about the slowdown in China? Do you think it’s going to have a dramatic impact in Japan, or is it relatively insulated or not even that big of a downturn?

At the moment, as I have said, China’s real GDP growth might be around 4.5%. Currently the Chinese government is taking action regarding the easing of interest rates and currency depreciation. More importantly, they started to use significant budgets in local areas. It is good to have this stimulation package in the Chinese economy. However, the issue is that they have to postpone real economic reform, which would be changing the actual economic structure to a domestic consumption base. I have faith that we will be able to see some recovery in China’s economy, and everybody will say, “That is fine, that is not a big shock!”

But more importantly, after 2017, because of postponing this economic reform, there will be fundamental problems, like an over-capacity, reduction in working population, environmental issues, and so on, that are coming up significantly, which will be just about 10 years after the Lehman failure.

How would you grade the importance of the US markets to Mizuho’s continued growth?

I think the US economy is getting stronger. A couple of reasons are shale gas and the increasing immigrant working population from Mexico, Columbia, and Peru. I think the US is the only developed country that will have an increase in the working population.

Thirdly, they are getting out from the monetary easing policy, which is good. The US dollar will appreciate further. So, the US market is going to be more important for Mizuho because of this strength. That’s the reason why we decided to acquire the RBS team; they are quite strong in the capital market.

We are also quite strong in the debt capital market in the US, but consolidating with RBS people means now we are the ninth largest player in the US. We have hired more than 100 people from the RBS US team. We have a very strong base to enhance further in the debt capital market in the United States.

One more area I am now looking at is the asset management businesses, with Dai-ichi. We have a 16% stake of Matthews International Capital Management LLC, in San Francisco. Matthews is an asset management company that has strengths in Asian products; we can introduce these Asian products to Japanese clients.

Another reason is FinTech. Innovation is coming up in the financial industries. The US market is the vital to increasing innovation in the financial industry. I think in the retail banking business, we’re going to have a revolution because of new technologies, by using the big data, AI. It’s a revolution. For example, Jack Ma is the head of the Alibaba Group and is a long-term friend of mine. He invited me to their headquarters in China. I saw so many SEs there, and I was impressed that Alibaba was not an e-commerce company, but a system company.

You’re not afraid of these disruptive powers? Do you think that these will enable, or help you grow the retail side of your operations?

It’s a threat. They don’t have any branches. They don’t hire any people. They are very strong. But, you know what, in Japan, in front of every station, the big banks hold branches and they are very expensive. They hire more than 100 people for the branch. But they don’t have any of this kind of branch network.

Maybe that’s the way Mizuho will go? Automation, AI, having these sort or virtual platforms?

We would have to change the business model entirely. My feeling is that this kind of innovation is coming up for young people and individuals. But on the other side, the older population is not good at using these technologies. They prefer to have more a face-to-face style of financial services. They visit the branch spending two hours to talk about buying a mutual fund. That is something very important. The face-to-face type of communication and technology are quite separate. We should be strong on both sides. That is a very important strategy for every financial institution for the future.

In 2013, you adopted a new brand slogan “One Mizuho: building a future with you” to communicate the intention of being an invaluable partner to your clients. In your opinion, what constitutes an invaluable partner?

The One Mizuho strategy comes from the history of the financial industry. In the 1980s, there were several banks, security companies, mutual funds, and life insurance companies, and they were separated. In the 1990s, Sandy Weill established the Citigroup, and under Citigroup there was Citibank, Salomon Brothers, and Travelers. That was the first case of becoming this kind of big financial group. That was to some extent the evolution of the business model. After that, J. P. Morgan and the Bank of America followed with this business model. But the year 2000 saw this business model beaten by a new model, which was the investment banking business model, led by Goldman Sachs, Morgan Stanley and Lehman Brothers. This meant that, by using their leverage, and by using their own accounts and having the new security-related products to sell, they could enjoy more than 20% ROE and high profits.

But, in fact, the Lehman collapse destroyed this business model. Now, no one has a clear business model in mind. All the financial institutions in the world are looking for the new business models to rise. Deutsch Bank is getting out from the investment bank businesses, UBS also. RBS is going back to their hometown and Citi is now shrinking some overseas activities, and so on. I think the meaning of One Mizuho is the answer of the new business model at this stage, which means the total financial consulting group. “Consulting” – it’s very important.

For instance, to guide the individual client who doesn’t understand what kind of product he or she should buy. Especially older individual investors in Japan who are not familiar with financial products, such as investments trusts and so on. So, at the moment we need to have very comprehensive and client-oriented advice and consulting for individuals.

As another instance, take the corporation, a very small automobile parts production company who is going to make an investment for the future, but we have to explain to them what’s going on in the automobile industries. Even when we explain that their products will be fit into EV (electric vehicles), they may not understand. They may not have sufficient knowledge about the trend of the automobile industry. We have to advise and we have to consult with them.

The new model of the financial institution should be a provider with high quality of consulting capability; this is very important. Banking capability is now critical. You have to offer banking services, trust services, security services, and consulting services simultaneously. That is the real purpose of One Mizuho, and we have been quite successful using this One Mizuho strategy, even for individual and corporate sectors. I believe that this is one of the answers of the new business model for the financial industries.

At the moment question marks still persist internationally: will Abenomics succeed in reducing deflation or continue with its changing mindset? Do you think this trepidation is fair? If not, what role do leading financial institutions, such as Mizuho, have in stepping up and saying, in fact Japan is turning a corner and this is a time to look at Japan seriously?

That’s a very difficult question. Well, one of the threats that Abenomics is experiencing so far is related to the Bank of Japan’s policy. They are buying JGB (Japanese Government Bonds) significantly to have similar monetary easing policy like in Europe. The US has been doing that, but now the US is getting out from this monetary easing. I don’t know whether they are going to be successful or not. But in Japan, we still have a significant monetary easing policy. I am afraid to see whether or not we can get out from this monetary easing policy amicably, but it looks like we are riding on the express train without brakes. This might be a significant threat for the future.

So, to answer your question, to have a sustainable success of Abenomics as a financial institution, we need to find out the amicable exit from this monetary easing policy, with the Bank of Japan. We have been losing the exposure to JGB gradually. And it is very important to have a safe financial network.

The Japanese economy is not the sole economy, and we might need close communication with Europe and the US, but that’s a very difficult task, I think, to get out from this monetary easing policy.

What advice would you give to other Japanese CEOs and chairmen who are interested in following in Mizuho’s footsteps? What are the keys to a successful globalized company?

Very simple. To be aggressive. Many Japanese companies are very strong when you look at the balance sheet. They have huge amount of cash, but because of the lost decade sentiment that is still haunting us, they are quite reluctant to use this cash for the future growth. ROE is just about 7% or so; it’s quite low compared to US companies. This is because of the bad memories of the bubble collapsing or the Lehman Brothers are still on their minds. In order to compete with the competitors in the world, we have to be aggressive. Financial institutions have to take appropriate risks. Yes, definitely, taking risks is one of the responsibilities of a financial institution. Everybody is now forgetting about this important role. A financial company has to take appropriate risk for the client. So, financial institutions and industrial companies have to be more aggressive. That’s the key to the substantial growth of Japan.

What final message would you like to communicate to G7 leaders about Japan, as it leaves behind these two decades of economic growth? What is the new brand of Japan?

Well, one of the biggest problems for the world economy, not only Japan, is inequality. We have to find out the solution to inequality. Otherwise, the world cannot grow. For instance, immigrant issues. This problem also comes from the inequality this planet is experiencing, but the human being so far has not been able to find the real solution to inequality. Even in Japan, between the rich and the poor, the difference has been gradually expanding. This is the very important subject for the people in the world. The human being has to find out the appropriate answer to this.

Finally, I will say that so many tourists are coming to Japan. Not only from China or Korea but from all over the world. Please come over to Japan to seek for the real hospitality of Japanese people.

This interview was held in October 2015.

0 COMMENTS