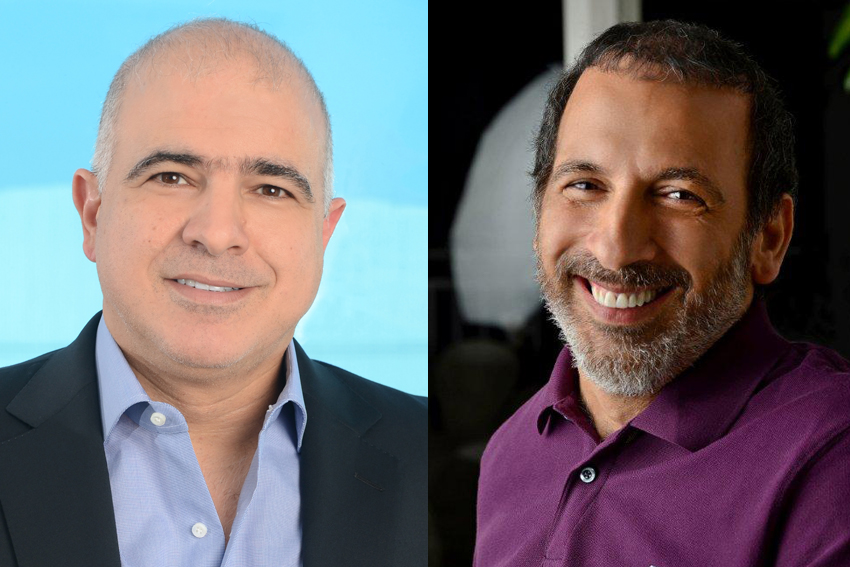

After the historical "Cumbre de las Américas" (Americas’ Summit), which shows the beginning of a new era, the continent faces several economic challenges, such as being the one with the highest social disparity, although it features countries like Colombia, which has achieved a major regional role in the last 10 years. Business & Investment sat down with Christian Daes, COO and Co-founder of Energía Solar and Tecnoglass, to talk the country’s and the company’s present and future.

What role do you think Colombia will play in the region within the following four years?

Colombia is playing and will go on playing a major role in South America, since it is the only country which has achieved sustainable growth year after year, together with an improvement in terms of disparity within the last 12 years, although some disparity remains present. Those achievements are the consequence of having overcome delinquency, of the improvement of the economic environment and the increased number of investments as a result of having improved regarding safety. Such factors have increased tourism and foreign investment. The country has developed internally.

Nowadays, the greatest challenge for Colombia is to become again an exporting country, since it has forgotten its industry. However, the role of Colombia will still be important, since it has two somehow socialist countries as neighbors; and the Southern Cone countries are developing slower than us.

What is the relevance of the peace process in the country?

The peace process is the most important factor of all. Colombia would be a totally different country in peace. We have lived six decades in war, featuring kidnappings, killings, invaded towns, kidnapped majors, among other problems. The achievement of peace would change the image of Colombia in the world.

Colombia is a topographically rich country, where all conditions are set so as to receive millions and millions of tourists. We have Quindío, the Amazon, Sierra Macarena, the desert and the beaches of Guajira, the snowed range of Santa Marta, among others. Colombia has many things to offer tourists coming from all over the world. However, people are afraid of coming to our country due to the insurgency.

Colombia has submitted its candidature to enter the "the club of countries with best governmental practices in the world," the OECD. Which is the contribution of Colombia to this forum?

More than contributing to the forum, Colombia needs that participation so as to learn the best government practices from the other countries, such as the Scandinavian and Anglo-Saxon, which stay light years ahead of us in terms of transparency. At the same time, it is important that businessmen do their part and are not extorted by corrupted public servants.

Which are the challenges for the companies?

The challenges for the companies are the aforementioned: companies should not be extorted by or request money from any public servant. Everything must be transparent and the result from a clear tender, where rules are equal for everybody.

During 2014, the housing and construction sector was the driving force of the job market and the economy and, as Minister of Housing Henao told us, the growing trend is expected to continue by over two figures for the next 4 years. How is Tecnoglass benefitting from the plans of the Ministry of Housing?

Within the Ministry of Housing, there are several projects being developed in order to assist the lower classes. We get benefits as suppliers for those classes, regarding windows, glass and aluminum. I do not agree that we can achieve growth at the rate as the minister says, but anyway, the greater the growth, the better for us.

Tecnoglass has been benefitted from the revaluation of the US dollar since most of its income is in such currency and most of its costs are in Colombian pesos. We were with Jorge Silva from Microsoft, who told us that they have frozen the dollar. Are you planning to use financial instruments to reduce uncertainty?

We have been thinking and simulating a lot of options, but we haven´t taken any decision so far. The dollar´s revaluation has been good for us as exporters. The situation affects us regarding the national agreements we have fixed in pesos; but at the same it improves the costs in pesos over all products we export, such as labor and national supplies.

Just over a year ago Tecnoglass entered the NASDAQ. You are the only company that is part of the world´s biggest electronic value market. Vice Minister Felipe Sardi told us about the Colombian pride regarding companies such as Tecnoglass. What meant entering the NASDAQ for the company?

Entering the Nasdaq is playing in the big leagues, so our credibility has increased a lot in terms of banks, providers and clients. Therefore, the company is better known, we get much more credibility and more sales. Additionally, being in the Nasdaq means that our company is serious, that we have transparent corporate governance and a serious board; and that our numbers are credible. Nasdaq has given us the access to low bank rates and bigger agreements in terms of bonding capacity.

You have stated you don´t think the price of your shares represents the value of your business, why do you think the true value of your company is underrated in the market?

We believe the market doesn´t fairly valuate our company since we are new and we have a low exposure, we have few analysts, as a matter of fact, we have just one analyst qualifying the share and that is very low for the market. For example, companies such as Apple or IBM have thousands of analysts; all companies, brokers and banks have their analysts on Apple, IBM or DuPont, whereas our share of stock has just one analyst.

This has been a new challenge for us, since we are at a learning process stage, for example, we are learning that you need to have a lot of shares in the stock so that the share has floating shares, so that you can buy and sell them. There are a lot of people not investing because they say: I invest $20 million dollar and the day I want to sell and collect it takes me two years. These things were unknown, we are learning them and we are going to change so that the company can get the real value it must have in the stock market.

You have approved a 0.50 dollar profit per share for 2015, to be distributed quarterly in cash. How was your commitment to give back part of the share capital welcomed by your shareholders?

Excellently, with the results, plus the dividends, the share has gone up almost 50% in the last three to four months, which means that the market is begging to understand the value of the company and the commitment of the management. It is not only about giving good results, but also about sharing those profits, generating enough profits to share them in cash.

You are making constant reinvestment of the profits in developments and technologies, in order to reach the goal of selling one billion dollars annually in 5 years. How important is reinvestment for business success?

When a company wants to grow, it needs resources and if such profit resources are distributed among shareholders, then the only way to grow is indebtedness. We have been very conservative in terms of debt, so we like to reinvest most of the profits in the company. This is the first time we distribute the profits and it is simply because we are in the stock market. Nevertheless, it is always better to improve and strengthen the company.

Regarding your new plant in Barranquilla, we can say that you are practically building a new city. 55% of the factory is operating at the moment and it is expected to reach its 100% of operating performance by August. Which are the greatest challenges you have faced regarding this mega investment?

The original challenge was to get funding, and we achieved that with foreign banks and payable in ten years, which eased everything. The schedule we had drawn was very hard to keep but we met it, we are even two weeks ahead of schedule and we are already producing glass. By the first of September, we will be out on the market with an extraordinary product.

Which are the prospects for Barranquilla regarding this new factory?

Barranquilla is as a technologically updated city as any soft coat glass producer in the world. There are not many soft coat glass machines in the world, there must be around 20. That means Barranquilla is one of those 20 cities which feature a soft coat high-technology plant and according to what we know and what we have discussed with suppliers and other companies which own this sort of machinery, the one we bought is the most complete of all.

Barranquilla is the natural gate to Latin America from North America and Europe. How is Barranquilla being positioned as the capital for entering into Latin America?

We are already settled in many countries, not only in Latin America but also in America as a whole. We sell to the US and we are starting market research studies in Canada and Mexico. We sell to Panama, Costa Rica, Bolivia and now we are entering Chile and Peru. We have sold in Venezuela, but due to the country´s situation we stopped selling our products there. In 5 years’ time, with this new soft coat plant we will surely be able to sell to all the countries in Latin America.

You said: "The Superpuerto will be the New Caribbean Star." Also, recently, you have stated the following: "the perfect storm so that, finally, this dream may come true”. How would you define this perfect storm?

For us, Barranquilla has the best labor, they are dedicated people, hard-working, with excellent qualities. They have the perfect location; the only thing missing is infrastructure. The perfect storm is when all those things converge together. That means that the right people are in the right place together with the right companies and infrastructures so as to step up. Now we have the major lack that exporting companies have to face: the few direct frequencies from Barranquilla to the world. When Barranquilla has its Super Port, not only our company, but Barranquilla as a city will take a major leap into the future.

Which are the challenges for the company regarding this mega project? How important is this port for Barranquilla?

It is no challenge for the company; it is a personal challenge since the company has not made investments in the port. We have personally invested some money in order to carry out this project. Furthermore, if I was told that we would lose our investment but we would get the port, I would do it, since the most important thing is what it means to the city, the importance the Super Port will have for Barranquilla is unexplainable, there is a before and after for the city. This project will bring industry, many lines and employment to the city, together with development that is good for all the people of Barranquilla, for Colombia and for all those connected to this.

The incomes of the company have grown 7.7% comparing with 2013 (197 million dollars), the sales in the US increased 52.3% and reached 101.6 million dollars, the US being half of the market. What has the US meant for Tecnoglass?

The US is the biggest market in America. It is a huge market of more than $30 billion dollars in windows made up of aluminum, wood, vinyl or glass. It is obviously our biggest market at present. We think it will continue growing the following years and that it is a big player in the future of the company.

What do specifically Miami and South Florida mean?

Specifically, they are our base. We are locals in Miami, it is a very cosmopolitan city where most of the investors are foreigners and they obviously look at us nicely since we have been supplying them for several years without quality problems, and that is the most important thing for a constructor: delivery on time, excellent products and ready assistance when the building work is delayed.

What has the FTA meant for Tecnoglass?

The FTA has given us the tranquility of a long-term rule. It has been good in terms of stability, but it has also opened the doors for foreign competitors to come and compete with us, which we think is fabulous.

What does Colombia have to do to get back on the "net exporter" path?

It is simple, when a country such as Colombia forgets its industry, its industry obviously falls behind. That is why Colombia became a net importer. Working in the industry in Colombia is very difficult. It is playing hero since we pay the highest expenses in terms of electricity and running water, gas is five times more expensive than in the US and the revaluation made us pay the highest salaries, however, devaluation put an end to this, for eight years we had been increasing the salaries continuously by 5 to 10% with the dollar falling every day. So when you look at the parameters, the cost of internal shipping, the cost of one thing and another; we can say that the only thing in which we are competitive today is labor, since the rest of the things are too expensive. In addition, we pay the highest taxes. Before entering the Nasdaq, we used to pay a rate of between 11 and 12% of interest, whereas our competitors in the US paid 4%.

The way the government can encourage to be again an exporting Colombia is: better credit accessibility at good rates, decrease in the costs of electricity and gas; and creation of critical infrastructure, such as the Super Port. The industry here was forgotten, people think that opening the market so that everybody can come to Colombia to sell low-quality products at very low prices is good, but it is not. For example, Chinese have compensation and they are given the 20% over the export. They send us goods at very low prices and their products are not taxed. Colombia is the only country that nowadays lets Chinese products enter with no tax, the Us, Canada and the EU have taxed Chinese products. If we keep allowing that, our industry will not improve.

In January, Tecnoglass will become shareholder of Glasswall, with offices in Miami. What is the importance of this alliance for Tecnoglass in South Florida?

We are not really shareholders of Glasswall, we bought Glasswall’s assets and they had an interesting warehouse of 16,000m2 which was prepared to build windows and had all the appropriate infrastructure; we additionally bought all the licenses for their windows and rails which allow us to widen our product range. Additionally, the owner, Hugo Colombo, who is one of the major developers in Miami, kept some shares of the company as part payment, which means we are going to do the work. So it was a strategic move, at a very reasonable price.

0 COMMENTS